hrui

Goal of This Article:

As always, I like to begin with the end in mind for my readers and set a goal to achieve in my article. So, what is my goal or purpose for writing this article on Stem (NYSE:STEM), considering I wrote a piece on the company just 30 days ago? It was just then that I put a strong buy rating on the stock, and it was at $14.25 a share and is right under $12 today. Wouldn’t it still be a strong buy being 16.5% cheaper now? One would think the answer is yes, but you may want to patiently wait to see what the macroeconomic environment does to the stock price before the end of the year, as you may be given a gift. The market currently has been in risk-off mode.

My goal for this article is to review the following:

- Why Stem may be a hold and not a strong buy after Q3 earnings?

- Introduce you to a new competitor that came across my radar through my findings in the Frost & Sullivan report, that Stem was listed as a leader in.

- Explain my thoughts on leadership and their execution year-to-date.

- Dig Deeper into potential risks and concerns I have, but also the potential rewards if all goes well.

So let’s begin.

Third Quarter Results (Stem Q3 2022 Earnings Presentation)

Executing to their Commitment

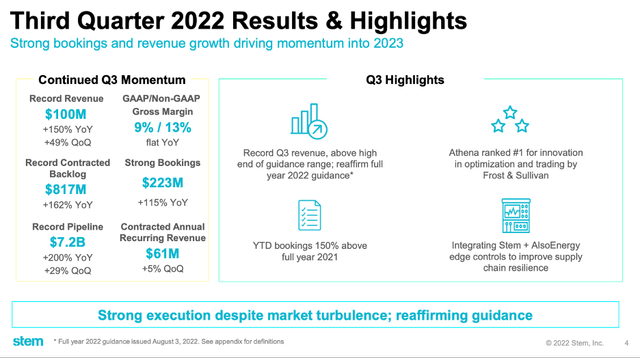

The first compelling event we have had since my last article, was the recent Q3 earnings call this past Thursday and Stem was ranked #1 by Frost & Sullivan as the leader for innovation in renewable energy and battery storage optimization and trading platforms. Let’s begin with earnings as Stem delivered a record quarterly revenue of nearly $100M in Q3. In growth terms this meant 150% year-over-year growth, 49% quarter-over-quarter growth, 4% above the high end of company guidance, and an 18% surprise to Wall Street expectations for Q3!

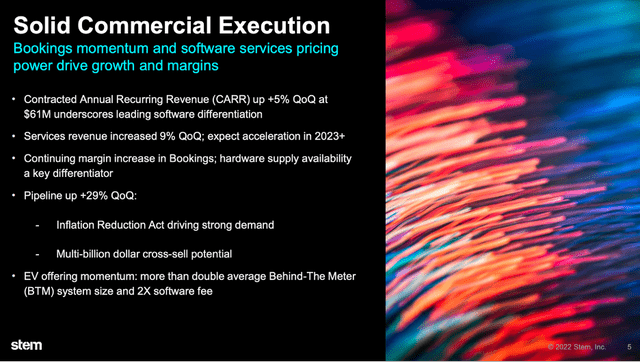

Stem also executed on the inputs that could lead the company to having a strong Q4 for 2022 and an even bigger year in 2023. The company reported $223M in bookings which was 115% year-over-year growth contributing to their record contracted backlog of $817M! The backlog growth was 162% year-over-year, and their contracted annual recurring revenue [CARR] grew sequentially 5% to $61M. Stem’s CARR metric is a very important metric shareholders want to pay attention to, because this is their Athena software’s annual recurring revenue which holds 80% product gross margins vs. the 10-30% gross margins their hardware sales generate. Shareholders want to see the software and services revenue part of the business grow to become a larger part of overall revenue and grow faster than hardware revenue, due to these larger profits they bring to the business. This indeed did happen in Q3 2022, and the services and software revenue portion grew 177% year-over-year to $13.7M. This higher margin part of the business was growing 31% faster than hardware revenue due to the increase in software only deals the company won in Q3.

Frost Radar Graphic (Frost & Sullivan 2022 Report)

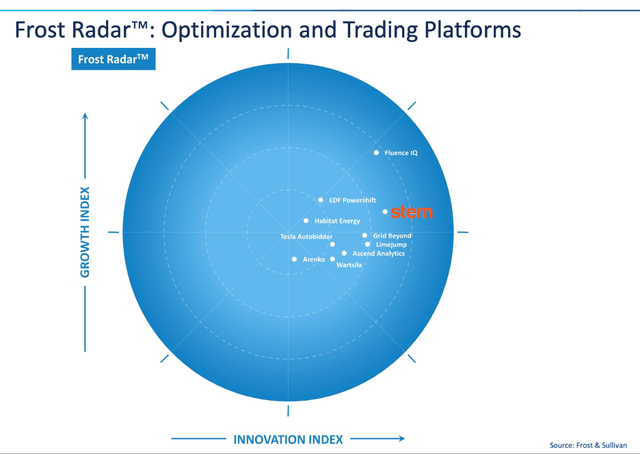

The Frost Radar: Digital Platforms for Renewable Energy and Battery Storage Optimization and Trading Report, by Frost & Sullivan was extremely helpful to understand how outsiders and other analysts viewed Stem’s technology vs. their competition. I will say by going through the entire report I did come across another competitor in Fluence Energy (FLNC) which scored close in innovation and higher in the Frost Growth Index Score. This led me down a rabbit hole of comparing the different companies in technology and financials. This may have caused me to consider potentially want to own both stocks as a hedge for ensuring I have a guaranteed winner in the optimization for renewable energy and battery storage market space.

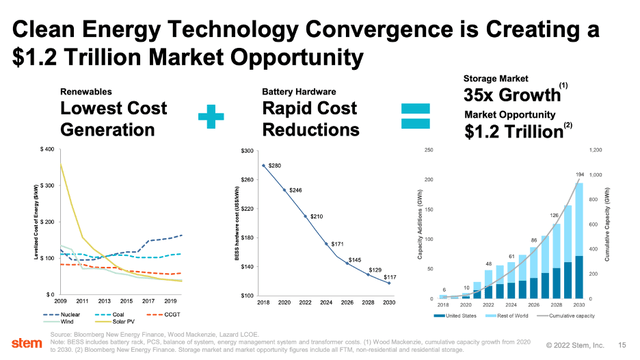

This arena of industry is projected to generate over $1.2T of revenue by 2050 and has many tailwinds coming that could lead to extreme growth for stocks in this sector. I had never seen any competitor rank so well as Stem in this fashion before and this company is a subsidiary of Siemens and AES joint venture together. I still have much more research to do on Fluence Energy before I buy shares, as they recently just had a change in CEO and CFO at the company. I will leave you with a few numbers that will make any Stem shareholder pause and must at least research more into Fluence Energy. Fluence Energy generated $239M in revenue in Q3, has $2.1B in backlog revenue, generated a positive cash flow for the second quarter in a row, has $762M in cash, and $0 Debt.

Stem 2022 Investor Presentation

Adapting and Creating New Revenue Opportunities

Let’s get back to reviewing Stem and their ability in 2022 to adapting to headwinds and creating new strategic revenue opportunities. We discussed in my last article how earlier in 2022 Stem acquired solar asset management platform AlsoEnergy. This acquisition gave Stem access to their 41,000 customers and presence in over 50 different countries, and management of approximately 32.5 GW of solar assets. The other strategic part of that acquisition was the 60% gross margins their software delivered and $49M of annual revenue. There is also lots of opportunity for cross-sell opportunities since Stem and AlsoEnergy only shared overlap of about 30% of their customer base.

What is more impressive about this strategic acquisition is the ability of how fast Stem has integrated their software into a unified joint offering with AlsoEnergy’s PowerTrack Software. Stem is further adapting to the supply chain headwinds they have been facing and has created its own universal “unit controller” edge device via AlsoEnergy for Athena-enabled control instead of having to continue to rely on joint 3rd part integrator offerings that force customers to get the same unit controller, battery, and inverter from the same provider. This enables supplier optionality to lessen supply chain volatility for customers and creates more flexibility for interconnected applications for customers. For Stem this will result in driving better margins, higher software revenues, and source batteries and inverters directly from OEMs.

Commercial Revenue Execution (Stem Q3 Earnings Presentation)

Stem is expanding into more Behind-The Meter (BTM) sales via their support for EV fleet offering. These sales more than double the average BTM system size sale they have on average and provide a software fee that is 2x in size. Stem booked some significant deals in Q3 including a partnership with InCharge, which is owned by ABB (ABB). Stem expects their EV fleet offering will comprise 20%-30% of all BTM revenue in coming years and be a greater portion of their gross margins. This segment of business has contributed to Stem’s 9% sequential revenue growth in services revenue in Q3 and will continue to grow in 2023.

Risks and Concerns

At this point you may be asking yourself, so did you move your rating to a hold all because of uncovering a strong competitor in Fluence Energy and that the market is extremely focused on risk-off stocks? That is part of the reason I have a hold at this very moment on the stock, but the hold is also more for more of me personally because it is already my 8th largest position in my portfolio. For a new investor it could still be a strong buy here or even one that does not have a large position in Stem. However, for me personally I want to only add if I can further lower my cost basis here, because I still believe there are other concerns that factor in on the stock and my position.

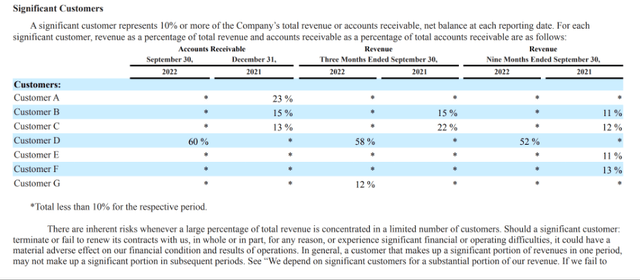

Stem Customer Concentration (Stem 10-Q )

Due to this company still being somewhat young and in a very nascent beginning of an emerging technology they do have customer concentration in revenue. It has been a part of their history for quite some time, but it fluctuates each quarter which company comes in as the largest portion of revenue over 10%. In Stem’s 10-Q you can see “Company D” was 60% of Stem’s revenue in Q3 and so there is risk there. I would like to see customer concentration come down over time along with gross margins improving. Gross margins were fairly flat in Q3 at 9% and Non-GAAP gross margins at 13%. The flip side to the gross margin argument is Fluence Energy was at -2% gross margins in Q3, but both gross margins are abysmal compared to full SAAS companies. My thesis on this company’s improving margins over time is the expectation that their CARR will grow exponentially in the long run and software like Athena and PowerTrack will be the larger parts of their revenue and margins.

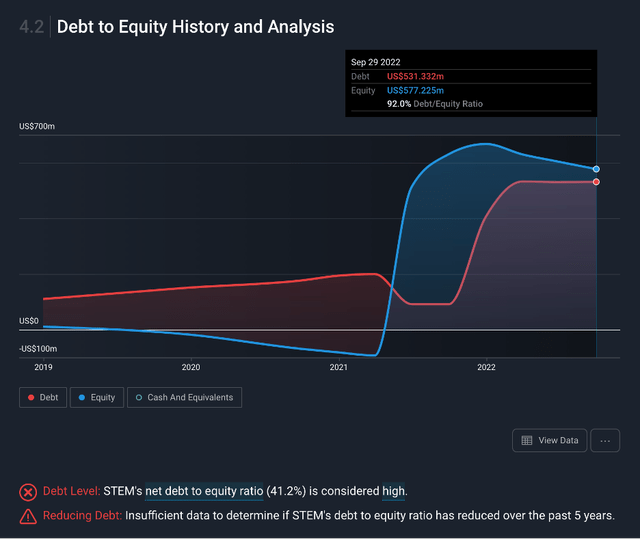

Stem Debt to Equity Ratio (Simply Wall St. App)

Another concern is currently their 92% debt to equity ratio due to the AlsoEnergy acquisition. Stem does have sufficient cash runway for more than a year, but they are currently not free cash flow positive. I like to invest in businesses with financial strength, free cash flow positive with supporting growth. It was encouraging to hear CEO John Carrington say they expect to be cash flow positive in the next 8 months towards 2H of 2023.

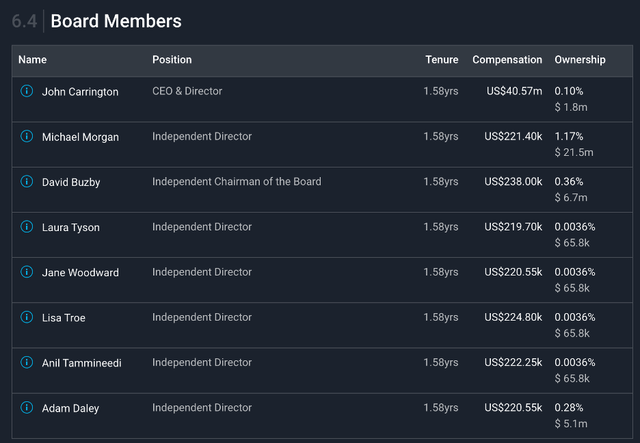

Now another irritating concern I do have with Stem is with all the insider selling that has gone on in the past year and that the CEO owns not even 1% of the company’s shares. I like to invest in companies where the CEO is fully aligned to shareholders and has a lot of skin in the game from a stock-based perspective. I can maybe forgive the insider selling I guess since the macroeconomics only got worse from when they sold, and it appeared they wanted to take some profits. However, it still rubs me the wrong way that John Carrington doesn’t own a ton of stock because the opportunity seems massive and he seems like a very good leader, so that just leaves me puzzled.

Board Member Share Ownership (Simply Wall St. App)

What’s Next?

In summary Stem is executing on all their growth commitments from a top line revenue perspective at an extremely high level and the macro headwinds in supply chain have impacted their earnings miss they had in Q3. I want to wait before I add any shares because I want to understand better how Fluence Energy compares to Stem and if it makes more sense to own both stocks instead of just one. I also want to see Stem’s financial strength improve in 2023 and see them get to cash flow positive in 2H of 2023. I do expect to add shares if they get that done and they continue to impressively grow as they have up to this point, or if the stock price goes back down to the ridiculous prices of $6 or $7 as it was earlier this year.

Let me know what you think below in the comments section and if you felt this was insightful drop me a like and a comment.

Be the first to comment