JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

Stanley Black & Decker (NYSE:SWK) is a multinational and industrial tool provider focused on further expansion into its industrial market. A series of accretive acquisitions have made SWK a powerhouse in industrials and in tools. SWK’s long-term capital allocation strategy is simple: half goes toward M&A and half returns value to shareholders.

Despite a hit to organic growth in 1Q22 for the industrial segment, SWK still maintains an estimated 10% 3-year CAGR for earnings per share, and still expects to see a high single/low double digit organic growth average across its sectors. The largest growth was in the tools & outdoor segment which saw a margin expansion of 2.6%.

With an aggressive long-term M&A strategy in place and the desire to expand globally with new e-commerce offerings, SWK offers solid shareholder returns without reducing the ability of the firm to make accretive acquisitions that would drive this international expansion. Additionally, there is much promise in the automotive and industrial sector as large brands begin shifting toward the electrification of vehicles and machinery.

|

FY2021 |

E2022 |

E2023 |

|

|

Price-to-Sales |

1.0 |

0.9 |

0.9 |

|

Price-to-Earnings |

15.0 |

10.2 |

8.9 |

|

EV/EBITDA |

10.9 |

9.7 |

9.0 |

Business Model

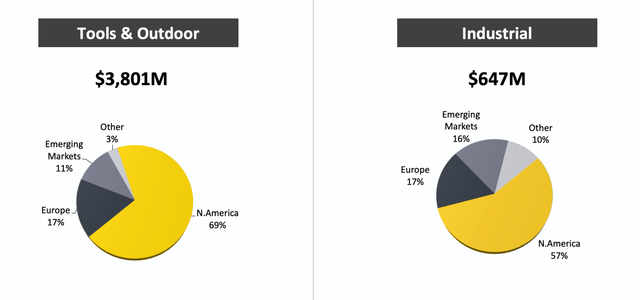

SWK operates two separate segments, tools & outdoor, and industrial.

SWK is a global leader in engineered fastening and the #1 brand in tools and outdoor products owning 9 successful brands including DeWalt, Stanley, Black and Decker, and Craftsman. These individual brands appeal to a broad range of consumers and specialty levels, primarily centered around the tradesman and professional markets with recent expansion into the industrial and automotive industry.

Industrial manufactures fasteners and structural components for machinery or vehicles, along with industrial-grade tools and proprietary industrial solutions. The total addressable market is estimated to be $85 billion, with SWK holding roughly $2 billion – mostly in the automotive sector.

Infrastructure tools such as attachment tools for machinery, and oil and gas integrity equipment (such as radiography equipment) make up a small (8%) but meaningful portion of SWK’s revenue.

Long-Term Reach

Projected 4-6% organic unit growth combined with pricing and acquisitions to achieve a 10-12% total revenue growth per year. eCommerce has become an increasingly important part of the SWK model, allowing hyper expansion into European consumer markets, and Chinese industrial markets which previously were difficult to break into through traditional channels.

Tool & Outdoor is expected to have mid-to-high single digits in organic growth, while margins are expected to compress because of inflation and recent acquisitions. The industrial segment expects to see similar results, without as many acquisitions on the books.

SWK has grown to be the #1 firm in tool & outdoors because of its history of acquisitive growth. The focus areas are consolidating the tool industry, outdoor segment product expansion, and growth in the industrial segment.

The expansion of SWK into the automotive tooling/fastener market comes at an excellent time as consumer preferences and OEMs alike switch toward hybrid and electric vehicles. Presently, SWK can earn roughly $10 per car produced. However, fully electric cars are estimated to provide $30-60 per car to SWK.

Additionally, SWK has launched an “industry 4.0” program designed to provide more stringent standards and interconnectivity within factories, eliminating repetitive human tasks through robotics, and “upskilling” the company’s workforce.

Risk

SWK operates multiple segments that appeal to a wide variety of consumers and while its business model is margin resilient, should its modernization programs (like industry 4.0) fail to come to pass, it may result in SWK losing its place at the top of the market or result in further supply chain failures.

With inflation at a high, and supply shortages ravaging the industrial sector SWK faces two primary headwinds; the lack of supply means a lack of production (meaning fewer sales for their equipment and industrial components) and an increase in input costs. This is estimated to be a $1.4 billion headwind, which is up $600 million from their estimate at the end of FY2021. As a result, SWK is focused on normalizing margin levels in 2023.

Inventories have bulged across the manufacturing sector, and SWK is no exception. However, it estimates that by 2H22, it should see a serious reduction and will end the year lower than FY2021.

Conclusion

While SWK is in the midst of its “industry 4.0” streamlining, it has not shied away from acquisitions to expand international or e-commerce offerings, seeking to hit 10-12% revenue growth per year. While so far this has paid off, being able to expand EPS with a 10% 3-year CAGR, there are estimated to be $1.4 billion in remaining headwinds through FY2023 as inventories have bulged across the manufacturing sector. However, we believe that the success shown thus far will continue in particular as industrial and automotive sectors begin electrification.

Be the first to comment