guvendemir

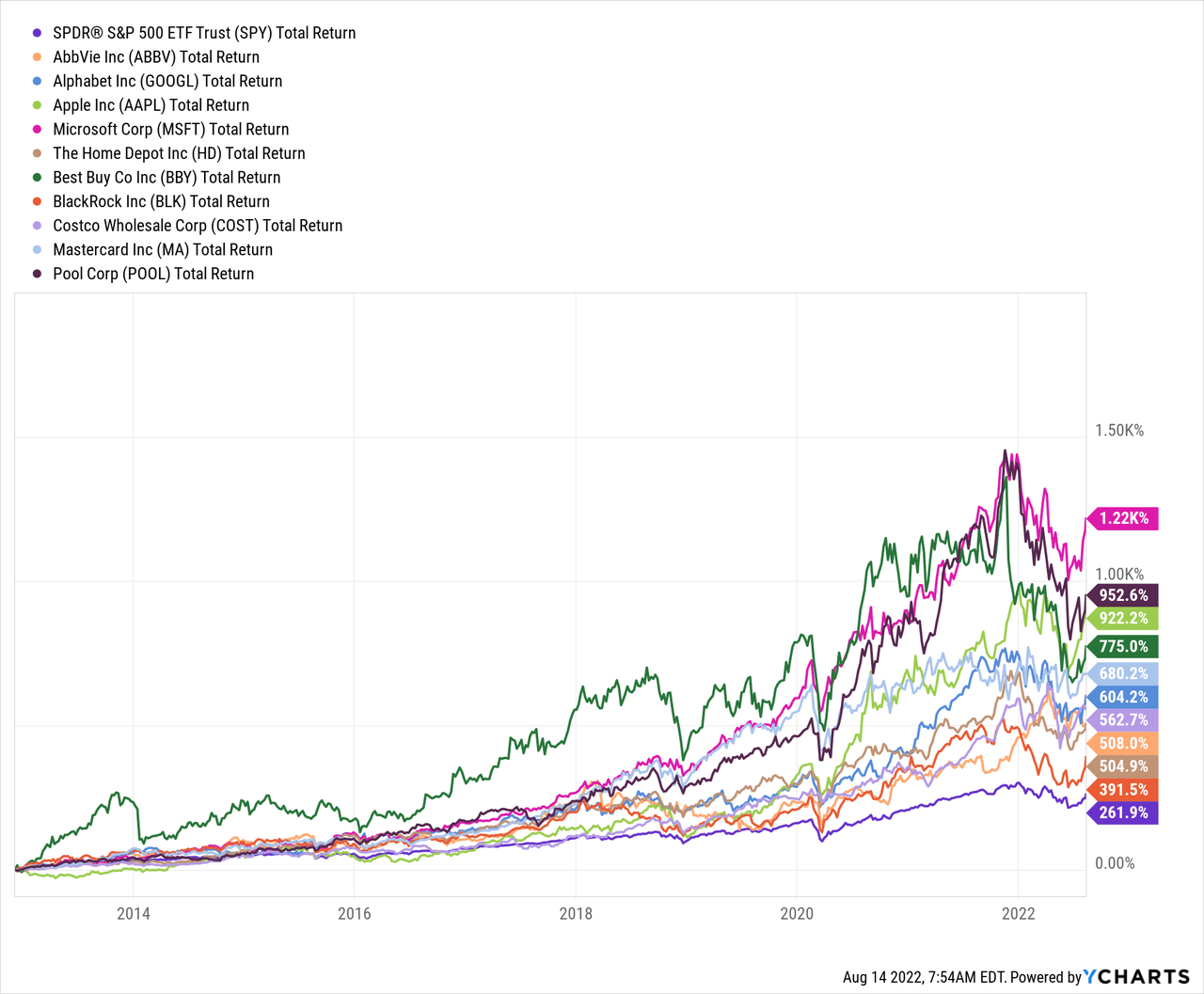

The idea of buying stocks like you have to own them forever makes the selection more challenging and requires more research. It also needs a long-term mindset that ignores short-term fluctuations. Buy and hold forever shouldn’t be taken literally. Companies can transform good and bad, the business environment changes, and long-term trends are subject to adjustments.

Every stock goes through times of overvaluation and undervaluation. In case of gross overvaluation, it may be prudent to sell a position at least partially.

It’s possible to trim positions for cash or use the dividends as personal income.

Selection Method

I’ve looked at several criteria for selecting what I consider buy and hold forever stocks.

- The first one is subjective. I look for a strong story behind the company. A sound strategy and clear goals make the investment case more attractive.

- Strong revenue growth per share and good profitability are essential.

- A high return on equity proves the management’s efficiency.

- Buybacks and/or dividends are signs of shareholder-friendly management. All companies on the list regularly returned cash to the market through buybacks, dividends, and often both.

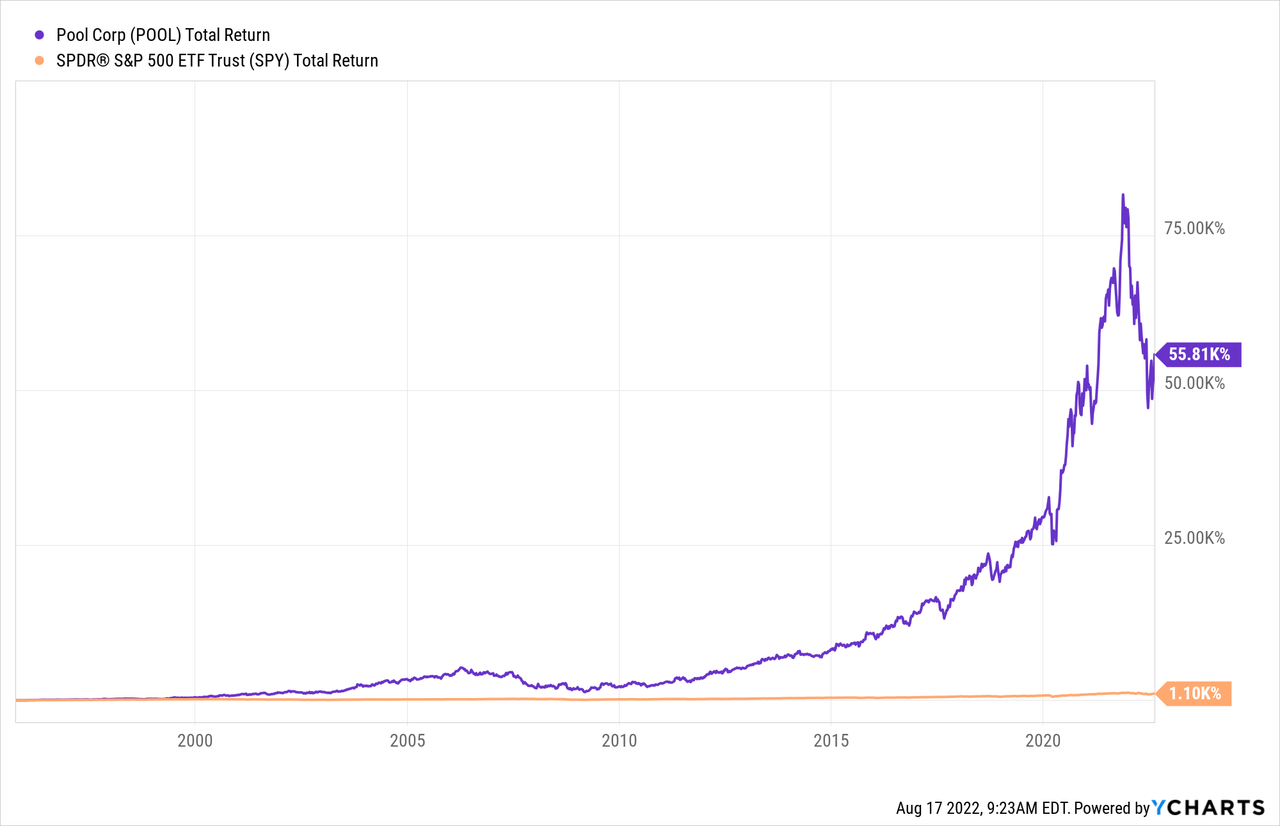

- Strong past performance on the stock market measured in total return helps to underwrite the previous points. It’s no indication of the future but underscores the market’s appreciation of the company, especially if the valuation didn’t change too much.

Ratings – Buy Or Hold

I give every company a “buy” or “hold” rating based on their current valuation. I don’t use sell ratings for these stocks as overvaluation periods will often be corrected by a stagnating share price and increasing revenues and profits. A high valuation doesn’t necessarily lead to a lower share price.

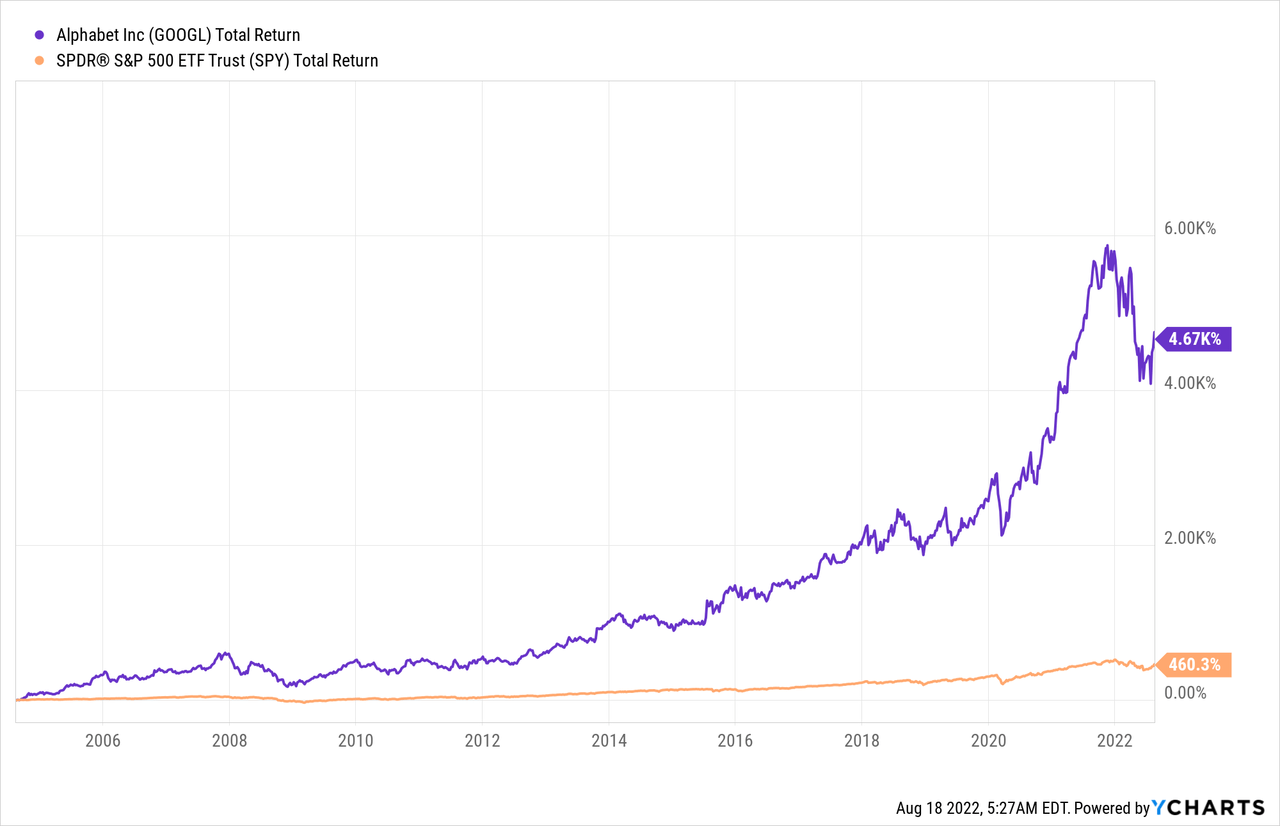

Alphabet Inc. (GOOG, GOOGL) – Buy

The tech behemoth formerly known as Google is still number one in online advertising. Its search engine keeps a steady growth pace as the company looks for new growth avenues. YouTube became another fundamental pillar of the company with continuous revenue growth and strong profitability. Outside the advertising space, it’s quickly growing cloud revenues.

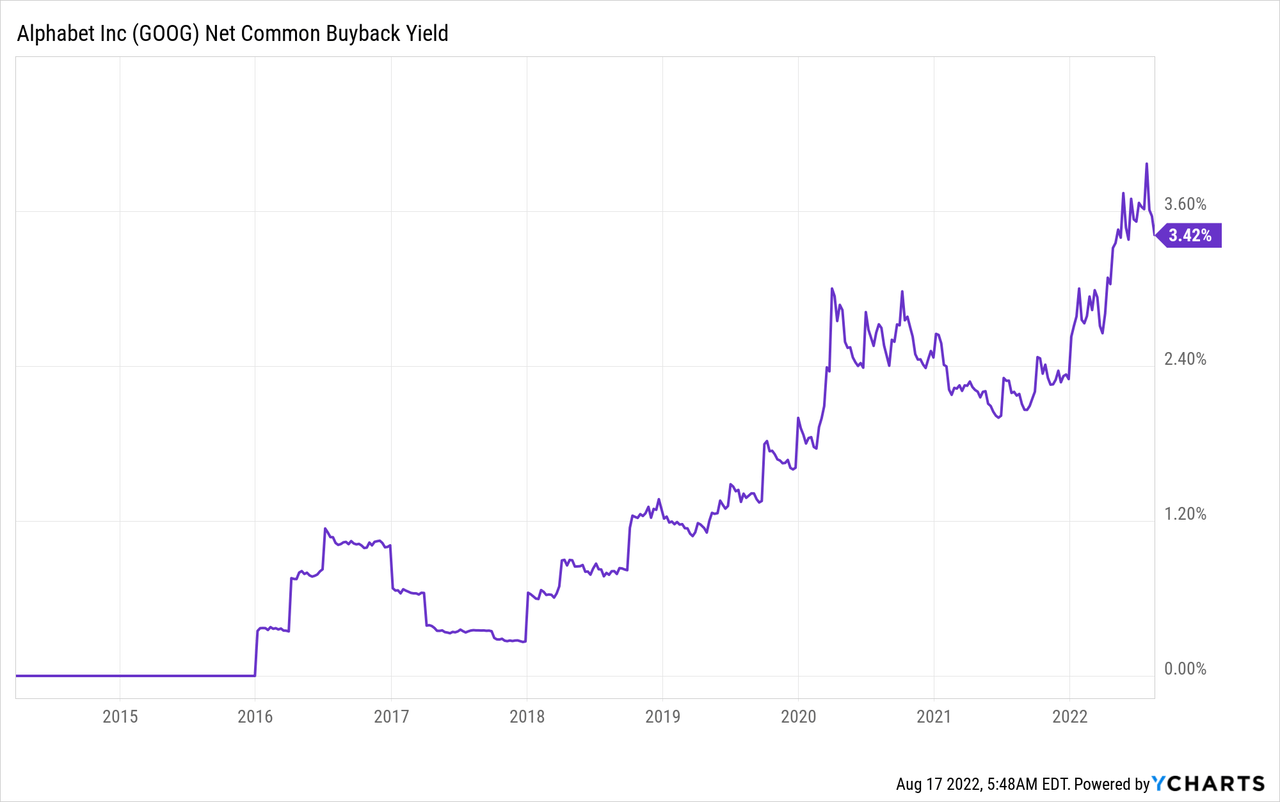

GOOG Shareholder Returns

Alphabet doesn’t pay a dividend. It only returns cash with buybacks.

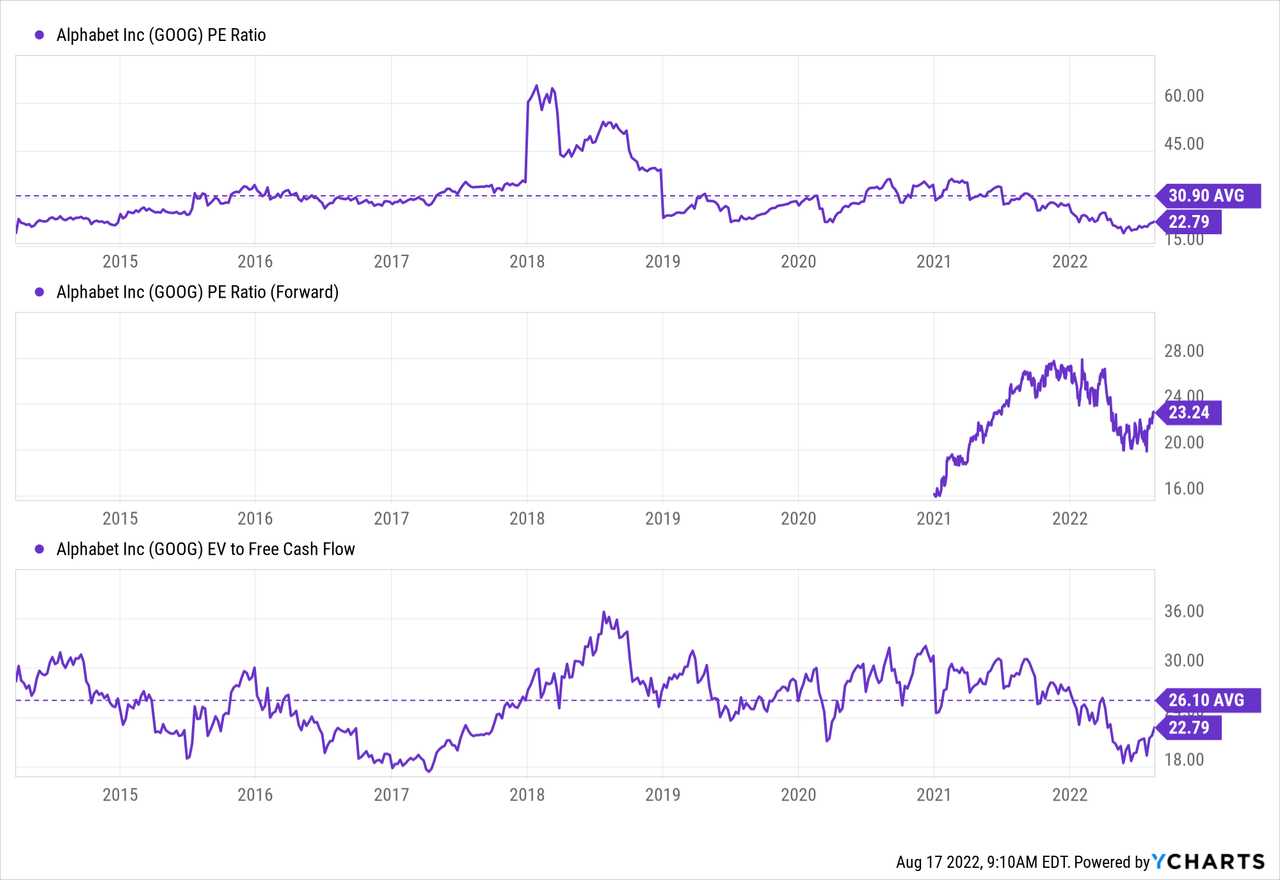

Valuation

Alphabet’s valuation is well below its 10-year average. Analysts expect a slight decline in EPS for next year as the advertising market could get hit by the slowing growth/recession. I only see this as a small bump in the long road ahead.

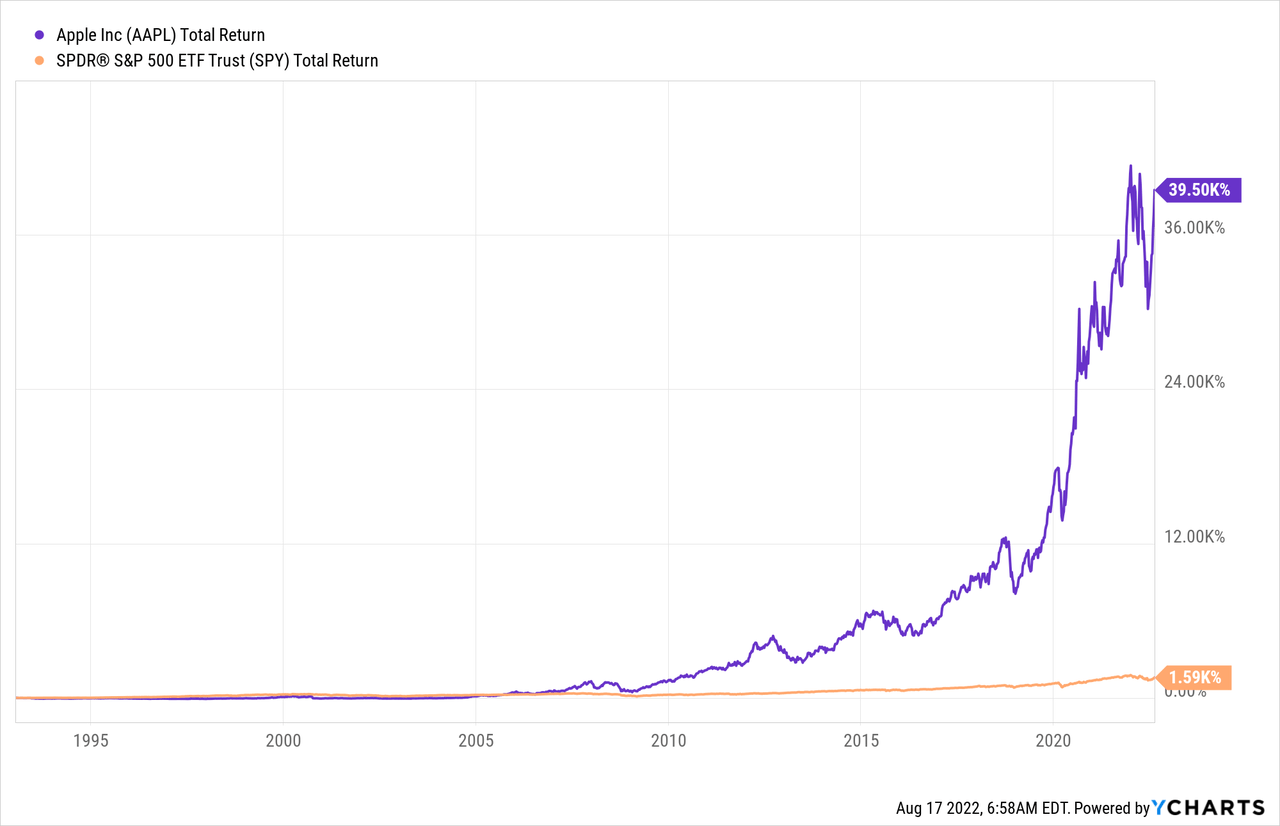

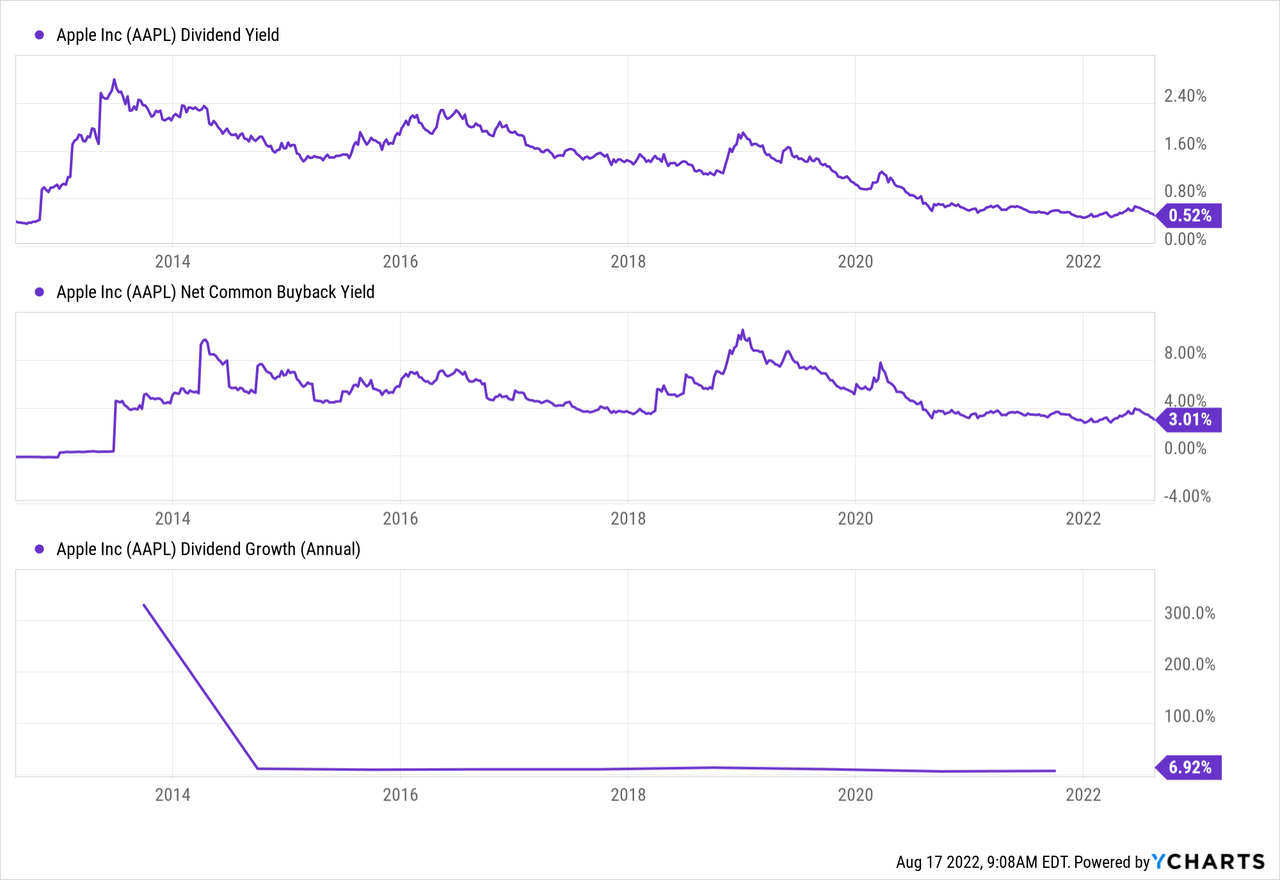

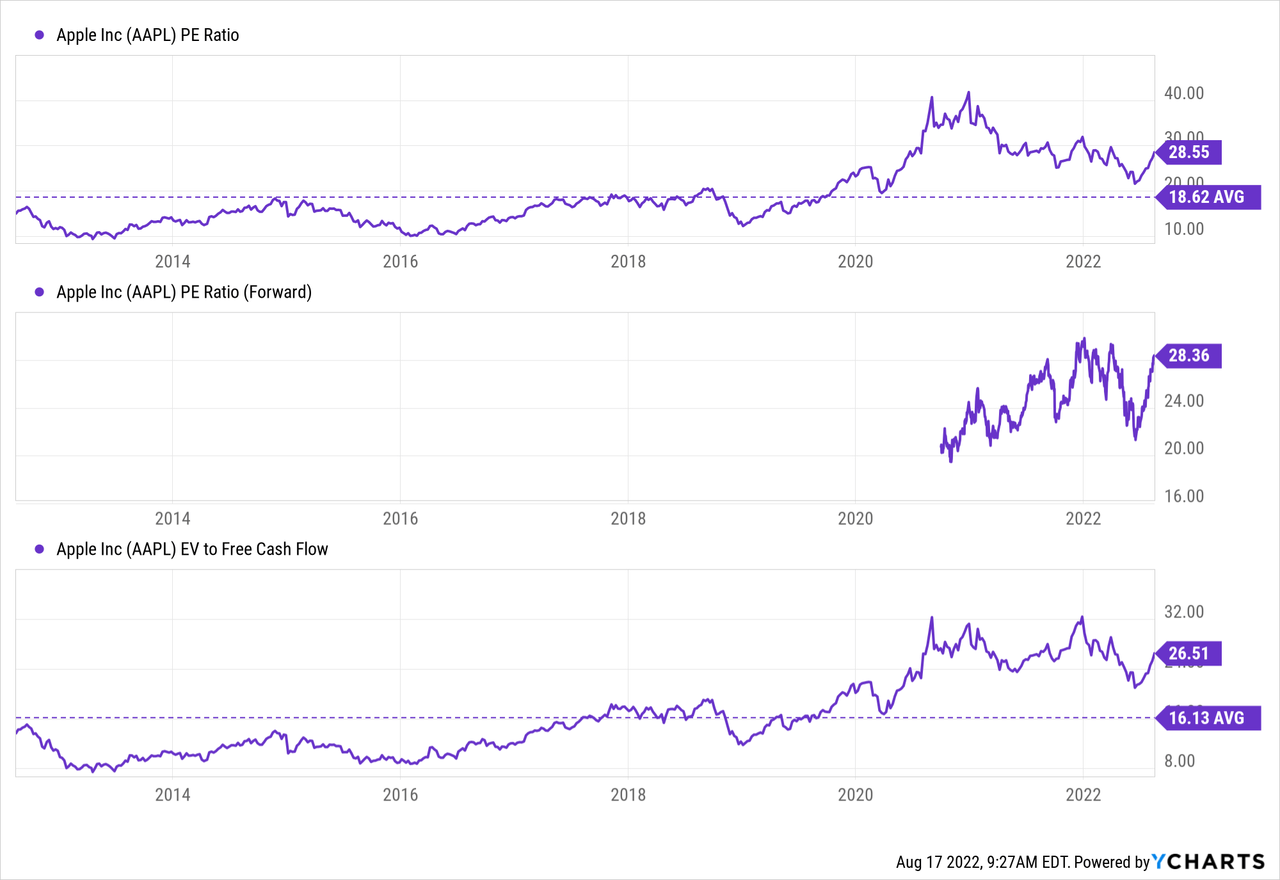

Apple Inc. (AAPL) – Hold

Apple is one of the best-known consumer products. It has a loyal consumer base and made several transitions throughout its existence. iPhone sales still dominate its revenue streams with more than 50% of revenue. Services are steadily gaining share in Apple’s revenue and now produce ~20% of revenue.

AAPL Shareholder Returns

The company pays a growing dividend since 2012 and uses excess cash to buy back shares.

Valuation

Apple looks rather expensive in comparison to the past ten years. There is some nuance as the company was often (too) cheap in the last decade and surprised the market with its growth and profitability. A further switch to more steady and predictable service revenues also justifies a higher valuation.

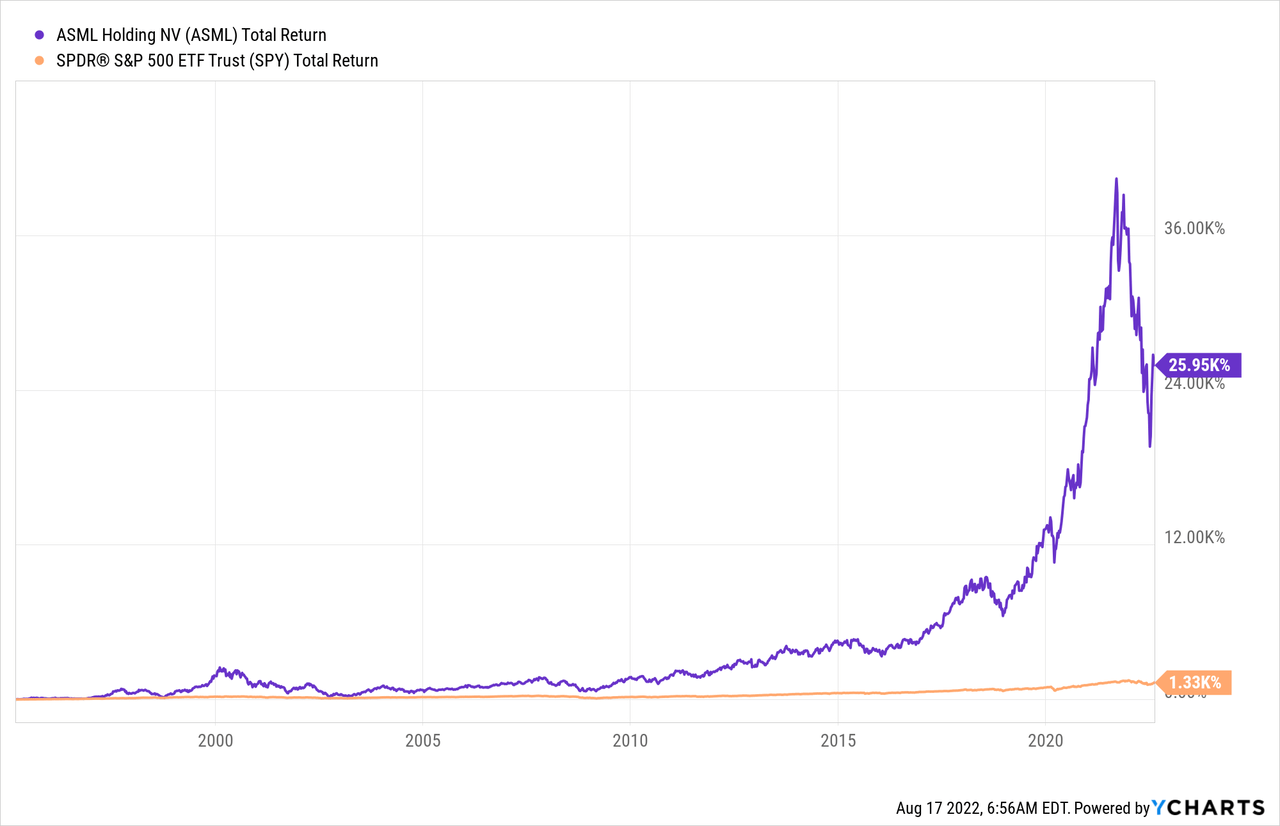

ASML Holding N.V. (ASML) – Buy

ASML is the leading provider of semiconductor equipment. The complicated and exact equipment profits from the continuous growth of the semiconductor sector. Its innovations aren’t equaled by any competitor, giving the company a vast moat. It’s located in the Netherlands and is the only non-U.S. stock on the list.

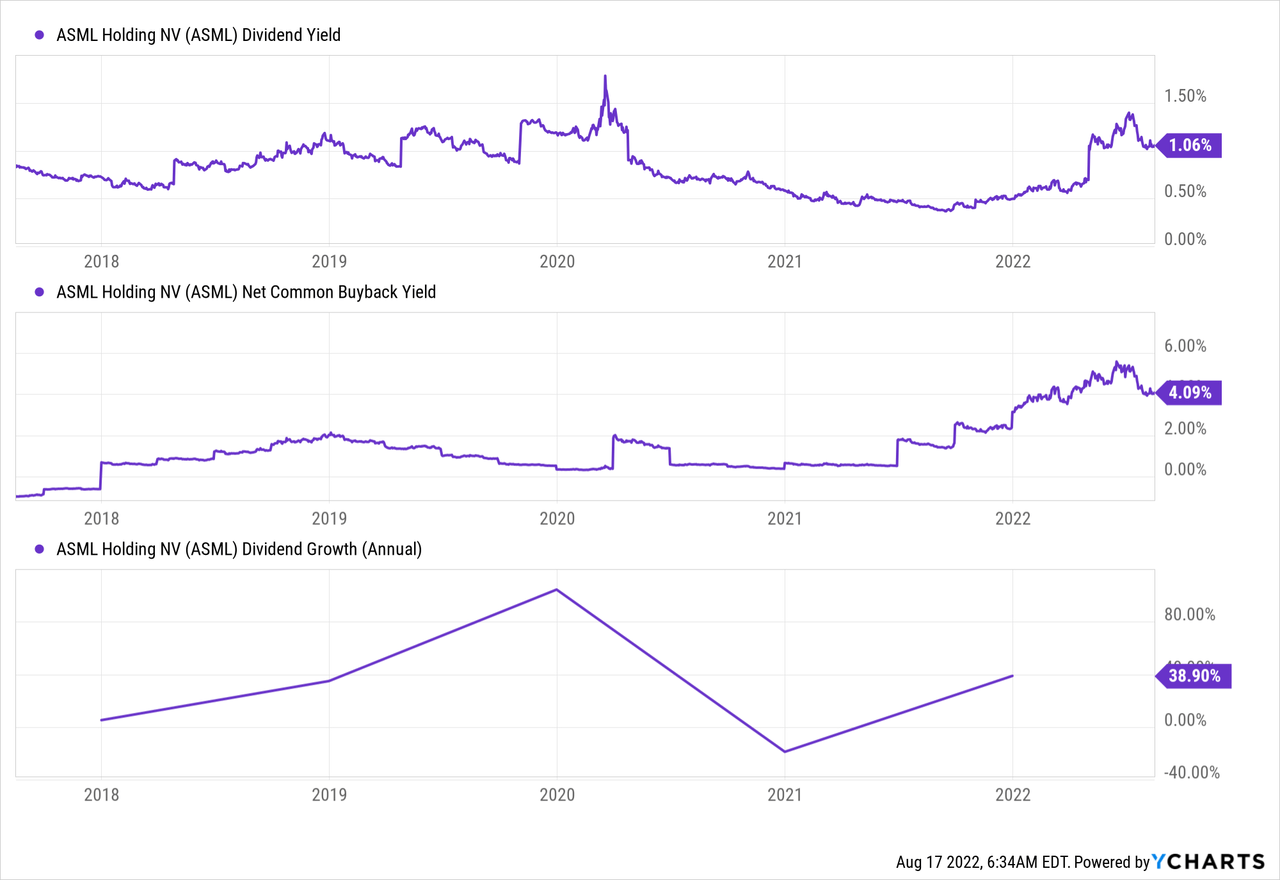

ASML Shareholder Returns

ASML pays a regular and increasing dividend. It just switched to a quarterly dividend. It repurchases shares at a steady rate.

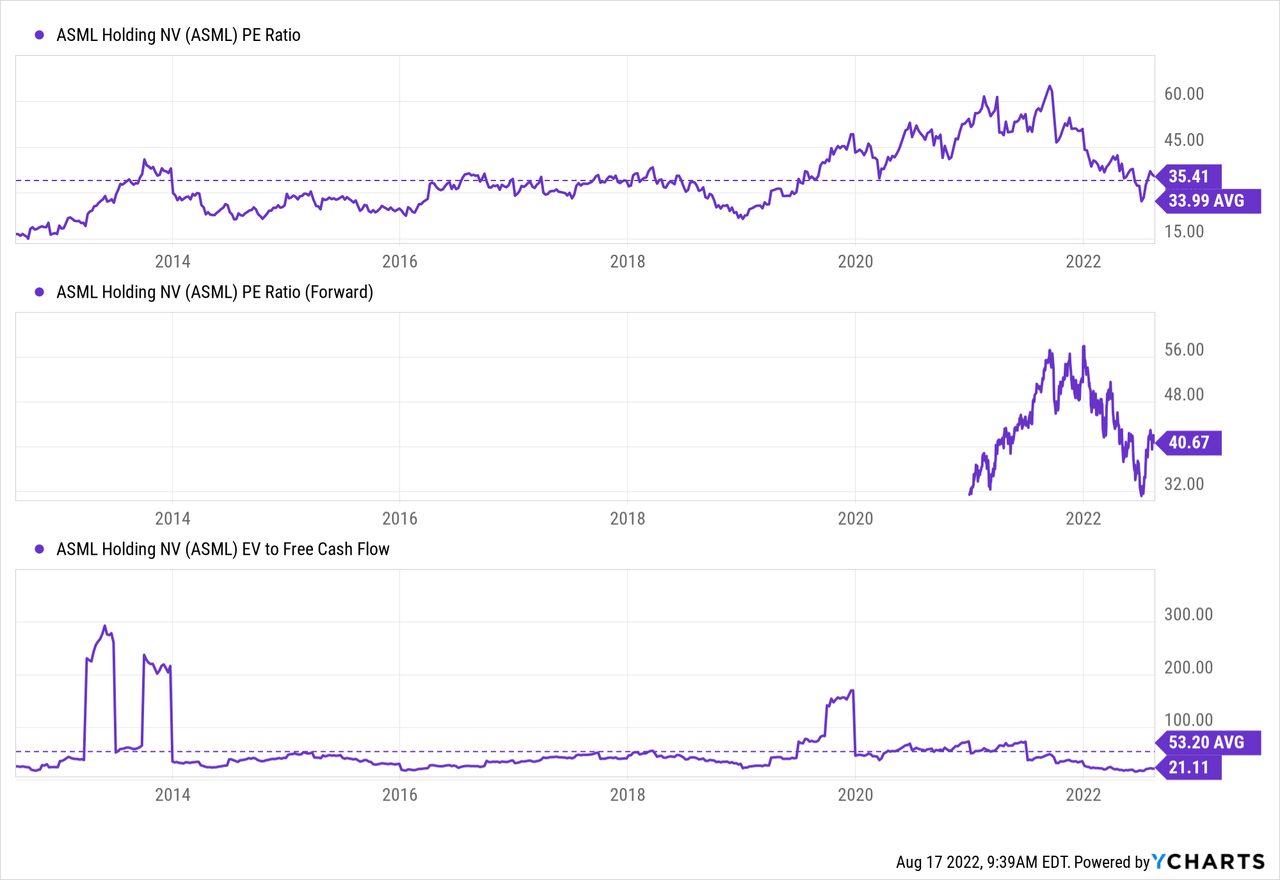

Valuation

ASML’s valuation metrics contradict each other. The high forward P/E can probably be ignored as the company had to delay some sales into 2023. Its backward-looking P/E is in line with its historical average. It improved its free cash flow (“FCF”) conversion over the past year, which it still has to prove to be durable. Overall, it looks reasonably valued.

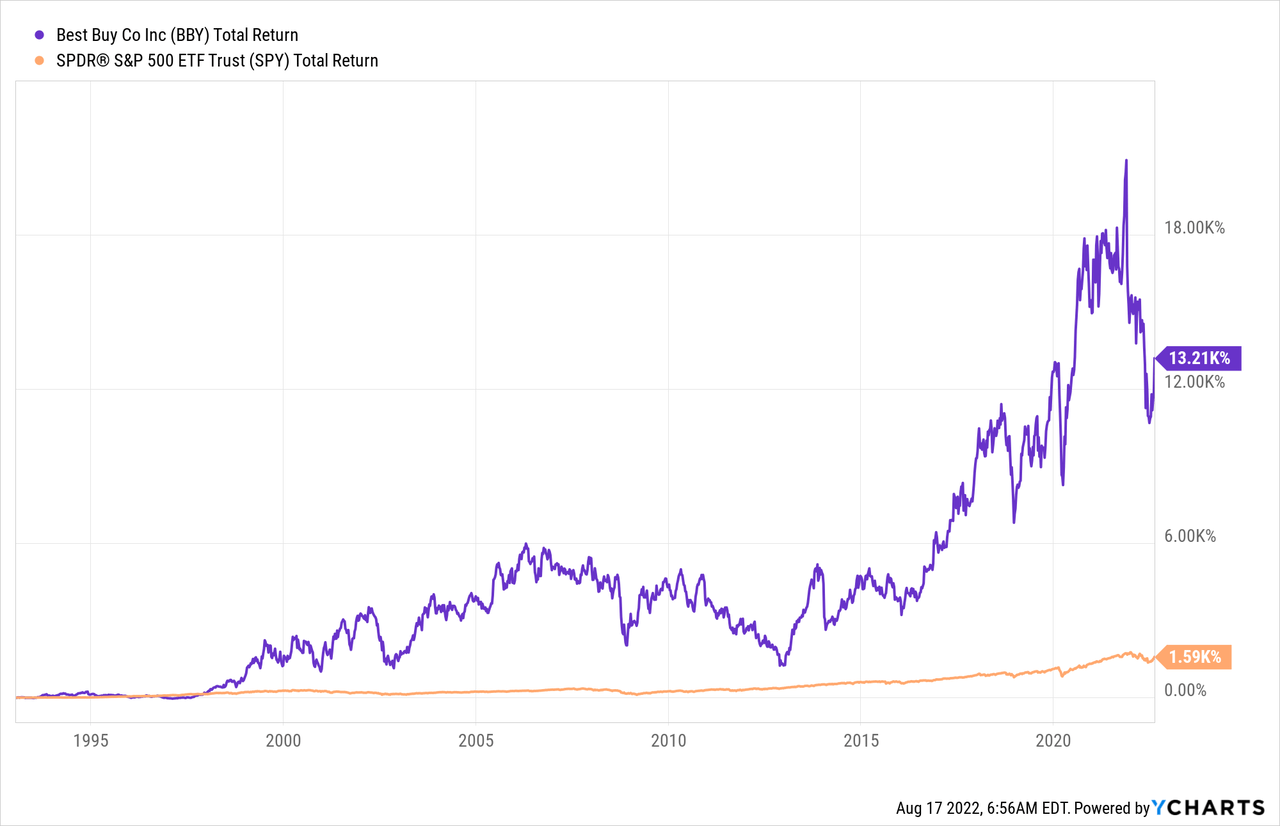

Best Buy Co., Inc. (BBY) – Buy

Best Buy is a successful technology product retailer. As a “classic” retailer, it survived the competition of online shops. It’s one of the few electronic retailers with physical stores left. That’s now probably an advantage. The company’s strong track record also resulted in above-average returns on the stock market.

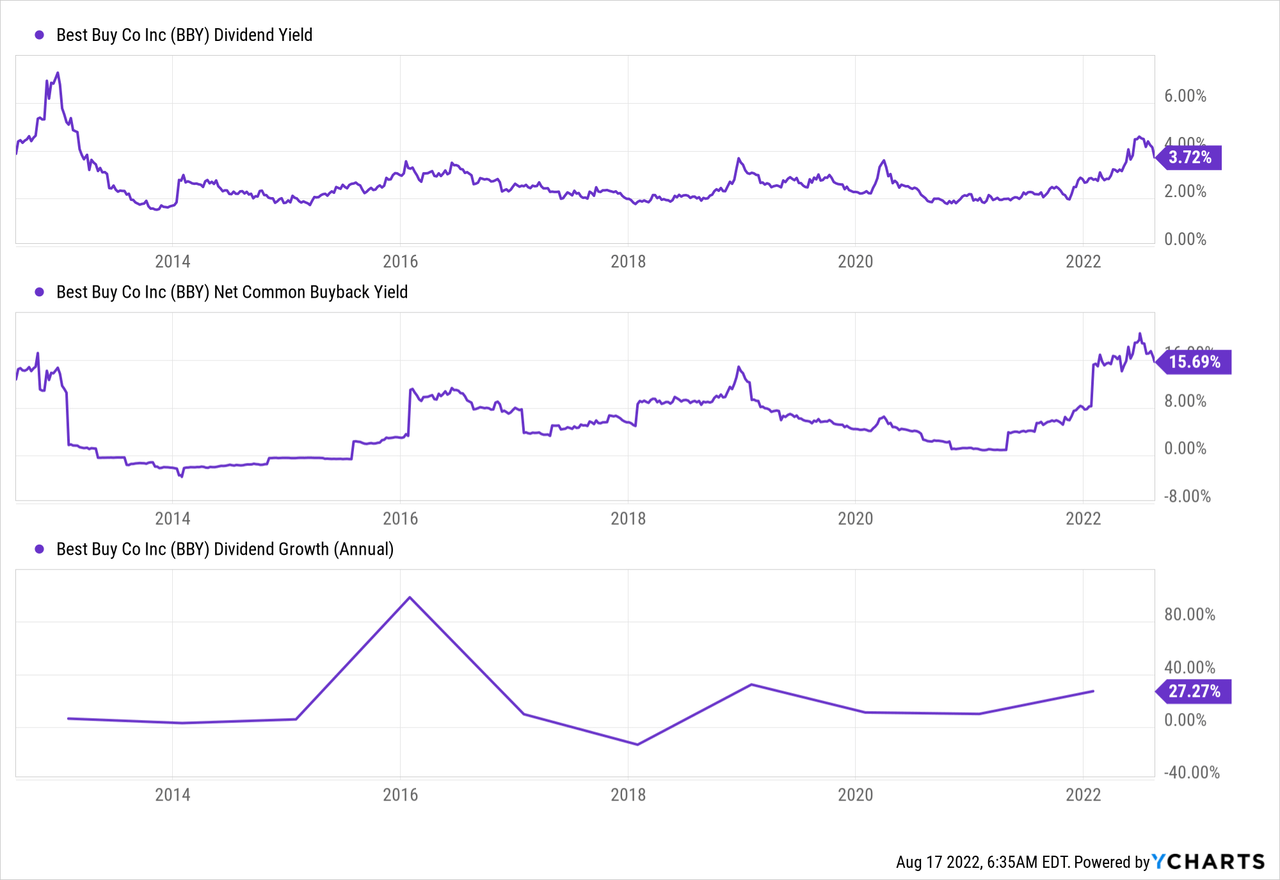

BBY Shareholder Returns

Best Buy pays a growing dividend since 2004 and regularly launches large buyback programs.

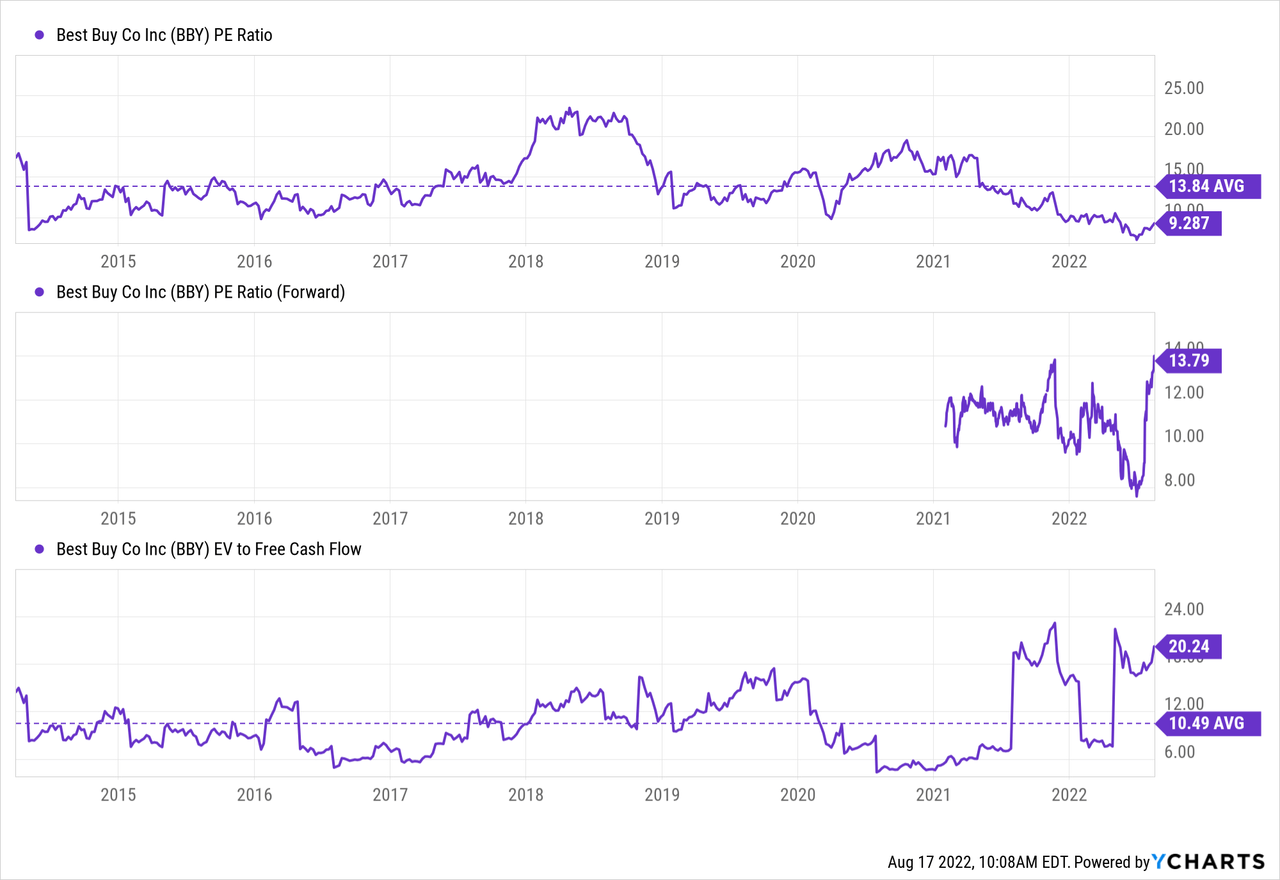

Valuation

Best Buy is cheaply valued using the TTM PE. Forward P/E is in line with its historical average. FCF conversion was low over the past twelve months. Once it normalizes FCF, it looks relatively cheap.

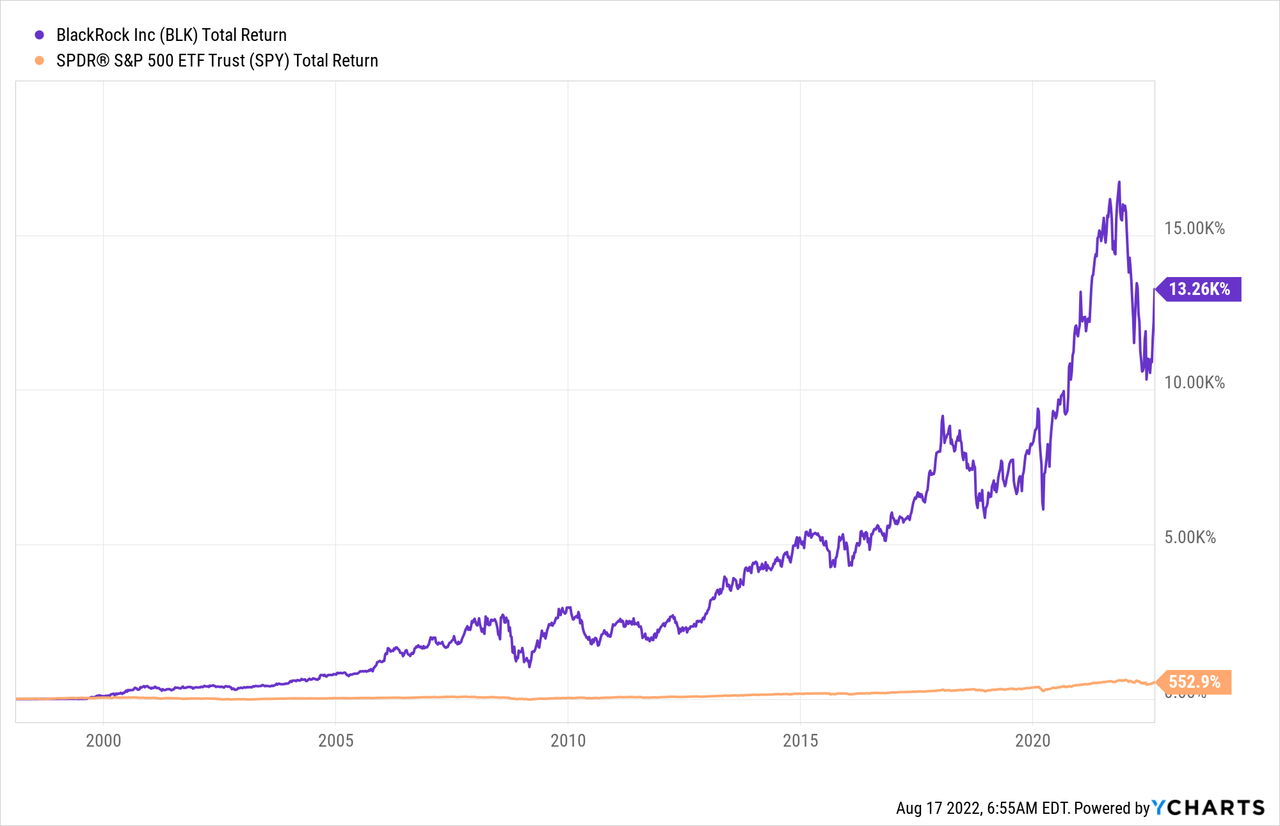

BlackRock, Inc. (BLK) – Buy

BlackRock is a global investment manager with several products to appeal to a broad range of investors. It profits from the continuous growth in its active investment funds, ETFs, and alternative assets. The dependence on public market products makes its assets under management subject to the volatile market environment.

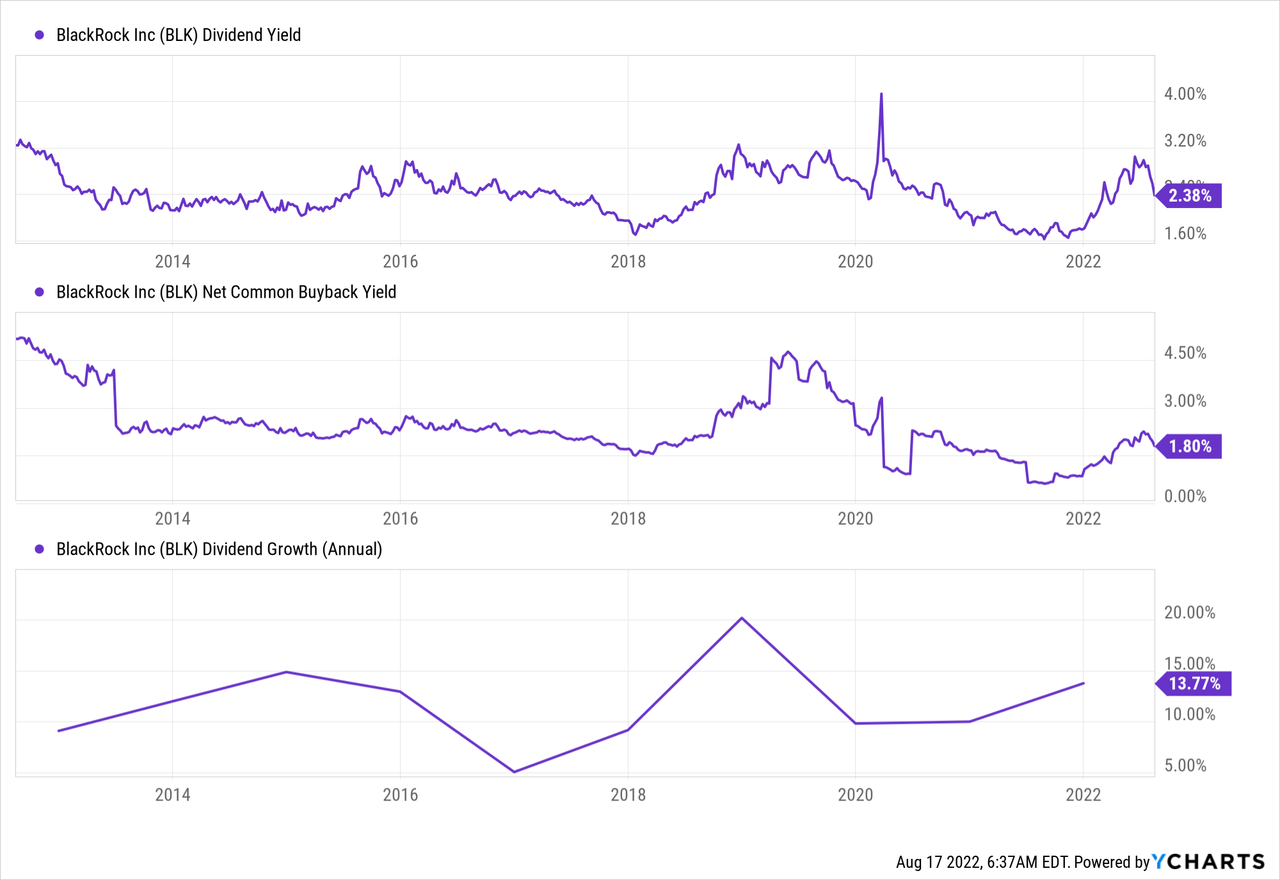

BLK Shareholder Returns

BlackRock’s dividend has been in place since 2004 and is growing at a decent pace. It uses excess cash for buybacks.

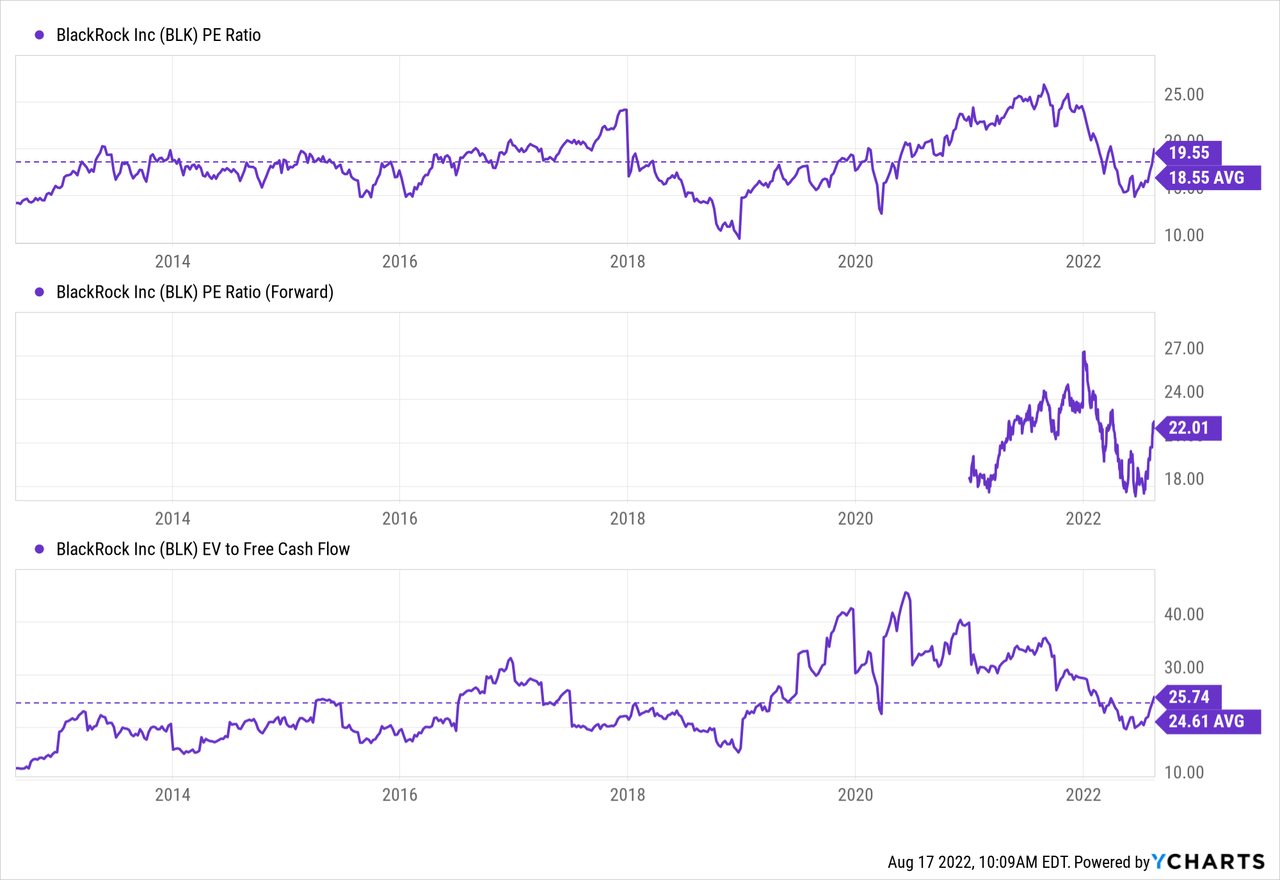

Valuation

BlackRock looks normally valued. Its valuation metrics are in line with its 10-year average. Forward P/E is slightly higher as the AUM declined approximately in line with the market. Overall, its average valuation is a good thing for long-term investors.

Costco Wholesale Corporation (COST) – Hold

Costco is a global big box retailer. Despite its large scale, it keeps a fast-growth rate by adding more warehouses. It has over 111M cardholders globally. Its members are loyal with 91.3% renewal rates.

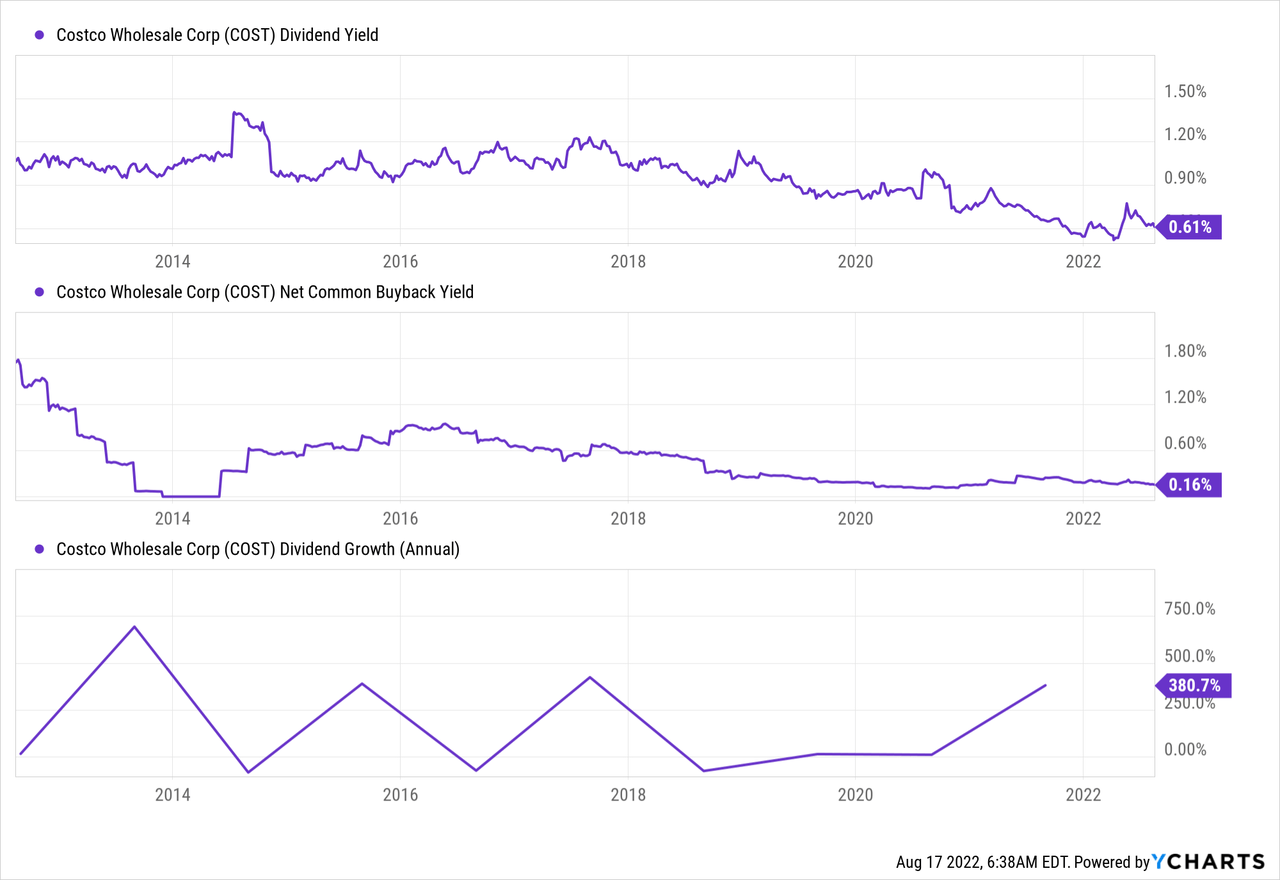

COST Shareholder Returns

Costco’s quarterly dividend grows steadily. It also paid four times special dividends with excess cash in the past ten years. It regularly repurchases shares for a relatively small amount.

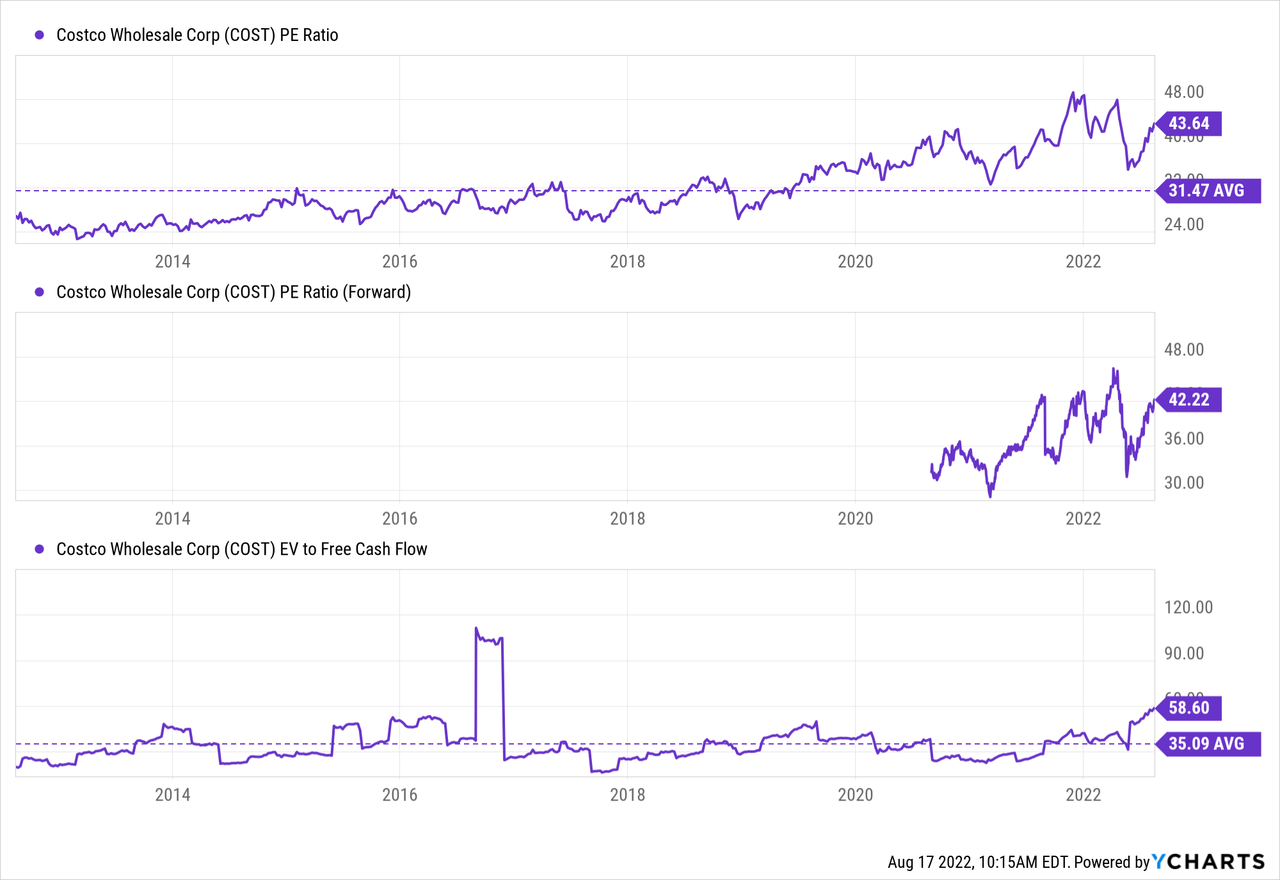

Valuation

Costco’s valuation is far above its historical average. P/E and forward P/E are high and approximately 40% above their 10-year average. Its FCF is somewhat lumpy, and the EV/FCF isn’t the most suitable metric for Costco. It seems the market got ahead here, and COST is currently overvalued. It’s not a problem for long-term holders but probably not the best time to get in.

The Home Depot, Inc. (HD)

Home Depot is a home improvement retailer. Long-term trends of better isolation and improved home comfort support the company. The investments and improvements of houses give it a steady tailwind.

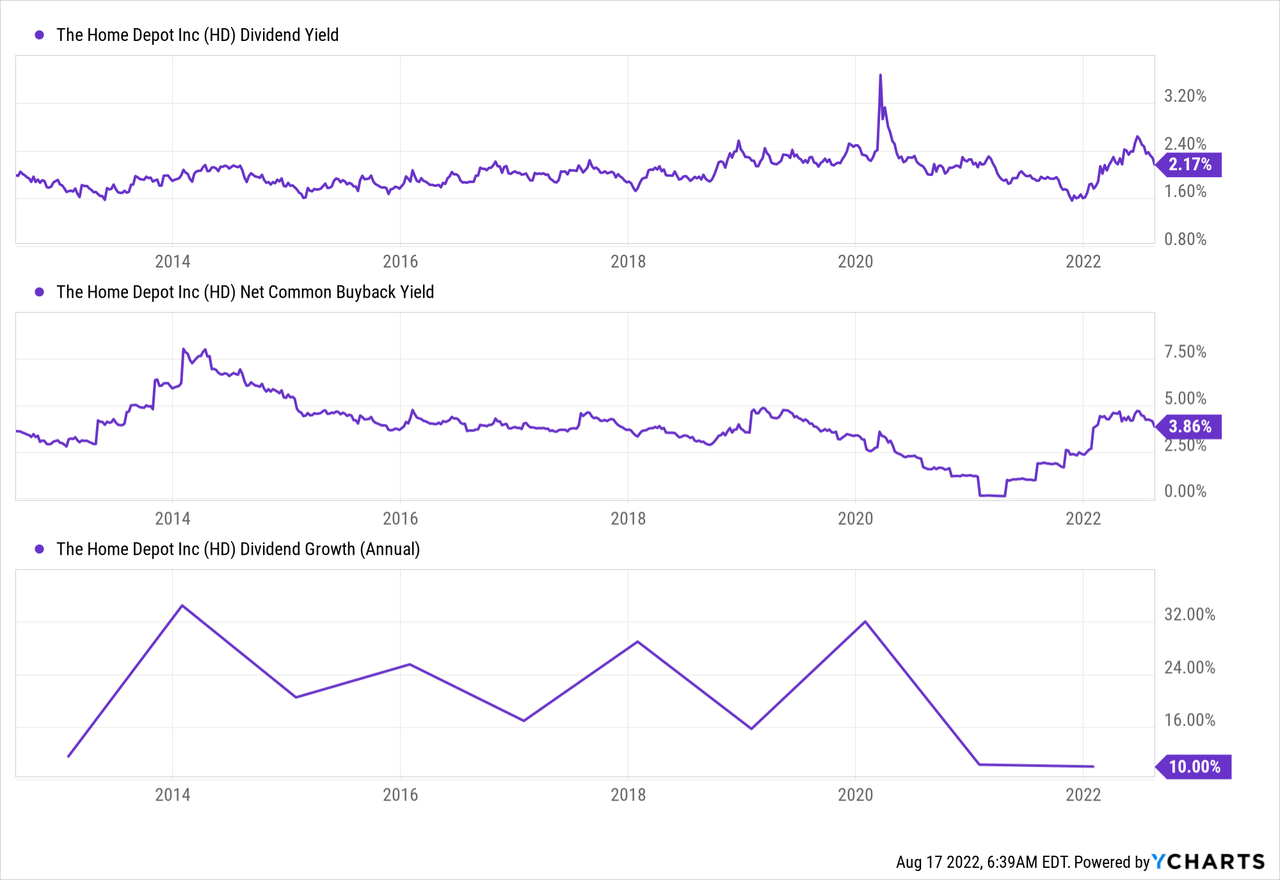

HD Shareholder Returns

Home Depot pays a growing dividend and repurchases shares.

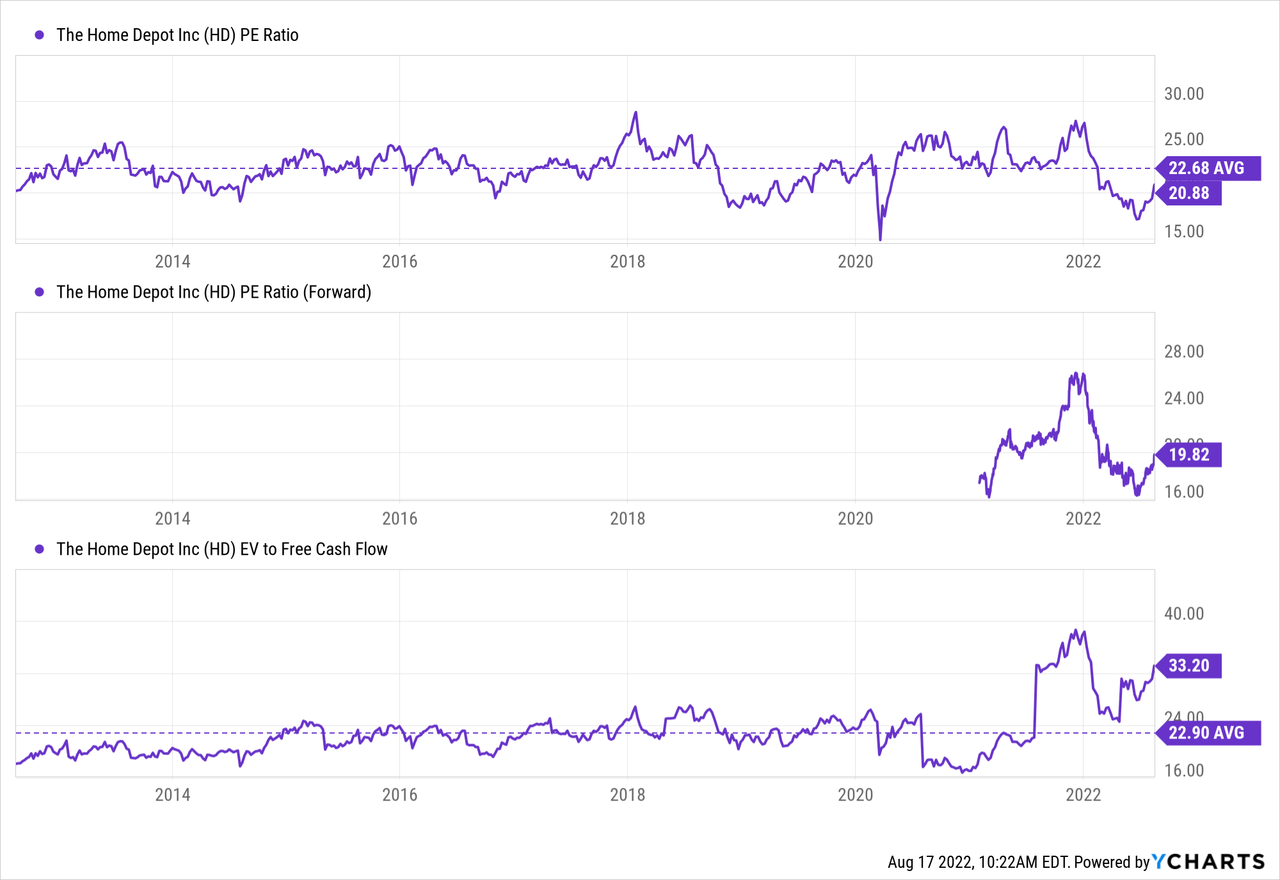

Valuation

Home Depot is valued in line with its historical average. FCF conversion was low over the past twelve months and should improve again. P/E ratios are below their historical average. It’s reasonably valued for long-term investors.

Mastercard Incorporated (MA) – Hold

Digital payments are on a long-term uptrend that’s still going on. Mastercard and other card providers profit by creating attractive ecosystems for customers and merchants. It operates with high margins as it profit from its scale and network effects.

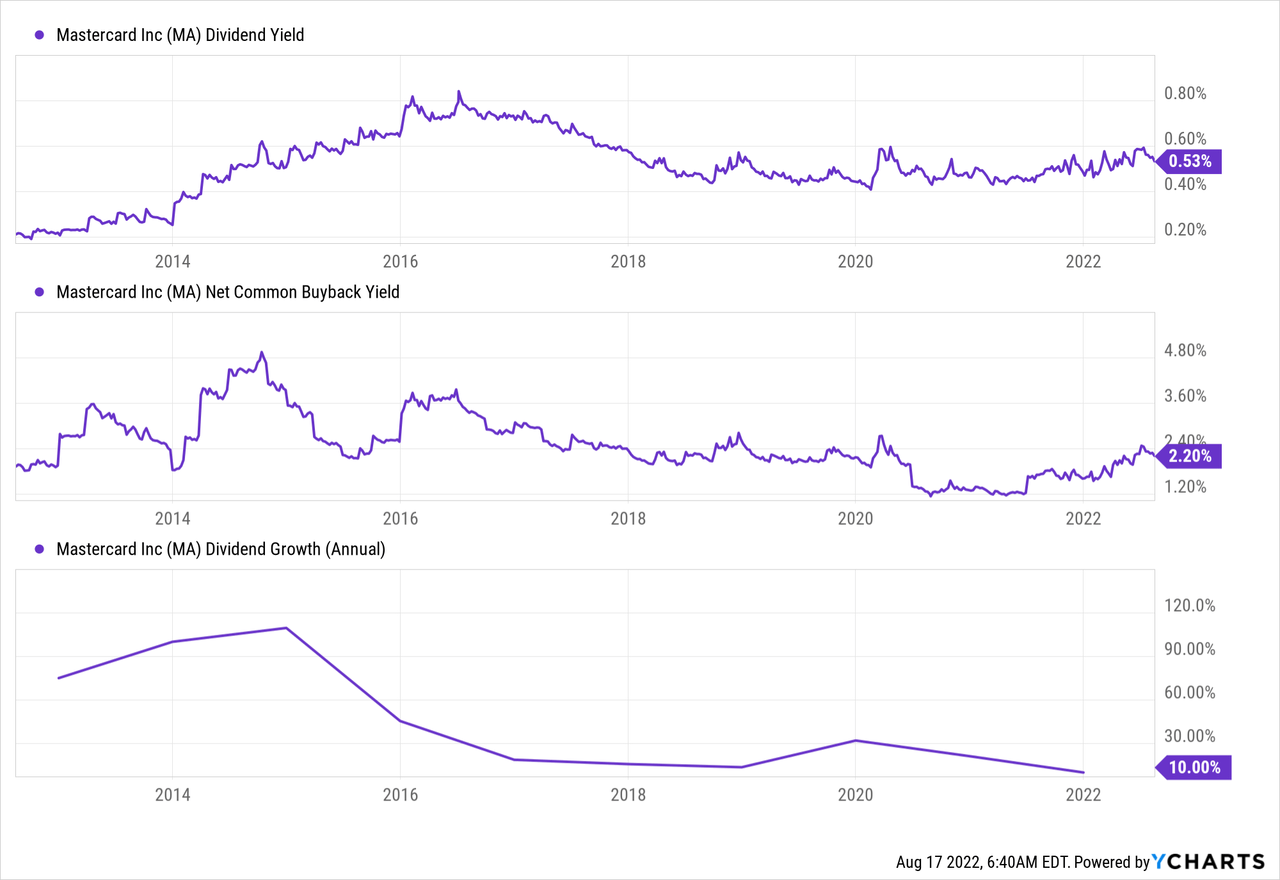

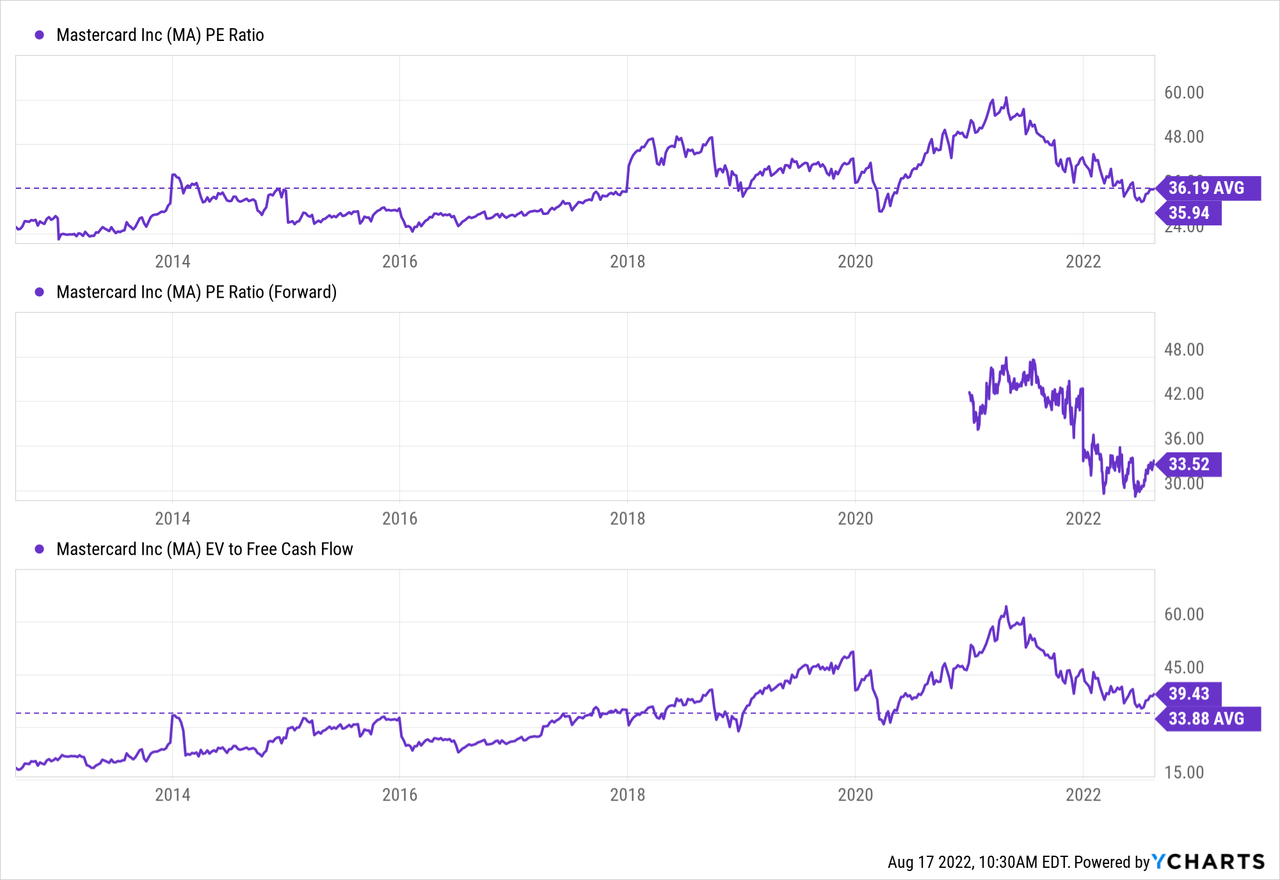

MA Shareholder Returns

Mastercard is another dividend growth company with regular buybacks.

Valuation

Mastercard’s valuation metrics increased over the past decade as the market appreciated robust and profitable growth. It might look expensive with a 36 TTM P/E and 33.5 FWD P/E. Those align with the 10-year average and provide a decent entry point.

Microsoft Corporation (MSFT) – Hold

Microsoft is a tech giant with its origin in operating systems for personal computing. It successfully expanded beyond that with business solutions and cloud services. The newer segments provide more growth and look to expand further.

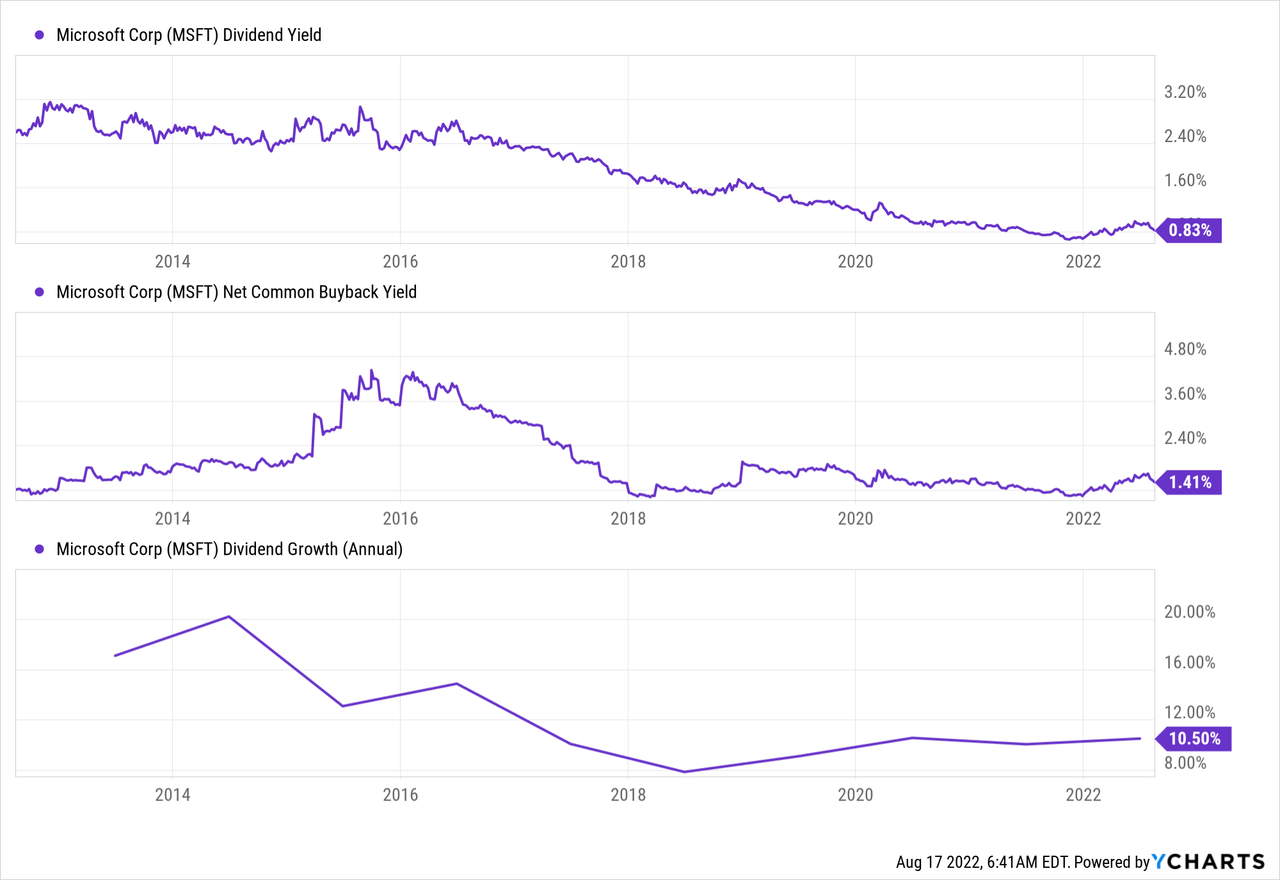

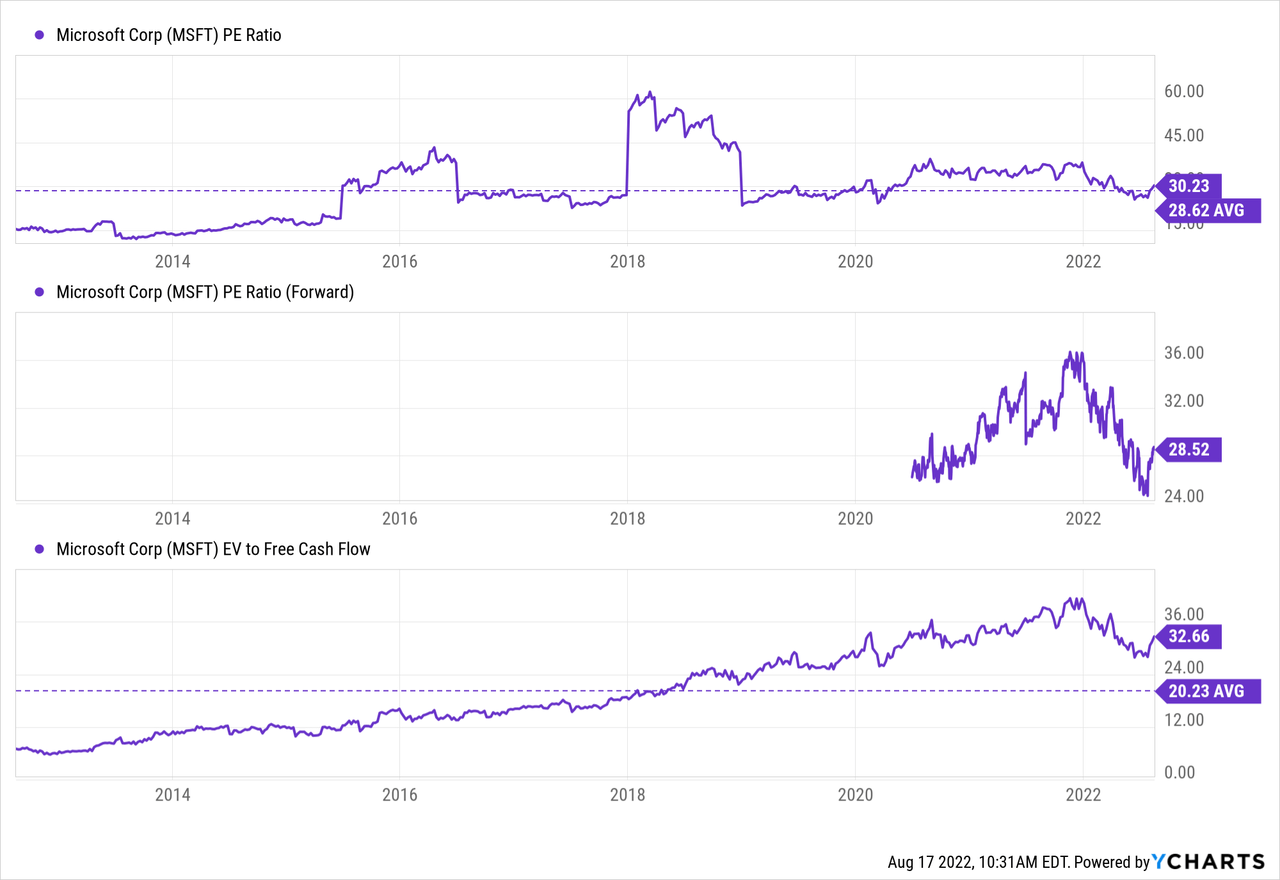

MSFT Shareholder Returns

Microsoft returns cash to shareholders through a growing dividend and share repurchases.

Valuation

Microsoft looks expensive, mainly since FCF conversion declined over the past few years. P/E is slightly above the 10-year average but increased from 2012-2015. It might signal a couple of slow years next on the stock market.

Pool Corporation (POOL) – Buy

Pool distributes everything related to pools. It has a broad range of products for professional contractors and retailer customers. It sells a lot of maintenance and minor supply products. These recurring sales make up 58% of revenue and are more predictable. Revenue proved to be sensitive to the housing market in 2008, which seems to worry investors again today.

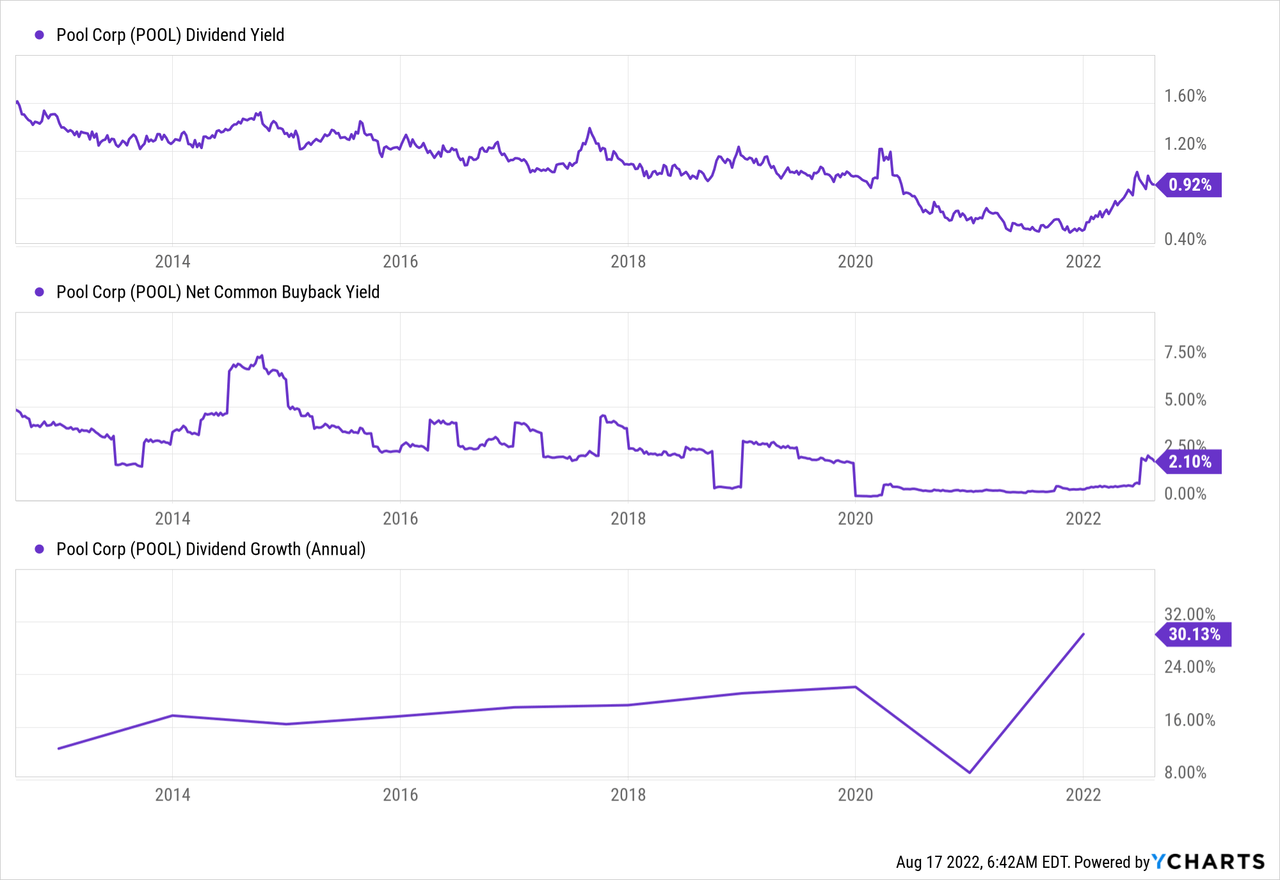

POOL Shareholder Returns

Pool’s dividend grows swiftly. It returns excess cash through buybacks.

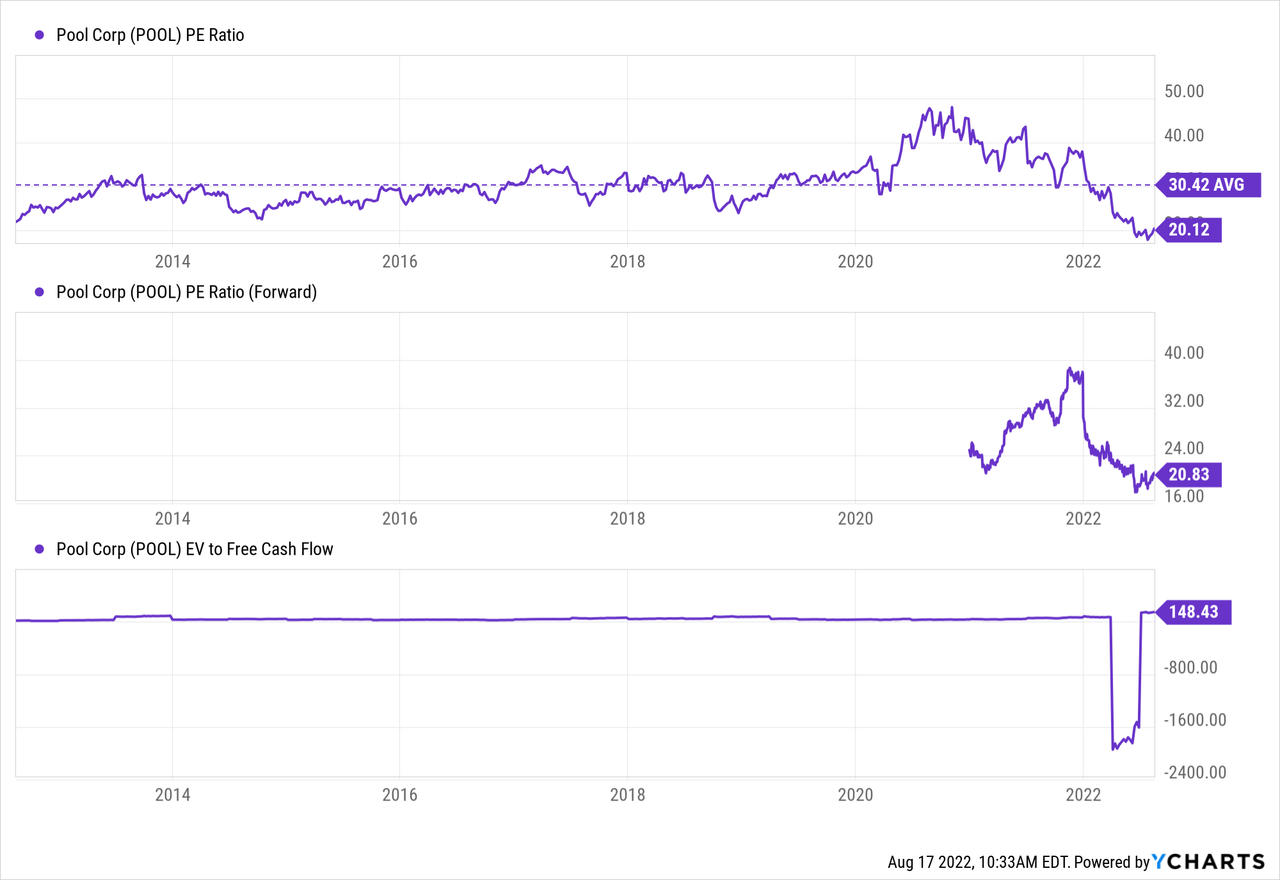

Valuation

Pool looks cheaply valued. Its P/E is at the lowest level in 10 years after the share price fell on estimates slightly below expectations. The FCF conversion took a big hit due to a build-up in inventories. As the situation normalizes, the company should produce ample FCF as it always did. It looks cheap and a good entry point for investors willing to look beyond the next quarter or year.

Conclusion

These are a starting point. I believe there are more possibilities for a buy and hold forever list than these ten stocks. The current market situation could provide opportunities as the summer rally seems to halt. The short-term remains unpredictable, and I believe investing in stocks I believe in for the long run is vital.

I look forward to reading your “buy and hold forever” ideas in the comment section!

Be the first to comment