zhaojiankang

Introduction

I initially wanted to go with a different title, like “not your usual recession” or something along those lines. First of all, we’re not in a recession, but the odds are making it look like a done deal at this point. Second, Cleveland-Cliffs’ (NYSE:CLF) shares are barely underperforming the stock market this year, which is uncommon for a cyclical company like the one behind the CLF ticker. Third, we’re seeing a worrying trend of steel companies idling their production. Not just in Europe, where the energy crisis is doing a number on its energy-intensive industries, but also in the US, where companies prefer to shut down production over paying huge bills. Finally, I believe that in a scenario where the Fed is expected to pivot, we see a mix of returning demand expectations, a weaker dollar, and (related) higher inflation expectations. I believe this is a huge win for the steel industry – especially companies in North America.

In that area, Cleveland-Cliffs is my favorite.

Now, let me elaborate on my four points, as I believe we’re dealing with an extremely attractive valuation and an unusual mix of tailwinds.

Point 1 – Growth Slowing (The Recession Part)

The first part of this article applies to most companies, as a recession hurts every company. Even safe utility companies often see slower electricity output when growth comes down.

This year, recession risks started to rise. High inflation hurt the consumer, supply chain issues were still present, and an increasingly hawkish Fed basically vowed to keep raising rates until inflation came down to acceptable levels. That’s also why the market is so nervous, as it knows the Fed isn’t likely to change its course – at least, for now.

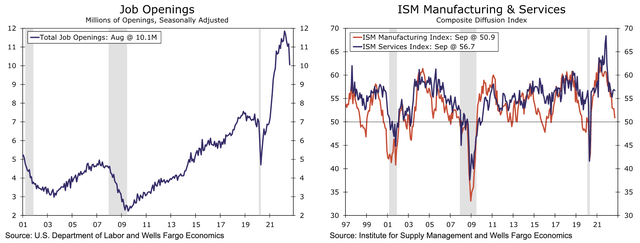

As the chart on the right side below shows, the ISM manufacturing index is closing in on contraction territory, with services not far behind. The chart on the left side shows a steep decline in job openings. However, there are still 1.7 vacancies per unemployed person, which is inflationary. Hence, the Fed isn’t expected to act anytime soon, which is why markets are so very worried.

Wells Fargo

However, even the Fed expects unemployment to increase under these circumstances. According to Bloomberg:

Even by its own optimistic projections, the Federal Reserve’s interest-rate increases are likely to push up unemployment next year to 4.4% from the current 3.5%, a magnitude of increase that historically tends to beget even more job losses — unemployment increases don’t come in medium-sized junks; they tend to snowball. It’s disconcerting to imagine how US consumption, which is hanging on by a thread, will react when people start to lose their jobs in significant numbers.

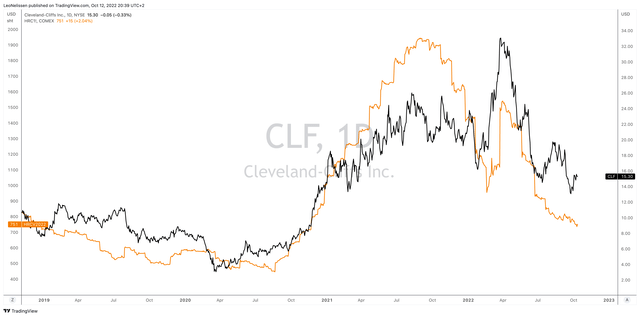

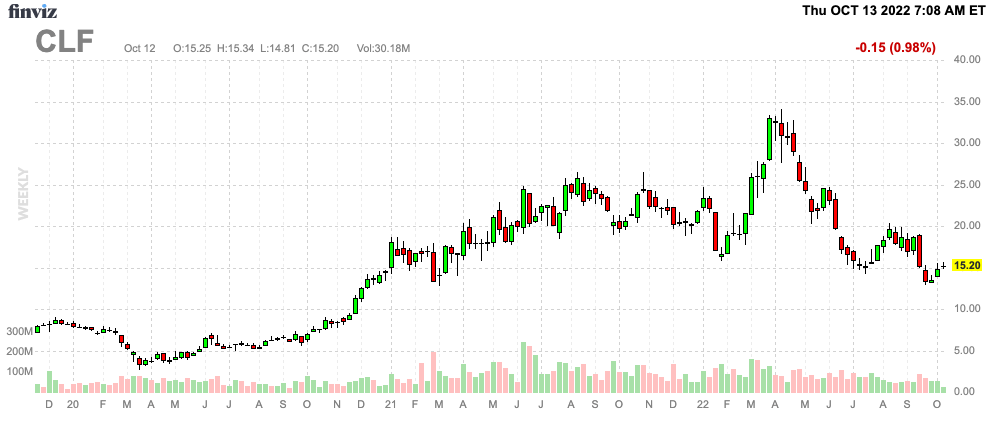

The Cleveland-Cliffs stock price has also been adjusted to these new economic expectations. CLF is now trading roughly 55% below its 52-week high, which is the biggest sell-off in the company’s young history.

TradingView (Black = CLF, Orange = Midwest HRC Steel Futures)

Please note that I am referring to “young history” as in the “steel company” CLF. Prior to 2020, CLF was a pure-play iron ore stock with a lot of leverage. The risks were much higher, but more on that in the next part of this article.

Point 2 – The “New” CLF

This has been one of the most discussed topics since 2020. Hence, I’m not going to spend too much time on it, except for the parts that give the company an edge in the current environment – and going forward.

Essentially, in 2020, Cleveland-Cliffs bought AK Steel, a company I frequently covered prior to the acquisition. AK Steel was the leader in automotive steel. It failed to generate any long-term shareholder value, but it did own assets that made so much sense for CLF to buy.

The company also acquired ArcelorMittal USA, which made CLF the largest flat-rolled steel producer in North America. Bear in mind, in 2019, the company produced no steel at all.

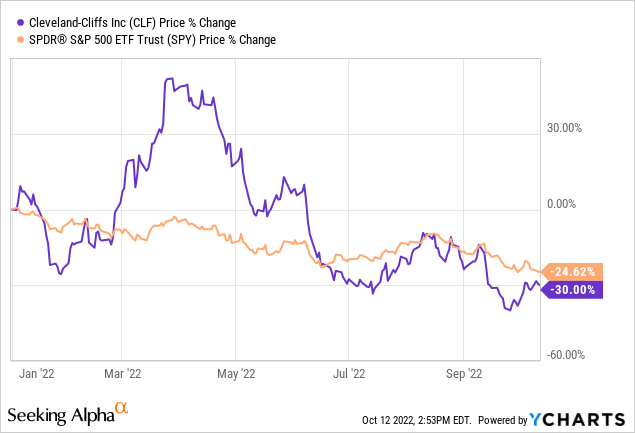

With that in mind, the chart below is quite interesting. Despite ongoing market woes, CLF shares have barely underperformed the S&P 500 during this year’s sell-off. Granted, they have fallen further from their 52-week high, but what we’re seeing is unusual as CLF used to get beaten down pretty badly during sell-offs.

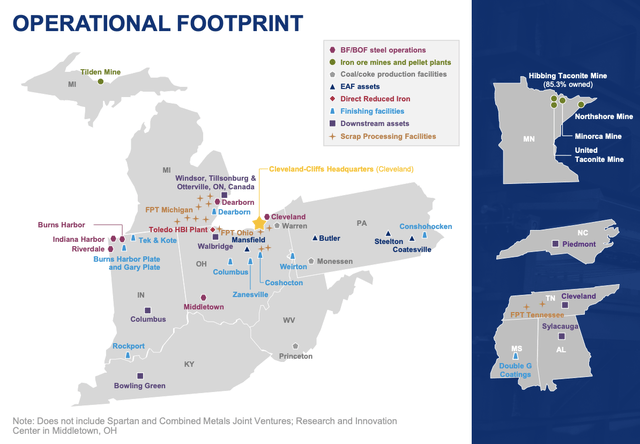

For starters, the “new” CLF is going far beyond iron ore production. Thanks to its M&A activity, it now owns the most impressive internal steel supply chain I’ve ever seen in the industry. The company has a “fully integrated steelmaking footprint” covering iron ore and pallet plants, coal and coke production facilities, scrap facilities, as well as everything related to producing finished steel products. Moreover, its geographic footprint is concentrated in the Midwest (with assets in the South), which significantly lowers transportation costs – and risks!

Cleveland-Cliffs

These risks are especially important to take into account as companies procuring iron ore in South America are exposed to geopolitical and related risks that could harm production at some point in the future. For example, the Brumadinho dam disaster cost close to 300 lives. It was another wake-up call for iron ore buyers all over the world.

With that said, the better performance of CLF is based on (at least) two reasons. The first one is that CLF is a different business – financially speaking.

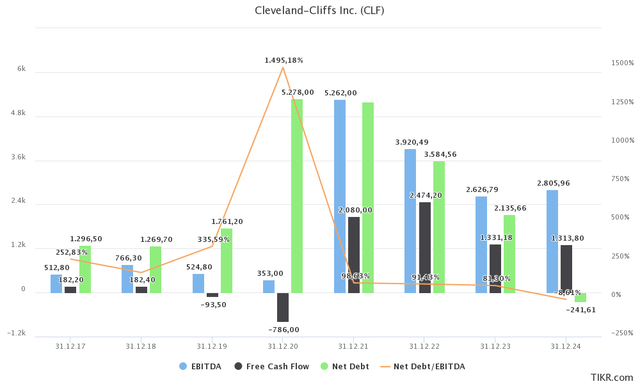

The chart below shows how M&A changed the company. Net debt went from $1.7 billion to $5.3 billion, which was almost 15x EBITDA in 2020. However, it changed the company for the better. Going forward, the company is expected to do $1.3 billion in free cash flow in a “normal” year. That’s 16.5% of the company’s current $7.9 billion market cap. This allows the company to quickly reduce net debt to a negative number in 2024. These expectations can change, but it shows the company’s power to generate cash. Even this year, net debt is not expected to exceed 1.0x EBITDA anymore. Prior to the pandemic, these numbers were unheard of.

Currently, the company has a BB minus credit rating. I expect that to be boosted to the BBB range in 2023.

TIKR.com

Even in these circumstances, the company is in a great spot to maintain high free cash flow. For example, half of its order book benefits from fixed prices. This will keep its selling price elevated, despite falling steel prices. Bear in mind that this was somewhat of a headwind when steel was rallying. Now it’s a tailwind.

Moreover, this month (October), the company will see some contract resets. This will lead to a higher average selling price, as lower-priced contracts are ending.

Also, the company is encountering lower maintenance and is able to release the working capital it has built for more than 18 months.

Last but not least, the company is lowering CapEx as it sees no major capital projects in the foreseeable future. That’s not something a lot of steel companies can say.

The second reason why CLF is different is that automotive is turning into a tailwind.

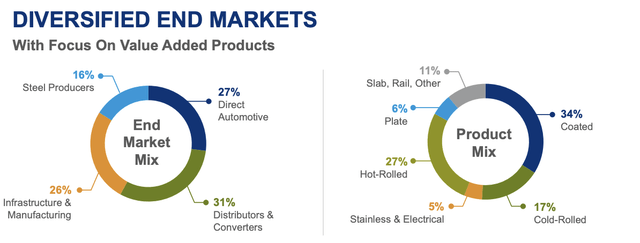

CLF is the largest North American automotive steel producer. That’s usually high-quality steel not a lot of companies can compete with. Last year, the company supplied 6.8 million tons of steel to automotive customers. These customers – combined – produced 13 million cars, which is way below the longer-term average between 17 and 18 million units.

Cleveland-Cliffs

The reason behind this is supply chain issues. These issues are now slowly fading as a result of more available supplies like semiconductors. Ford (F) alone has two years’ worth of production backlog.

While buying conditions for new vehicles are going down the drain due to slower economic growth and high inflation, shipments are picking up steam.

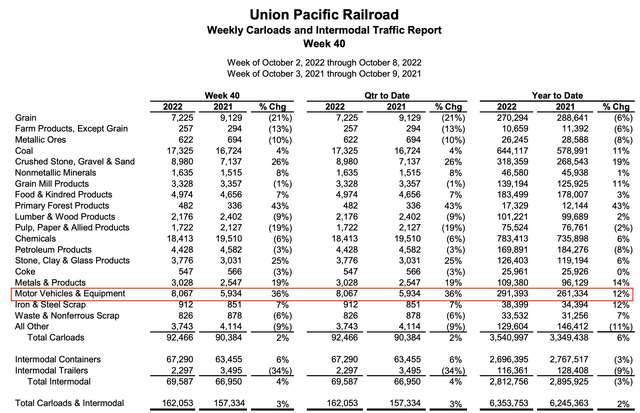

For example, using shipments data of one of the largest automotive shippers Union Pacific (UNP), we see that motor vehicle and equipment shipments are up 12% year-to-date. However, quarter-to-date, these numbers are up 36%, indicating higher production rates.

Union Pacific

This supports steel companies. If this were a “normal” recession, the situation would be different. Now, CLF has pricing and production tailwinds despite easing prices and slower auto demand (orders). That’s truly special as it gives the company some support in what are certainly tough times for most companies.

Point 3 – Idling Production

The best thing for CLF is that a lot of steel companies are shutting down production. Europeans started this trend as they simply cannot maintain production rates given the surge in electricity prices. However, it is now also impacting companies all over the world.

For example, in Europe, ArcelorMittal is reducing steel production by 17%.

It’s a foreboding sign for Europe’s economy, which is facing a looming recession after Russia cut its supplies of natural gas. Steel demand is viewed as a barometer for growth, particularly in the manufacturing and building sectors.

About a tenth of crude steel capacity in Europe is currently offline, with ArcelorMittal’s cut by 20%, according to Jefferies. Some of its blast furnaces in Spain, France, Germany and Poland have been idled on weak demand.

TradingView (German Power Baseload Futures)

In the United States, U.S. Steel (X) idled its 1.5 million short ton per year blast furnace with no scheduled restart, according to Oilprice.com.

More recently, U.S. Steel announced the indefinite idling of its 1.4 million-short-ton-per-year Mon Valley blast furnace. The furnace was previously taken offline on September 3 for maintenance. Although the company initially planned to return it to production after 30 days, they later announced it would remain idle. According to a company statement, management wished to “balance our production with our order book.”

This decision is based on lower demand and oversupply due to imports -despite the loss of production in Europe.

Technically, it makes sense to reduce supply. However, I believe we’re running into a scenario where demand will eventually come back while supply is still offline. Bringing back capacity in the US will take time, and I doubt that European supply will return anywhere close to pre-crisis levels.

When demand comes back, I expect a steep increase in steel prices, which benefits companies with a strong footprint in the industry. That’s where CLF comes in.

While I cannot make the case that CLF won’t idle production, it has hedged 50% of its energy costs, which will help the company to remain competitive. That’s obviously on top of its own efficient internal supply chain and beneficial geographic location – US energy is way cheaper than overseas.

Point 4 – When’s The Bottom?

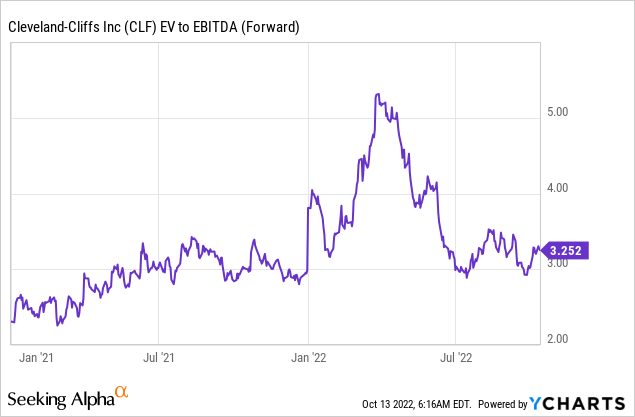

The Ohio-based steel producer is currently trading at a 5.0x multiple of 2023E EBITDA of $2.6 billion. That’s based on its $13.1 billion enterprise value, consisting of its $7.9 billion market cap, $2.1 billion in 2023E net debt, $280 million in minority interest, and $2.8 billion in pension-related liabilities.

EBITDA estimates have come down from $2.8 billion, which is the result of sell-side analysts incorporating economic weakness. However, as I wrote in my prior article:

Even under “normal” circumstances, CLF should be trading at no less than 7x NTM EBITDA. This would imply a market cap of $14.9 billion, roughly 90% above current levels.

That’s below the company’s 2022 all-time high. On a long-term basis, I expect CLF can rise to $50-$60. Free cash flow generation will erase net debt and all major financial obligations on top of the secular economic tailwinds discussed in this article.

That said, during bull markets, stocks tend to trade above their fair value. Bear markets cause the opposite to happen, which is why a cheap valuation never guarantees a bottom.

This week, I wrote an article covering four stocks I want to own during times of inflation. It was based on my view on the market as I believe that we’re soon in a position where central banks will have to prioritize financial stability over fighting inflation.

This is a part of my takeaway:

The market is stuck between a rock and a hard place. Economic growth is slowing, inflation remains high, and the Fed is making things worse by aggressively hiking into the aforementioned weakness.

Based on this context, we’re getting closer to a point where the Fed will be forced to pivot. Financial stability is becoming a huge issue, which means the bank will have to pick between either protecting financial stability or fighting inflation. If it picks the latter, it may fail to achieve any of its goals. If it picks the first option, inflation will likely rise again.

I believe that we’re getting close to a pivot. If that is the case, demand and inflation expectations will come back up, which will help CLF tremendously.

At that point, I believe the stock can easily break $35 again. This could be in the second half of 2023 or in 2024. It really depends on the severity of the ongoing economic decline and how quickly the Fed can turn dovish, I believe this happens in the first quarter of 2023.

Takeaway

In this article, we discussed a number of things. First of all, we looked into current developments, which have not been kind to CLF shareholders – or any market participant on the “long side”.

Economic growth is slowing, inflation remains high, and the Fed is eager (or forced) to maintain a hawkish stance despite rising financial instability.

I believe that we’re closer to a point where the Fed will have to pivot as it will have to prioritize financial stability over combating inflation.

That said, Cleveland-Cliffs is one of the best buys on weakness. This steel producer benefits from its massive transition, turning it into a highly profitable steel producer with short and secure internal supply chains, high-quality output allowing it to go far down the value chain, a healthy balance sheet, hedged energy prices, and the benefit from high automotive pent-up demand.

Moreover, once demand comes back, it will encounter subdued supply growth, given energy prices and related production cuts. So far, CLF has been protected from these issues, and I expect that the company will emerge as one of the biggest winners of the next upswing.

However, regardless of how bullish I am, please be aware that CLF is highly cyclical and volatile. It is hard to make the case that CLF cannot go any lower, despite its highly attractive valuation.

Other than that, I believe we’re dealing with a tremendous investment opportunity here.

FINVIZ

(Dis)agree? Let me know in the comments!

Be the first to comment