Khosrork/iStock via Getty Images

It pays to have sufficient dry powder on hand to take advantage of high yield opportunities, and this may be one of those times. After the S&P 500’s (SPY) worst first half in 52 years, there are currently a number of high yields that are ripe for the picking.

It pays to stick with those names that have a durable track record of consistently rewarding shareholders, and this brings me to one such name, Starwood Property Trust (NYSE:STWD). In this article, I highlight what makes STWD an attractive high yield buy at the current price, so let’s get started.

Why STWD?

Starwood Property Trust is a diversified finance company that focuses on commercial mortgages, infrastructure lending, and owned real estate. It’s survived multiple real estate cycles since 1991, and is led by long-time Chairman and CEO, Barry Sternlicht. Since inception, STWD has deployed over $87 billion of capital, and currently manages a portfolio of over $25B across debt and equity investments.

While there are many debates over whether internally or externally managed companies are better, the real answer is more nuanced, as there are advantages to both. For STWD, I view the external management as being a plus, as its 350 employees are able to leverage the skills and expertise of Starwood Capital Group’s (the external advisor) 4,000-person platform. This gives STWD a line of sight and deal flow that it simply would not have as a standalone company.

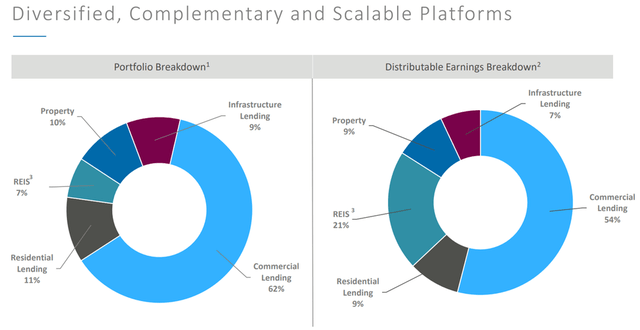

Since inception STWD has developed an impressive collection of assets that span across commercial, residential, and infrastructure lending, as well as real property and securities. As shown below, 30% of STWD’s distributable earnings come from property and real estate securities, providing it with a stable alternative earnings source to complement its loan portfolio.

STWD Portfolio Mix (Investor Presentation)

Of course, commercial lending remains STWD’s core bread and butter business, representing 54% of its distributable earnings, and it continues to be conservatively managed. This is reflected by the fact that this $14.8 billion portfolio carries a safe weighted average loan to value ratio of 61%.

This implies that borrowers would have to see on average a 39% loss in the fair market value of the underlying property before STWD begins to see losses on its property loans. Moreover, STWD’s commercial loans carry relatively low durations of 2-4 years, making them less subject to duration risk, and it targets attractive 10-13% levered returns.

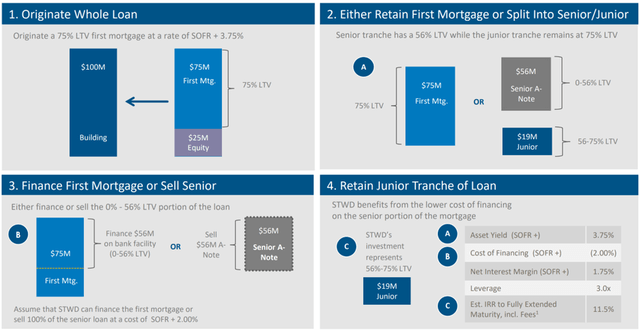

STWD is able to generate these high returns by prudently underwriting and being the first originator of loans, then splitting them into senior / junior tranches, and selling or financing the senior tranche while retaining the junior tranche, which carries a higher yield. This is perhaps best exemplified by the following diagram.

STWD Lending Model (Investor Presentation)

Meanwhile, management continues to shift the portfolio away from office and towards multifamily, which is now the largest property type at 32% of STWD’s CRE loan portfolio. The company is also proving adept at recycling capital from lower yielding assets towards higher yielding ones, as reflected by its recent $85 million gain on sale of an industrial asset. Importantly, STWD continued to out-earn its $0.48 quarterly dividend with distributable EPS of $0.76 in the last reported quarter.

Looking forward, STWD is well-positioned for rising rates, as 98% of its loan portfolio is floating rate. It also maintains plenty of capacity for new loan originations, with $9.6 billion in availability on its existing credit lines and carries an adjusted debt to undepreciated equity ratio of 2.1x, down from 2.3x at the end of last year. These factors helped STWD to garner an upgrade to its credit rating to BB with a stable outlook.

Factors that could drive STWD’s share price down include the potential for an economic slowdown or decline, and continued headwinds in the office space market. It appears, however, that management is in tune with market forces, and has been careful on orchestrating its office-related loan portfolio, as noted during the recent conference call:

We have been discerning on adding office loans and the few we’ve added are very well leased, and we believe well insulated from any potential future economic shocks. We continue to grow our international CRE lending business, which accounts for one-quarter of our lending portfolio today and should continue to grow. Starwood has been an investor in the CRE markets for decades.

We know the sponsors and we know the assets. Our best-in-class international teams operate in less competitive debt markets than the US, and we believe we can create incremental shareholder return with less leverage and better structure on assets we are equally adept at valuing.

Meanwhile, STWD appears to be attractive at the current price of $21.22, which is under its book value of $21.98, equating to a price to book ratio of 96%. Sell side analysts have a consensus Buy rating on STWD with an average price target of $28.43, implying a potential one-year 43% total return including dividends.

Investor Takeaway

Starwood Property Trust is a well-managed, high yield commercial mortgage REIT that is positioned for rising interest rates. It has a strong balance sheet and plenty of capacity for new loan originations, with increasing exposure to the more stable multifamily asset class. The stock looks attractive at the current price with a 9.1% dividend yield for high income investors.

Be the first to comment