JuSun/iStock via Getty Images

The recent market rally may be discouraging for value investors who were hoping to accumulate more of their favorite stocks at bargain prices. I’m always reminded, however, that it’s a market for stocks rather than the stock market.

This brings me to Stanley Black & Decker (NYSE:SWK), which is an “old economy” stock that continues to trade at a discounted level while “new economy” tech stocks have started to bounce. This article highlights the merits of investing in SWK at the current price for potentially strong returns, so let’s get started.

SWK: Too Cheap To Ignore And Set To Soar

Stanley Black & Decker is a manufacturer of power tools, hardware, and security systems. It has been in business for over 170 years and is a well-recognized brand with a loyal following. The company has a diversified product lineup and operates in over 60 countries.

SWK has demonstrated strong growth, as reflected by full year 2021 revenue growth of 20% to $15.6 billion, with a record 17% organic revenue growth. It also recently closed the MTD and Excel acquisitions during the fourth quarter, putting it in a leadership position in the outdoor power equipment industry.

Notably, the top-line growth was driven by favorable pricing, which masked a decline in product volume. Additionally, gross margin was down by 630 bps during Q4 as higher supply chain costs weighed on profitability. Furthermore, a slowdown in the housing market could put further pressure on demand.

Much of these concerns have already been baked into the share price. To get a sense of how much SWK has dropped, it currently trades 35% below its 52-week high of $225.

Despite these headwinds, I’m encouraged by management’s plan to grow the top line in the mid-twenties this year and grow adjusted EPS by 15% – 19%. This could be driven in part by an aggressive $4 billion share repurchase plan for 2022, with as much as $2 to $2.5 billion worth of repurchases in the first quarter alone.

Furthermore, management sees tailwinds this year stemming from home remodeling, as homeowners tap into rising home equity, and from a continued rebound in industrial activity, especially in the automotive sector. These sentiments were weighed during the recent conference call:

Household formation, driven by millennial first-time home purchasers as well as the urban exodus support strong housing demand and the low levels of existing housing inventory will continue to be a catalyst for new residential construction. Home prices have appreciated, building home equity, which generally supports home reinvestment growth through repair and remodel activity. In recent years, the consumer mindset and behavior patterns regarding home and garden have shifted as more time is spent in these environments.

Leading indicators for non-resi construction, such as ABI and Dodge rebounded during much of 2021 and have remained positive as construction activity has continued to recover. And lastly, we are cautiously optimistic that the cyclical recovery in auto and aero will begin to emerge in 2022, a $300 million to $400 million multiyear revenue growth opportunity for industrial.

Meanwhile, SWK maintains a strong A rated balance sheet, and a 2.2% dividend yield that’s well-covered by a low 27% payout ratio. While the 5-year dividend CAGR of 6% isn’t too high, this could change with the robust earnings growth anticipated for this year. Moreover, it’s worth noting that SWK is a Dividend King with 53 years of consecutive raises under its belt.

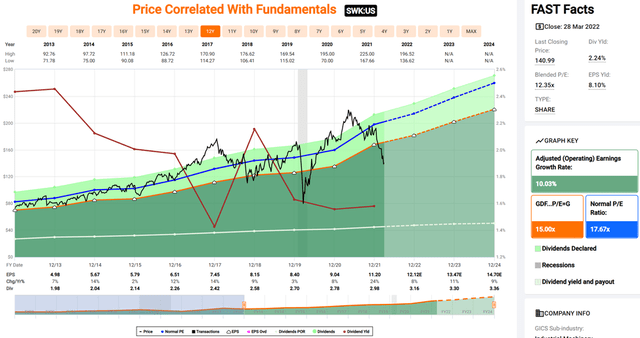

SWK appears to be rather cheap at the current price of $146, with a forward PE of just 12.1, sitting well below its normal PE of 17.7 over the past decade. Analysts expect to see a double-digit EPS rebound in the second half of this year, and have a consensus Buy rating, with an average price target of $209. This translates to a potential one year 45% total return.

SWK Valuation (FAST Graphs)

Investor Takeaway

Despite some short-term headwinds, Stanley Black & Decker looks poised for solid long-term growth. The company has a strong balance sheet, a diversified product lineup, and a management team that is committed to returning value to shareholders. SWK trades at a material discount to its historical valuation at current price of $146, and I believe it offers a compelling opportunity for potentially strong long-term returns.

Be the first to comment