Diego Thomazini

Written by Nick Ackerman. This article was originally published to Cash Builder Opportunities on September 29th, 2022.

While the market continues its volatility to the downside and upside, looking at more consistent dividend payers can help one sleep at night. My individual stock portfolio is littered with these types of consistent dividend grower names. However, when running across a screener lately for years of consecutive dividend growth, I came across Stepan Company (NYSE:SCL).

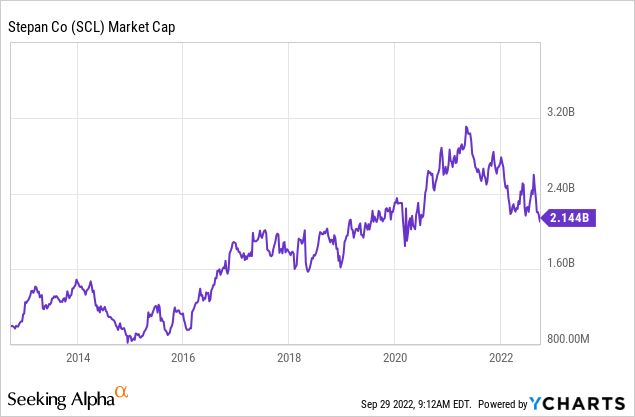

This company has a market cap of $2.14 billion, making it just barely a mid-cap-sized company. Though that was a rather recent development as the company’s share price benefited from the COVID pandemic. That drove the share price much higher than where we were just a few years ago.

Ycharts

Consistent and long-term track record of dividend growth caught my attention in this name. The valuation being relatively more attractive lately is also providing interest.

About Stepan Company

It is a specialty chemicals company with operations in three different segments. They have surfactants, polymers and specialty products. Although they also like to add that they are “unique in the industry and do not have a competitor or competitors to precisely match its business because its products have a specific focus.”

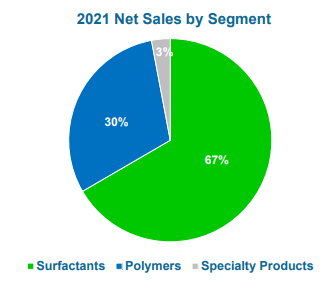

The surfactants make up the bulk of the sales for the company by a wide margin. If you are interested in what a surfactant is, just as I was, this is how they describe it:

“A surfactant is a surface-active agent that changes a liquid’s surface tension. They can act as detergents, wetting agents, emulsifiers, foaming agents or dispersants. End products consist of cleaners & disinfectants, laundry & dish detergents, fabric softeners, personal wash products, paints, and agricultural products.”

SCL Net Sales by Segment (Investor Relations)

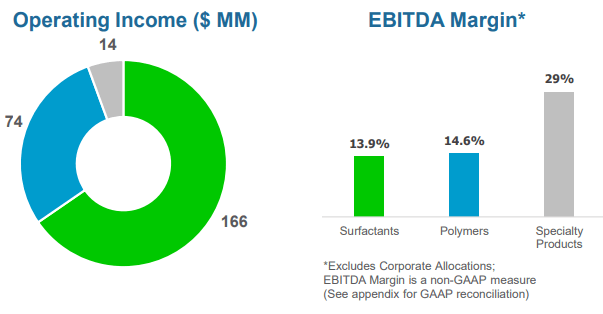

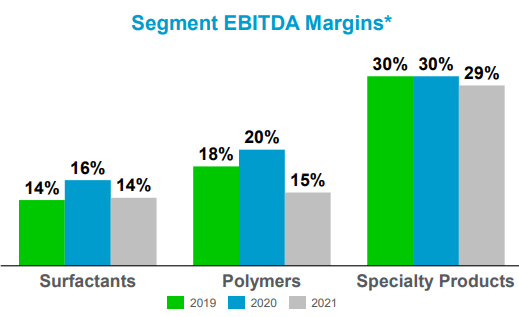

With this revenue breakdown, their operating income comes in quite similar, looking at that pie chart. However, there is quite a material difference when looking at the margins of each segment. Specialty products are more than double the margins of surfactants and around double the polymers.

SCL Operating Income And EBITDA Margin (Investor Relations)

While they might be a smaller company, they have production facilities worldwide. They’ve also been in business for 82 years and have a four-part strategy:

- Research and development by developing a continuous stream of higher, value-added product applications, improving existing processes and developing new processes for known products.

- Acquisitions in surfactants, polyols, and urethane systems.

- Globalization by establishing manufacturing locations, sales offices and product development laboratories to supply its customers in their global expansion.

- Strategic alliances by leveraging its core technologies in world markets with joint ventures where it adds know-how, technology, capital and customers to complement resources of local partners with raw material supplies, plant sites, regional know-how and connections.

Consistent Dividend Growth

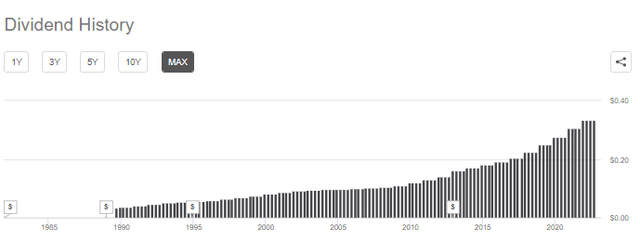

As I mentioned at the article’s opening, I ran across SCL due to searching for some companies with the longest dividend growth. Of the 82 years that SCL has been operating, last year, they announced their 54th consecutive dividend increase. These increases also haven’t been small more recently, with this last one a boost of 9.8%. The next increase should be announced shortly.

SCL Dividend History (Seeking Alpha)

With that type of commitment, I would suspect it would take a massive economic downturn for years to dissuade the Board from continuing this streak. There have been a few stock splits along the way, too. Those don’t change a company’s fundamentals at all but generally coincide with a company that is doing the right thing.

That type of appreciation to cause share splits is a bonus on top of consistent dividend growth. As shares have appreciated, that has driven the actual yield of the shares lower. Thus, the higher dividend growth lately would be very welcomed. This is especially true when inflation has been running so high. Keeping up the purchasing power of your dollars can be important; dividend growth above inflation can be seen as offsetting the negative impacts.

A long-term track record is excellent for a dividend grower, as well as the commitment from the management team to keep it going. However, what it really comes down to is the outlook of the dividend and if it seems as though it can continue.

In this case, the payout ratio comes to 19.85%. That leaves plenty of capacity to continue to grow. In fact, the company’s earnings could be cut in half, and it still wouldn’t be too elevated.

Earnings Outlook

With earnings anticipated to grow from this company, that puts it in a situation where it can continue to churn out these increases. As a smaller company, there aren’t too many analysts covering the stock, but they anticipate the EPS to grow by ~9.5% and ~8% in the next two years, respectively.

To help grow the earnings, the company also has been repurchasing its shares. Lower outstanding shares can boost EPS, and that also translates into a lower payout ratio too.

Ycharts

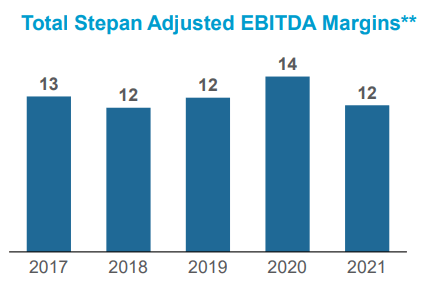

We touched on margins above, noting the different margins between the segments. In 2021, margins took a hit after a strong 2020.

SCL Margins (Investor Presentation)

The 2021 adjusted EBITDA margins seem to be the same as 2018 and 2019. This seemed to be related to the polymer business segment and the inflation pressures for raw materials.

SCL Segment Margins (Investor Presentation)

As they noted in the latest earnings call in Q2 2022, the polymer business was making a recovery.

But if I think about the 14.2% that we just delivered in Q2 in Polymers, as you know, I mean, we are taking the pricing actions that we needed to take and raw material prices are starting to — the slope of increases starting to come lower and lower. So we are just recovering the margins that we used to have in this business, and we are not even there yet. If you go back in our history, you know that this business used to have even higher. So we feel very good with the work that the Polymers team has delivered in the first half, recovering our margins from last year.

Valuation

The overall market has been driving lower. That has impacted SCL with a lower share price as well. As a chemicals company, they can be seen as naturally more economically sensitive. However, their diverse customer base and prior recessions show that SCL has weathered these storms. Again, 54 years of consecutive dividend growth isn’t something many companies can say.

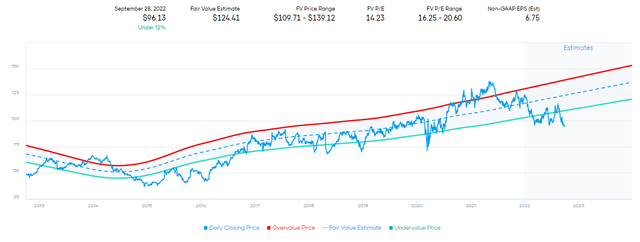

Given the latest declines, we see the stock tumble further from its fair value estimate.

SCL P/E Historical Range (Portfolio Insight)

Only three analysts are covering SCL, and their average price target is $133. So based on analysts’ and historical P/E valuations, we see that SCL could have potential upside from here.

Conclusion

SCL is a unique specialty chemicals company that provides products to manufacturers around the globe. This has provided consistent earnings growth, translating into dividend growth for investors. At 54 years of consecutive dividend increases, they are in a unique situation of having weathered many recessions. That includes much deeper recessions than what is even predicted for 2023. With a low payout ratio and earnings still expected to grow, SCL is in an interesting situation that is worth looking at for investors.

Be the first to comment