monticelllo

Investment thesis

One of my personal investing goals is to build a dividend portfolio able to pay the monthly mortgage payment. One of the cornerstones of this portfolio is Starbucks (NASDAQ:SBUX). I personally love the company and its products. Even though sometimes we read that it is a bit pricey and that it could be hurt by a recession that would make consumers more thoughtful about their spending; even though the company has still to recover from the pandemic in order to obtain the same guest traffic especially in many downtown areas full of offices; even though China is at the moment a big pain in the neck, I do think that I will be able to rely on the stock for some years. However, I felt it was time to revise my investment thesis once again in order get a good understanding of what I am owning right now. The result I want to share is the following: I think over the long-term Starbucks will be a very interesting play; however, the company is facing some headwind that may make the stock more volatile.

Key drivers of my investment

When I picked Starbucks for my dividend portfolio I looked at the following aspects.

- Gross profit margins. They have to be at the top end of the industry. Starbucks is usually around 27% which I consider good for restaurants.

- Net profit margins. Starbucks is usually around 13-14%.

- Return on total capital in order to quantify the return the company makes by using its capital structure. I like it a little bit more than ROCE because it considers the company debt and how well the company is using it. SBUX carries indeed quite a bit of debt, however its ROTC is 18.5%, higher even that McDonald’s 15%.

- EPS, free cash flow yield and dividend yield. They are clearly correlated as a healthy dividend needs to be supported by free cash flow and by EPS. SBUX’s free cash flow yield is just below 3%. I usually prefer stocks with a yield above 3% so, at the moment, this metric makes the stock look a bit expensive. The dividend yield is 2.20%. Clearly, I look for a dividend yield that is less than the free cash flow yield. I then look at the payout ratio and, although it is now at around 60%, Starbucks usually keeps it around 50% which I think is a healthy ratio.

- Strong moat and brand value. I believe this is the key that unlocks pricing power which is important to have especially during inflationary times.

- Future growth.

Starbucks is facing some headwinds

The whole restaurants industry is currently under pressure as inflation pumps up raw material prices and the companies have to face the issue of whether to pass the whole weight of inflation onto customers or not. On one side they have to preserve and defend their profitability, while, on the other, they have to take care of their value proposition and how it is perceived by customers who could turn away before high price increases.

Now, Starbucks just recently released its quarterly earnings report that gave us a mixed picture. Here are the main facts I want to recap:

- Quarterly revenue reached a record high $8.2 billion with a 9% YoY growth. It is now clear that the company will end its fiscal year with a total revenue that will be above $30 billion for the first time in its history. This means that from 2014 to 2022 the company doubled its revenue, surpassing even McDonald’s, whose revenue has been almost flat for the past decade, as I have outlined in a recent article.

- Comparable store sales increased in North America by 9%, 8% coming from an increase in average ticket and the remaining 1% coming from increasing comparable transactions. This shows that the company has been able to offset inflationary pressure by raising prices without hurting guest traffic.

- Internationally, the company took a big hit as comparable store sales were down 18%. This was mainly linked to China, the second largest country for the company (at the end of 2022 Starbucks expects to have 6,000 stores in the country). China’s lockdowns are known, as the zero-COVID strategy is still followed by the government, and this leads to poor results for Starbucks, whose comparable store sales decreased by 44% in the country. Without China, the company reported that every international market grew by double digits.

- The main driver of Starbucks growth is the opening of new stores. Currently, the company has almost reached 35,000 stores, 318 of which were opened in the last quarter. The company operates 51% of these, while the other 49% are licensed. While the U.S. market seems almost saturated with its 15,560 stores and a 2% growth YoY, internationally the company still has room to grow.

- While revenues increased, the operating margin in North America contracted from 24.3% to 22% YoY due to higher commodity costs and wage increases. Internationally, the operating margin saw an even bigger drop from 19.4% in 2021 to the current 8.5%.

- A real growth came from the Channel Development segment, whose revenues totaled $479.7 million up 16% YoY. The operating margin, though contracting, is still very high and shows a very interesting opportunity for the company. In fact, while last year it was 52.2%, this year it went down to 40%. As the company scales this segment and makes its products available on more shelves, we could see profitability ramp up for the whole company.

- As expected, the EPS were down 18.6% YoY. For the year, the revenue is up 14%, but the operating income is up only 1% and EPS barely positive by 0.5%.

- Free cash flow per share decreased YoY by 39% from $1.20 per share to $0.73 per share

How can we judge these results? If we don’t consider the context, they are not very pleasant. We see margins shrink, EPS go down, free cash flow decreasing. These are usually signs that endanger a company and its dividend. We also know that the company, in order to meet is workers’ requests, has suspended its buybacks which I think was one of the main facts that took support off of the stock making it weaker than others in the bear market of this year.

With these results I would start considering selling the stock and moving out of it. However, if we put things in context, these results are not as bad as they appear.

In fact, it is clear that China has a big impact on the company. I don’t expect the country, even though it is run very differently from the Western ones, to keep its zero-COVID policy up for a long time as it is economically unsustainable. Actually, as China recovers, we should see Starbucks post outstanding results, as we have seen many companies do after the pandemic.

Secondly, the company is being run once again by Howard Schultz, whose understanding of the business is unique and who addressed the issues during the earnings call.

Key points from the earnings call

First of all, Howard Schultz pointed out that the

international segment, excluding China, grew revenue 33% year-over-year or 50% excluding FX, while meaningfully expanding operating margin, reflecting the strong operating leverage inherent in our complementary portfolio of company-operated and licensed stores.

This was meant to reassure investors that internationally, the company is facing only temporary headwinds which have nothing to do with problems within the company. On the international side, Schultz was almost proud to talk about the decision to finally enter the Italian market. As we know, Starbucks was born after Schultz visited Italian espresso bars. However, the company didn’t feel it was the right time to enter this particular market. As Schultz stated:

Italy is a market we only recently entered and a market that is close to my heart and that no one ever expected us to succeed in. Starbucks is flourishing in Italy. The quality of the coffee, the food and the partner and customer experiences are second to none. Traffic in our Milano Roastery, Starbucks’ shrine to coffee, is strong throughout the day, driven largely by tourist activity. But most importantly, traffic in our Italy retail stores is largely local customer driven. And when I was there, what I observed is Italians drinking straight espresso at Starbucks. We are being warmly welcomed in Italy, the country in which our Starbucks journey literally began. Given the success we are enjoying in Milan, we are now planning to open in Rome and in Florence.

Of course, this market is very small compared to the company’s size and it will not have a big impact yet on the results. However, it is meaningful that Starbucks finally found itself ready to be present in a country where the espresso is a must. It shows that Starbucks feels it has the quality to be accepted by this market.

In the EMEA Region, Starbucks is expanding its roasting operations in Amsterdam in order to meet growing demand across the region. Moreover, the partnership with Nestle is taking off and, as Schultz said:

Global Coffee is among Nestle’s largest strategic growth categories and our partnership with Nestle now extends across 81 markets focusing on at-home coffee and food service channels.

Schultz also addressed the issue that the company needs to be reinvented in order to keep its fast growth. More will be announced in September, but the CEO said Starbucks will take a five-step plan to move toward an even brighter future:

- Starbucks will focus on operating more as one global enterprise

- The relationship with its partners will be strengthened

- Stores will be reimagined to deliver superior experiences

- Connection with customers will be redesigned

- The role of coffee will be threaded throughout each priority and will have an even major role

At the moment, we don’t know exactly what these statements mean and what impact they may have. I would advise any investor thinking of exiting the position to wait until the new path Starbucks means to undertake is unveiled. In fact, Schultz has proved more than once that he is able to imagine over and over the company making it a value creation machine for all its stakeholders.

What to expect for Q4

During the Q3 earnings call, the management warned investors that they should expect lower margin and EPS YoY. In addition to inflation, the company’s results will see the impact of some investments such as increasing wage benefits that should help the company’s retention of its workers and partners. As Rachel Ruggeri, Starbucks’ CFO said:

The wage investments that we’ve taken in of our broader investments overall, as you know, it’s an incremental $1 billion this year, largely related to wage. But in addition to that, more training hours, more labor hours to be able to support some of our production. What that does when you think about it is from a revenue standpoint on a consolidated basis, in Q3, that was about 2% of our overall consolidated revenue. It will be about 4% next quarter.

As a long-term investor, I do understand why Starbucks is willing to invest big now for its workers and partners. It is, in fact, a huge cost to rebuild a well-trained workforce.

Valuation

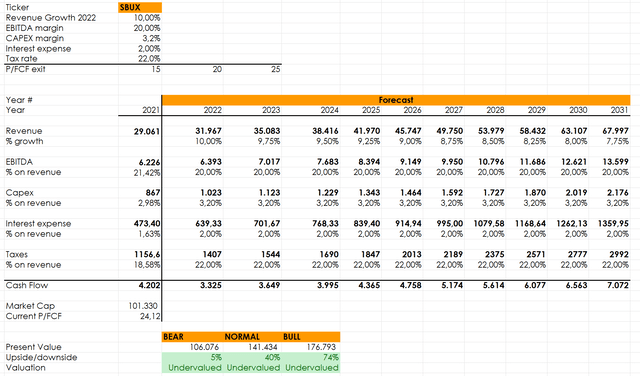

Here is my discounted cash flow model I am using to have a fair understanding of Starbucks’ valuation.

I plugged in a revenue growth that decreases from 10% to 7.75% over the past decade. I kept the EBITDA margin around 20%, as per the Q3 earnings report. Here, I do expect the company to increase it, but I kept it at 20% to be more conservative.

I then use three possible price/free cash flow exit multiples.

Author, with data from Seeking Alpha

In all my three scenarios, I still see Starbucks as undervalued. This is why I recently added to my position as I expect the company to overcome some hurdles and deliver good results for the next decade.

Be the first to comment