Bill Pugliano/Getty Images News

Thesis

I previously pointed out that Stellantis (NYSE:STLA) stock is trading very cheap and I assigned a ‘Buy’ recommendation. Although Stellantis stock has not moved much since my initial article, I reiterate my bullish thesis – and argue investors should give it a little bit more patience.

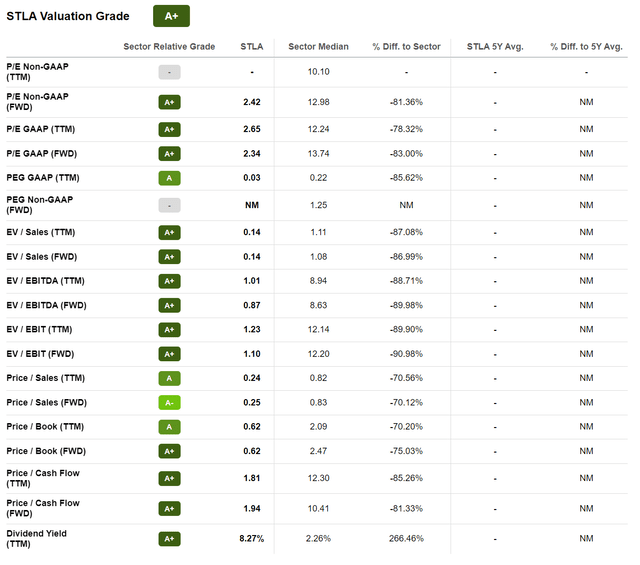

As of late October 2022, the stock is trading at a one year forward P/E of about 2.3, a P/S of 0.25 and a P/B 0.62. In my opinion, Stellantis could be the world’s most undervalued and underappreciated carmaker.

For reference, STLA stock has lost about 30.5% YTD, versus a loss of 18.5% for the S&P 500 (SPY).

Value Thesis Remains Strong

Stellantis is the world’s fourth largest carmaker with about $177 billion of revenues in 2021. But with an enterprise value of less than $25 billion, the OEM auto maker is valued like an experimental start-up such as Lucid Motors (LCID) and Rivian (RIVN).

It doesn’t matter which valuation multiple an analyst considers for STLA – they all point to a 70% – 90% undervaluation versus the sector median. For reference, Stellantis one year EV/EBITDA is x0.9, which implies a 90% premium to the sector median. STLA’s EV/Sales is x0.14, which points to a 87% undervaluation respectively?

What is going on here? The market apparently ascribes little value to Stellantis automobile empire, with more than $177 billion of revenues. But investors should consider that there are no indications that point to deteriorating fundamentals, and/or a loss of market share in the race for auto electrification.

Don’t Worry About Fundamentals

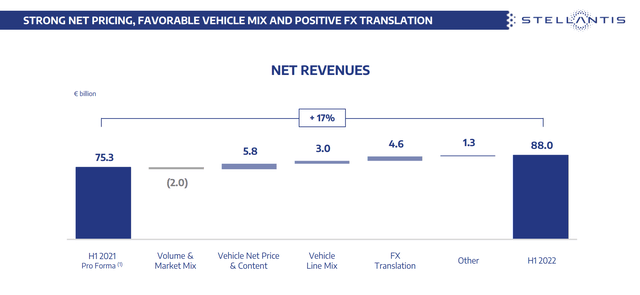

A major argument why I continue to have confidence in Stellantis’ deep value thesis is anchored on exceptionally strong fundamentals. For the 1H 2022 period, Stellantis reported net revenues of $88 billion, which represents a 17% year over year increase versus 1H 2021 – despite 1H 2022 being clearly more challenging than 1H 2021. The company’s adjusted operating income for the period reached €12.4 billion and net income jumped to €8.0 billion, which represents a year over year increase of 44% and 34% respectively.

Management highlighted that the strong topline performance was driven by favorable price increases, a high-margin vehicle mix and positive FX translation effects. And given a 14.1% operating margin, pricing power more than offset any headwinds from raw material and wage inflation.

Moreover, in 1H 2022 Stellantis generated €5.3 billion of industrial free cash flow and ended the period with €59.7 billion of cash and short term investment, versus total debt of about €28.2 billion (more than €30 billion of net cash).

For 2030, Stellantis continues to target the following:

Net Revenues to double to €300 billion, while sustaining double-digit AOI margin through the entire plan period

Generate more than €20 billion in Industrial Free Cash Flows.

Target a 25-30% dividend payout ratio through 2025 and the repurchase of up to 5% of outstanding common shares

EV Strategy Gains Momentum

Reflecting on Stellantis’ valuation, as highlighted above, the company would only need about 2 years of TTM profitability to amortize the entire enterprise value.

Arguably a major reason why markets doubt Stellantis future profitability, is anchored on challenges relating to the EV transition, as legacy carmakers such as Stellantis are perceived to loose against new-generation brands such as Lucid – thus, the (irrational) valuation puzzle.

But Stellantis hasn’t yet given investors any reason to confirm their doubt. In fact, Stellantis’ electrification strategy ‘Dare Forward 2030’ appears to gain momentum.

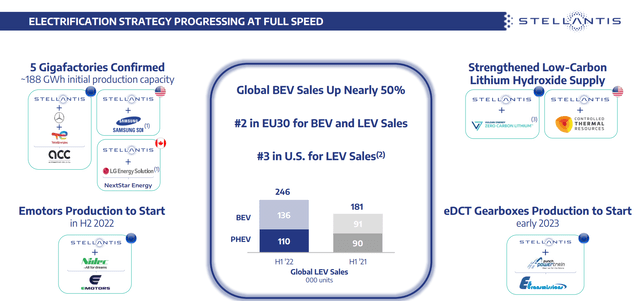

In the 1H 2022, Stellantis reported a 50% year over year growth in global BEV sales, growing to 136,000 deliveries. If an investor would also consider PHEV vehicles as ‘next-generation green automobiles’ then Stellantis cumulative 246,000 deliveries would catapult the European OEM carmaker on top of the global EV rankings – ranking second in the EU30 and third in the U.S. market.

Target Price Update

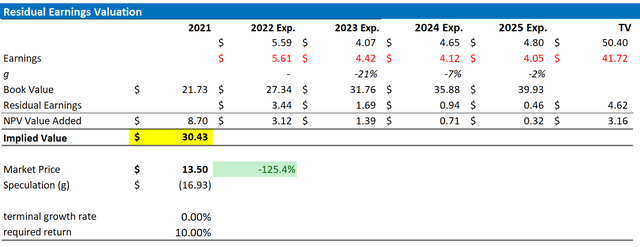

Anchored on Stellantis’ strong 1H 2022, I upgrade my residual earnings model for STLA to account for consensus EPS upgrades. However, I continue to anchor on an 10% cost of equity and a 0%, terminal growth rate (which I think are very conservative assumptions).

Given the EPS updates as highlighted below, I now calculate a fair implied share price of $30.43, versus $36.06 prior.

analyst consensus; author’s calculation

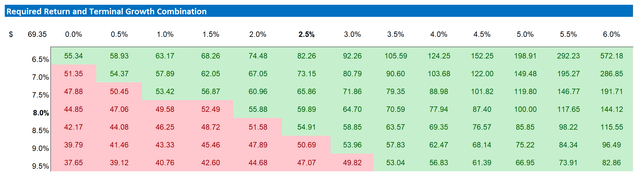

Below is also the updated sensitivity table.

analyst consensus; author’s calculation

Risks

As I see it, there has been no major risk-updated since I have last covered Stellantis stock. Thus, I would like to highlight what I have written before

As for Volkswagen, similar downside risks apply to Stellantis: 1) slowing consumer confidence globally, and especially Europe, due to inflation outpacing wage growth; 2) geopolitical risks including the Ukraine war and Stellantis’ exposure to China add to business uncertainty; 3) supply-chain challenges including semiconductor shortages, which could become even more challenging due to the Covid-19 lockdowns in China; 4) higher than expected CAPEX and R&D investments in order to realize the strategic repositioning towards an electric mobility provider; 5) timid EV adoption due to concerns about the EV technology and charging infrastructure build-up; 6) macroeconomic uncertainty relating to the monetary policy actions of the ECB and actions of the European/German government against Russia. And finally, following the FCA – PSA merger, integration of the two entities into one single conglomerate might prove more timely, costly and challenging than currently estimated.

Conclusion

Arguably, legacy carmakers such as Volkswagen (OTCPK:VWAGY), Ford (F) and General Motors (GM) are all trading cheap. But no OEM auto-company is trading at a similarly low valuation as Stellantis – the EV/EBITDA of close to x1 (90% discount to the sector) is simply breath-taking.

Reflecting on Stellantis’ fundamentals and the carmakers’ EV strategy, I believe STLA stock should be fairly valued at about $30.43/share.

Be the first to comment