PeopleImages/iStock via Getty Images

Remember our old friend TINA? The notion that “there is no alternative” to stocks has come and gone. At least in my view. Today, the bond market yields near 4%, and even high-quality corporate credit earns investors 4.69%, according to the latest data from the St. Louis Federal Reserve.

You can take a look for yourself on the iShares website – iShares Core U.S. Aggregate Bond ETF (AGG) sports a yield to maturity of 3.73% while iShares iBoxx Investment Grade Corporate Bond ETF (LQD) has a 4.81% YTM. With all the excess savings built up from the pandemic, people must know where to park their cash.

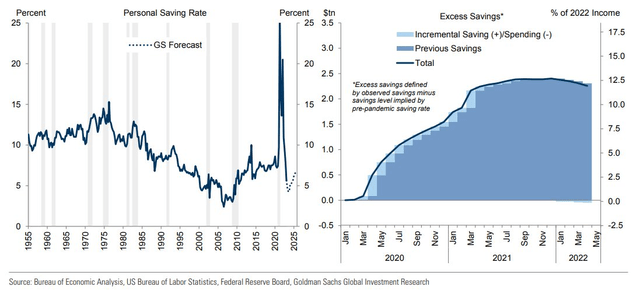

U.S. Personal Savings Rate Down, But Excess Savings Remains Huge

Goldman Sachs Asset Management

And you don’t even have to step out onto the credit risk spectrum to earn something. The iShares 1-3 Year Treasury Bond ETF (NASDAQ:SHY) holds just near-term Treasury securities. That means there’s no default risk, and duration risk – the chance that the fund will decline when interest rates climb – is relatively low compared to longer-dated Treasuries. SHY yields 3.02% as of June 24’s mark date.

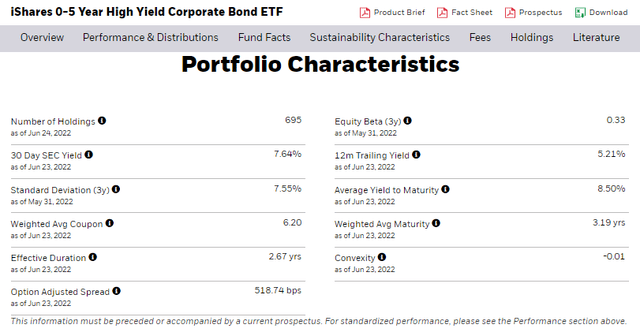

For the risk-seeking, though, the iShares 0-5 Year High Yield Corporate Bond ETF (SHYG) is a short-duration, high-yield corporate bond fund. Its yield is 8.5% at the moment – higher than what you might earn even on stablecoins!

SHYG: An 8.5% Yield On Low-Duration, High-Default Risk Bonds

iShares

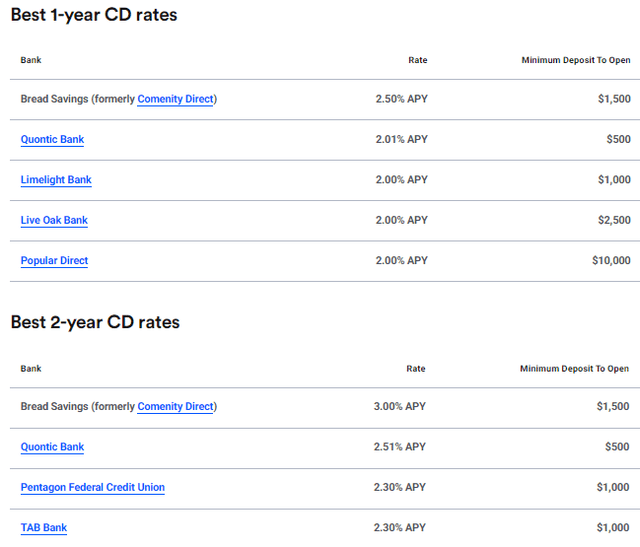

What’s more, everyday folks can earn more than 1% in online high-yield savings accounts right now and the certificate of deposit (CDs) market catches risk-averse investors’ interest, too.

Investor Interest Piqued in the CD Market

Bankrate.com

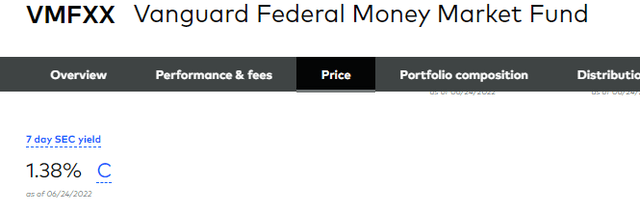

Another place to stash your cash – which just recently became a viable alternative – is simply going with a solid money market mutual fund. Consider that the Vanguard Federal Money Market Fund (VMFXX), as of last Friday, pays investors 1.38%. When analyzing money market mutual funds’ yields, be sure to look at the 7-day SEC yield. That gauge annualizes the past week’s rate while backing out the fund’s expense ratio. For other bond mutual funds, the proper rate to look at is the yield to maturity. And you must know the fund’s expense ratio.

Money Markets Finally Paying Something Decent: 1.38% SEC Yield

Vanguard Group

What’s my take on the best fund to go with for your cash? I assert SHY is right. At least right now, it has a yield to maturity that’s considerably higher than the seven-day SEC yield on the best money market fund. And CDs often tie up your money, so it’s not the preferred choice. Let’s dive into SHY a bit more.

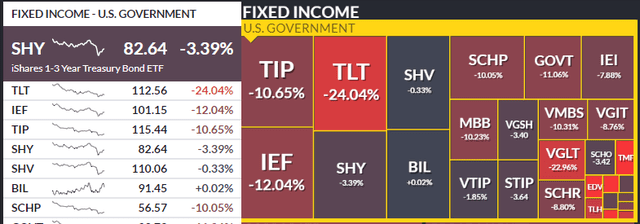

According to iShares, the ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities between one and three years. Now, the toughest thing for people to get over is seeing all that red on the YTD return fact sheet. Yes, the fund is way down in 2022, but that’s exactly why its yield is finally attractive. After all, the best gauge on future bond fund returns is simply its starting YTM.

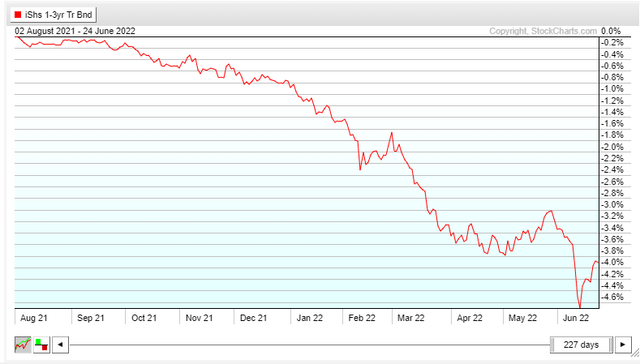

SHY Total Return Since Early August 2021

Stockcharts.com

YTD Returns: SHY (And Other Bond ETFs) In the Red

Finviz

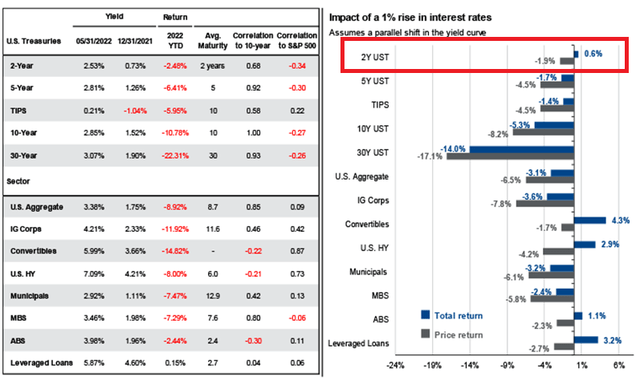

There’s another great chart from JPMorgan Asset Management that illustrates well the effect that rising bond interest rates have on total returns. A bond fund’s effective duration simply tells an investor how much the fund will decline for every 1% upward change in market interest rates. The shorter the maturity, the weaker the impact rising rates has on a fixed-income product’s price. Hence, as of May 31, even if rates climbed 1% on a two-year Treasury note, you would still have a positive total return over a one-year timeframe. So, SHY is an excellent choice for your cash even if there’s a little bit of duration risk.

Rising Interest Rates: Not A Major Risk For Short-Dated Treasuries

J.P. Morgan Asset Management

The Bottom Line

Investors remain flush with cash. There’s still more than $2 trillion in excess savings out there. SHY is a good choice since you earn more than 3% right now while taking on very little duration risk. And since it’s a Treasury ETF, there’s no chance of default. As the year progresses, though, keep your eye on money market yields as those should rise in real-time with Fed policy.

Be the first to comment