HadelProductions/E+ via Getty Images

Investment Thesis

In a previous article, we explored why investors in Vale S.A. (NYSE:VALE) should remain cautious in the current environment, as iron ore prices have peaked and the Chinese demand is easing. Despite the relevant risks, the narrative has not changed, and the previous investment thesis remains intact, with VALE finally qualifying for a strong buy rating.

Sluggish Local Chinese Steel Demand

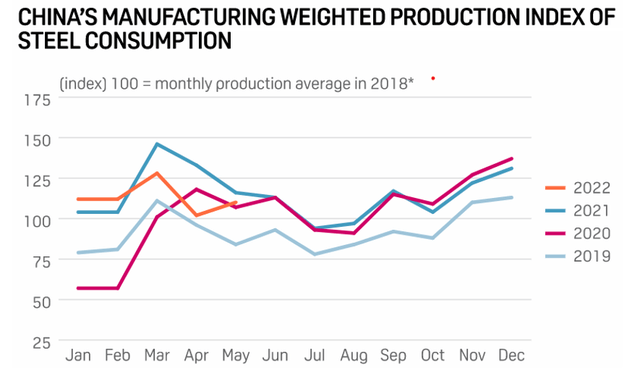

China’s steel exports will likely stay sluggish for the rest of 2022, as rocketing global energy prices and monetary tightening across the world will likely ease demand and reduce overseas steel consumption. As a result, the manufacturing production index for steel consumption in China produced by S&P Global Commodity Insights stood at 110 points in May, down 5 points from the same period of 2021.

The lockdowns in major cities have been a major factor in damaging local steel demand and crippling construction activity in the country. As a result, China’s crude steel consumption fell by 14% in May compared to the same period. Demand decline has also meant inventories are piling up in the country’s biggest warehouses.

China’s Manufacturing Weighted Production Index (www.spglobal.com)

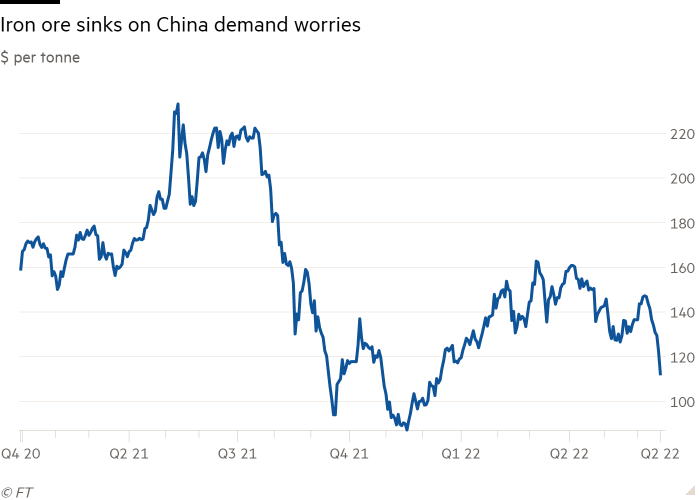

Iron Ore Prices On A Downward Trajectory

Iron ore prices have been plummeting, and on June 20th, iron ore fell to a six-month low of $111.4/t and is feared to fall lower in the near future amid a gloomy outlook for China’s property market. The Chinese property sector accounts for nearly 40% of Chinese steel demand; hence, the outlook of the country’s real estate market is essential in determining the prices of Iron ore contracts. In April and May, new home prices fell in more than half of China’s 70 biggest cities for the first time since 2016, and sales of properties were down nearly 60%.

The decline in Iron ore price will squeeze the company’s margins and pressure its future profitability. During Q1 2022, the company reported realized price of Iron ore for the quarter at $141.4/t. However, the realized prices for the company in the coming quarters are expected to drop as Iron ore prices have continued to show weakness during the latter half of Q2.

Iron Ore Sinks (www.ft.com)

However, it’s not doomsday yet for Iron ore and the Chinese steel demand. The government is discussing a stimulus package for the economy as it recovers from COVID-related lockdowns. In addition, President Xi recently reiterated his intent to achieve the economic goals for the current year, despite the pandemic and property sector setbacks. As a result, Iron ore prices increased by 5.3% to $113.8/t after the President’s remarks, while steel rebar and hot-rolled coil closed more than 2% higher in Shanghai. Similarly, Citibank and JPMorgan analysts forecast a recovery in Iron ore prices later in the year, expecting a stimulus package by the Chinese government soon and an improvement in the country’s property activity.

China’s Centralized Group

In an effort to reduce the volatility in the prices of Iron ore and decrease the reliance on the Australian Iron ore supply, China is planning to set up a centrally controlled group led by the China Iron and Steel Association and the planning ministry to consolidate the country’s iron ore imports through a new centrally controlled group.

China is the world’s biggest consumer of Iron ore, with its steel industry absorbing approximately 70% of global production, most of which is supplied by Australia. However, trade tensions have been running high between the two countries, and China is strategizing to reduce its dependence on Australian Iron ore exports; Australia accounted for more than 60% of China’s total imports in 2021, according to China’s customs data. This development could potentially benefit other suppliers of Iron ore, such as Vale, since it can increase its share of exports to the country as China cuts down on Australian Iron Ore.

Vale’s Recent Developments

Earlier in May, Vale announced its supply deal with Tesla for a low-carbon nickel. The Brazilian miner will supply Class 1 nickel to Tesla from its operations in Canada. This deal is part of the company’s long-term strategy of increasing its exposure to the fast-growing electric vehicle industry.

Moreover, Vale recently announced that it had completed studies for potentially developing a nickel sulfate operation in Quebec with an annual capacity seen at 25,000 tonnes to serve the emerging electric-vehicle market better. Therefore, the company has a long-term strategy of increasing its exposure to the electric vehicle industry, which will prove fruitful in the long run.

Venture Capital Initiative

Last but not least, the company recently launched Vale Ventures as part of its corporate venture capital initiative. This $100 million fund will enable start-ups to create new business and innovative technologies to incorporate into Vale’s operations. Vale firmly believes sustainable mining is the future and will invest in start-ups if any start-ups help Vale become global friendly.

Takeaway

Mr. Market is harsh with Vale, especially when the stock broke below the $14 price level. Nevertheless, at current levels, Vale earns a strong buy rating as the risks and uncertainties are fairly reflected in the stock price.

Be the first to comment