z1b/iStock via Getty Images

Investment Thesis

Steel Dynamics (NASDAQ:STLD) is one of the largest domestic steel producers. As expected, it reported record results for its Q1 2022 earnings. Not only were revenues strong, but free cash flow was a massive improvement from the same period a year ago.

This led to management returning to shareholders nearly 60% of its free cash flow produced this quarter. To put this figure in context, this equated to a 2.4% capital returned to shareholders over the past 90 days alone.

Thus, despite growing revenues by more than 55% y/y, shareholders also got a nice return on capital.

Meanwhile, I argue that contrary to commonly held belief, the party here isn’t over.

Indeed, I make the case that paying approximately 5x this year’s estimated free cash flows is a very compelling entry point for investors, offering them a compelling risk-reward. Here’s why:

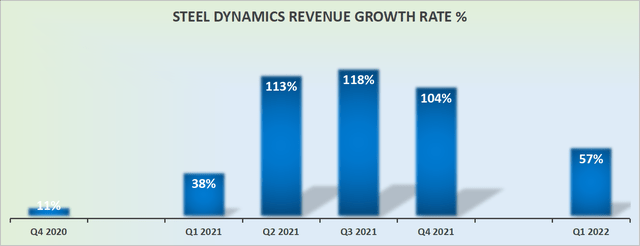

Revenue Growth Rates Were Up 57% Y/Y

Steel Dynamics revenue growth rates

Steel Dynamics printed topline growth of 57% y/y. Obviously, everyone expected that Q1 was going to be strong anyway, particularly given that it was the easiest comp of the year.

But the big uncertainty now is how will the rest of the year unfold.

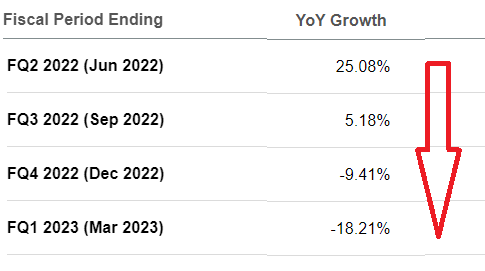

Steel Dynamics analysts’ revenue consensus

Analysts presently expect that as we get further into 2022, the following quarters are going to get progressively less impressive, to the point that by Q4 2022, Steel Dynamics’ revenues will report negative revenue growth rates.

However, I don’t believe that to be the case at all.

Why Steel Dynamics? Why Now?

Steel Dynamics is one of the largest domestic steel producers and metals recyclers in the United States. Steel capabilities have been meaningfully underinvested in for years. This has led to widely reported steel shortages.

In turn, this has led to steel prices trending higher over the past 6 months.

Trading Economics, steel prices

Moving on, the fear that investors have against getting too enthusiastic and backing this space is that there’s the expectation that there will be demand destruction.

However, I don’t believe that to be the case, at least not any time soon. Why?

Firstly, China wants to minimize polluting its country with carbon-intensive industry as it works to minimize carbon emissions in its pledge to reach 2-degree temperature rise by 2030. Thus, China is looking to cap its yearly steel production.

Secondly, Russia is a big exporter of steel, but given sanctions against the country, this has implied that getting steel to the West is now close to impossible.

Consequently, even if one wanted to start bringing more steel supplies online it’s going to take 3 years, if not longer.

Therefore, together you have two big countries that can’t or won’t as aggressively flood the market with steel.

So you end up with high demand, high prices, and a shortness of supply, positioning steel manufacturers in the West in a great environment.

Finally, the real icing on the cake is that steel manufacturing is very energy-intensive. So, if you are Europe-based, given the current energy crisis, it simply becomes prohibitively expensive to meaningfully ramp up production.

This leaves North American steel producers in a very favorable environment, with high demand and relatively lower energy costs.

Shareholder Returns in Focus

Steel Dynamics holds approximately $1.9 billion of net debt. Given the strong market environment discussed above, I believe this is a solid fiscal position.

To give you a sense of just how strong Steel Dynamics’ ability to generate free cash flows is, consider that Q1 2022 reported free cash flow of $659 million compared to a negative $48 million in the same period a year ago. This is a swing of more than $700 million y/y, on a company with a market cap of $17 billion. These numbers are noteworthy.

Management obviously realizes just how much free cash flow it’s making and not only increased its dividend by 31% to provide shareholders with a 1.49% dividend yield, but more impressively has meaningfully increased its capital return program.

To put in context its capital return program, consider that dividends paid out amounted to $51 million during the quarter, while share buybacks reached $349 million.

This means that out of the free cash flow generated in the quarter, approximately 61% was returned to shareholders this quarter.

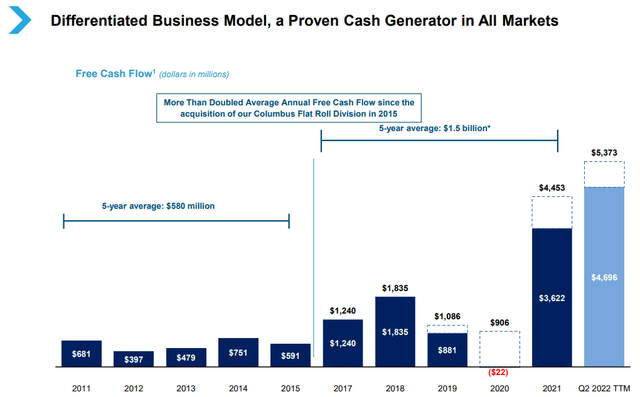

Steel Dynamics Q1 2022 investor presentation

The figures above are not actual free cash flow figures, because they are based off EBITDA minus capex figures, and as such are only a rough approximation of free cash flow.

Nonetheless, you still get an understanding that we are not talking about a one-off strong quarter. We are talking about a business that is just coming out of a prolonged bear market.

STLD Stock Valuation – Still Attractively Priced, Even Now

What’s the first rule of investing in commodities? The first rule is you don’t buy commodities at low multiples, because that’s the end of the cycle, right? Well, allow me to remind you that Steel Dynamics just reported more than 55% y/y growth. That’s evidently not the end of the cycle.

The end of the cycle is Netflix (NFLX) reporting that it’s going to be growing by 10% and being priced at more than 17x operating earnings.

Could it be that the old economy is now the ”new growth industry”?

It seems like blasphemy to even posit such a question. Everyone is so steadfast in anchoring to higher prices for Netflix and lower prices for Steel Dynamics, that to mere mortals it appears inconceivable that Netflix won’t soon revert higher and at the same time that Steel Dynamics could not possibly go higher.

And that’s why Steel Dynamics is still this cheap.

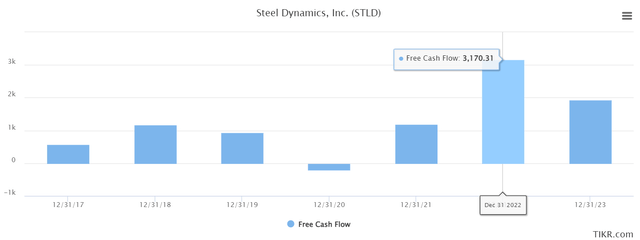

Tikr.com

Presently, analysts following the company expect that Steel Dynamics’ free cash flow this year could reach more than $3 billion. This would put Steel Dynamics priced at approximately 5x this year’s free cash flows.

Obviously, the big fear amongst the investment community is that the steel prices retrace lower in 2023 and that this boom year will mark a peak in steel demand.

However, I don’t believe that to be the case at all.

The Bottom Line

If you want to build an EV, how do you think Tesla (TSLA) makes a car? Approximately 15% to 20% of EVs are made from steel.

What about servicing President Biden’s infrastructure package? Same, steel, US-based steel.

What about to match pent-up demand in the energy sector? Again, steel. The list goes on and on, why steel’s demand is going to remain high and we are only at the start of a long supercycle.

You should expect Q2 2022 to report yet another record quarter. And paying 5x free cash flow doesn’t seem expensive what-so-ever.

To preempt your question, I don’t own shares in this name, but I do own shares in a slightly smaller peer. Whatever you decide, good luck and happy investing!

Be the first to comment