Matt_Gibson

STAG Industrial, Inc. (NYSE:STAG) should be in the portfolio of every passive income investor, in my opinion. The real estate investment trust pays a high-quality dividend, which translates to predictability and, as a result, stability.

STAG Industrial’s funds operations cover its high-quality dividend, and the trust’s stock trades at a competitive FFO multiple.

STAG Industrial currently pays a covered 4.6% dividend yield, which is expected to rise as the real estate investment trust continues to invest in its real estate portfolio.

Portfolio Strategy And Composition

STAG Industrial invests solely in a portfolio of industrial real estate. As of September 30, 2022, the trust’s portfolio included 563 buildings and 111.6 million square feet, representing a (net) increase of 4 properties from June 30, 2022. The portfolio has a weighted average lease term of 4.9 years and an occupancy rate of 98.2% (which is difficult to improve).

Overview (STAG Industrial, Inc.)

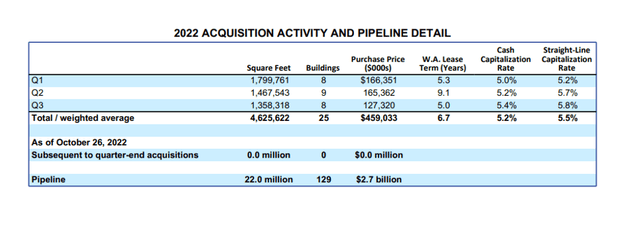

STAG Industrial acquired 8 new properties (before divestitures) totalling 1.36 million square feet in the third quarter. During Q3’22, the trust completed the divestiture of four properties totalling 1.29 million square feet.

From January to September, STAG Industrial spent $459.0 million on the acquisition of 25 properties while selling $133.0 million in real estate (6 properties). As a result, the portfolio is steadily growing, as evidenced by predictable growth in funds from operations.

2022 Acquisition Activity (STAG Industrial, Inc.)

STAG Industrial Has A Very Low Dividend Payout Ratio

A low dividend payout ratio is the signature metric that investors should look for when it comes to securing dividend income from high quality dividend real estate investment trusts. A trust that has consistently covered its dividend with funds from operations in the past is likely to maintain and grow its dividend in the future.

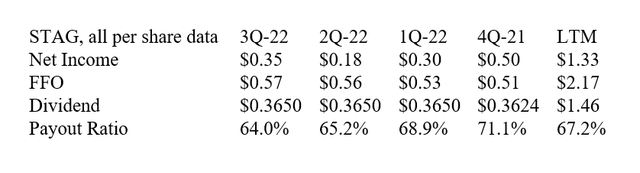

STAG Industrial generated $0.57 per share in funds from operations in the third quarter, more than enough to cover the $0.365 per share dividend payout.

The implied Q3’22 payout ratio was only 64%, indicating that the trust has significant room to increase its dividend payout while also investing additional funds in the expansion of its real estate portfolio.

The dividend payout ratio in the previous 12 months was only slightly higher at 67.2%, demonstrating that passive income investors don’t need to be concerned about STAG Industrial’s (monthly) dividend.

Dividend (Author Created Table Based on Trust Information)

Guidance And Valuation

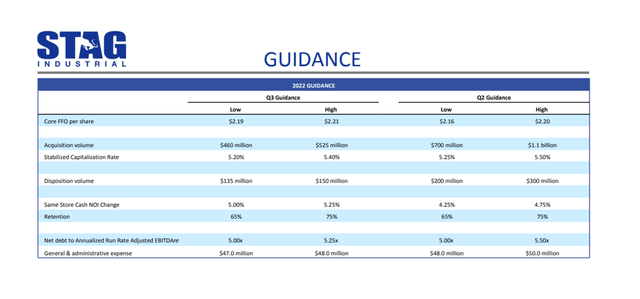

STAG Industrial forecast $2.19 to $2.21 per share in funds from operations in 2022, a slight increase from the top end of guidance.

In the second quarter, the trust expected funds from operations to range between $2.16 and $2.20 per share. STAG Industrial’s FFO guidance is based on the assumption that the real estate investment trust will acquire $460-525 million in industrial real estate this year while selling $135-150 million in industrial real estate.

Guidance (STAG Industrial, Inc.)

STAG Industrial’s potential is valued at 14.5x funds from operations based on guidance of $2.19-2.21 per share in funds from operations.

Prologis, Inc. (PLD) is valued at 22.2x funds from operations, based on a revised funds from operations forecast of $5.12-5.14 per share. Prologis also has a dividend yield of only 2.8%, so I believe STAG Industrial is the clear choice for passive income investors in terms of FFO valuation and yield.

Why STAG Industrial Could See A Lower Valuation

STAG Industrial is laser-focused on the industrial real estate market, which has different economics than the residential real estate market.

Industrial real estate is more vulnerable to volatile demand than residential real estate, and it may experience faster rising vacancy levels during a recession.

STAG Industrial’s real estate portfolio is well-managed, and unless the U.S. real estate market experiences a significant downturn, I don’t see the trust being unable to meet its dividend commitments to its shareholders.

My Conclusion

STAG Industrial is a high-quality real estate investment trust that pays a stable and growing dividend that is covered by funds from operations to passive income investors.

The payout ratio is extremely low, providing a high margin of safety for the trust’s dividend.

STAG Industrial’s real estate portfolio is expanding, and the trust will most likely be able to increase its dividend in the future even if the U.S. real estate market experiences a recession in 2023.

Be the first to comment