Dreef/iStock via Getty Images

Investment Thesis

Despite Starbucks’ (NASDAQ:SBUX) optimistic guidance from its Investor Day presentation in early September, it remains to be seen if the company could survive the coming winter. The Feds have proved to be very concerned about the relatively elevated August CPI levels of 8.3%, leading to a 75 basis point hike on 21 September 2022. The future seems murky as well, with the persistent hawkish tone in the Feds commentaries potentially leading to another 75 basis points hike in November 2022.

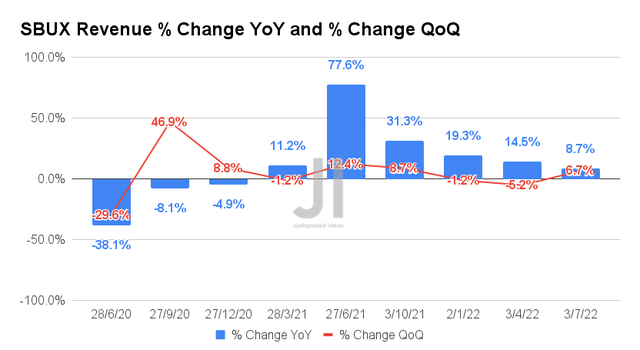

Though SBUX may have reported decent FQ3’22 earnings with robust consumer spending trends, we may see a quick turnabout soon, since food and gas prices remain inflated for now compared to pre-pandemic levels. Its revenue growth is already showing signs of deceleration QoQ and YoY, pointing to the expected normalization from the hyper-growth experienced during the reopening cadence in 2021.

Furthermore, SBUX may finally experience a short-term pullback in consumer discretionary spending over the next three quarters, significantly worsened by the elevated electricity bills over the coming winter. It would be interesting ( to say the least ) how this giant plans to survive the stormy weather, with the new CEO at its helm and the supposed “final exit” of its long-term CEO. We shall see.

SBUX’s Financial Health Remains Relatively Stable Thus Far

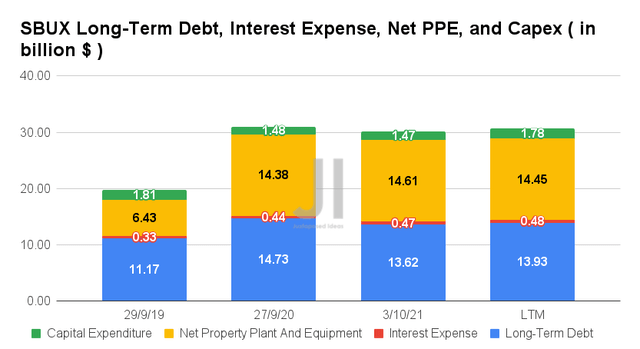

In its recent Investor Day presentation, SBUX guided massive expansion plans ahead, with capital expenditures of up to $3B for the next three years, including $450M for existing store upgrades. In addition, the company plans to build up to 2K new locations within the US, with a total of 9K stores in China and 2K in Japan by 2025. Therefore, we expect to see a moderate increase in its debt leveraging ahead from the $13.93B reported in the last quarter. Nonetheless, investors have nothing to worry about, since only $1.75B will be maturing by the end of 2023. Thereby, moderately ensuring SBUX’s liquidity ahead.

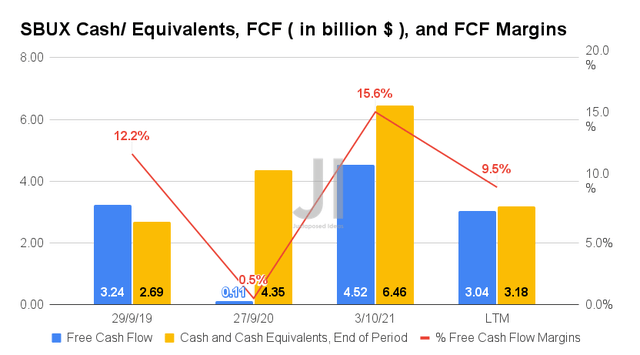

Furthermore, SBUX seemed well poised for its aggressive expansion, given the robust Free Cash Flow (FCF) generation of $3.04B and an FCF margin of 9.5% in the LTM. Though these numbers are still shy of their pre-pandemic levels by -6.17% and -2.7 percentage points, respectively, we must also highlight the company’s relatively stronger cash and equivalents of $3.18B on its balance sheet in the latest quarter.

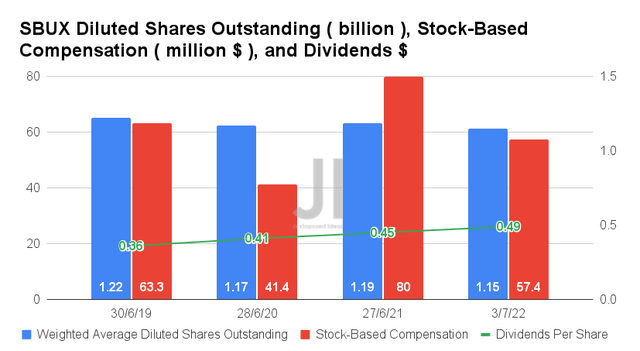

For now, SBUX investors seem upbeat as well, due to the company’s planned $20B of capital return over the next three years, in the form of dividend hikes and share buybacks. The management has guided an average of 2% dividend yield at the same time, representing notable improvements from the previous 4Y average of 1.88%. Combined with the consistent dividend hikes of 36.11% and $6.03B in share buybacks contributing to the moderation in its share count by -5.73% since FY2019, it is no wonder that the stock has performed decently, with a 5Y Total Price Return of 78% and 10Y Return of 313.1%.

Mr. Market’s Faith Has Been Restored – For Now

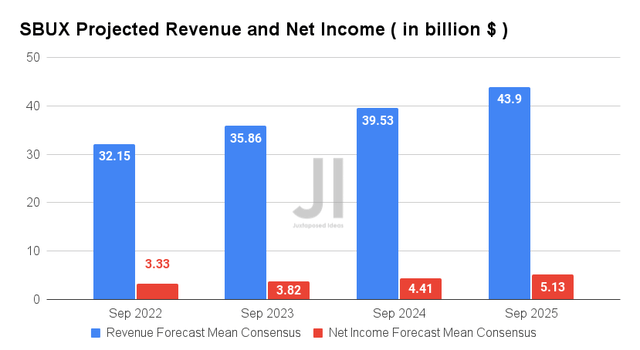

Over the next four years, SBUX is expected to report revenue and net income growth at an exemplary CAGR of 12.62% and 5.13%, in comparison to the 2Y pandemic CAGR of 5.73% and 8.03%, respectively. It is also evident that Mr. Market is relatively confident about the company’s forward profitability, given the growth in its adj. net income margins from 9.4% in FY2019, to 10.1% in FY2021, and finally to 11.68% by FY2025.

In the meantime, SBUX is expected to report revenues of $32.15B and net incomes of $3.33B for FY2022, representing an increase of 10.63% though a decline of -20.52% YoY, respectively. This indicates FQ4’22 revenues of $8.32B and net incomes of $926.7M, representing YoY growth of 2.2% though a decline of -47.47%, respectively. Otherwise, an excellent increase of 2.95% YoY in its net income after adjusting for the sale of its assets then. Impressive indeed, given the tougher YoY comparison due to the hyper revenue growth of 31.3% and net income of 229.21% experienced in FQ4’21.

It is also remarkable that SBUX has optimistically guided a remarkable annual growth in its adjusted EPS by up to 20% through FY2025, despite the short-term worsening macroeconomics due to the rising inflation and the Fed’s continuous hike in interest rates through CY2023. Furthermore, the company sees an impressive annual global comparable sales growth of up to 9% at the same time, contributing to its global revenue growth of up to 12% over the next three years.

Therefore, it is no wonder that the SBUX stock had rallied by 5.53% post investor day on 13 September 2022, though most of those gains are also digested by now due to the Fed’s hawkish commentary on 21 September 2022. Naturally, the S&P 500 Index has also been decimated with a -20.99% plunge YTD.

So, Is SBUX Stock A Buy, Sell, or Hold?

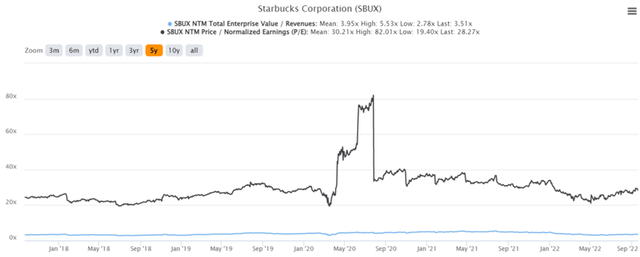

SBUX 5Y EV/Revenue and P/E Valuations

SBUX is currently trading at an EV/NTM Revenue of 3.51x and NTM P/E of 28.27x, lower than its 5Y mean of 3.95x and 30.21x, respectively. The stock is also trading at $88.60, down -24.78% from its 52 weeks high of $117.80, though at a premium of 29.55% from its 52 weeks low of $68.39.

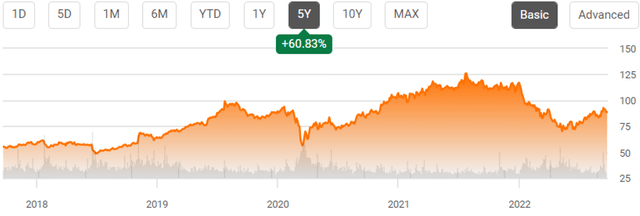

SBUX 5Y Stock Price

Consensus estimates remain bullish about SBUX’s prospects, given their price target of $100.31 and a 13.22% upside from current prices. However, since the stock is trading above its 50 and 100-day moving average of $85.31 and $80.39, respectively, we would like to recommend some patience instead due to the minimal margin of safety.

Winter may be coming for SBUX. We shall also await its FQ4’22 performance and forward guidance in November. That would provide the key indicator of consumer demand for their ever-popular lattes and Frappuccinos.

Be the first to comment