Nadya So/iStock Editorial via Getty Images

Starbucks Corporation (NASDAQ:SBUX) recently appointed its founder Howard Schultz as its interim CEO. Howard Schultz is one of the most accomplished American business leaders and under his leadership, SBUX grew from 11 stores in the early 1980s to more than 28,000 stores in 2018. The coffee chain delivered a ~21000% gain in the value of its stock price between its initial public offering in 1992 and Schultz’s departure as executive chairman in 2018.

One of the first decisions Howard Schultz announced after assuming the new position was the suspension of SBUX’s buyback program to invest more in its people and stores. While the stock reacted negatively to this news and corrected ~11% last week, I believe it is a bit too soon to write off Howard Schultz’s moves given his excellent pedigree in value creation. Frankly, the recent decline is not his fault alone. The stock was already on a downward trajectory before he took over as interim CEO. The company reported its Q1 2022 results earlier this year. While the company’s domestic sales performance has been good, its Chinese sales, as well as overall margin performance, have disappointed.

In Q1 2022, the company reported revenue growth of ~19% with sales growth of 23% in North America and 12% in the International segment. However, operating margins declined 40 bps to 15.1% with North American margins declining to 18.9% (down 170 bps) and international margins at 16% (down 80 bps). The company’s channel development segment posted revenue of $417.1 million (up 12% YoY) and an operating margin of 43.9% (down 480 bps). The company’s EPS of $0.72 missed the consensus expectation of $0.80. While the company maintained its FY22 revenue guidance, it lowered margin and earnings guidance to reflect the cost pressures that were amplified by the Omicron variant. Analysts and investors were already anticipating some of these headwinds and the stock had started declining even before the company reported its Q1 results.

This decline continued after earnings with further concerns around unionization as well as the sudden departure of the company’s previous CEO Kevin Peterson adding to investors’ worries. While I understand investors’ concerns, the stock has corrected quite a bit and is now valued attractively with a ~2.40% dividend yield. Further, most of these concerns are short term in nature. Suspending buyback to invest more to upgrade stores might negatively impact the near-term profitability but in the long term, it may help increase footfalls and enable the company to charge higher prices. The company’s long-term growth story remains compelling and I believe this dip is a good opportunity for the long-term investors to take a position in the stock at an attractive valuation.

SBUX Stock Key Metrics

For any restaurant company, Same Restaurant Sales or comp sales, new store growth, and margins are important metrics. Starbucks Corporation is also trying to leverage its brands and develop new channels to sell its products outside of the company operated and licensed stores. These sales have operating margins in the mid to high 40s range and the revenue and margin growth from this channel development initiative is also a key metric for Starbucks Corporation.

Same Restaurant Sales Performance And Outlook

The company reported a total growth in comparable restaurant sales of ~13% in Q1 2021 with North American comparable-store sales increasing ~18% YoY and international comparable store sales decreasing ~3% YoY. The company’s North American comps benefited from easy transaction comparison (transactions in Q1 2021 were down 21%) as well as the introduction of new beverages like Pistachio Latte, Honey Almond milk cold brew and Honey Almond milk flat white which helped both transaction and ticket size. The company’s ticket size also benefited from customized premium beverages.

|

Starbucks Global Comp Sales |

||||||

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

||

|

FY 2020 |

Change in Comp Sales |

5% |

-10% |

-40% |

-9% |

-14% |

|

Change in Transaction |

2% |

-13% |

-51% |

-23% |

-22% |

|

|

Change in Ticket Size |

3% |

-4% |

23% |

17% |

10% |

|

|

FY 2021 |

Change in Comp Sales |

-5% |

15% |

73% |

17% |

20% |

|

Change in Transaction |

-19% |

-4% |

75% |

15% |

9% |

|

|

Change in Ticket Size |

17% |

19% |

-1% |

2% |

10% |

|

|

FY 2022 |

Change in Comp Sales |

13% |

– |

– |

– |

– |

|

Change in Transaction |

10% |

– |

– |

– |

– |

|

|

Change in Ticket Size |

3% |

– |

– |

– |

– |

|

|

Starbucks’ North American Comp Sales |

||||||

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

||

|

FY 2020 |

Change in Comp Sales |

6% |

-3% |

-41% |

-9% |

-12% |

|

Change in Transaction |

2% |

-7% |

-53% |

-25% |

-21% |

|

|

Change in Ticket Size |

3% |

5% |

27% |

21% |

11% |

|

|

FY 2021 |

Change in Comp Sales |

-6% |

9% |

84% |

22% |

22% |

|

Change in Transaction |

-21% |

-10% |

82% |

18% |

7% |

|

|

Change in Ticket Size |

20% |

22% |

1% |

3% |

13% |

|

|

FY 2022 |

Change in Comp Sales |

18% |

– |

– |

– |

– |

|

Change in Transaction |

12% |

– |

– |

– |

– |

|

|

Change in Ticket Size |

6% |

– |

– |

– |

– |

|

On the international side, China was the biggest detractor with comp sales down ~14%. Even if we remove the adverse impact of lapping VAT subsidies from the prior-year period, comp sales were still down ~10% in China.

|

Chinese Comp Sales |

|||||

|

Q1 |

Q2 |

Q3 |

Q4 |

Full Year |

|

|

FY 2020 |

3% |

50% |

-19% |

-3% |

-17% |

|

FY 2021 |

5% |

91% |

19% |

-7% |

17% |

|

FY 2022 |

-14% |

– |

– |

– |

– |

Looking forward, I am optimistic about the same-restaurant sales growth prospects in both North America and China. If we look at US transaction comparison, they declined ~21% in 1Q21 vs. 1Q20 (i.e. pre-Covid levels). While they increased ~12% in 1Q2022, they are still running below their pre-Covid levels. As the US economy continues to open up and consumers become more comfortable dining out, I believe the US comps should continue to rise. In addition, the company’s new offering should also help it attract customers and increase ticket size.

In China, while the company is facing several headwinds due to the recent surge in Omicron cases, I believe conditions will eventually return to normal, similar to what has happened in other geographies which have seen an Omicron outbreak. Further, the company has recently announced a partnership with Meituan, an e-commerce service provider in China, which will help online consumers connect with Starbucks stores. Also, Starbucks China has introduced Starbucks Now stores, on which the order can be placed via Starbucks Mobile App or Starbucks Delivers and orders can be collected at the delivery point. These company-specific initiatives as well as Omicron cases fading will help the company’s comp sales in China in the coming quarters. Since China is a big part of the company’s international sales, I believe the international sales will turn positive as China recovers from Omicron.

In addition to these factors, I believe Howard Schultz’s plan to invest in stores might also help improve the comp sales. While Howard Schultz hasn’t revealed many details about his plans yet, there are talks about him furthering the premium experience and introducing evening dinners and wines to boost sales. While there is still a lot of uncertainty, store remodels usually tend to increase same-restaurant sales and with Howard Schultz at the top, there is little reason to doubt the company’s execution.

New Store Growth Prospects

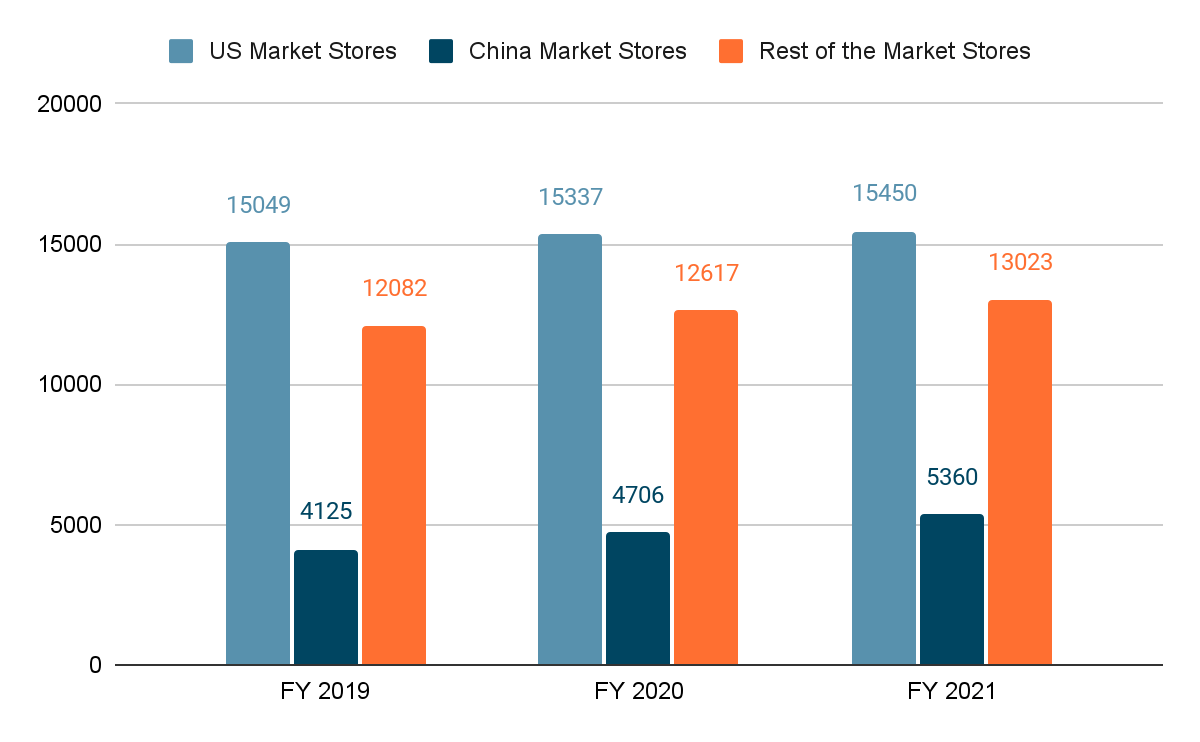

One of the great things about Starbucks is its “affordable luxury” positioning. This has helped it grow its global store count to over 34,000 and there is still a significant growth opportunity, especially in the Asia-Pacific including China.

Despite the pandemic, the company was able to add more than 1,200 stores in China over the last two years. In the last quarter, the company opened 484 new stores out of which 197 or ~40% were opened in China. Management is happy with the kind of profitability and returns on investment these stores are generating. On its last earnings call, talking about Chinese new store performance, Starbucks’ former President and CEO Kevin Johnson said, “We continue to build these net new stores, they’re performing at best-in-class store profitability and return on investment.”

Looking forward, given the encouraging store level profitability, I believe the company’s new store growth in China will continue at the current high rate. Other Asia-Pacific countries also offer good long-term growth opportunities for the company.

Starbucks Stores (Company Data, GS Analytics Research)

The company continues to increase its store count even in mature markets like the US which is encouraging. I believe several smaller restaurant players, who had limited financial ability to cope with Covid-related lockdowns, went out of the business over the last two years and there is a good scope for Starbucks to gain market share as the economy reopens. So, I am optimistic about the company’s store growth prospects both in the U.S and internationally.

Channel Development

In addition to opening new stores, the company has started focusing on initiatives like channel development to leverage its brand. Channel development refers to the sales of Starbucks branded tea and coffee products that are sold outside the company operated and licensed stores. This segment has contributed 6% to the company’s total revenue in the fiscal year 2021. The good thing about this segment is its operating margins in the mid to high 40% range. The growth in this segment’s sales over the coming years will impact the mix positively and will be a tailwind for SBUX’s margins.

Starbucks is taking various steps to improve sales in this segment. They recently entered the energy drink category with Starbucks BAYA in its portfolio. The company has entered into a JV with PepsiCo for this ready-to-drink business. As energy drink is a fast-growing market, it bodes well for channel development sales in the coming years.

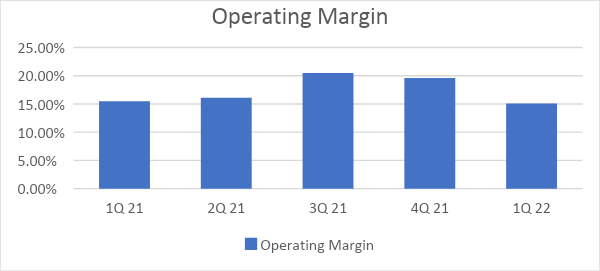

Margin Headwinds

As discussed in the beginning, while the company’s revenue performance was ok last quarter, raw material inflation and supply chain disruptions resulted in increased costs. Management expects these costs to stay elevated for the rest of the year. The company has also provided vaccination pay for its employees and partners. This will lead to an increase in employee benefit costs till the mid of 2022. In Q1 22, the operating margin declined by 30 basis points to 15.1% year on year due to an increase in store partner wages, other benefits and inflation. In the International segment, the higher distribution cost and strategic initiatives lead to a contraction of operating margin by 170 basis points to 18.3%.

Starbucks Operating Margin (Company Data, GS Analytics Research)

On its last earnings call, management conveyed its expectations of a Y/Y decrease in margin for Q2 2022. But they were expecting an improvement in the fiscal year 2023 and beyond with a target to increase margin by 18% to 19% by 2024 helped by an increase in sales.

I am a bit sceptical about FY2023 margin improvement now as Howard Schultz has publicly conveyed his intention to increase spending on employee compensation and upgrading stores. However, I believe FY2024 targets may still be met as some of the benefits from store level investment and upgrades will start showing in comp sales and margin benefit from operating leverage will likely more than offset cost-related headwinds.

What Is The Reason For Stock Buybacks?

Usually, when a company has excess cash than it requires for running and expanding its business, its management may consider returning some of the cash to shareholders through dividends or share buybacks. Excess cash may come from operations or management may choose to take on additional debt if the company’s leverage appears too low to them. The idea behind reducing share count is to increase EPS, as a result of which, stock price in relation to EPS might look cheap.

The amount of share buybacks usually increases in the mature phase when the company doesn’t need too much capital to pursue its growth plans. In many of these cases, a company consistently purchases shares to return cash to shareholders and it, like regular dividends, is a part of management’s strategy to make optimal use of cash. Alternatively, a company might also choose to opportunistically buy shares if management believes that the stock has become too undervalued.

Starbucks has been consistently buying back shares for the last several years and was yet able to post a good growth rate. So, I believe it was a part of management’s strategy to return cash to shareholders rather than just opportunistic repurchases due to low valuations.

Why Is Starbucks Suspending Stock Buybacks?

Starbucks and many other corporations are increasingly facing threats from unionization efforts. President Biden and his administration are considered relatively friendly towards unions. President Biden has time and again raised questions about workers’ plight and raising minimum wages to $15 per hour.

Unionization is usually considered bad for any company as it removes cost flexibility. SBUX’s previous management took various measures like raising the wages of its employees to a minimum of $12 an hour from October 2021 and providing a target to increase the average hourly wage of its retail employees to nearly $17 by the summer of this year to thwart unionization efforts. This, of course, was in addition to legal steps. However, the company failed to thwart unionization.

After one of the company’s stores in Buffalo voted in favour of unionization in December last year and became the first one to unionize, 16 others have voted for unionization till last week and more are expected to vote this week. Clearly, Starbucks needed to do more if it wanted to dissuade unionization and remain competitive. Howard Schultz’s effort appears to be twofold. First, he recognizes that he needs to incentivize employees not to join the unionization drives. Second, in order to offset the long-term cost impact of giving better incentives to employees, he needs to drive more sales from each store. So, he decided to invest more in stores as well.

In the short term, it looks bad as both these steps will put an additional cost burden on the company. But there is a very good long-term rationale behind them. Given the way inflation is trending and President Biden’s view around minimum wages, employee pay was anyways going to rise. So, doing it voluntarily before other peers only helps raise the company’s reputation as an employee-friendly workplace.

As far as investment in stores is concerned, it will be a long-term tailwind for the company’s sales. So, there is not much to worry about other than the short-term impact.

Since the cash for these initiatives has to come from somewhere and share buybacks make sense only if the business is headed in the right direction, management decided to suspend share buybacks in favour of investing more in the company’s employees and its stores.

What Is SBUX Stock Forecast?

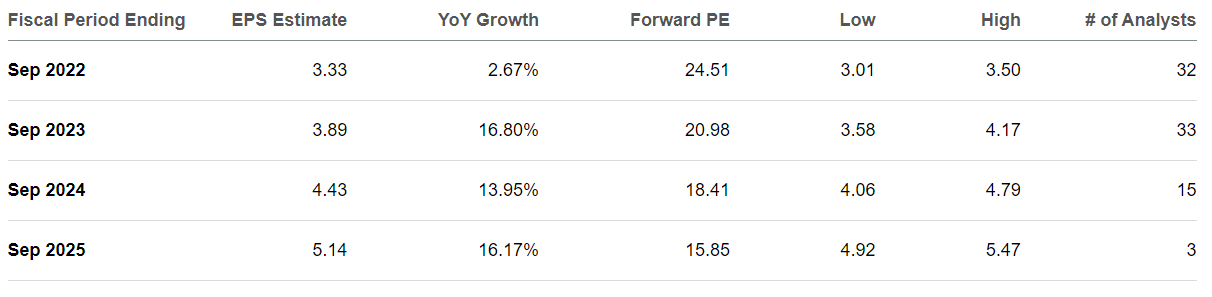

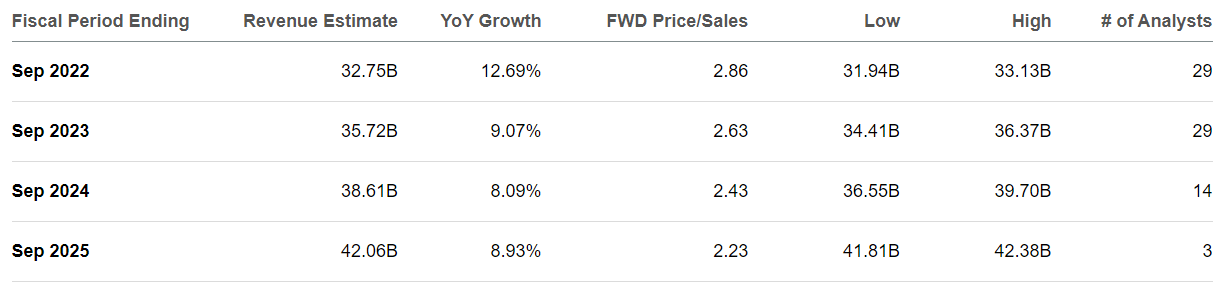

If we look at consensus EPS forecasts, sell-side analysts are modelling low single-digit EPS increases for the current year and low to mid-teens increase for the next three years. For revenues, they are modelling a low double-digit increase this year and a high single-digit for the next few years.

Starbucks Consensus EPS Estimates (Seeking Alpha)

Starbucks Consensus Revenue Estimates (Seeking Alpha)

The company’s low single-digit EPS growth this year seems to be factoring in the cost headwinds from inflation and supply chain woes as well as the Chinese lockdown due to Omicron. However, I believe most of the sell-side analysts haven’t yet updated their model for more investment in employees and stores. Since not many details have been divulged as of now, there is a good deal of uncertainty about the near-term impact of these investments. However, in the long term, sales growth from investing in stores should be able to offset these margin headwinds to a good extent. So, I believe the company should be able to achieve its long-term margin targets of 18% to 19%. Overall, I believe EPS estimates for FY22 and FY23 will likely get lowered while FY24 and FY25 EPS numbers may remain around the current levels. So, while there is a short-term headwind, I don’t think long-term investors need to worry much.

Is SBUX Stock A Buy, Sell, Or Hold?

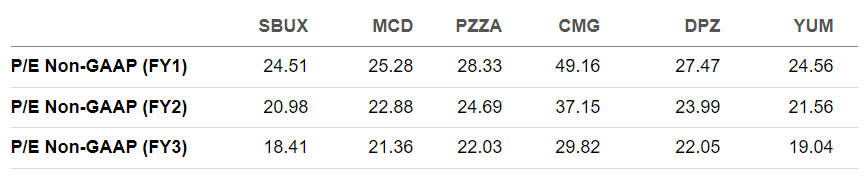

If we look at SBUX’s P/E multiple, it is not only lower than other fast-growing restaurant peers like Papa John’s (PZZA), Domino’s (DPZ) and Chipotle (CMG) but also lower than relatively mature concepts like McDonald’s (MCD) and Yum! Brands (YUM).

Starbucks Relative Valuation Vs. Peers (Seeking Alpha)

The stock also has a good dividend yield of ~2.4%. Some investors are worried that the stock may see some potential downgrades from sell-side analysts. However, I believe the stock has already corrected quite a bit from its 52-week highs and most of the concerns surrounding the company are short term in nature. While the market is too much focused on short-term cost pressures, the company’s investment in stores and move towards a more premium positioning might also enable it to raise prices which can help offset these cost pressures – a fact many bearish investors/analysts are ignoring. Hence, I find risk-reward favourable and have a buy rating on the stock.

Be the first to comment