da-kuk

In June, I opined that I’m not going to add to my Farmer Bros. Co. (NASDAQ:FARM) position, and since that time the shares are down about 3.37% against a loss of 13.24% for the S&P 500. The company has released full year results since, and so it’s time to review this name again. Specifically, I want to determine whether there’s a clue in the relative outperformance over the past few months. I want to determine whether or not it makes sense to buy more, hold, or sell at the moment. I’m going to come to that decision by highlighting a few of the comments that were made during the most recent earnings call. I’m also going to look at the updated financial history, and I’m going to review the stock valuation. After all, the shares seem to have “bottomed”, so this may be an ideal time for me to add to my stake.

I imagine that all of my readers have very busy lives, and are constantly moving from one life enriching event to the next. Based on that assumption, I offer a “thesis statement” paragraph at the beginning of each of my articles so that you can step into the article, get the “gist” of my thinking, and then get back to enjoying your champagne on the beaches of Norway. Although insider buying activity remains compelling here, I’m not adding to my position yet. In my view, the CEO himself made the point that this is not a great inflation hedge, as some are suggesting it is. Additionally, as the CFO stated during the earnings calls, variable costs grow along with sales. This is part of the reason why profits have remained elusive here. Although the demand for coffee products in the United States is generally robust, I need to see evidence that this company is capable of turning revenue growth into consistent profitability before buying more. Finally, I think investing is an inherently relativistic process. When we have limited capital to invest, and there are very profitable businesses trading at very low valuations, Farmer Bros. just isn’t a company to get too excited about in my view.

Notes on Farmer Bros. Earnings Call

There were three points that I found particularly interesting as I read the most recent earnings call that I want to highlight below. If you’re considering an investment in this business, I would urge you to read the entirety of that call. To whet your appetite somewhat, I want to highlight a comment the CEO made because I think it’s relevant to the idea that this is an inflation hedge. I also want to push back against a COVID related narrative that I’m increasingly finding tiresome. I also want to highlight comments made by the CFO about expenses.

First, the following is a statement made by the CEO during the most recent earnings call.

Our hedging programs have been an effective defense against coffee price inflation, but there’s still a lag before we fully catch up, and future prices are unknown. Much of the impact of this lag is due to two factors. First, our normal process for passing through cost updates to our direct customers includes a lag between when we incur the cost and when they are passed through to the customer. Secondly, the speed and magnitude of inflationary pressures that we are experiencing make it challenging to continue expanding margins as we have in the past.

So, the company suffers from higher costs, and manages to ameliorate some of those via hedging efforts. There’s a lag between when the company suffers higher input costs and when those costs can be passed along to customers. Additionally, according to the second point the CEO made, it seems that this company is affected by the pernicious effects of inflation also. In my view this calls into question the idea that it offers protection against inflation that some are suggesting.

Also from the CEO

As we continue to recover from the impact of COVID and shift our focus from fixing and optimizing our operations, we anticipate pursuing a more aggressive growth-oriented approach.

Earlier in the call, the CEO made the point that the fourth quarter of this year is the first quarter without any significant impact from COVID related mandates. It may be mean spirited of me, and I’m very, very comfortable being mean spirited toward CEOs, but I’m growing a bit bored of narratives that blame Covid for challenges in the business. In response to this comment, I feel a strong need to point out that the company was losing money as far back as 2018. I don’t know how many of my readers are trained historians, but for those of you who are not, the pandemic wasn’t an issue in 2019 when the company lost $74 million. The pandemic wasn’t an issue in 2018 when they lost $18.7 million.

The CFO made the point that fiscal year 2021 was positively impacted by gains of $14.4 million from the sunsetting of their Retiree Medical Program, the implication being that comparisons to that year are even more challenging. The way I interpret this statement is that, in the absence of this gain, 2021’s $41.6 million loss would be even worse, but that’s just me.

The CFO then stated:

Turning now to our operating expenses, which increased by $12.4 million in fiscal 2022 over the prior year period due to an $11.8 million increase in selling expenses and a $4.2 million increase in general and administrative expenses, partially offset by a $2.3 million gain on the sale of assets. The increase in expenses was primarily due to variable costs, including payroll associated with the higher sales volumes and operating costs related to our distribution center in Rialto, California, which was opened in the latter half of fiscal 2021.

So, higher sales volume led to higher variable costs, including payroll and operating costs associated with the new distribution centre in Rialto. I think this will be worth remembering when I review the financial history here next.

Financial Snapshot

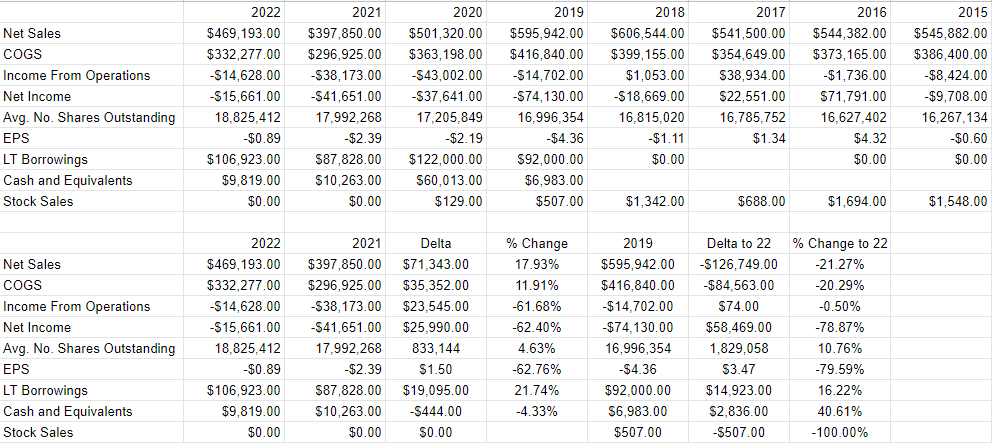

In some ways the financial performance over the past year has been impressive. Specifically, revenue is about 18% higher than 2021, while COGS are only about 11.9% higher than last year. Additionally, income from operations has improved dramatically, as losses have shrunk from $38.2 million to $14.6 million. Net income has similarly improved, with losses shrinking from $41.6 million to $15.66 million. Admittedly, $2.9 million of 2022’s net income was impacted by $2.9 million in gains from asset sales. Selling expenses continue to increase, but they’re doing so at a slower rate than sales increases. Specifically, selling expenses were only 12.3% higher in 2022 than they were in 2021, and G&A is up by only 9.8%. Additionally, interest expense has collapsed by over 40%.

The problem is that this company, like so many others, hasn’t fully recovered from the pandemic in my view. Revenue in 2022 was 11.9% lower than it was in 2019. Although net income has swung massively in the company’s favour from a loss of $74 million to a loss of $15.66 million in 2022, we need to put 2019’s loss in context in my view. The 2019 loss included both a goodwill impairment charge of $42 million and a gain on assets of $25.2 million. So, netting these out we get a loss of $57 million in 2019, making the improvement to 2022 less impressive.

Also troubling to me is the deterioration in the capital structure. The company is sitting on about 21.75% more debt in 2022 than it had in 2021. This increases the level of risk here, and higher debt is generally troublesome at a time when interest rates are generally rising globally. If the company continues to experience negative net income, the twin problems of increasing indebtedness and dilution will persist in my view.

That written, I am maintaining a small position in this stock, and I’m intrigued by the insider buying here, including a fairly substantial purchase that we learned about a few days ago. Thus, I’d be happy to buy more at the right price, but the valuation will need to be compelling to get me excited.

Farmer Bros. Financials (Farmer Bros. investor relations)

The Stock

My regulars know that I’ve talked myself out of some profitable trades with the words “at the right price.” So, if you’re heading to the comments section to write about how my fastidiousness in this regard is self harming, save yourself the effort because I’m way ahead of you. In response to this criticism, I’d point out that I’m of the view that it’s better to miss out on some gains than lose capital. My regulars also know that I consider the “business” and the “stock” to be quite different things. Every business buys a number of inputs and turns them into a final product. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business, future demand for coffee, the input prices for coffee, the extent to which this company can hedge those costs etc.. It may also be the case that some analyst decides that “future growth catalysts” are weaker than once thought, and the stock falls in price in sympathy, in spite of absolutely no change at the company. The stock also moves around because it gets taken along for the ride when the crowd changes its views about “the market” in general. A reasonable sounding, if counterfactual, argument can be made to suggest that the reason the shares have dropped in price since I last wrote about Farm Brothers is because the market has swooned since then. It’s impossible to prove this point definitively, but it’s worth considering. In any case, the stock is affected by a host of variables that may be only peripherally related to the health of the business, and that can be frustrating.

This stock price volatility driven by all these factors is troublesome, but it’s a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations. Cheap shares are insulated from the buffeting that more expensive shares are hit by.

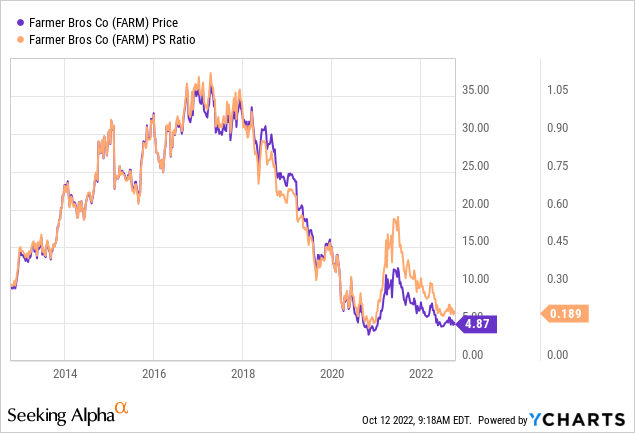

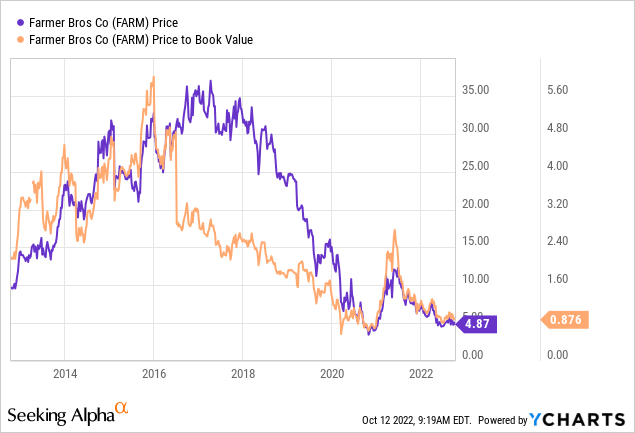

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. In case you need to be reminded, when I last reviewed this name the shares were trading near multi year low valuations. Specifically, the market was paying about $.21 for $1 of sales, and the shares were trading at a price to book value of .94. Fast forward a few months and this is the current state of the world:

The shares are trading near record lows, and that’s compelling in some way. The problem is that they were trading near multi year lows for most of the past four years as the stock dropped further and further in price. I’m skeptical of the view that this is an inflation hedge, and I’m very concerned about the ongoing lack of profitability. If and when the company’s strategic plan-now in its third year-eventually pays off and the company turns a profit, I’ll reconsider. While I acknowledge that the coffee market in the United States is relatively robust and is growing, I’ll need to see evidence that this company has what it takes to turn rapid sales growth into profits before buying. I may miss out on some upside, but that’s a better option than buying too early in my view.

Be the first to comment