Maja Hitij/Getty Images News

The biggest news of the day was Elon Musk acquiring 9.2% of the struggling social media site. The news that Musk apparently wants to take a crack at improving Twitter (NYSE:TWTR) is an encouraging move considering the fears of him starting a competing platform in the lines of Truth Social (DWAC) being built by Trump. My investment thesis remains very Bullish on the stock despite the initial 25% pop on the move by the CEO of Tesla (TSLA).

Executive Usage Issue

Just a week ago, Musk ran a Twitter poll with 2 million votes questioning whether the platform adhered to free speech principles. Over 70% of the votes gave the social media site a thumbs down.

Now, Twitter is a public enterprise, so the company definitely doesn’t have any such requirements. Shareholders though definitely want a platform appealing to all users, whether Republican or Democratic.

Musk now appears to control a larger position of the company than founder and former CEO Jack Dorsey. New CEO Parag Agrawal finds himself in an odd situation of where Elon Musk is a more important shareholder now than Jack in multiple ways.

Musk actually has far more users on Twitter than Jack Dorsey. Despite the latter being a similar influential person to the world having founded both Twitter and Block (SQ) along with work on bitcoin, Musk is far more active and influential on the platform as a top 10 personality with over 80 million followers.

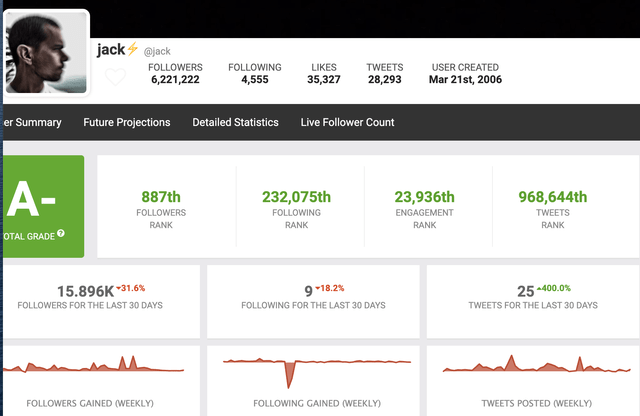

According to Social Blade, @jack is the 887th most followed Twitter account, but the username has the engagement rank down at 23,936th. Jack Dorsey hardly ranks in the top 1 million for actual tweets.

Source: Social Blade

The company has a long history of hiring executives without much experience on the platform. Even the recently-elected Chairman and now co-CEO of Salesforce (CRM) only has 106K followers. He isn’t what one would consider a power user of the social media platform despite being a very influential businessman now.

Parag has no job security and surely won’t keep his job if Elon Musk were to sell these shares and create a competing platform. Ironically, the new CEO hasn’t tweeted since March 16 while the previous tweet goes all the way back to March 3. As with Jack previously, the executives don’t appear to even support the social media site via regular usage.

Lack Of Revenues

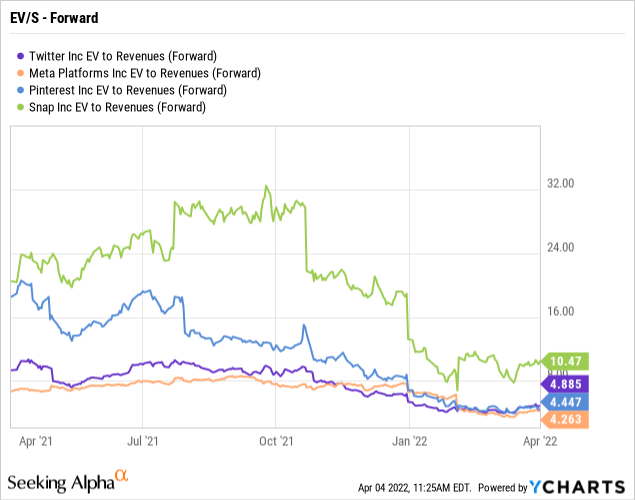

The stock is up 25% now on the news probably with traders hoping Musk in combination with a venture fund will make a bid for the whole company. Twitter is only back to $50 now while the stock traded above $70 last summer. The stock only trades at 5x EV/S multiple, but the multiple is inline with Meta Platforms (FB) and Pinterest (PINS) now.

Ychart

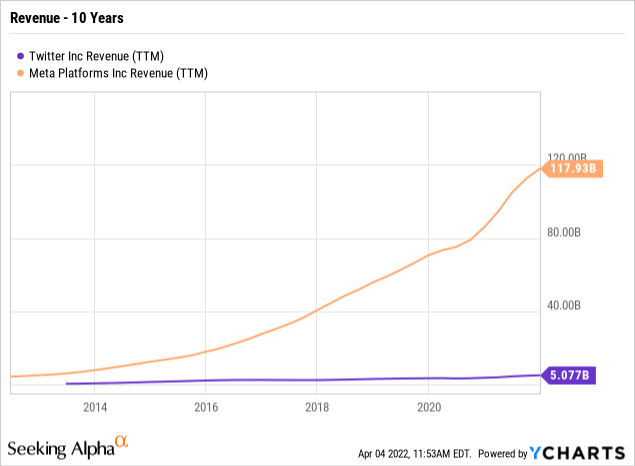

The real story isn’t the multiple of the stock. The issue is the limited revenue base for Twitter in comparison to Meta Platforms (FB). Twitter has done a horrible job of growing the revenue base despite having a social media network as influential to the world as Facebook. Over the lat decade, the former Facebook has grown the trailing revenues to over 23x the size of Twitter.

Ychart

One might even wonder the connection between the lack of usage on Twitter by executives and the minimal revenue growth over the years. After all, the executives appear less interested in using the platform as much as keeping former President Trump (a prior top user) to quit using Twitter.

Consensus analyst estimates have Twitter revenues growing around a 20% clip the next two years to reach $7.3 billion in 2023. The company has already forecasted revenues reaching $7.5 billion.

The analyst community appears to have major doubts on the social media platform to grow at rates hardly faster than the much larger Meta Platforms targeted to grow at rates of 12% and 17%, respectively. Noteworthy, Meta is forecasted to add revenue this year multiples the total size of Twitter leaving little excuses for the social platform not far outpacing the revenue growth of the far bigger Meta.

Takeaway

The key investor takeaway is that Elon Musk brings an interesting party to the table with his power and influence on the social platform far exceeding those of co-founders and current executives. The company has far underperformed the sector leader over the years and subtle improvements in the site could drive the faster growth warranting a far higher stock price.

Twitter is cheap at the current valuation with the sector beaten down, but the real opportunity is the business model to catch up with the global influence of the platform and the importance of the site to influential people like Elon Musk.

Be the first to comment