cyano66/iStock via Getty Images

Investment thesis

Not many investors know that Intesa Sanpaolo (OTCPK:ISNPY), the largest Italian bank, is now zero NPL bank and that it has undergone a massive de-risking while become the largest Italian wealth management company. The stock has currently traded down, and I caught the opportunity to buy a decent number of shares to support my incoming dividend stream. In this article, I would like to show the reasons that made me choose to rely on Intesa’s cash returns to shareholder. At today’s prices, the bank has a dividend yield of 9% and it just approved a share buyback that is worth almost 5% of the current market cap. The combined return is 14%. Please, be aware that Italy charges a 26% tax on dividends. Depending on your country, a part of it can be refunded thanks to treaties against double-taxation.

A premise on Italy

I have been wondering more than once whether to write an article about an Italian bank or not. In fact, Italy has not been an investors’ favorite from 2008 onwards and is still looked at as somewhat unstable and unreliable compared to other European countries. The banking system, in particular, paid a high fee to the financial crisis and then was under further pressure during the sovereign debt crisis in 2011 due to the strong exposure to domestic bonds.

However, since 2014 the system has started to recover and many of the major banks have undergone a massive de-risking action, while monitoring to stay well above the CET1 ratio of 10%. The Italian banking system is also consolidating with M&A that are giving birth to stronger groups.

The macroeconomic scenario, even though inflationary pressures, the war in Ukraine and a possible recession are contributing to a gloomy horizon, still sees Italy supported by the European Recovery and Resilience Plan. Italy will benefit from grants and loans of almost €200 billion, around 10% of the current GDP. Italy is the largest beneficiary of the plan and, as such, will be strictly controlled by the EU. This should give a certain reassurance to investors wary of the country since the financial crisis and the following decade of stagnation. Some estimates state that this plan should have a positive impact on Italy’s GDP by adding to its natural growth a boost between 1.5% and 2.5% by 2026. Another 0.3% should come from the positive impact coming from the other European countries’ Recovery and Resilience Plans.

Both Italian households and companies hold a high level of savings since the start of the pandemic. Italian household wealth this year is at €10 trillion, €4.8 of which in assets. The country is also characterized by low household debt and lots of liquidity parked in banks. Just to get an idea, in May 2022, 2.061 € billion were in the Italian banking accounts. Italians deposit around €30-40 billion per month in their accounts and are known to be good savers. However, saving money is not enough with a record high inflation. Thus, there will be the need to preserve the value of these deposits and many Italians should convert part of their cash savings into bonds or, more probably, into insurances and investments designed to provide a hedge against money depreciation.

An overview on Intesa Sanpaolo

As I already mentioned, Intesa is the largest bank in Italy. However, we must consider that the bank has transitioned to a variety of business areas that go from a classic bank for deposits and loans to private banking, asset management, investment banking and insurance.

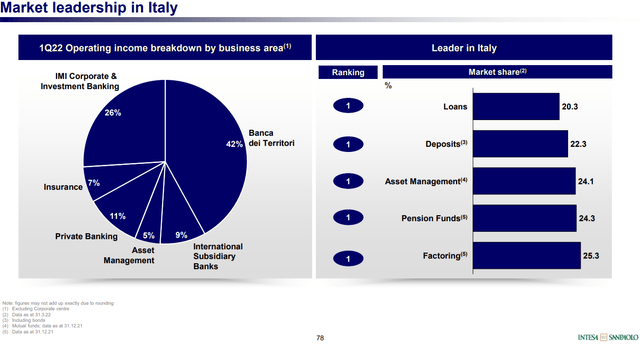

Intesa San Paolo Q1 2022 Results Presentation

As shown from the slide above, Intesa is the leader in loans, deposits, asset management, pension funds and factoring with a market share that is always above 20%. It is important for me to start considering this bank as a wealth management company, rather than a simple bank.

The concerns with Intesa in the past years were due to two problems: the strong exposure to Italian bonds and the amount of NPLs.

On the bond side, Intesa currently has the possibility to move into 50% of the total portfolio being of the Italian government bond, but it currently is below 40% and its CEO stated that he doesn’t intend to increase this percentage. However, we have seen more than once over the past decade that the European Central Bank closely monitors the spread between European government bonds in order to prevent possible speculations. Thus, Italian bonds are quite safe from default and extreme volatility and actually offer a positive yield compared to other bonds.

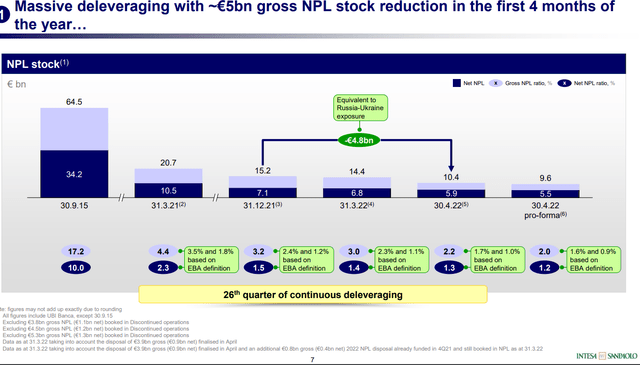

The real problem was the non-performing loans. However, Intesa has massively reduced its NPLs by €54 billion from 2015 to 2021, as shown from the slide below that highlights the deleveraging process.

Intesa San Paolo Q1 2022 Results Presentation

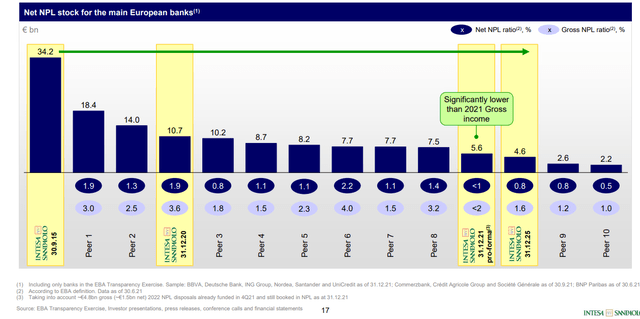

Over the past quarter, the bank reduced another €5 billion which is the equivalent of the Russia-Ukraine exposure. This whole process brought the bank to be already among the best European banks in terms of net NPL stock with an NPL ratio that is now under 1%, making Intesa a zero NPL bank with the gained advantage of very low underlying cost of risk which moved down from 97 bps in 2020 to 59 bps in 2021.

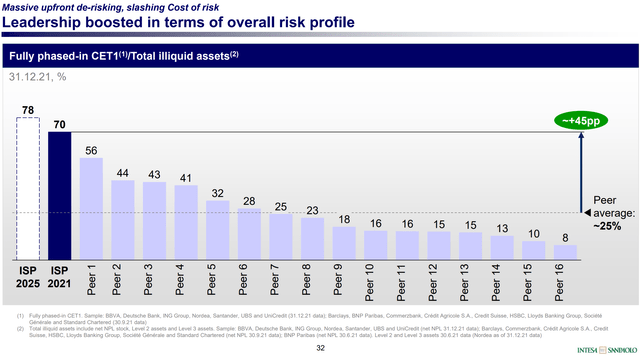

Intesa San Paolo 2022-2025 Business Plan Presentation

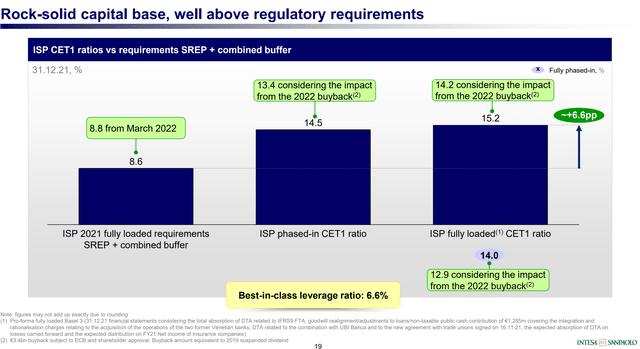

Intesa also has CET1 ratio at 13.6%, well above European regulatory requirements that ask banks to have overall capital requirements to 10.6% of risk-weighted assets. This also puts the bank in a strong position that enables it to pass the ECB stress tests and be sure to face any upcoming headwinds in a much stronger position than the one it had in 2008. We have already seen that the banking system reacted well to the pandemic and Intesa was no lagger in this.

Now, to clarify what a CET1 ratio is, we have to know that it is a measure of bank solvency that tells a bank’s capital strength. A bank’s capital sees CET1 at the bottom of the capital structure. In case of a crisis, any incurred losses are deducted from this tier. When losses are deducted from this tier, if the CET1 ratio drops below the regulatory requirements, the bank has to build back its capital ratio, otherwise it could be overtaken or even shut down by the regulating authority. As we see in the slide below, Intesa has undertaken major efforts to protect itself from another financial crisis and it has been quite careful to stay well above regulatory requirements as per the capital base.

Intesa San Paolo 2021 Results Presentation

Now, thanks to the actions aimed at de-risking and slashing the cost of risk, Intesa has gained the leadership among its European peers when we look at the phased-in CET1/total illiquid assets ratio that we explained above.

Intesa San Paolo 2022-2025 Business Plan Presentation

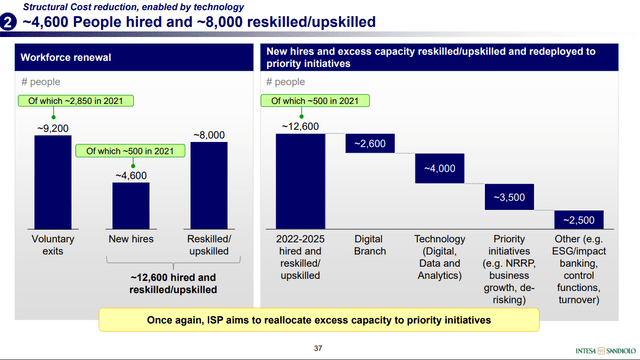

Let’s move on to Intesa’s future prospects. First of all, the company is turning more and more technological and the more it invests the more it is saving on costs. In the business plan for 2022-2025, Intesa plans to invest €5 billion on technology that will generate a more efficient bank able to save €2 extra billion that will go all the way down to the bottom line. Intesa will have a 1,500-branch reduction enabled by digital banking. Furthermore, the company is planning about 9,200 employee exits, while planning to hire only 4,600. The headcount is going down as the bank becomes more efficient and moves most of its operation online.

Intesa San Paolo 2022-2025 Investor Presentation

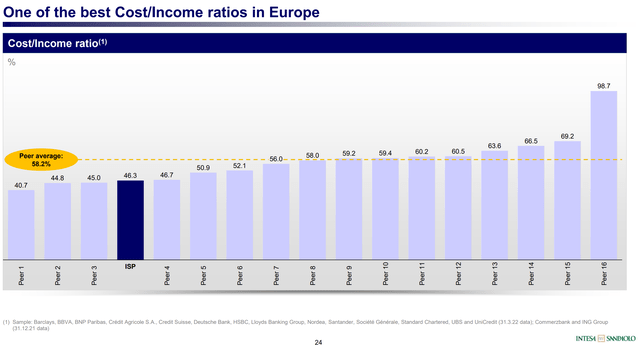

The company is laser focused on profitability and has managed to bring down its cost/income ratio to 46.3% in the last quarter, making it one of the best banks in Europe. This was an outstanding result, as Intesa’s business plan for 2022-2025 aimed at bringing the ratio down from 52% to 46% in three years. However, Intesa seems to be already ahead of its plans. This is quite usual, as the bank tends to give very conservative estimates regarding its future.

Intesa San Paolo Q1 2022 Results Presentation

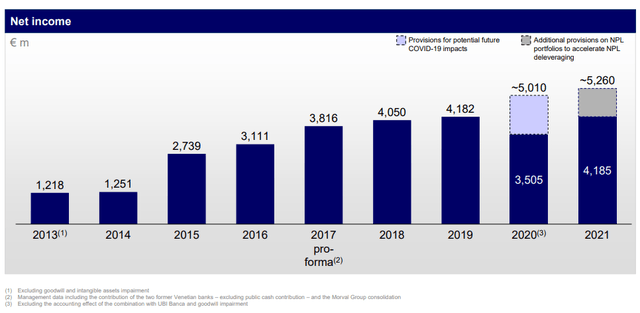

This ratio is highly important, as it shows that the company is managed well with a focus on efficiency and profitability which are supported by the three drivers we have talked about: de-risking, cutting costs, and organic growth of commissions. As we said before, Intesa is the largest wealth management player in Italy, a country where household own a lot of cash and assets that will need to be managed in order to be preserved. Moreover, Intesa’s insurances are fully-owned products, so the bank enjoys a full return on them. Not by chance, in the last year, 57% of Intesa’s revenues came from fee-based business: commissions and insurance. These have been the greatest drivers of a net income that is steadily growing, as shown below.

Intesa San Paolo 2022-2025 Business Plan Presentation

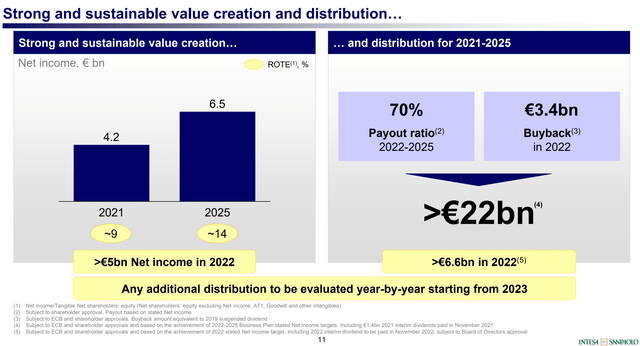

Intesa dividend policy

What does Intesa plan on doing with its net income and the resulting free cash flow? It is no mystery that Intesa’s management has been more and more oriented to generous distributions to the shareholders. In the past four years, Intesa returned €19 billion to the shareholders. Now it is planning to increase this to over €22 billion from 2021 to 2025. Intesa also used to pay an annual dividend, but it recently split the payment in two in order to become more interesting for income investors. It will usually pay in November and in May and the dividends will be 70% of net income. I am confident that through its improving efficiency, Intesa will be able to keep its net income growing over the next four years, thus rewarding shareholders with at least €18 billion in dividends to which Intesa will add another €3.4 billion in share buyback, half of which, as we said earlier, has just been approved.

Intesa San Paolo 2022-2025 Business Plan Presentation

Why am I expecting Intesa to return so much cash to shareholders? Because, usually Intesa’s management has been highly conservative in its future forecasts. For example, Intesa, to be conservative, didn’t factor in its future earnings the potential hikes in interest rates. As Intesa’s CEO Carlo Messina said during the Q1 2022 Earnings call:

our target was not factoring in any potential upside from an interest rate increase, which is now much more likely to happen. We have a very high flexibility in reducing costs as we continuously demonstrated in the past, and we have already achieved zero NPL bank status with a very low underlying cost of risk. […] An interest rate increase is a strong upside for us because for every 50 basis points rate rise, net interest income can increase by more than €900 million.

As the ECB is expected to raise rates at least twice this year, we can take for granted this net interest income increase by €900 million which will contribute to boost up the ordinary dividend or will end up as a special dividend.

At today’s current share price, the dividend yield is 9% with the forward dividend yield probably being 10%. Even in case of a double dividend taxation, these yields are alluring, especially if supported by a well-run business that is proving more and more profitable and safe.

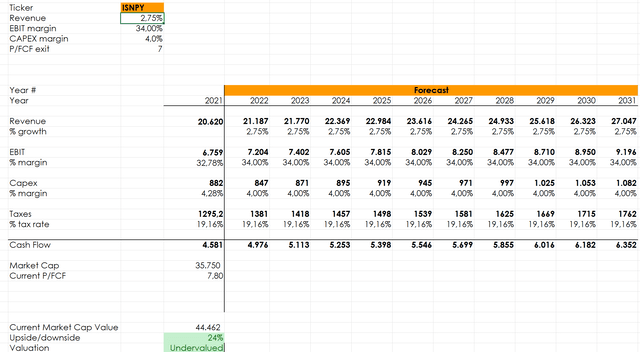

Valuation

I ran a forecast analysis based on Intesa’s free cash flow, by plugging in the expected revenue growth, the EBT margin and subtracting capex and taxes. In this way I reach an estimate of the cash flow for the following ten years. Based on conservative assumptions and using the sector median P/FCF ratio of 7, I reach the conclusion the Intesa has at least a 24% upside or a fair price of $16.00.

Author with data from Seeking Alpha

Conclusion

Investors may price in that the stock is in a sector and a country that carry more risk than others so they could pay slightly more attention on the way to establish their position. Given the bear market we are in, I started building a position when the stock was trading at $12. However, I didn’t deploy all my money in just one purchase, but I added to my position for every $1 the stock price lost. I rely on Intesa to offer me significant dividend returns that, at today’s rates, will repay my initial investment in less than 10 years unless Intesa fails or enters in such a crisis that it won’t be able anymore to sustain its dividend policy. This is why I bought it and why I currently rate it a buy, suggesting investors to take a look at this unheard-of bank outside of Italy to see if it can fit a dividend seeking portfolio.

Be the first to comment