Joe Raedle

Introduction

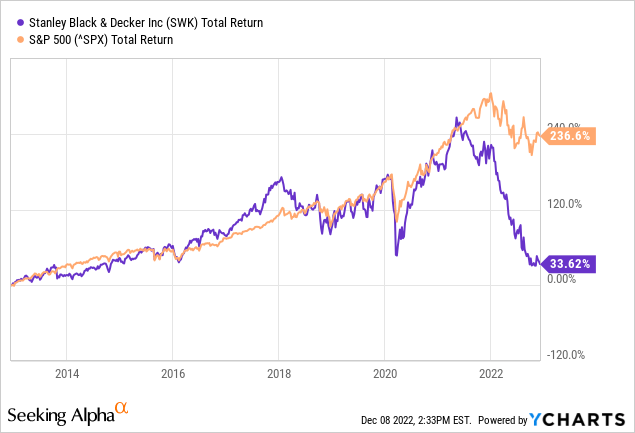

Stanley Black & Decker (NYSE:SWK) is a stock that experienced a strong rally since the corona crisis until mid-2021, after which the share price plummeted until now.

Until mid-2021, the stock price rose over the past 10 years. Its stock price almost paralleled the S&P 500 but is currently down. This was due to mediocre quarterly earnings and particularly poor guidance. The stock’s valuation metrics are favorable due to the sharp decline, which may provide a great buying opportunity. Although the macroeconomic outlook looks weak, I expect the stock to move sideways at first, after which the stock will start a strong advance when the quarterly figures show a positive outlook.

Company Overview

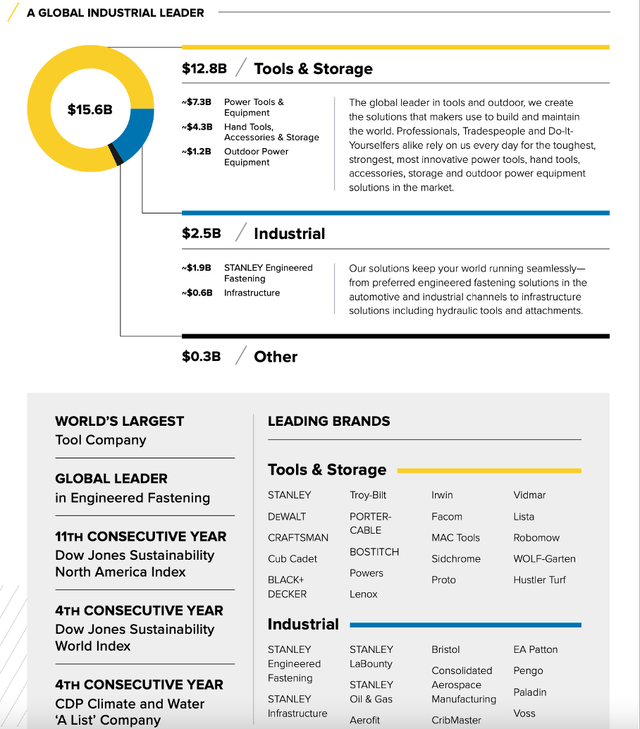

Company Overview (Stanley Black & Decker 2021 Annual Report)

Stanley Black & Decker supplies industrial tools to both businesses and consumers worldwide. The company is divided into 2 segments: Tools & Outdoor, and the Industrial segment. The Tools & Outdoor segment is the largest segment, generating 84% of total sales. Tools & Outdoor includes well-known brands such as Stanley, DeWalt, Craftsman and Black + Decker. Tools & Outdoor is divided into Power Tools (power tools and equipment, pneumatic tools and fasteners), Outdoor Power Equipment (lawn and garden products and related accessories, and Hand Tools, Storage & Accessories.

The Industrial segment provides fastening systems and products to companies in the automotive, manufacturing, electronics and other industries. It is also engaged in the sale and rental of custom pipe handling, welding and coating equipment for use in construction and other infrastructure solutions in the oil and natural gas pipeline industry.

Third Quarter Earnings Came In Mixed

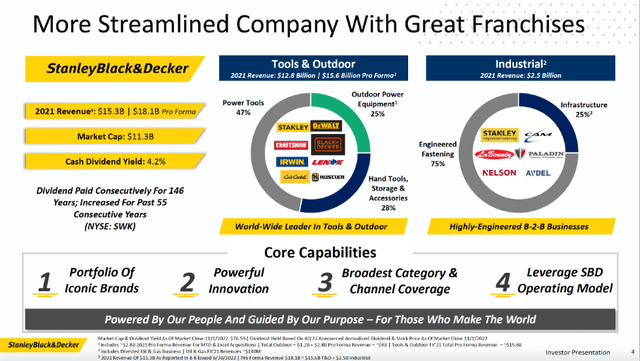

More Streamlined Company With Great Franchises (Stanley Black & Decker 3Q22 Investor Presentation)

Earnings for the third quarter were mixed. Revenue was up 9.0% year over year, but earnings per share lagged with a decline of 73% year over year. Of particular concern was that free cash flow was deep in the red at -$2.3B on revenue of $4.12B.

The cause of the mixed earnings was inflationary pressures due to weakened consumer demand. Stanley Black & Decker acted quickly, cutting SG&A expenses by $65 million this quarter. During the quarter, the company cut about 1,000 finance jobs to reduce costs. The goal is to further reduce costs to achieve total cumulative cost savings of $2B ($1B annualized) by 2025. The company plans to achieve the cost savings through supply chain and SG&A optimization. The cost savings should lead to a gross margin of more than 35% by 2025. The current gross margin is 25% as of September 2022. Inventories fell to $6.3B from $6.6B and the CEO Donald Allan Jr. said it will not reduce headcount further.

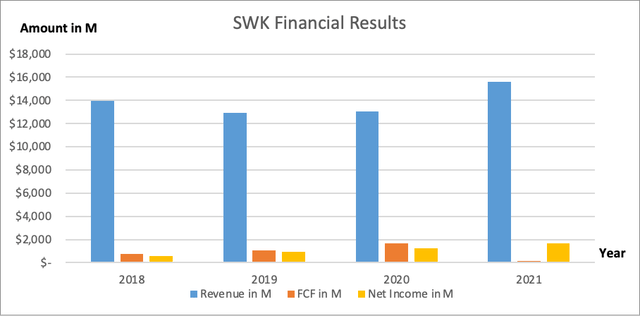

Looking at the big picture, Stanley Black & Decker grew strongly in 2021 due to the housing boom while the Fed cut interest rates. Sales rose 20%, net income rose 37% and earnings per share increased 16% year over year.

SWK Financial Results (SEC and Author’s Own Graphical Visualization)

The Tools & Outdoors segment is expected to experience a decline in sales due to weak consumer confidence and rising inflation. I wrote in an earlier article that a recession is imminent in the United States. The yield spread is deep in the red, indicating that a recession is imminent within now and a year. Sales in the Tools & Outdoors segment come primarily from consumers, and they are the most affected during a recession. The large share of 84% of total sales indicates that the risks are mainly in this segment. Sales in the Industrial segment are expected to increase by high single digit to low double digit.

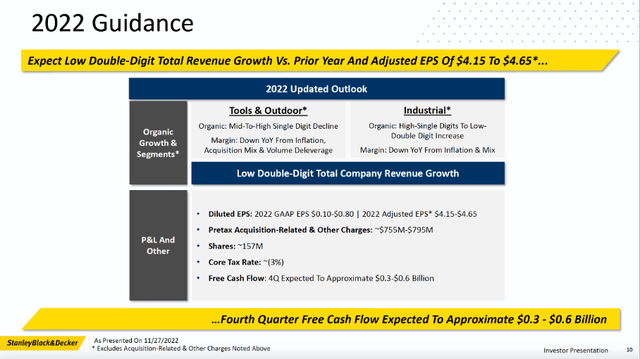

Stanley Black & Decker lowered its earnings per share forecast for fiscal 2022 from $5.00 to $6.00 per share to a range of $4.15 to $4.65 per share. Free cash flow was deep in the red in the third quarter, but the company expects free cash flow in the green for the final quarter of 2022. Analysts on the Seeking Alpha SWK ticker page expect earnings per share to rise 13% after fiscal 2023.

Stanley Black & Decker 2022 Guidance (3Q22 Investor Presentation)

Stanley Black & Decker Offers A High Dividend Yield Of 4.2%

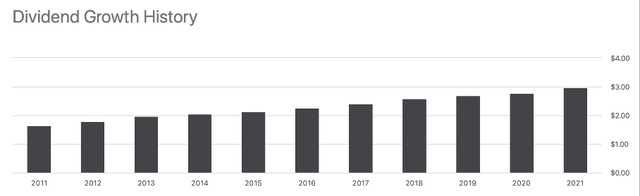

Dividends per share have increased at an average annual rate of 6.1% over the past 10 years. Dividend payout ratio is 0.30 for fiscal year 2021, so dividend payments are manageable. Free cash flow was deep in the red this fiscal year, which is a major risk to the dividend payout. Since the company expects free cash flow to be positive in the fourth quarter, I see some improvement in its financial performance.

The dividend per share is currently listed at $3.20, representing a dividend yield of 4.2%. Looking ahead, the consensus dividend for fiscal 2022 is $3.14 and for fiscal 2023 is $3.22 (up 2.5%). Adjusted earnings per share is expected to be $4.38 and $4.95 per share, so the dividend should be well covered by the company’s earnings.

Dividend Growth History (SWK Seeking Alpha Ticker Page)

Valuation Extremely Favorable

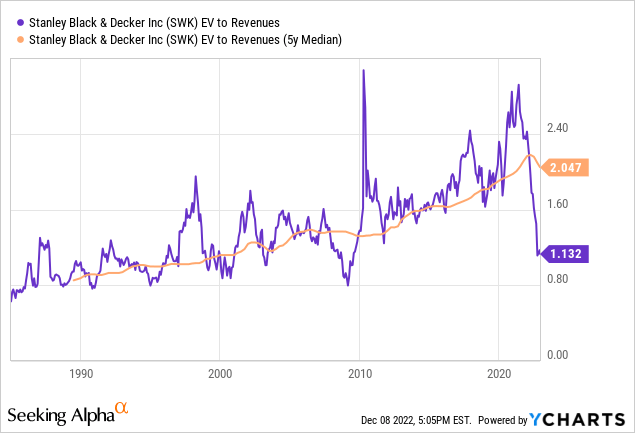

I prefer to use the ratio of enterprise value to free cash flow to understand the valuation of the company. Since the company has negative free cash flow this year, the EV/FCF ratio seems unrepresentative for now. In 2017 and 2018, the gross margin was around 35%, and since the company is targeting a gross margin of 35+% by 2025. Therefore, I see the EV/Sales ratio as a good choice to chart the stock’s valuation and compare it to the value from 2017 and 2018.

The graph is drawn from before 1990 to the present to show that the median EV/Sales ratio increased during a period when interest rates generally decreased. Now the EV/Sales ratio is almost at 2008 levels, this indicates that the company is extremely favorably valued.

Although there are significant risks associated with investing in the stock because of the lowered outlook, this could be a good buying opportunity now that the company is lowering its costs and improving its gross margin. Management is strong and acts quickly to mitigate potential future losses and strives to improve its financial position. The strong management, high dividend and cheap valuation make the stock worth buying.

Key Takeaway

- Stanley Black & Decker grew strongly in 2021 due to the housing boom while the Fed cut interest rates. Sales rose 20%, net income rose 37% and earnings per share increased 16% year over year.

- Earnings for the third quarter were mixed. Revenue was up 9.0% year over year, but earnings per share lagged with a decline of 73% year over year. Of particular concern was that free cash flow was deep in the red at -$2.3B on revenue of $4.12B.

- The cause of the mixed earnings was inflationary pressures due to weakened consumer demand.

- The company plans to achieve the cost savings through supply chain and SG&A optimization. The cost savings should lead to a gross margin of more than 35% by 2025.

- Now the EV/Sales ratio is almost at 2008 levels, this indicates that the company is extremely favorably valued.

- Although the macroeconomic outlook looks weak, I expect the stock to move sideways at first, after which the stock will start a strong advance when the quarterly figures show a positive outlook.

- Now is a good buying opportunity because the company is lowering its costs and improving its gross margin.

Be the first to comment