Justin Sullivan/Getty Images News

Thesis and Background

This is an update of an earlier article I published on NIKE, Inc (NYSE:NKE). The article was published more than 1 year ago back in August 2021. The article acknowledged the perpetual compounding power of NKE (which is still valid now). But the main point of that article was to caution readers about NKE’s overvaluation risks at that time (when its stock prices were ~$170 and FW P/E stood around 39x). Indeed, the stock has suffered a 33% price correction since then, compared to a 10% loss in the S&P 500 index.

Source: Seeking Alpha

Against this background, this update article is motivated by two considerations. First, the valuation change caused by its large price corrections and also the changes in its fundamentals since then. In the remainder of this article, you will see why I am still concerned about the stock. I am still seeing very limited upside and plenty of downsides. And my top concerns are:

- Its valuation is still too expensive, both in absolute terms and relative terms. Its FW P/E has shrunk to ~30x now from 39x due to the 33% price correction. However, as to be elaborated on later, given its long-term profitability levels, a 30x P/E limits long-term total return to the mid- or lower-single-digit level.

- On the fundamental side, the business is facing plenty of headwinds.

- Notably, I am very concerned about its current inventory levels, which I anticipate creating a range of trickle-down problems and keep its profitability under pressure, as examined more closely next.

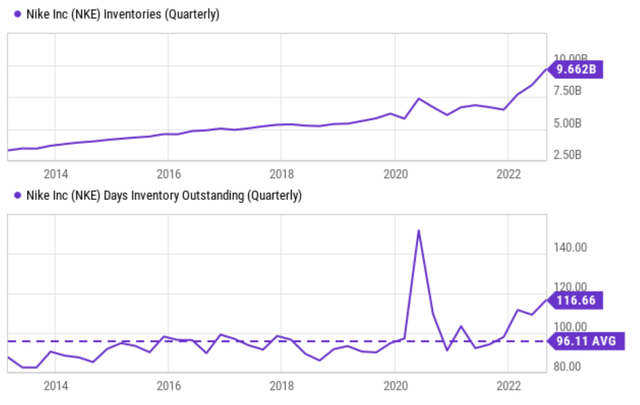

NKE has an inventory problem

NKE’s inventory currently sits at $9.66B, a historical peak as you can see from the top panel in the following chart. To contextualize the size of the inventory, the bottom panel shows the inventories in terms of the number of days outstanding. And you see, it translates into 116.6 days of inventories outstanding on a quarterly basis. It is far above its long-term average of 96.1 days, and at a historical peak level in the past 10 years except for the breakout of the pandemic.

I anticipate such bloated inventory levels create trickle-down problems. The initial supply-chain strains led to increased ordering so the company would not be caught with a lack of products to sell. In turn, now with demand apt to taper because of economic constraints being placed on the average consumer, footwear is piling up. When this happens, it will take time for NKE to clear its inventory, most likely by discounting the prices, which would pressure profitability consequently in the quarters to come. Carrying such a high inventory creates substantial balance sheet risks also.

And next, we will see that its valuation is still expensive, further adding to the investment risks.

Source: Seeking Alpha

NKE has a valuation problem too

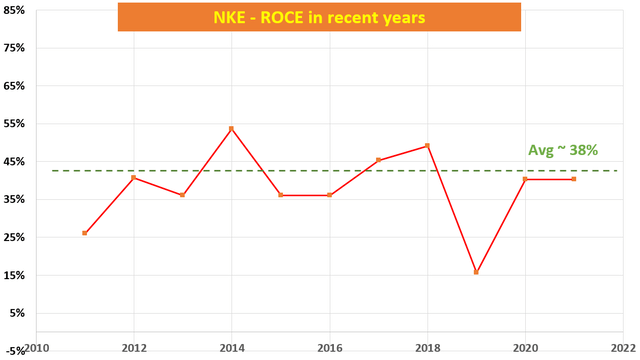

As aforementioned, there is no doubt that NKE demonstrates excellent perpetual compounding power. The next chart shows its profitability measured by ROCE (return on capital employed). And as you can see, NKE’s ROCE has been remarkably healthy and stable with an average of 38%. In the long term, the growth rate of a business is given by the following simple equation:

Longer Term Perpetual Growth Rate (“PGR”) = ROCE * Reinvestment Rate (“RR”)

NKE has been maintaining a RR of ~10% in recent years. Combined with a 38% ROCE, NKE could maintain a perpetual compounding rate of 3.8% (38% ROCE * 10% RR = 3.8%). Considering that this is the organic growth rate that can be perpetually sustained, a 3.87% CAGR is nothing to be sneered at.

Source: Author using Seeking Alpha data

As detailed in our blog article:

The long-term return is “simply” the summation of the owner’s earning yield (“OEY”) and the perpetual growth rate (“PGR”) that we just discussed. That is: Longer Term ROI = OEY + PGR. And OEY is the owner’s earnings divided by the entry price.

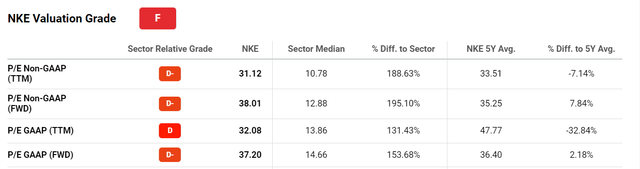

At its current price levels as of this writing, its P/E ratio is in the range of 31x to 38x as you can see from the following SA data depending on which EPS you use. As a result, its OEY is in the range of ~3.2% to 2.6%. Recall that its PGR is ~3.8%. Thus, the total long-term ROI under current conditions would be in the range of 7.0% to 6.4%.

Finally, note that the reason that the so-called terminal P/E does not show up in this frame is that in the long term, all fluctuations in P/E ratios are averaged out (all luck at the end even out). But in the near term, P/E ratio changes of course can derail short-term returns to deviate from the above long-term ROI. And with NKE’s current 30+ P/E multiple and profitability headwinds, I see good odds for its total returns to fall below the 7.0% to 6.4% range.

Source: Seeking Alpha

Other risks and final thoughts

Besides the inventory problem as aforementioned, I anticipated the supply-chain issues to continue as well. The combination of costlier shipping and longer shipping times is creating troubles for its bottling too. Finally, the Chinese market showed some sales weakness, as the country keeps dealing with the lingering effects of the pandemic. In the U.S., given the high inflation in 2022 and the economic uncertainties, the vitally important Christmas shopping period may not be as strong as expected. On top of all these issues, the strengthening in the U.S. dollar adds another headwind. It can hurt NKE’s numbers in Europe, Asia, and Latin America when reported in U.S. dollars.

Given the above analysis, I am seeing a very limited upside (up to 7.0% in the long term). And given the current valuation and fundamental risks, investors at this point will need plenty of patience and commitment to see such long-term ROI materialize. In the meantime, there are plenty of headwinds and downsides in the near term. All told, I am seeing an unfavorable risk/return profile.

Be the first to comment