Editor’s note: Seeking Alpha is proud to welcome Mike Zaccardi as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

sdominick/iStock via Getty Images

Stock splits are all the rage right now. Earlier this year, Amazon (AMZN) and Alphabet (GOOG) (GOOGL) officially announced plans to splits shares. Tesla (TSLA), another major TMT (technology, media, and telecom) stock, stepped on the split gas pedal last week, all but confirming plans to perform its second split in two years. Recall the last time Tesla split-shares surged in the weeks after the company’s press release. Another share price vault occurred around when it was added to the S&P 500. For a while, it was relegated to the U.S. extended market (which actually skewed that index’s returns since TSLA was such a heavy weight).

Stepping into the ring: GameStop

Back to the split story: GameStop (GME) was not to be outdone in late March. It, too, announced a split, but of the share dividend variety. In all, GME executives said they want to increase the company’s share count from 300 million to one billion, according to The Wall Street Journal.

Why? And Why Now?

So why are all these high-profile firms suddenly splitting? I believe there are a few reasons – some financial, some behavioral.

The Usual Reason Cited

For starters, splitting a stock helps small investors access shares they might not otherwise afford to purchase due to an extremely high pre-split price. By taking a stock’s price from, say, $3,000 to $100, retail investors can buy whole shares. What’s different today is that fractional share trading is commonplace across the brokerage world (but not all brokers offer the service). Still, being able to purchase whole shares and round lots (100 share lots) might attract new investors who once priced out.

First In the Pool

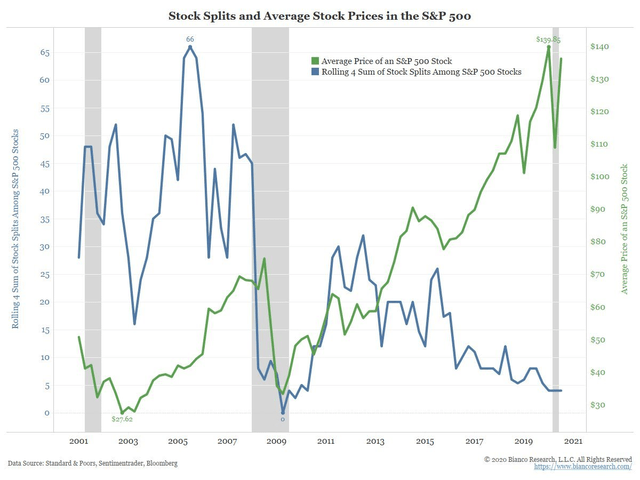

Another factor I assert that plays a role is the “first in the pool” effect. That is, it takes a big mover to start a trend before everyone else jumps in. While Apple (AAPL) and Tesla split in the summer of 2020, the trend did not really take off. After a big bull market commencing in March 2020, now seems to be the time when splits are sparking. Once a few big companies do it, everyone else might feel a sense of comfort to perform the same corporate action.

Meteoric Rise in the Average Price of S&P 500 Stocks

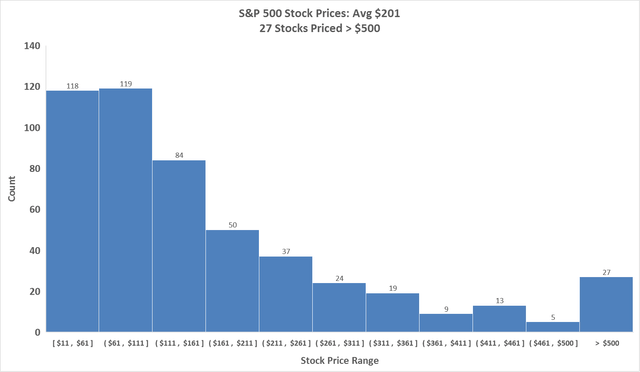

It was thought that there was an ideal price range for an S&P 500 stock, perhaps in the $20 to $150 range. That rule of thumb went by the wayside in the 2010s as the average S&P 500 stock price surged. Today, the median S&P 500 stock has a price tag of $118. The average is above $200. That contrasts with history. Consider that even at the 2007 bull market peak, the average SPX stock price was under $80 (as per Standard & Poor’s and Bloomberg data). Maybe a new stock split era has sprouted?

27 Stocks Currently Priced Above $500 In the S&P 500 Index:

Stock Splits: Average S&P 500 Stock Price (2000-20):

What About Returns? It Might Not Be What You Think

Splits used to be a great sign of further stock price gains, but recent history suggests alpha is less available. You can dig into returns using a nifty index: The 2 for 1 Index is a list of 25 to 30 stocks, equally weighted and rebalanced every month.

Conclusion

My take: Be careful jumping on board with recent stock splitters. While long-term returns are great in the months after a split announcement, more recent data indicates you cannot make easy money by simply scooping up shares of companies recently announcing stock splits.

Be the first to comment