marchmeena29

Written by Nick Ackerman, co-produced by Stanford Chemist. A version of this article was originally published to members of the CEF/ETF Income Laboratory on September 26th, 2022.

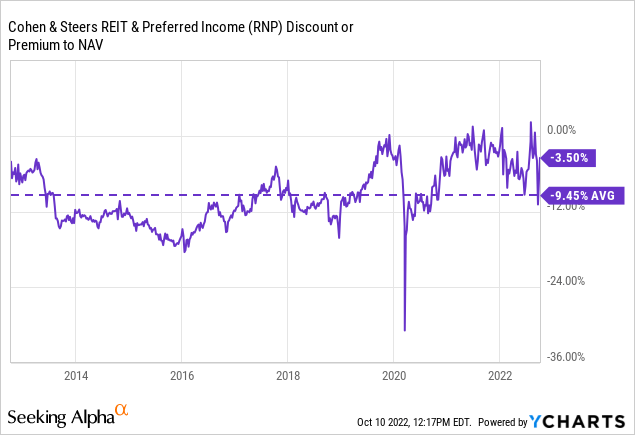

Cohen & Steers REIT & Preferred & Income Fund (NYSE:RNP) had recently touched up to an attractive discount. Though the discount has been quite volatile, as we often experience in times when the overall market is volatile for closed-end funds. REITs themselves are down, so a discount for RNP could be seen as even more attractive.

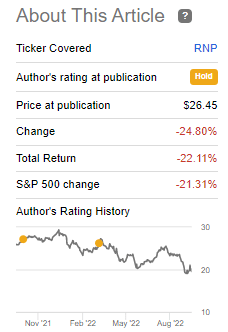

Since our previous update, RNP has performed similarly to the broader market on a total return basis. That would be including the distributions the fund has paid out. The S&P 500 isn’t an appropriate benchmark, but it can provide us with some context of how this fund is performing.

RNP Performance Since Previous Update (Seeking Alpha)

The leverage in this fund is also playing a role too, making it a more volatile play. Still, that’s where opportunity can open up in these volatile times for closed-end funds. When the discounts are widening is generally when solid returns can be made. This is especially true for higher-quality funds, which I believe RNP is.

The Basics

- 1-Year Z-score: 0.18

- Discount: -3.50%

- Distribution Yield: 8.34%

- Expense Ratio: 1.06%

- Leverage: 28.86%

- Managed Assets: $1.6 billion

- Structure: Perpetual

RNP’s objective is “high current income” and a secondary objective of “capital appreciation.” To achieve this, they invest just as their name would suggest; “investment in real estate and diversified preferred securities.” They will invest in both U.S. and global positions. Most of the portfolio has been held in the U.S. or North American investments.

The fund’s expense ratio comes to 1.06%. That is around the average for closed-end funds. The total expense ratio comes to 1.76% when including the leverage expenses. Interestingly, that is down from the 1.78% we saw reported at the end of fiscal 2021.

Leverage And The Fund’s Subsidiary

Leverage has been inching up for this fund. It is from the depreciation in the underlying portfolio, but they’ve also even increased borrowings by another $25 million to $450 million. That’s according to their latest semi-report from the previous annual report. At this time, it still isn’t at an alarming level despite a nearly 27% drop from the last time we covered the fund.

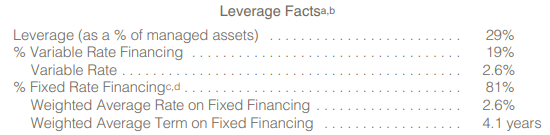

Some funds are more susceptible to the downside of higher interest rates due to their holdings or the type of leverage they carry. RNP is a fund that relies on a credit facility, but most of its borrowings are locked in at a fixed-rate due to interest rate swaps and fixed-rate borrowings.

RNP Leverage Facts (Cohen & Steers)

The fixed-rate portion declined from 85% of the borrowings previously to touch down at 81%. That still isn’t an overly meaningful impact at this time. It still represents that the majority of the leverage won’t see higher expenses for several years yet.

Additionally, the fund’s wholly-owned subsidiary issued Series A Cumulative Preferred Stock on January 27th, 2022. It was a private placement of 125 shares that resulted in gross proceeds of $125k. Certainly nothing material, but the 12% yield certainly means someone is getting a sweet deal. This is well above and beyond anything that we’ve seen in terms of financing costs for CEFs, even with rising rates. However, for the REIT subsidiary, perhaps this is the going rate for now.

The reason for this subsidiary is to seemingly invest in private real estate that RNP couldn’t necessarily invest in themselves.

Cohen & Steers RNP Trust (the REIT Subsidiary), is a wholly-owned subsidiary of the Fund organized under the laws of the state of Maryland as a statutory trust on July 9, 2021 that commenced operations on November 30, 2021. The REIT Subsidiary acts as an investment vehicle for the Fund in order to effect certain investments on behalf of the Fund, consistent with the Fund’s investment objectives and policies. The Fund expects that it will achieve a significant portion of its exposure to private real estate investments through investment in the REIT Subsidiary. The REIT Subsidiary may use wholly-owned, limited liability companies to contain the exposure of individual private real estate investments. Unlike the Fund, the REIT Subsidiary may invest without limitation in private real estate. Investments in the REIT Subsidiary are limited to 25% of the Fund’s total assets. The Consolidated Schedule of Investments includes positions of the Fund and the REIT Subsidiary. The financial statements have been consolidated and include the accounts of the Fund and the REIT Subsidiary. All significant inter-company balances and transactions have been eliminated in consolidation.

Performance – Challenging Year For Real Estate

As inflation was rising, real estate was viewed as somewhat of a safe space to put capital to work. The idea is that the increasing values should help support REIT prices. However, aggressively higher interest rates seemed to have counteracted any of that benefit and more. Now that real estate prices are coming back down, we have seen real estate is one of the poorer-performing sectors YTD. At the time of writing, the Real Estate Select Sector SPDR (XLRE) is down nearly 28% YTD.

This is doubly as bad for RNP that not only utilizes leverage in their portfolio but because their preferred and other fixed-income holdings (primarily CoCos) will also depreciate as rates rise. There are quite a few holdings in the portfolio that are fixed to floating-rate securities. However, the drop in prices comes before the floating rates kick in. It should eventually lead to greater income generation for the fund.

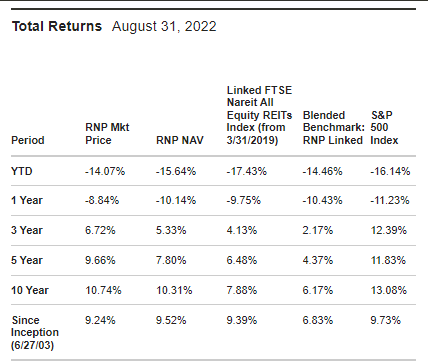

That has translated into poor performance for RNP all around. Really making no place safe for this portfolio. Still, the longer-term performance of the fund is holding up well. Here are the total annualized returns at the end of August 31st, 2022. Since then, the markets have only fallen further, but it can still give us a guide on how the fund has performed relative to its blended benchmark and the market more broadly.

RNP Total Returns (Cohen & Steers)

The fund is now trading above its historical discount range. That being said, it jumped to an almost 11% discount briefly. That is the type of opportunity that can open up in CEFs during volatile years.

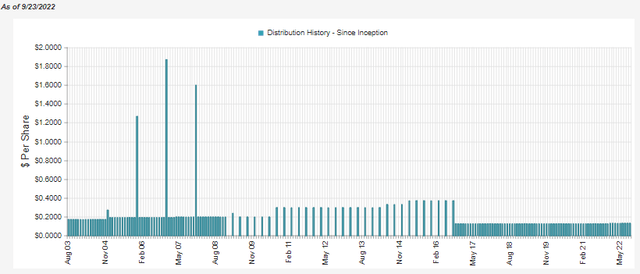

Distribution – Capital Gains Become Scarce

Since the original publication, RNP has declared a large special distribution for the end of this year. This was the result of significant gains in the previous year that they hadn’t paid out yet.

The fund only cut its distribution during 20089/09. Since then, it has maintained or raised the payout to shareholders. First, they paid a monthly distribution; then, the large cut came from switching to quarterly. Since that time, the fund has switched back to monthly.

After years, the fund finally raised its distribution once again. Unfortunately, it was heading into this year, going into a bear market.

RNP Distribution History (CEFConnect)

I’m not necessarily expecting a cut in the distribution anytime soon. Meaning the 8.41% distribution yield seems quite stable at this time. Especially considering that the distribution rate on NAV comes to 7.50%, that seems quite reasonable.

However, what would cause me more concern is a further collapse in the overall market. RNP requires a significant portion of its distribution to be covered via capital gains – that’s despite the strong income focus of both REITs and its fixed-income exposure.

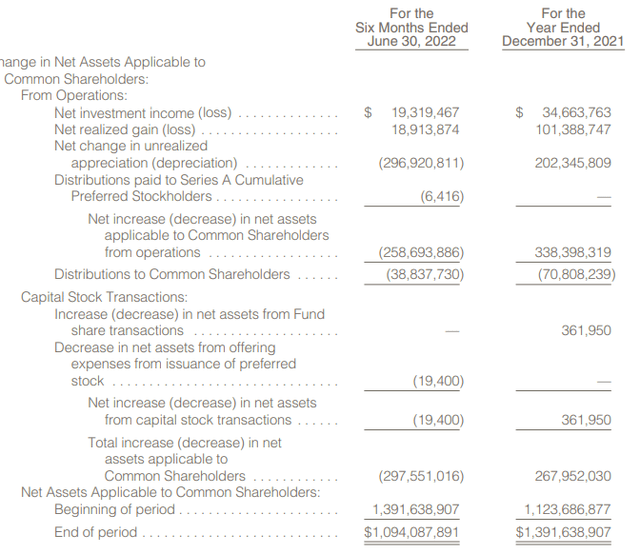

Similar to its sister fund, Cohen & Steers Quality Income Realty Fund (RQI), we see that NII has increased in the latest report. That’s a positive change as the fund managers shift their portfolios to a more income-oriented stance. That is opposed to the high-growth names they had been looking at previously.

Of course, higher rates by themselves should see income increase even further in the fund due to higher yields being obtained. With an increase in borrowings, that too adds a bit further to what is possible for generating higher income. At this point, though, the fund is completely maxed out on its credit agreement up to the $450 million unless it is renegotiated higher.

RNP Semi-Annual Report (Cohen & Steers)

NII coverage came to around 50%. That means they need to find another 50% in gains to pay off the distribution if they want it “covered.” At this point, they were able to achieve mostly that with realized gains. The unrealized gains sleeve is up substantially. As the market continues to sour, that will only become more difficult to find the realized gains needed.

Now that the fund has boosted its distribution, the total distributions paid out will further increase. They also have the preferred dividends to cover for their subsidiary. The common distributions should cost them around $77.676 million annually. That works out to around $7 million more than we saw in the previous fiscal year.

RNP’s Portfolio

The fund’s turnover rate puts it as a fairly active fund – not the most overly active but also not sitting around doing nothing. For the last six-month report, turnover came in at 21%. That’s about in line with the prior full year of 40%.

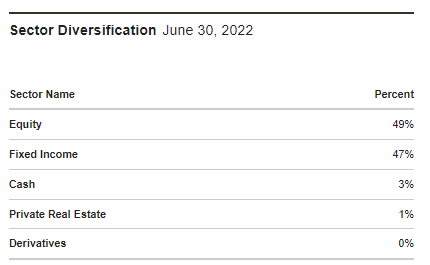

At the same time, we don’t generally see significant or dramatic shifts in the portfolio at the broader level. The fund is often around 50/50 split between equity and fixed income.

We also see private real estate making an appearance, presumably due to the new subsidiary holding in the fund. At 1%, that’s an infinite increase from the 0% previously. Of course, at 1%, it isn’t going to be a mover and shaker of the fund.

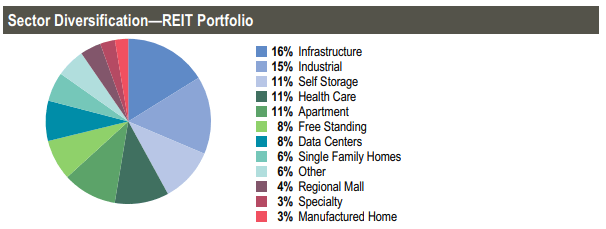

RNP Sector Diversification (Cohen & Steers)

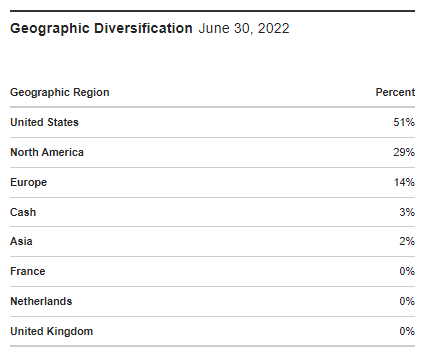

From a geographic perspective, the bulk of the portfolio remains invested in the U.S. However, there has been a slight decrease from the end of 2021.

RNP Geographic Exposure (Cohen & Steers)

Also, I’ll point out once again that the U.S. is listed separately from North America and France, the Netherlands and the U.K. being broken out separately from Europe. With all three of these European country positions at 0% exposure. I think the point they are trying to make is to show the largest exposure within these continents. However, to me, it still comes off as a bit unusual. I think it would look better to present either country or continent exposure. This is just personal, but anyway, I digress.

The fund has maintained its highest exposure to infrastructure and industrial exposure for sector exposure. With a diverse group of sectors, exposure can help the fund perform a bit better during a downturn, as some sectors can perform better than others. Healthcare is often a notable defensive area of the market.

RNP REIT Portfolio (Cohen & Steers)

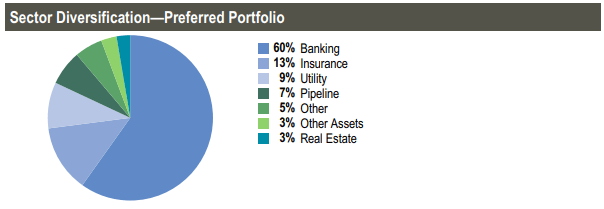

The fund’s preferred exposure might be more concentrated in banking and insurance, but that tends to be the case for preferred holdings. The CoCos are also going to be banking related. Still, it adds further diversification beyond the sectors in which the REIT portfolio is invested.

RNP Preferred Portfolio (Cohen & Steers)

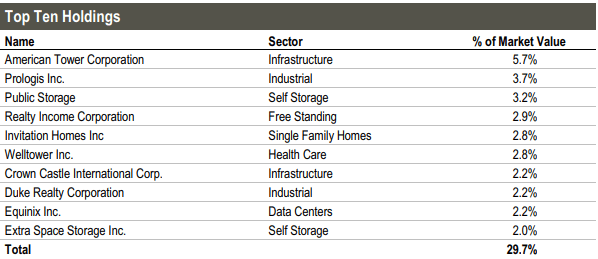

When shifting to looking at the top ten holdings of the fund, we see a similar move that RQI made. As I noted above, the fund shifted to a more income-oriented portfolio, away from growth. They still retain their digital infrastructure holdings, such as American Tower (AMT), Crown Castle (CCI) and Equinix (EQIX). However, we also see Realty Income (O) appear. They have historically kept O exposure to either none or minimal levels.

RNP Top Ten (Cohen & Steers)

O is one of the market’s most stable monthly dividend payers today. There are good prospects that it continues to be a strong player going forward too. The price has been getting crushed, but that hasn’t stopped them from continuing to inch up their dividend to investors.

Conclusion

RNP is currently trading at an attractive discount, especially when considering how much valuations have come down in REITs overall. This is a steady fund, and I see it as one of the higher-quality plays. Around half of its portfolio is in real estate, and the other is in fixed-income investments. That hasn’t worked out well for 2022. For a longer-term investor that has some time to wait for a recovery, RNP could present a compelling opportunity.

Be the first to comment