AndreyPopov/iStock via Getty Images

Thesis

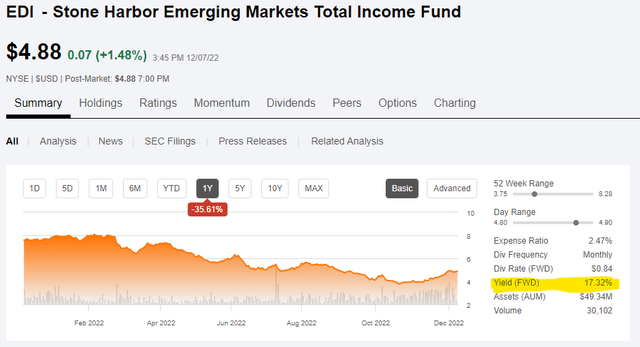

Virtus Stone Harbor Emerging Markets Total Income (NYSE:EDI) is a EM CEF. The fund is on the small side with only $50 million in total assets, and historically has exposed a highly eroding NAV. The fund is up more than 20% in the past month, on the back of lower risk free rates, narrower credit spreads and a narrowing of the discount to NAV.

Despite its positive recent performance, the CEF is a long-term lemon with deeply negative annual total returns on a 3-, 5- and 10-year respectively: those figures come in at -14%, -8% and -3.5% respectively. This EM CEF has lost investors a very significant amount of money in the past decade, even before inflation is factored in. At the end of the day past performance does matter, and if an asset manager is unable to post a positive total return from the structure it puts forward then it ultimately should not be in that business. Just as a reminder, investing in a very simple and risk free instrument like a short-term treasuries fund, would have yielded positive results in said period.

The CEF structure is supposed to bring constructive leverage to the EM space, and by utilizing the structure correctly, an asset manager should be able to generate above average return profiles. It is not the case here. Moreover, the CEF displays a glaringly high dividend yield:

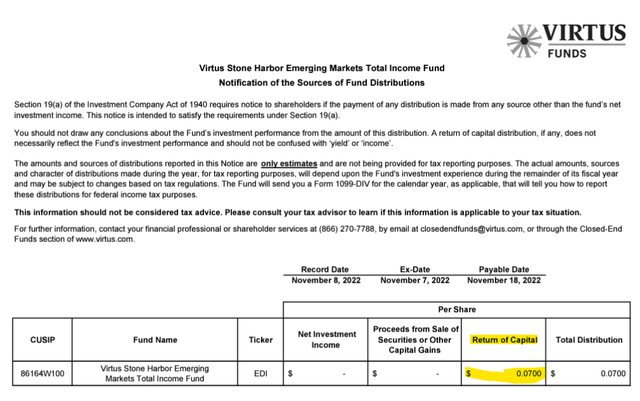

This yield is unsupported, with the fund generating actual cash-flow closer to a 7% yield level. The rest comes from return of capital (‘ROC’), which is a very unhealthy way to run the AUM into the ground:

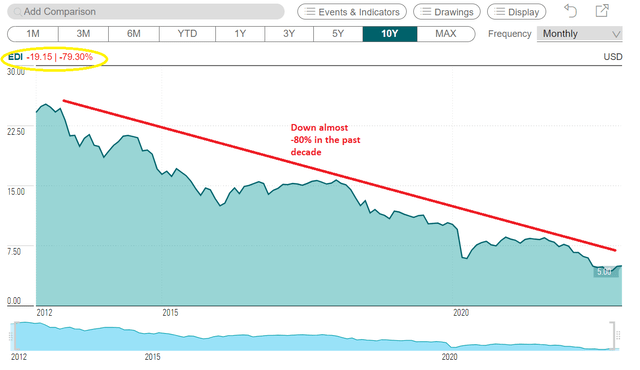

When you return capital to investors via ROC, you are basically constantly decreasing your NAV, because it is a fake yield. We can see how EDI exhibits a NAV which has decreased by almost 80% in the past decade. This trend will continue given the current fund dividend policy, and it will most likely result in the fund being closed down at some point (or be merged into another fund).

Holdings

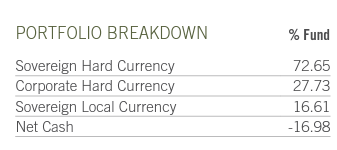

The fund is an EM one, with most of the holdings in hard currencies:

Allocation (Fund Fact Sheet)

‘Hard Currency’ means the fund holds sovereign debt from emerging markets but denominated in Usd. This feature allows investors in the asset class to forgo any foreign exchange implications, or be forced into entering hedging agreements that would otherwise eat into returns. Hard currency bonds are the best and most liquid credits in the space because they trade onshore (i.e. they clear through U.S. exchanges) and benefit from the protections allowed under NY law usually.

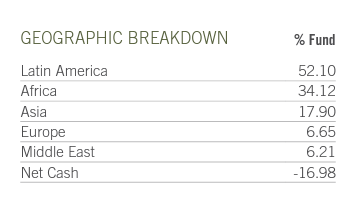

The fund focuses on Latin America through its collateral composition:

Geographic Parsing (Fund Fact Sheet)

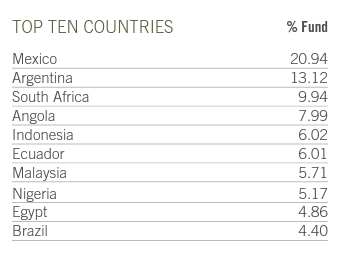

We can see the same parsing through its individual country listing:

Countries (Fund Fact Sheet)

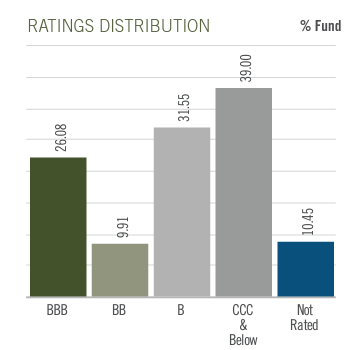

Mexico is this CEF’s largest exposure, closely followed by Argentina and South Africa. The fund runs a middle-of-the-road credit profile:

Ratings Distribution (Fund Fact Sheet)

EM credits are generally risky, so we can say that this fund’s ratings matrix is not overly aggressive. Please keep in mind that the likes of Argentina fall in the CCC bucket.

The historic issue with EM credits is the fact that political risk is never appropriately priced in. Most market participants price in first order risks like interest rates, credit risk and Fx risk, but not second order risks. There are a couple of examples that come into mind which fall into this second order category: Russia and Turkey. After Russia’s decision to invade Ukraine, Usd denominated debt gapped down and it is currently subject to sanctions. A political decision brought about this state of affairs, when in fact the country is very much solvent and able to pay its debts. The political factor was not correctly priced in. Turkey finds itself in a similar situation, but for different reasons. Turkey has been lowering interest rates, despite a galloping inflation. Those types of actions run against basic monetary policy, yet they are currently happening in Turkey. The reason behind these moves is the president’s desire to lower interest costs so he gets re-elected. This factor was not priced in the bonds either.

Distributions

The fund is currently using a shocking 100% ROC dividend:

Section 19a (Section 19a Fund)

This is akin to me taking $100 from you and just giving it back over the years while I collect a substantial management fee.

Conclusion

EDI is an emerging markets closed end fund. The vehicle is up over 20% in the past month on the back of lower risk free rates, narrower credit spreads and an improvement in the discount to NAV. The fund however, has a horrendous long-term performance, with negative annual total returns on a 5- and 10-year basis. Moreover, the CEF exhibits an unsupported 17% dividend yield that is currently entirely paid out of return of capital. Just say no to these structures that ultimately only lose investors capital long term. A retail investor is best suited to exit EDI and deploy capital to instruments that generate long-term positive annual returns.

Be the first to comment