Pekic

Article Thesis

Starwood Property Trust (NYSE:STWD) is a mortgage REIT that has seen its shares come under pressure in recent months. The market fears what rising interest rates might mean for real estate markets in the US, but I do believe that these worries are overblown. Starwood Property Trust has a resilient, low-risk business model and should actually see its profits increase due to rising rates. With an inexpensive valuation and a high dividend yield, Starwood Property Trust looks like an attractive contrarian investment at current prices.

Market Worries Send Starwood Property Trust Lower

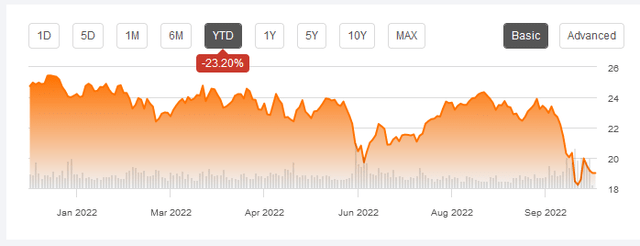

Equity markets, overall, have performed badly in 2022 so far. That also holds true for many mortgage REITs, including Starwood Property Trust:

Shares have dropped more than 20% so far this year, with STWD dropping by a pretty sizeable 16% over the last month alone. Clearly, this sell-off was driven by market worries, as STWD would otherwise not have dropped this much in such a short period of time.

Interest rates keep rising in the US as the Fed is cracking down on inflation. The market anticipates that this will lead to issues in real estate markets, which is why real estate-related companies such as STWD have come under pressure. But even though acquiring a new house has become way more costly over the last year, a major decline in the US housing market is far from guaranteed, I believe.

First, building new homes has become more expensive, due to rising costs for all kinds of materials and due to more costly labor. With high costs for building new homes, there’s little risk that the market will suddenly become oversupplied. Many homeowners have locked in low mortgage rates over the last decade, and they will be unlikely to sell, as they would then lose their low-cost mortgage that can be seen as an “asset” or advantage in a high-inflation environment. That will further restrict the supply of homes to the market, I believe. Last but not least, demand for homes should remain healthy, as the population in the US continues to grow, which includes the impact of positive net migration. So while US home prices will not continue to surge as they did over the last two years, I do not believe that it is particularly likely that we will see a huge price drop for American homes. Instead, it seems more likely to me that there will be some consolidation and that prices will move sideways for a while, as supply will not be very high which will prevent the market from dropping much.

This would prevent high mortgage defaults, especially since Starwood Property Trust’s loans are pretty conservative. On average STWD’s loan-to-value is around 60%. Thus even if US real estate prices were to drop considerably, the hit could be fully stomached by the equity holders. According to the St. Louis Fed, the US home price index dropped by around 20% when the housing bubble burst around 15 years ago. That was one of the steepest downturns in the US real estate market, and I do believe that we will not see a similar downturn due to the current increase in interest rates, due to the aforementioned reasons. But even if it were to occur, it would not hurt Starwood Property Trust a lot.

In fact, the price decline could be twice as high as 15 years ago, at 40%, and it would still not affect STWD’s average loan thanks to a 60% loan-to-value ratio, which means that there is, on average, 40% equity in these properties (which would take the hit first, before lenders such as STWD would be affected). In other words, if the housing market moves sideways, there’s almost no risk to Starwood Property Trust. And even if the housing market dropped in line with what we saw 15 years ago, the impact would likely not be especially harsh.

Starwood Property Trust does not invest in residential and multifamily loans only, which means that other real estate markets are important as well. But multifamily and residential mortgages make up the largest portion of STWD’s portfolio, following a shift towards these segments in recent years. STWD also lends to hotel, office, mixed-use, and other categories. Here, real estate markets could be more volatile, but risks do nevertheless not seem overly high. Hotels should benefit from growing demand as global travel continues to recover, which will increase hotels’ profitability and will thus reduce the default risk on STWD’s loans. Likewise, the back-to-the-office trend that is emerging should support office real estate markets, again reducing risks for STWD’s loan portfolio in this space.

Starwood Property Trust also has some other businesses on top of that. It lends money to the energy midstream space, for example. This includes loans for assets such as pipelines that move oil and natural gas, terminals and storage facilities, and so on. That is, I believe, another low-risk business for STWD. The world is experiencing an energy shortage right now, especially following OPEC’s recent decision to cut production levels. That means that US production is even more important than it was in the past. The energy infrastructure across the US is highly essential for both the US and the world as a whole, as the US is a key LNG supplier for Europe, for example. At the same time, counterparties for infrastructure players, i.e. oil and gas companies that want their products moved to end markets, are highly profitable. This results in a low risk of non-payment, which means that these pipelines and other assets should be highly profitable. As a result, the loans that STWD has made in this space are very unlikely to fail, I believe.

STWD Should Benefit From Rising Interest Rates

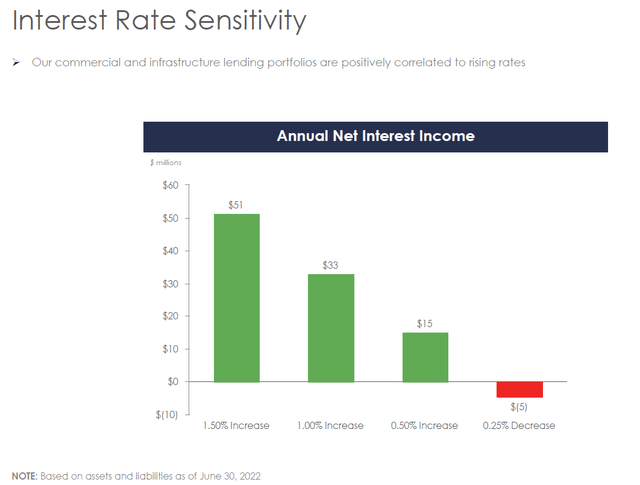

Starwood Property Trust is a company that lends and borrows money at the same time — as banks do. When interest rates rise, net interest margins generally expand. That’s why banks and other lenders are generally becoming more profitable in a rising rates environment. The same holds true for Starwood Property Trust, which explains the impact in the following slide from its most recent earnings presentation:

The company notes that a 1% increase in interest rates would provide a $33 million tailwind to net profits. At the time of the presentation, the Fed rate stood at 2%. Today, it’s at 3.25%, and many market watchers believe that it will rise to 4% or more over the next couple of quarters. That would pencil out to a 200+ base point increase, suggesting that net interest income should climb by around $70 million. This should be additional net profit, all else equal, as STWD does not pay any income taxes. In other words, the expected interest rate increase through the next couple of quarters could lift Starwood Property Trust’s net income from $730 million (forecast for this year) to around $800 million, all else equal. That’s good enough for a high-single-digit increase. Of course, that’s not an absolute gamechanger, but still a compelling tailwind. And since the market appears to be pricing STWD for a profit decline, any bottom line growth is good news.

Starwood Property Trust Is Attractively Priced Amid This Sell-Off

Starwood Property Trust is forecasted to earn $2.32 this year, according to Seeking Alpha’s data. With the trust trading at $19 today, that makes for an 8.2x earnings multiple. That’s below average, as STWD was mostly valued at more than 10x net profits in the past.

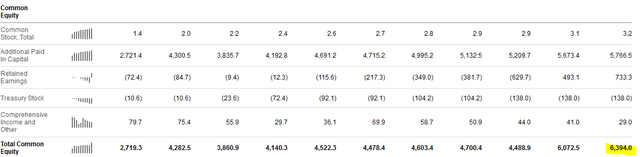

Similarly, Starwood Property Trust looks inexpensive based on its book value multiple. The following table shows STWD’s book value/equity value over time — there’s a clear upward trend that has allowed STWD to hit a new record book value level at the end of the second quarter:

Today, with Starwood Property Trust being valued at just $5.9 billion, investors can acquire STWD’s shares below book value. That has mostly not been possible in the past, as STWD’s median book value multiple over the last five years is 1.28. Both the current earnings multiple as well as the current book value multiple do thus suggest that STWD is undervalued by 20%-30% versus the historic average, meaning that right now could be a good time to invest in this high-quality mREIT.

At the same time, Starwood Property Trust is currently offering a dividend yield of 10.1%, with the dividend being covered at a rate of 1.21 (the payout ratio stands at 83%). That makes for compelling income potential. STWD has maintained its dividend at the current level for more than a decade. It didn’t even cut the dividend during the midst of the COVID-induced panic in early 2020, when many other mREITs reduced or eliminated their payouts.

Risks To Consider

No investment is without risk, which also holds true for STWD. I believe that risks are low here, but investors may still want to keep an eye on a couple of things. A steep real estate market downturn could endanger some of Starwood Property’s loans, although it would require a pretty harsh bear market for this to have a meaningful impact.

New COVID lockdowns seem unlikely, but were they to occur, that would be a potential headwind for STWD’s loans in the hotel and office space, due to travel restrictions and work-from-home measures potentially leading to defaults.

Takeaway

Starwood Property Trust is a well-managed, high-quality mREIT that has a solid track record, below-average leverage, and a low loan-to-value across its portfolio, which leads to low risks.

Rising interest rates should be beneficial for its profits going forward, and yet the market is pricing STWD for a steep earnings decline. To me, it looks like the market is worrying too much about the (overblown) risks, which creates a nice buying opportunity in this mREIT that is now trading 20%+ below its historic valuation following the 15% price drop over the last month. The hefty 10.1% dividend yield that investors get at current prices is very attractive and looks sustainable for the foreseeable future.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!”

Be the first to comment