double_p/iStock via Getty Images

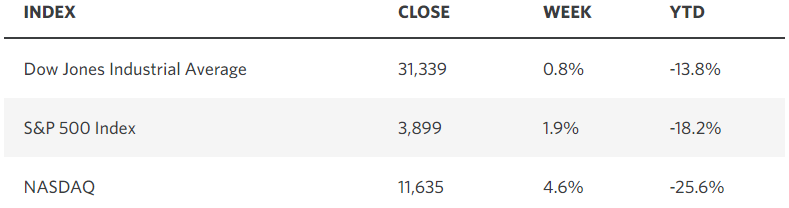

Investors are caught between a rock and a hard place. On the one hand, we want the rate of economic growth to slow in order to bring down the rate of inflation, which requires tightening monetary policy conditions. Therefore, strong economic data is frowned upon because it suggests the Fed will have to tighten more aggressively. On the other, we don’t want to see economic data weaken so severely that it chokes off the expansion and results in a recession. The goal is to successfully navigate between these two, resulting in a soft landing, which is the best of all outcomes. Stocks rebounded sharply last week in response to signs that we are making strides in that direction.

Edward Jones

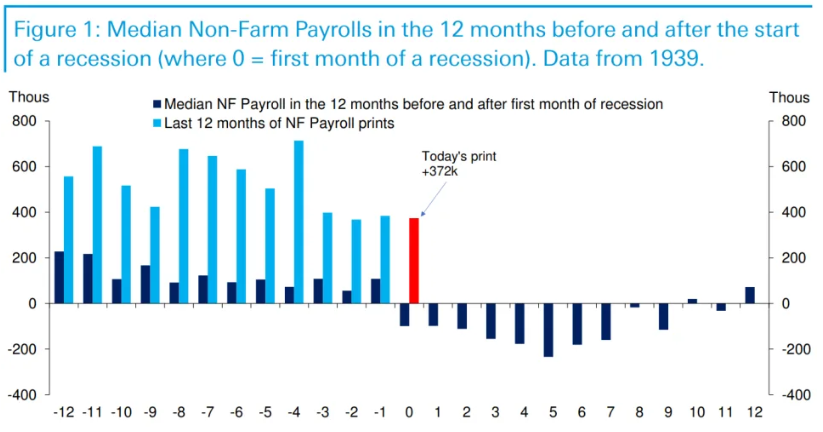

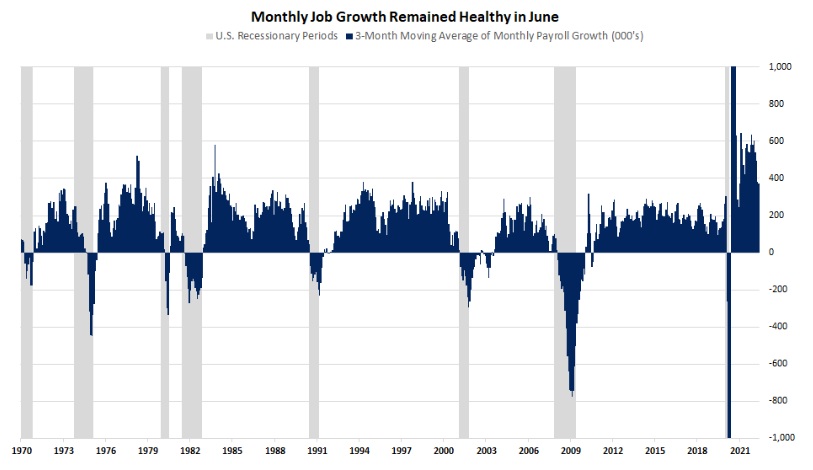

Last Friday’s jobs report showed the resiliency of this expansion in the face of stiff monetary policy and financial market headwinds that has the consensus obsessed with recession. The economy created 372,000 jobs in June, resulting in no change in the 3.6% unemployment rate. We have finally recovered all 21 million jobs lost during the first two months of the pandemic. That strength was coupled with another month of moderation in wage growth with the year-over-year increase falling to 5.1% from 5.3% in May and the peak rate of 5.6%. That is what the Fed wants to see to help lower the inflation rate. This is not a recessionary environment, especially when bars, restaurants, and other hospitality companies hired 67,000 workers in June.

Yahoo Finance

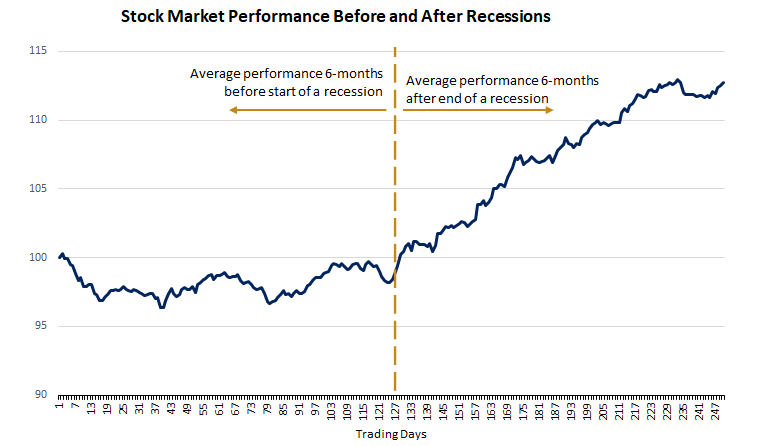

Considering that the majority of the public, investors, and pundits are convinced we are in the midst of a recession, let’s look at the ramifications of such an event from a market perspective. For starters, our markets have done most of the dirty work pricing in an economic contraction with the S&P 500 falling 21% from its January high. That is what typically happens to the market during the early stages of a recession. More importantly, the market bottoms and starts its recovery an average of four months prior to a recession’s end. Therefore, even if we are in the midst of a recession that were to extend into the third quarter, lasting nine months, precedent suggests the low for the S&P 500 is behind us.

Edward Jones

While the year-to-date decline for the index has been modest relative to past recession-driven bear markets, I think that is consistent with what would be a relatively modest economic contraction, should one occur. We don’t have a tremendous amount of excess built up in the real economy, as we did following longer expansions like the one leading up to the Great Recession. Furthermore, consumers are in much better shape than they have been in the past from the standpoint of jobs, wages, savings, and debt payments as a percentage of disposable income sitting at a 40-year low.

My base case continues to be that the contraction in the first quarter was an anomaly, due to the pandemic-induced trade deficit, and that we will avoid a recession this year. It is hard to imagine a downturn in the economy when the labor market continue to add close to 400,000 jobs each month. It would be unprecedented. This looks much more like a mid-cycle slowdown with inflation and tighter monetary policy conditions slowing growth.

Edward Jones

The fact that the yield curve between 2-year and 10-year Treasuries is modestly inverted tells me that the market thinks the Fed is poised to tighten monetary policy too aggressively, supporting the recession fears that have emerged in recent weeks. As more signs that inflation is abating emerge, the expectations for rate hikes during the second half of this year should start to come down. That should be the fuel for a second-half market recovery.

We have now had a 6.3% rally off the June 16th low in the S&P 500, which is similar to the 11% rally in March and 7% rally in May. The bears are convinced this is another dead-cat bounce, but I feel differently. We need a new catalyst to see a trend reversal, which could come in the form of more favorable inflation news when the Consumer Price Index is reported on Wednesday. We also begin earnings season this week with several of the money-center banks scheduled to report.

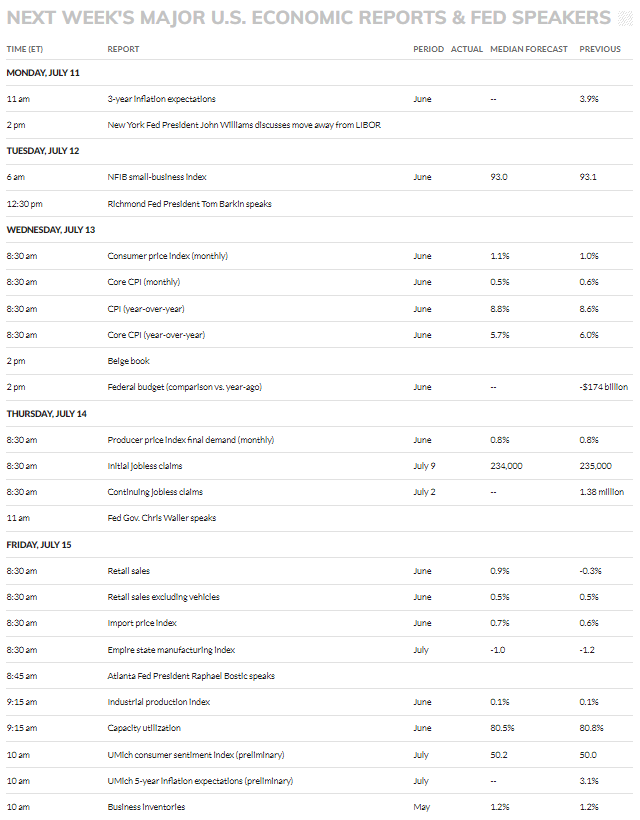

Economic Data

Wednesday’s inflation report is likely to dictate whether last week’s market recovery was a dead-cat bounce or the beginning of the summer rally I have been expecting. We need to see the nominal rate start to decline to convince the consensus that the peak is behind us. Retail sales for June is also an important number on Friday that will tell us to what degree the rate of consumer spending has slowed down.

MarketWatch

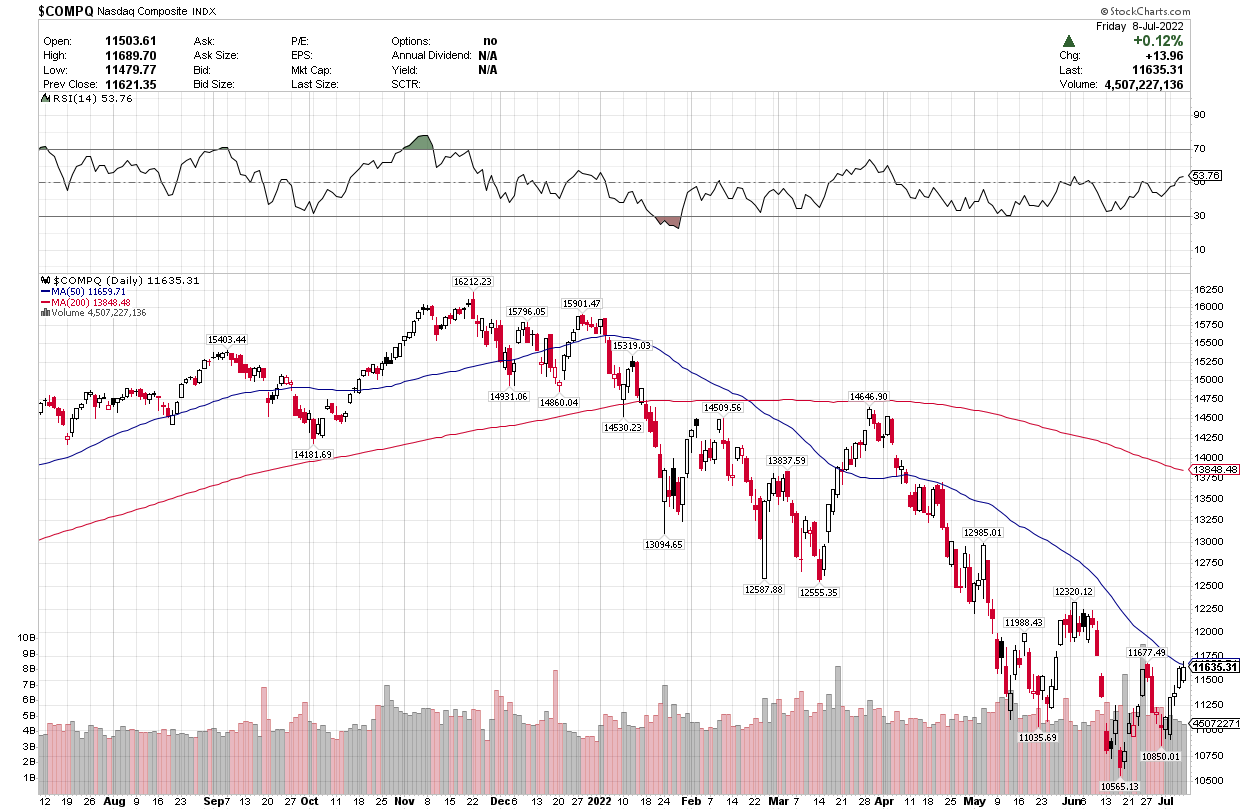

Technical Picture

The Nasdaq Composite looks poised to break above its 50-day moving average for the first time since March, which would be a positive development. We are seeing a similar chart pattern for the Russell 2000 index.

Stockcharts

Be the first to comment