martinrlee

Thesis

There should be no argument that Starbucks (NASDAQ:SBUX) is one of the best brands and companies in the world. Recently, however, the company has struggled with challenges including Covid-related lockdown in China and wage inflation. Given that sentiment against equities was weak in the first half 2022, Starbucks stock intermittently sold off more than 35%. Now, despite the recent rally, the stock is still down some 25% from all-time highs.

I think it is only a matter of time until Starbucks stocks reclaims its old ATH and ventures for new records. Accordingly, I buy the rally.

A few words about Starbucks

Buying Starbucks stock is deeply connected to the company’s deep value profile. Starbucks is the world’s largest coffee retailer with more than 33 thousand stores in more than 80 countries. But what makes Starbucks really so interesting for investors is that the company has managed to build an incredible brand that has enough consumer power to charge between $5 and $10 per drink, arguably as much as you would pay for a meal in a fast-food chain. According to the Interbrand ranking of 2021, Starbucks is considered as the 51 most valuable brand globally, up from 56 in 2020.

Growth & Strong Financials

Arguably, Starbucks is a growth company. Or at least the opportunity should be defined as GARP. From 2012 to 2021, Starbucks revenues jumped from $13.3 billion to $27.3 billion, which is a CAGR of more than 8% and triple the nominal GDP growth. Respectively, gross profit grew at an even higher rate of about 10%, increasing from $3.5 billion to $8.4 billion.

In 2021, Starbucks generated earnings from continuous operations of $4.2 billion and EPS of $3.57. Investors should consider that even in 2020, despite the global COvid-19 lockdowns, Starbucks remained profitable and generated $925 million of net income.

As of late July 2022, Starbucks has about $3.3 billion of net cash on the balance sheet and net debt of about $20 billion. In 2021, Starbucks generated cash from operations of $5.99 billion.

Investors should note that goodwill and intangibles are only about $3 billion, clearly not reflecting the company’s true brand equity value.

Short-term Struggles

Although Starbucks revenues grew by about 9% year over year in the June quarter 2022, up to $8.2 billion for the period, the company’s operating income dropped from $1.4 billion to $1.19 billion. Respectively, Starbucks’ earnings per share fell from 97 cents to 79 cents.

Starbucks’ bottom line was pressured by the global labor shortage and accelerating wage inflation. The company said to have increased hourly wages to $17 and has also considerably increased the training hours for new baristas (which is a cost obviously).

Moreover, the June quarter included the period of aggressive Covid-19 lockdowns in China, which caused a 44% drop of the country’s comparable sales. Investors should note that China is the company’s second largest market with more than 5.700 stores.

In my opinion, these struggles are transitory. Firstly, investors should consider that the company still has enormous brand equity and pricing power, which will offset higher cost and wage inflation. And secondly, the Covid-19 situation in China has eased considerably since the period from April to end of June.

Residual Earnings Valuation

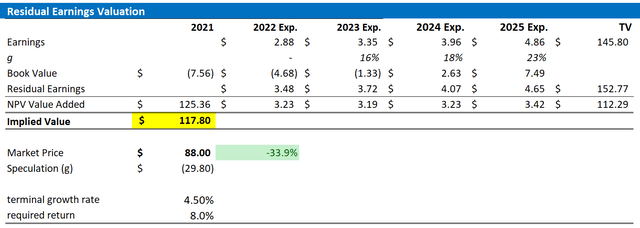

Let us now look at the valuation. What could be a fair per-share value for Starbucks’ stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of August 12, 2022. My calculation indicates a fair required return of 8%.

- To derive SBUX’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply a 0 percentage points to reflect the balance of a secular decline for oil and gas business and the transition towards green energy.

Based on the above assumptions, my calculation returns a base-case target price for Starbucks of $117.80/share, implying material upside of almost 35%.

Analyst EPS Estimates; Author’s Calculations

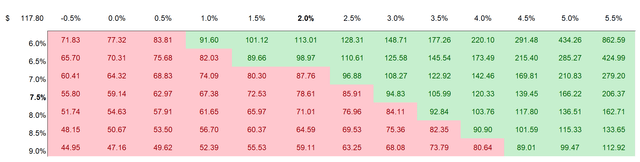

I understand that investors might have different assumptions with regards to Starbucks’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst EPS Estimates; Author’s Calculations

Risks To My Thesis

I think Starbucks is significantly de-risked at current valuation levels. However, investors should monitor the following, arguably temporary, headwinds: 1) high wage inflation which has and could continue to pressure Starbucks profit margins. 2) Slowing consumer confidence due to inflation and other macro-economic challenges could pressure Starbucks customers to safe on arguably non-essential and ‘overpriced’ coffee. 3) China’s challenges with the Covid-19 epidemic, and consequently the country’s reopening, could take longer than expected. This in turn would impact Starbucks business operations in the country. 4) Much of Starbucks share price volatility is currently driven by investor sentiment towards risk and growth assets. Thus, investors should expect price volatility even though SBUX’s business outlook remains unchanged.

Conclusion

Although I acknowledge that short term challenges including wage inflation and a lagging business in China, I argue Starbucks remains a secular growth business. From SBUX’s valuation lows YTD, the stock has rallied by some 20%. And I am buying the rebound. I value SBUX based on a residual earnings framework, anchored on analyst EPS consensus, and see almost 35% upside. My target price is $117.80/share.

Be the first to comment