Phynart Studio

Investment Thesis

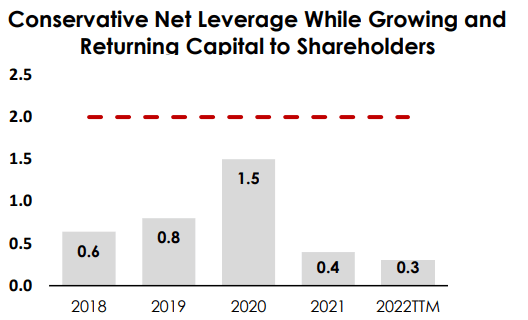

Steel Dynamics (NASDAQ:STLD) reports all-around record results. Furthermore, with its balance sheet notably strong, with net debt to EBITDA falling to a low of 0.3x, Steel Dynamics believed that its best use of capital was simply to return it to shareholders.

During Q2 2022, through repurchases and declared dividends, Steel Dynamics’ total annualized yield stands at 14%.

Not bad when we consider that the stock is priced at approximately 3x its 2022 free cash flows.

I rate the stock a buy.

Steel Dynamics’ Revenue Growth Rates Are Impressive

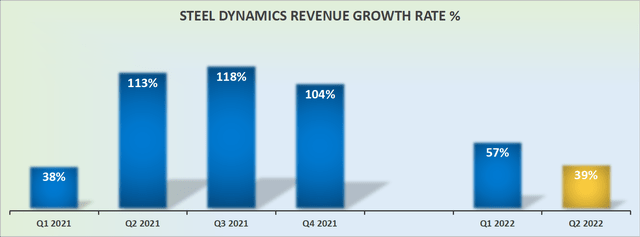

Steel Dynamics revenue growth rates

As you can see above, despite the seriously tough comparisons with last year’s Q2 period, Steel Dynamics still grew by 39% y/y.

This period marked a record financial quarter in many lines of the income statement, starting all the way at the topline, to the bottom line, through its cash flows.

Given that the past couple of months has seen Steel Dynamics’ stock sell-off by more than 20%, there appears to be a misalignment between what the company is reporting and what investors are expecting.

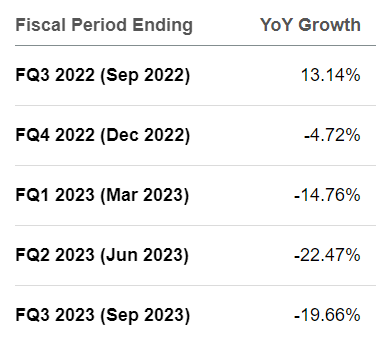

Analysts revenue estimates

For their part, analysts continue to expect that Q2 marks the high point in Steel Dynamics’ revenue growth rates and that its revenue growth rates will rapidly reduce starting Q3 and move into negative territory by the end of Q4.

Steel Dynamics’ Near-Term Prospects

Steel Dynamics is one of the largest domestic steel producers and metals recyclers in the United States.

As you know, the overall thesis here is that there’s an overabundance of steel that is depressing steel prices. This has seen steel prices sell off significantly in the past few months, with steel prices now trading in line with the fall of 2020 when demand fell off the cliff during the pandemic. This is where steel prices are now, once again.

On this front, Steel Dynamics stated,

Customer order entry activity continues to be healthy across all of our businesses, conflicting with the more pessimistic emotion in the marketplace.

Still, why are steel prices so low? Take your pick from the following. There’s an overabundance of cheap steel. China’s real estate market, arguably one of the biggest uses of steel around the world, is in a slump. There’s a likely global recession underway. During a recession demand for steel products will see the company’s profitability rapidly retrace lower, given their very high fixed costs.

Indeed, as noted above, this is exactly what analysts are expecting from Steel Dynamics’ revenue growth rates over the coming few quarters.

Meanwhile, Steel Dynamics increased its shipping volume by 6.9% y/y to 3.1 million tons reaching a new record.

Consequently, despite the gloomy spot market, Steel Dynamics reported very strong profitability.

Capital Allocation Policy

Steel Dynamics Q2 2022 presentation

As you can see from the graphic above, Steel Dynamics’ net leverage continues to not only move down over time, but it’s now at a 5-year low of 0.3x for its trailing twelve months. Steel Dynamics’ net debt stood at $1.7 billion as of Q2 2022.

Furthermore, I believe that it’s reasonable to assume that Steel Dynamics’ net debt will further improve once Q3 gets reported.

Given its very strong balance sheet, combined with record cash flows, it only makes sense that Steel Dynamics looks to return excess cash back to shareholders.

In my previous article in June, I stated that,

Steel Dynamics didn’t hesitate to buy back 2.5% of the company and deploy nearly $400 million worth of capital. This is nearly a third of its share repurchase program gone in 90 days.

This assessment turned out to be too conservative. During Q2 2022, Steel Dynamics actually ended up repurchasing $517 million worth of stock, or 3.5% of its stock.

What’s more, this level of buyback, when taken together with the 0.5% dividend yield for the quarter, puts Steel Dynamics on a combined annualized yield of 16%.

STLD Stock Valuation – Priced at 3x Free Cash Flow

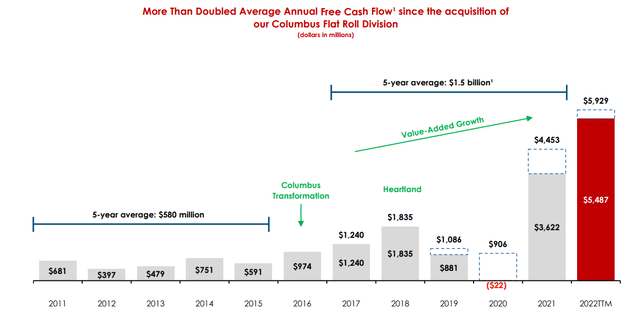

Steel Dynamics Q2 2022 presentation

As you can see above, for Steel Dynamics’ trailing twelve months, its free cash flow reached $5.5 billion. This puts its stock priced at 2x trailing free cash flow.

That being said, there’s the assumption that Steel Dynamics’ forward-looking free cash flow will not be anywhere near as strong as this record period observed.

For context, keep in mind that for H1 2022, Steel Dynamics’ free cash flow reached $3 billion. Consequently, even if the second half of 2022 sees only half of this level of free cash flow, at $1.5 billion for the whole of H2 2022, that still leaves this stock priced at 3x free cash flow.

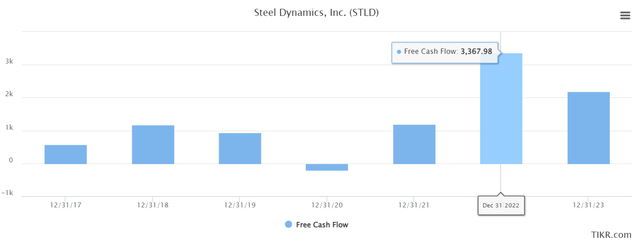

TIKR.com

From another perspective consider the following. Analysts estimate that for 2022 as a whole, Steel Dynamics’ free cash flow reaches $3.4 billion. That’s nearly the same as Steel Dynamics has already reported in the first half of 2022, at $3.0 billion!

That means that analysts expect only a further $200 million per quarter of free cash flow on average.

This strikes me as absurd.

The Bottom Line

There’s a considerable amount of fear that a global recession will see demand for steel plunging. However, the underlying performance of Steel Dynamics does not appear to tally up with that narrative.

The company is reporting record results, record shipments, and returning to shareholders an annualized 14% combined yield.

Compared with what investors are getting elsewhere in the market, this valuation strikes me as attractive.

Be the first to comment