InfinitumProdux

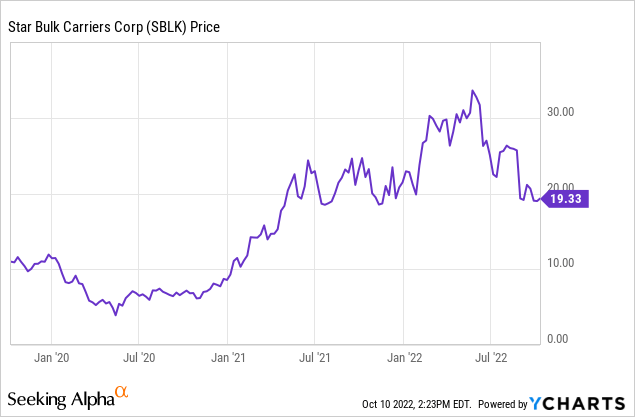

Star Bulk Carriers (NASDAQ:SBLK) specializes in the oceanic shipping of bulk commodities using its fleet of over 100 vessels. It currently has a high dividend rate, 33%. In the contrary column is the fact that the stock price has dropped about 43% since its peak of $33.99 earlier this year. Star Bulk’s price it set by more than one variable, and each variable both fluctuates and is hard to predict accurately, given the nature of the dry bulk shipping business. This article will sort through the complexity, pointing out some of the shoals of danger and channels of clear sailing that may be ahead. I believe the picture as a whole presents opportunities for long term investors who are willing to accept a degree of risk. Star Bulk is a value stock and a dividend stock, but it has its dangers you should be aware of before investing.

Star Bulk Overview

The dry bulk shipping industry is fragmented and therefore prices services more like a free-market economy than we see in most other sectors. The ships owned by Star Bulk tend to be in the larger classes, notably the Cape Size segment that is mainly used to move iron ore and coal (including coke) over long distances, like from Brazil to China. As shipping rates swing so do shipping company profits and stock prices. Back in May of 2020, when the pandemic was just getting underway, you could buy Star Bulk stock in the $5 to $6 range. The stock price over the past 10 years has been nothing if not volatile.

Most recently Star Bulk owned 41 Newcastlemax or Capesize ships, 50 Kamsarmax or Panamax ships, and 37 of the smaller Ultramax or Supramax ships. Almost all of them have already been fitted with emissions scrubbers. That provides a competitive advantage over ships needing higher-priced, low-sulfur fuel. Almost all will have the new requirements, ballast water environmental systems, by the end of this year. That means much capital spending is completed, though all vessels periodically are sent for dry dock inspections and repairs. Iron ore is the largest single commodity shipped by Star Bulk, and coal is second. Grains and minor bulks (aluminum and other ores, cement, etc.) make up over 40% of the volume shipped.

A good level of detail is provided by the SBLK Slideshow from the Q2, 2022 conference, and of course the Star Bulk conference transcript. If you want to follow the daily minutia of the bulk shipping business, you can look at Hellenic Shipping News.

Q3 Shipping Rates As Shown By The BDI

The key to following dry bulk shipping rates is the BDI (Baltic Dry Index). This year rates began unusually strong, above 2,250. We did see the usual January dip to near 1,250, but even that is better than most of the past 10 years. Rates peaked in May at 3,369, which is phenomenally high (but not as high as the 2021 peak of 5,526). Rates then came down to hit a bottom of 835 in late August before springing back to the current level, which is 1,944 on October 10, 2022. It is important to realize that the BDI reflects spot rates for the industry. Individual shippers can get rates that vary from the industry average based on reliability and specific factors like commodity shipped, size of vessel, and the ports used. All kinds of glitches, like tropical storms or other reasons for port closure or backups, can send rates higher or lower. Star Bulk reported at its Q2 conference on August 5 that it had already covered 61% of its fleet’s available days at an average rate of $29,000, which would mean it may not have been very effected by the lower rates later in the quarter.

Star Bulk Dividend History And Policy

Star Bulk’s dividend policy makes it possible to guess the current quarterly dividend announcement based on public information like the BDI and Star Bulk prior statements on bookings. Dividends based on a quarter are paid in the following quarter. The first of these dividends was for Q1 2021, was paid in May 2021, and was only $0.30 per share. The dividend then increased each quarter, hitting a peak of $2.00 per share paid out in February of this year. For Q1 and Q2 this year, the dividend was $1.65. It is likely to be lower for Q3 because, as discussed above, shipping rates have been lower. The dividend depends on cash generated each quarter, which in turn depends on those shipping rates and expenses. Some cash is used each quarter to make debt payments.

2H 2022 Outlook

Historically dry bulk shipping rates are lowest in Q1, then rise to a peak in either Q3 or Q4. This year we are not seeing that usual seasonality because of some decrease in demand due to Covid policies and the real estate construction crisis in China and effects on national economies from the Ukraine War. Worries that high interest rates set by the Federal Reserve will hurt the U.S. and global economies are also causing buyers of bulk commodities to be cautious. But while Q3 and probably Q4 2022 are demonstrating weaker shipping rates than in 2021, they are still higher than 2020 and most of the last decade. It is possible that economic stimulus in China will keep rates up in Q4, at least at roughly Q3 levels.

2023 Outlook

The question for 2023 is: global hard landing, or global soft landing? I am in the soft-landing school but acknowledge that depends on inflation ebbing from interest rate hikes that have already taken place. But in either case, we know that very few new bulk ships will be launched in 2023, so capacity should not be excessive. Most likely, 2023 will see a return to a seasonal pattern, with Q1 and Q2 rates profitable but not spectacular for Star Bulk or its competitors. As inflation dies down, as the pandemic stops concerning even Xi Jinping, and as older, inefficient vessels are scrapped, rates should be healthy in Q3 and Q4 2023. Significant downside and upside deviations from this pattern would mainly depend on macroeconomics.

Stock Price And Conclusion

One more factor that could influence the stock price in 2023 is current short interest at 10.37%. On the surface, that means some investors are negative on the stock and hope it will decline further. It also means they will have to cover their short position later, perhaps adding to a price rally. More generally, the stock price already anticipates lower dividend payments. If annual payments decrease to $4 per share, at the present price of about $20, that is still a 20% dividend. It is possible that as the BDI does its usual downturn in December or January the stock will become even cheaper. The risk in waiting for that before buying includes losing out on the Q3 and Q4 dividends, and that a reviving Chinese economy will send rates higher rather than lower. Also, the stock price tends to increase as the ex-dividend date approaches, which should be around November 24. The rise in the stock price then might be amplified by short covering, and the effective dividend lowered. I think the best way is to think not by quarter, or even by year, but by decade. This looks to be a strong decade for bulk shipping company stocks, based on a low rate of ship construction and a big backlog in desired infrastructure. I remain optimistic about Star Bulk and other dry bulk shippers, while not wanting potential investors to overlook the various sources of downside risk.

Be the first to comment