Darren415

This article was first released to Systematic Income subscribers and free trials on Oct. 25.

In this article we highlight the Hybrid mortgage REIT preferreds sector which focuses on non-Agency mortgage securities. Hybrid mREIT book values continue to outperform their Agency counterparts, in part due to the resilience of households. However, this strength is not reflected in the performance of their preferreds which have underperformed Agency preferreds. In this article we discuss some of the reasons for this book value outperformance and discuss a couple of double-digit yielding opportunities in the sector.

Households Remain Resilient

Bank earnings are providing good coincident indicators of household health. Overall, there is no sign that households are struggling or that there is any kind of deterioration in the health of the sector.

The JPMorgan CFO had this to say:

We just don’t see anything that you could realistically describe as a crack in any of our actual credit performance . . . We’ve done some fairly detailed analysis about different cohorts and early delinquency bucket entry rates and stuff like that. And we do see, in some cases, some tiny increases. But generally, in almost all cases, we think that’s normalisation, and it’s even slower than we expected

The Wells-Fargo CEO added:

Deposit balances per [retail] account decreased from the second quarter, but were still higher than a year ago and remained above pre-pandemic levels. However, we continue to closely monitor activity by segment for signs of potential stress and for certain cohorts of customers. We’ve seen average balances steadily decline and are now below pre-pandemic levels, and their debit card spend continues to decline . . . but it’s important to note that this remains a small percentage of our total customer base. Overall, our consumer deposit customers’ health indicators, including cash flow, payroll and overdraft trends, are still not showing elevated risk concerns. Debit card spending remained significantly above pre-pandemic levels . . . Credit card spend remained strong in the third quarter, up 25 per cent from a year ago, with double-digit increases coming across all spending categories

Strong household balance sheets and low debt service levels are helping households through a slowing macro environment. This resiliency is also explained in large part by accumulated savings through August exceeding the pre-COVID trend which stand at around $1.3trn or about 8% of annual consumer spending, according to Wells Fargo. It would take another 15 months to deplete this stockpile if it continues to be drawn down at the same pace.

Wells Fargo

And although the amount of outstanding revolving credit has risen sharply, it stands 5% below the pre-pandemic trend. Moreover, as a share of disposable income household debt service ratios remain low. Overall, consumers have low sensitivity to rising rates as much of the typical debt profile is driven by the mortgage which is typically fixed-rate.

Wells Fargo

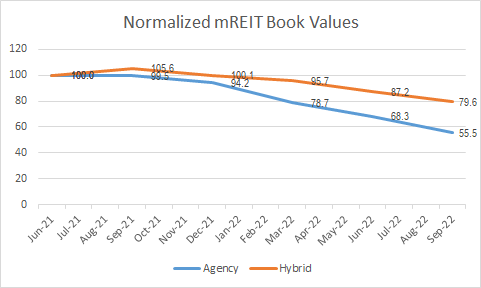

Hybrid mREIT Book Values Far From Falling Off A Cliff

The Q3 earnings season has not yet started in full, however 6 mortgage REITs have provided guidance for Q3 NAVs, three in the Agency sub-sector (ARR, NLY, AGNC) and three in the Hybrid sub-sector (MFA, EFC, MITT). The key takeaway is that the Hybrid sub-sector continues to be more resilient in the wake of the broader fallout in the mortgage sector. The chart below compares the trend in book values for these two subsets over the past year.

Systematic Income

The key drivers of the book value outperformance of the Hybrid mREIT subsector are 1) lower leverage of hybrid mREITs, 2) the fact that the household sector is still holding up fine – we just saw this from Q3 bank earnings reports, 3) whole loans are much less liquid than Agency MBS and they are much less leveraged via mark-to-market facilities, particularly now, which means they are less prone to negative feedback loops of margin calls, fire sales, lower prices, more margin calls etc., 4) lower susceptibility to interest rate hedging drags due to high rate volatility, 5) the Fed balance sheet runoff is affecting only Treasuries and Agencies directly rather than whole loans.

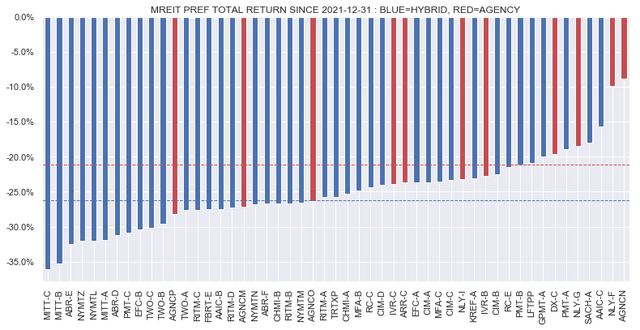

However, what’s interesting is that this stronger book value performance of the Hybrid sub-sector this year has not been rewarded with stronger returns. The chart below shows the year-to-date total returns of the mREIT preferreds sector with blue bars indicating hybrid preferreds and red indicating Agency preferreds. The horizontal lines show average figures for the two sub-sectors. The average hybrid mREIT preferred has fallen by 6% more than the average Agency preferred.

Systematic Income

Some of this outperformance is due to the fact that AGNCN and NLY.PF have both switched to floating-rate coupons, in the process increasing their yields by 2-3% – a dynamic which has supported their prices. However, even if we exclude these two preferreds the Agency subsector still outperforms.

The market appears to be trading this sector in terms of “less safe / more safe” and rewarding Agency mREIT preferreds due to their perception as being “safer”. In our view, this is not the right way to approach the sector and the book value trajectory this year of both sub-sectors clearly lays this out.

Our Picks

Our approach to mREIT preferred investing is focused on a number of key fundamental metrics. These include the level of leverage (specifically, focusing on recourse leverage), the level of Agencies in the portfolio, the amount of mark-to-market leverage instruments and the level of equity / preferred coverage.

All else equal we focus on mREITs with a lower level of leverage, higher level of Agencies, higher level of equity / preferred coverage and lower level of mark-to-market financing. Most of these are self-evident. Some allocation to Agencies is always attractive because Agencies are liquid, even in a distressed market environment, and can be used to source cash for margin calls.

We combine these three fundamental metrics in a stress test that uses the drawdowns across Agencies, whole loans, MSRs and other securities to stress the book value of a given mREIT. Needless to say, we overweight those with a higher level of stress equity / preferred coverage.

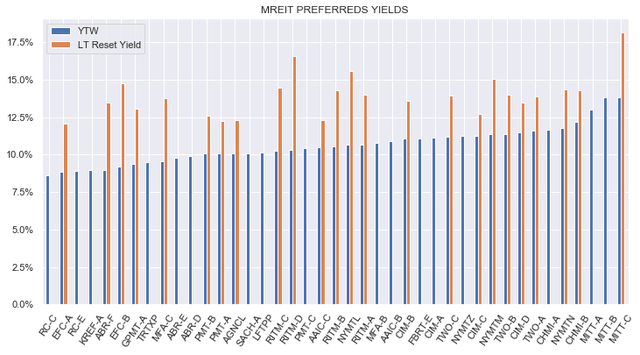

Besides the fundamental picture, yields are clearly relevant as well for allocation. The chart below shows two types of yields for the hybrid mREIT preferred sub-sector: the familiar stripped yields and the long-term reset yields i.e. the stripped yield at the expected terminal value of Libor over the next decade which is around 4%. Stripped yields are what these stocks are yielding now and the LT reset yield is what they will yield over the longer-term, unless redeemed. Stocks without an LT reset yield are Fixed-rate and will continue to pay their stripped yield unless redeemed.

Systematic Income

We would highlight the following preferreds in the sub-sector.

Rithm Capital (formerly NRZ) (RITM) is focused on servicing assets, non-agency origination and single-family residential properties. Its book value up to Q2 has held up remarkably well due to its MSR overweight, which benefit from rising rates. Unlike nearly all other mREITs, its book value was up 9% year-on-year as of Q2. This has helped to maintain its strong equity coverage of 5.4x.

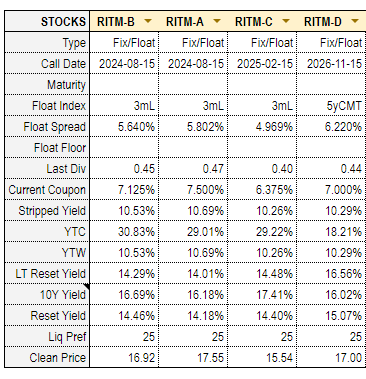

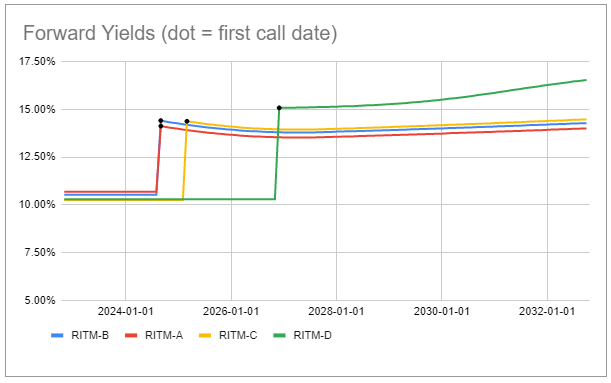

The RITM preferreds suite consists of 4 stocks as shown below. All are currently fixed rate but all will switch to a variable-rate coupon, three based on Libor and one based on 5Y CMT i.e. the 5Y Treasury yield.

Systematic Income Preferreds Tool

This is how the yields of these stocks are expected to evolve going forward. In the suite we like both the (RITM.PB) and the (RITM.PD). RITM.PD offers some diversification in the portfolio due to its unusual Treasury yield link, however, it will take time to switch. RITM.PB, on the other hand, will switch to a floating-rate in less than two years.

Systematic Income Preferreds Tool

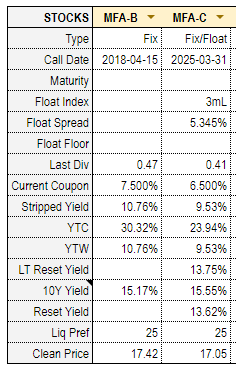

We would also highlight the MFA Financial (MFA) preferreds. The company focuses primarily on whole loans such as Non-QM or non-qualified mortgages. MFA carries primarily fixed-rate financing, the majority of which is non-mark-to-market. It has a relatively low recourse leverage of 1.8x and a Q3 equity / preferreds coverage of 4.5x.

The two MFA preferreds look like the following:

Systematic Income Preferreds Tool

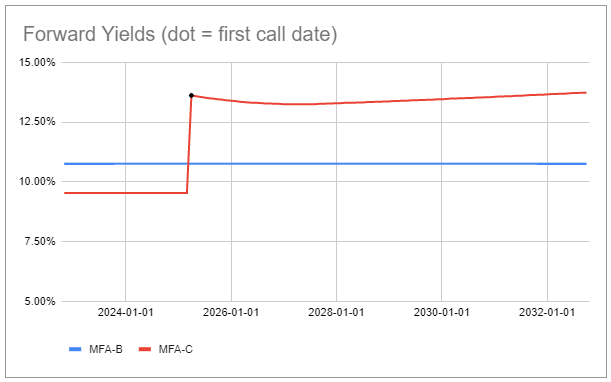

Their yield profile looks like the following. We currently hold (MFA.PB) in our High Income Portfolio due to its potential (though low probability) redemption and highest yield. However, if short-term rates stay high, MFA.PC will start to look increasingly more attractive over time.

Systematic Income Preferreds Tool

Be the first to comment