Anthony Bradshaw/DigitalVision via Getty Images

I continue to feel that we have world war in the financial markets, with a few different factions all facing one another simultaneously.

First, you have interest rates, which have obviously been on the rise in a very real way for the first time in the average market participant’s memory. Rates going up are analogous to a headwind in a marathon for gold. It’s not the be all, end all, but higher rates certainly don’t help gold prices.

Secondly, we’ve got inflation, which would normally push gold prices higher, but wait… are we really experiencing inflation in the traditional sense, or are we merely experiencing a huge imbalance of supply and demand resulting from the aftershock of the pandemic and the “Zero COVID” policy being implemented by many Asian countries? I’d argue the latter, because inflation, by definition, is the devaluation of a currency…

… which brings me to Faction #3 in this war – the US dollar. The USD is up big since 2021, and the increase in the value of the dollar is even bigger when you look back to 2011 (when the US Treasury was downgraded that August). Makes a lot of sense, doesn’t it (excuse the sarcasm). Our currency here in the U.S. was even lower back in 2008.

Like interest rates, a strong dollar is typically another distraction for gold. So, we have rates creating a headwind in our face, and then we have a strong dollar acting as an uphill run that continues to increase in angle as the USD rises in value versus other currencies. Again, it doesn’t make a whole lot of sense to have so much debt in this country along with a strong dollar, but this is just more evidence that inflation isn’t a “dollar thing,” it’s a supply and demand (and lack-of-production) thing.

In fact, if you omit all the years from 2015 to present – a time period over which the dollar has been choppy but dancing in a range and today, near its highs – you’d have to go back to 2003 to see strength in the currency as we’re seeing it today. So I have to ask myself, what is this “inflation” everyone is talking about? In fact, “real” inflation hasn’t quite hit us yet. It’ll be the devaluation of the USD resulting from the $30 trillion in debt we’ve accumulated as a country, combined with our inability to pay it back (or pay the interest on the debt, for that matter).

This brings me to the final faction in this war… the Fed. J-Po is doing his best to combat this man-made inflation resulting from COVID, but as mentioned above, when rates rise, we can’t expect gold to flourish. Quite the opposite, actually.

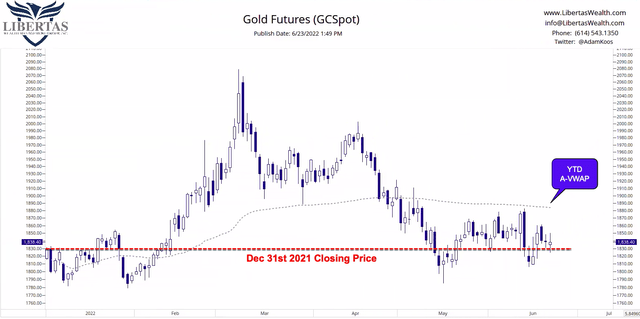

Assuming no big changes into the end of the week, gold is likely going to close lower, and we’ll also likely see a close below the December 31 (year-to-date starting) value. While I do think there’s a psychological component to YTD prices, what I feel is more important is the “average price paid for gold since the beginning of the year,” which can be measured using an indicator called the Anchored Volume-Weighted Average Price since the beginning of the year (or A-VWAP).

As you can see below, since late-April, the average gold buyer in 2022 was already in the red. While gold bugs have watched their nuggets roll and bounce along since May, June printed a higher low, which could indicate a potential move higher.

So, we’re going to have to see what takes place in this “world war” over the next few weeks, and whether or not gold can not only hold its YTD value, but more importantly, we need to see if it can climb back above $1,885, which would make the average market participant a YTD winner at that juncture, and this could bring further buying interest into the commodity.

What else could potentially cause gold to get a boost of nitrous oxide? The U.S. falling into recession, for sure. If we see a true recession, which would take place alongside a weaker dollar, then we’d see “real” inflation, which could help push the dollar to new 2022 highs by year-end.

The “good problem” we have in this country so far is that we don’t yet have an indication that a recession is certain – and even if we get two quarters of consecutive, negative GDP, we’ll still have to wait another quarter for confirmation of those numbers, all while living in a country with full employment. So, with that all being said, observing the evidence available today, even if the U.S. does fall into recession, it doesn’t seem to me that it would be all that severe.

It pays to remain objective in times like these. Rather than being a gold bull or gold bear, try stepping back, look at the big picture, and observe what the market is telling you. Evaluate the evidence.

For me, I see a series of long-term higher lows in the chart above, and despite all the headwinds gold has faced this year, it continues to march on… until it doesn’t.

Original Source: Author

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment