Scott Olson

Thesis

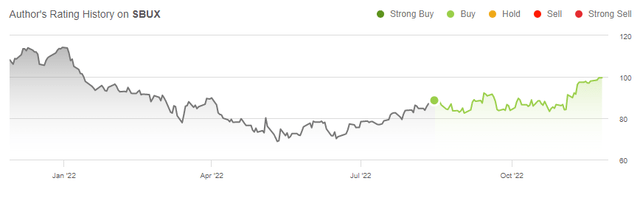

I have previously presented a bullish thesis on Starbucks (NASDAQ:SBUX), arguing that the company’s strong global footprint and brand value are underappreciated. Since my coverage, SBUX stock is up approximately 13%, as compared to a loss of almost 6% for the S&P 500 (SPY).

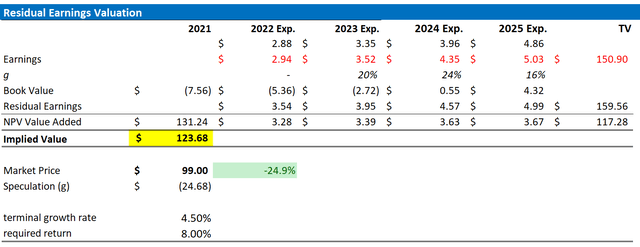

Following a strong September quarter, and a confident management outlook going into 2023, I argue there is still attractive upside in SBUX valuation. On the backdrop of consensus EPS upgrades, I update my residual earnings model for the company, and I now calculate a fair implied target price of $123.68/share (versus $117.80/share prior).

Starbucks’ Q4 Tops Expectations

Starbucks’ Q4 2022 results beat analyst expectations with regards to both revenue and earnings.

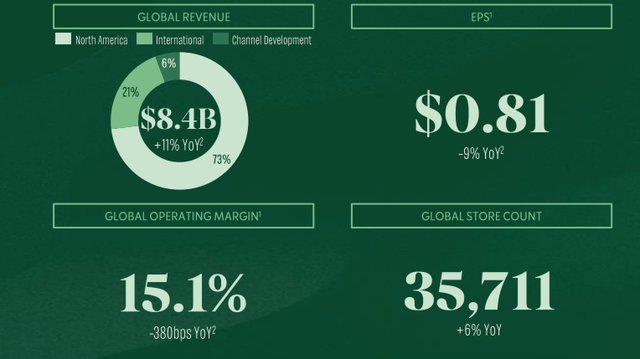

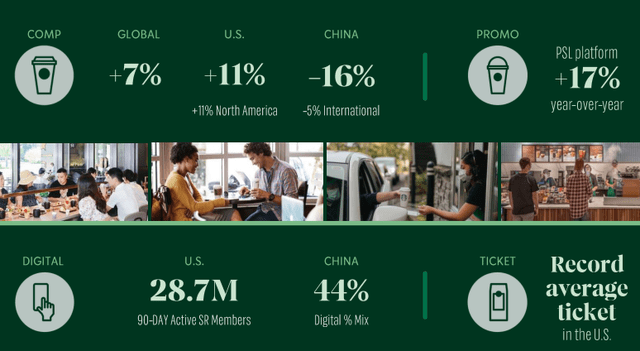

During the period from July to end of September, Starbucks managed to generate record revenues of $8.4 billion, which compares to $8.15 billion for the same period one year earlier (3% year over year growth, accounting for FX headwinds) and to approximately $8.3 billion estimated by analyst consensus ($100 million beat). GAAP earnings came in at $0.81/share. Although EPS contracted by about 50% versus the same period in 2021, the result tops analyst consensus by about $0.09/share.

Starbucks’ stronger than expected Q4 was achieved despite a very challenging performance in the company’s key growth market China, where in store sales contracted by 16% year over year as a function of the country’s zero-COVID policy.

Interestingly, although Q4 sales volume in the U.S. was about flat versus the same period in 2021, Starbucks managed to expand revenues by 11% year over year, on the backdrop of price increases – highlighting that despite economic headwinds, Starbucks remains a key priority in the U.S. consumer’s wallet share.

For the fiscal year 2022, which ended for Starbucks in October, revenues grew 13% year over year, to a total of $32.3 billion.

Expecting An Excellent 2023

Reflecting on strong results in 2022, Starbucks founder and CEO Howard Schultz provided bullish commentary for 2023: (emphasis added)

We saw accelerating demand for Starbucks coffee around the world in Q4 and throughout the year …

… our Q4 results demonstrate early evidence of the success of our U.S. Reinvention investments. Reinvention will touch, and elevate, every aspect of our Starbucks partner, customer and store experiences, and ideally position Starbucks to deliver accelerated, sustainable, long-term, profitable growth and value creation beginning in 2023

The positive sentiment was confirmed by the company’s CFO Rachel Ruggeri:

We are incredibly proud of our Q4 performance, and our 2023 guidance sets the stage for another year of record performance.

For fiscal 2023, Starbucks management expects year over year revenue growth to be ‘near the high end of [the] long-term target range of 7% to 9%’. Global year over year store growth is estimated to fall somewhere around 5%.

Moreover, on the backdrop of a ‘solid margin expansion’, Starbucks said that fiscal 2023 GAAP EPS expansion could reach the higher end of the company’s 15% to 20% guidance range.

China Will Be Key To 2023

International expansion will likely remain key for Starbucks’ growth story – and 2023 performance is poised to be especially influenced by the business in China.

Starbucks currently operates slightly more than 6,000 stores in China. Given the country’s aggressive zero-COVID policy it is no surprise that the market under-performed in 2022 – contracting 16% decline in comparable sales year over year.

But going into 2023, the situation appears skewed to the upside. During the analyst call following Q4 reporting, Howard Schultz commented: (emphasis added)

… [we] are encouraged by the early signs of recovery we saw in China in Q4, where innovation, increased customer physical and digital engagement with the Starbucks brand and the relaxing of COVID restrictions, drove solid positive sales momentum and sequential quarterly improvement.

The speed with which our business in China accelerated in Q4 and the strong positive correlation between Starbucks revenue growth and the relaxing of COVID mobility restriction reinforces our confidence in Starbucks’ long-term growth opportunity in China.

According to management commentary, Starbucks expects 13% year over year growth in China for fiscal 2023.

Target Price Estimation

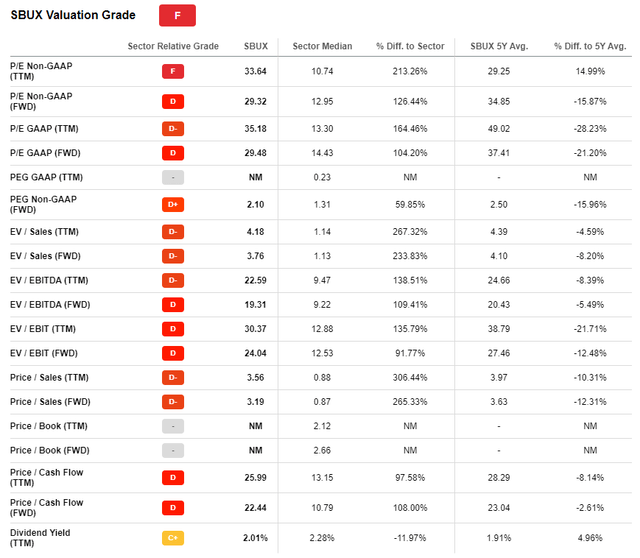

I acknowledge that Starbucks is not trading cheap (as compared to headline multiples). According to data compiled by Seeking Alpha, SBUX is priced at a one year forward P/E of x29 and a P/S of x3.2. These multiples imply a premium to the relevant sector median (Consumer Discretionary) of approximately 104% and 265% respectively.

But investors should consider that a multiple valuation is not always an efficient tool to estimate a company’s intrinsic value. In my opinion, the residual earnings model, which accounts for growth and cost of capital, is much better suited for this purpose. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

Residual Earnings Model – SBUX Update

Following a strong Q3 report, I update my residual earnings model for SBUX to account for consensus EPS upgrades.

In line with my previous base-case assessment, I continue to anchor on an 8% cost of equity and a 4% terminal growth rate (approximately between one – two percentage point higher than estimated nominal global GDP growth).

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price of $123.68 versus $117.80 prior.

Analyst Consensus EPS; Author’s Calculations

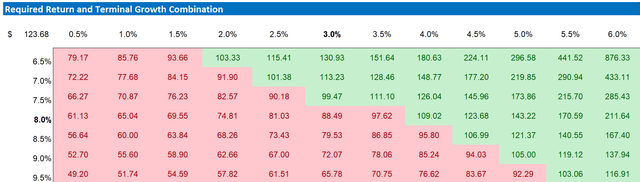

Here is the updated sensitivity table.

Analyst Consensus EPS; Author’s Calculations

Risks To My Thesis

As I see it, there has been no major risk-updated since I have last covered SBUX stock. Thus, I would like to highlight what I have written before.

… investors should monitor the following, arguably temporary, headwinds:

1) high wage inflation which has and could continue to pressure Starbucks profit margins.

2) Slowing consumer confidence due to inflation and other macro-economic challenges could pressure Starbucks customers to save on arguably non-essential and ‘overpriced’ coffee.

3) China’s challenges with the Covid-19 epidemic, and consequently the country’s reopening, could take longer than expected. This in turn would impact Starbucks’ business operations in the country.

4) Much of Starbucks’ share price volatility is currently driven by investor sentiment towards risk and growth assets. Thus, investors should expect price volatility even though SBUX’s business outlook remains unchanged.

Investor Takeaway

In my opinion, Starbucks remains a secular growth business. And following a stronger than expected Q4 reporting, and a bullish management outlook for the near-term future, am confident to reiterate a ‘Buy’ rating for SBUX stock.

Although SBUX’s headline valuation multiples based on 2022 numbers are not necessarily attractive, the valuation upside is definitely considerable when accounting for the company’s high value-adding growth outlook (for reference, Starbucks expects 15% to 20% EPS growth for fiscal 2023).

On the backdrop of EPS upgrades, I now calculate a fair implied share price of $123.68.

Be the first to comment