Falcor

While the general market has been pummeled over the past year, with its correction exceeding 25%, the Gold Miners Index (GDX) has suffered the real bear market, with its 52% correction from its 2020 highs being double the magnitude. Given that bear markets take both time and damage to eradicate bullish sentiment completely, the more fertile ground for looking for new ideas is in the gold sector, where the 22-month cyclical bear market has ground any remaining hope to fine dust. Fortunately for investors in SSR Mining (NASDAQ:SSRM), they temporarily evaded the correction, with the stock rallying in a near parabolic fashion to start 2022.

However, as I noted in “Outstanding Execution, But Tough Comps Ahead” in late March, its incredible year in FY2021 had left it lapping very difficult comps ahead in FY2022. The reason was that production was likely to dip sharply year-over-year from record levels, costs were increasing due to inflationary pressures, and the stock was close to fully valued at $22.00 per share. While these two things have come to fruition, the added negative was that cost guidance wasn’t conservative enough, and an incident at its flagship operation derailed Q3 production. In this update, we’ll see whether the 40% pullback has left the stock in a low-risk buy zone:

Marigold Operations (Company Presentation)

Q2 Results & Q3 Expectations

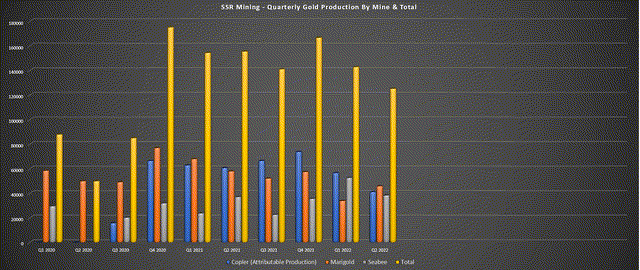

SSR Mining had a solid quarter in Q2, reporting production of ~159,300 gold-equivalent ounces, which was in line with guidance, but down sharply from the year-ago period due to difficult comparisons. This was related to production at Çöpler with a lower contribution from oxide material with much lower grades, plus autoclave maintenance that was completed in April. The lower output at this flagship asset offset an incredible quarter at Seabee (~38,300 ounces), leading to a sharp decline in revenue to just $319.6 million (Q2 2021: $377.0 million) and a significant decline in operating cash flow ($32.8 million vs. $135.8 million) despite higher gold prices.

SSR Mining – Quarterly Gold Production Per Mine (Attributable) (Company Filings, Author’s Chart)

From a cost standpoint, all-in-sustaining costs [AISC] surged to $1,267/oz, a 32% increase from $961/oz in the year-ago period. This was related to inflationary pressures from fuel, electricity, reagents, and labor costs. The result was that AISC margins plunged from $859/oz to $595/oz, moving SSR Mining from an industry leader from a margin standpoint to more in line with the industry average. Unfortunately, margins are likely to take another leg down sequentially without the benefit of lower-cost production from Çöpler in Q3 and the impact of much lower gold prices.

As discussed earlier, there was an incident at Çöpler on June 21st, where eight kilograms of cyanide within the dilution solution leaked from a pipeline that pumps solution to the heap leach pad at the operation. This was within the mine operating area and was cleaned up immediately without any discharge from the site. Still, it prompted an investigation, which led to a nearly 3-month suspension of operations. As of September 22nd, operations were restarted with the receipt of required regulatory approvals, but this should lead to a 55,000-ounce plus shortfall in production in Q3 2022 on a consolidated basis. The result will be a significant impact on consolidated AISC.

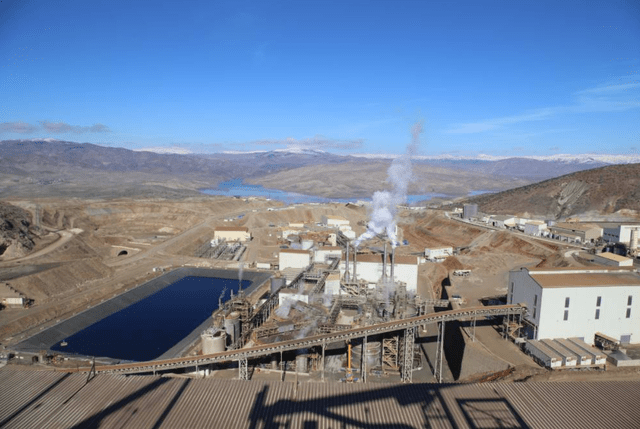

Copler Operations (Company Website)

Since SSR Mining produced ~187,000 GEOs at $1,006/oz in FY2022, the company will be up against extremely difficult comps as it reports results this month, leading to some ugly headline numbers on a comparative basis. The reason is that consolidated production is likely to be down at least 40%, with costs up more than 30% year-over-year, impacted by no benefit from low-cost production at Çöpler and inflationary pressures. If we combine this with a much lower average realized gold price ($1,760/oz or less), we could see AISC margins fall below $400/oz in the period, the lowest figure since Q1 2020 ($336/oz).

Recent Developments

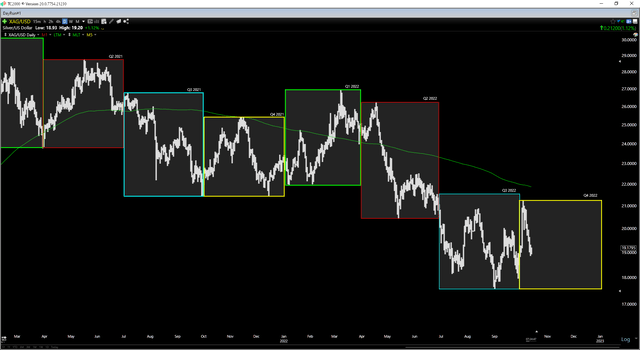

While the weaker gold price certainly doesn’t help its gold operations which make up over 75% of revenue, the lower silver price won’t help Puna’s margins much either. This is because the Argentinian mine’s FY2022 all-in-sustaining costs are expected to exceed $17.00/oz based on guidance, and the average realized silver price in H2 2022 is likely to come in below $19.75/oz. The result is significant margin compression here as well. The good news is that while the Q3 results will be rough, Q4 should be much better, with better grades from Marigold, a strong quarter in Turkiye, and better grades at Puna.

Silver Futures Price & Quarterly Averages (TC2000.com)

Fortunately, it hasn’t all been negative news since the Çöpler spill in Q2, with SSR Mining reporting positive exploration results from Ardich that were not included in the reserves published at year-end for the Cakmaktepe Extension. The Cakmaktepe Extension is already expected to contribute 1.2 million ounces of gold to the mine life at Çöpler, but with several impressive intercepts released recently, this figure could increase materially. Some highlights were as follows:

- 28.3 meters at 8.23 grams per tonne of gold

- 53.0 meters at 2.46 grams per tonne of gold

- 55.8 meters at 2.38 grams per tonne of gold

- 27.1 meters at 5.24 grams per tonne of gold

- 27.6 meters at 5.20 grams per tonne of gold

Just as importantly, the company has received the Environmental Impact Assessment [EIA] for the first phase of the Cakmaktepe Extension Project, a positive development considering the recent incident at the mine, which was certainly a blemish on operations. As shown below, while many of the intercepts were infill holes to confirm grades and tighten up drilling spacing at Cakmaktepe, several intercepts were outside of the planned reserve pit, suggesting strong potential for an expansion in reserves down the road. This positive development should help maintain Çöpler’s position as having an industry-leading mine life vs. most projects.

The other positive development is that valuations in the sector have become the most attractive in years. Outside of a small bolt-on acquisition of Taiga Gold in Saskatchewan, SSR Mining has been very patient regarding acquisitions. This has left the company with net cash of $700+ million in arguably the most favorable environment for M&A on a gold-price adjusted basis since 2015/2016, which could allow the company to diversify further if it chooses to at a very reasonable price. I believe this would be a major upgrade to the investment thesis, diluting its exposure to Turkiye, where the company clearly has high-margin operations. Still, some investors are less enthused with the heightened exposure, especially compared to the previous portfolio pre-Alacer.

Valuation

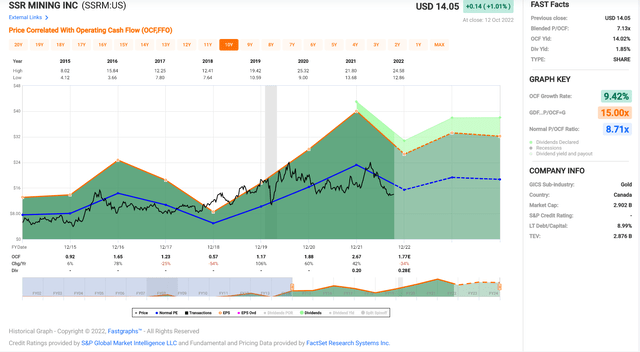

Based on an estimated year-end fully diluted share count of 222 million shares and a share price of $14.00, SSR mining trades at a market cap of ~$3.11 billion. If we compare this figure to an estimated net asset value of ~$4.15 billion, SSRM is now trading at a more than 20% discount to net asset value at just 0.75x P/NAV. From a cash flow standpoint, SSR Mining is valued at ~7.9x FY2022 cash flow estimates ($1.78 per share) vs. a 10-year average multiple of 8.7x.

SSR Mining – Historical Cash Flow Multiple (FASTGraphs.com)

When compared to sector peers, this is a slight premium to its peer group, with OceanaGold (OTCPK:OCANF), Centerra (CGAU), Eldorado Gold (EGO), and most mid-tiers trading at between 0.40x – 0.65x P/NAV. That said, SSR Mining deserves a premium for its scale (~700,000+ GEOs per annum) and solid execution over the years vs. hiccups for other names in the sector. Hence, SSR Mining’s valuation has become more reasonable even if it trades at a premium. Based on what I believe to be a fair multiple of 9.0x forward cash flow (FY2023 estimates: $2.20), I see a conservative fair value for the stock of $19.80.

While this represents a 40% upside from current levels and closer to 45% on a total return basis (dividends, buybacks), I think investors can do better from a relative value standpoint. One example is Agnico Eagle (AEM), which trades at its lowest cash flow multiple since 2015 despite considerable margin expansion, and is also returning ~5.0% per year to shareholders through dividends/buybacks. At a current share price of $41.70, the stock trades at a lower cash flow multiple than SSR Mining despite ~5x the production profile, a lower-cost profile, and 95% of its production coming from Tier-1 ranked jurisdictions.

Agnico Eagle produces ~3.4 million GEOs per annum vs. SSR Mining’s ~700,000 GEOs; the bulk of its production comes from Ontario, Quebec, Finland, Victoria, and Mexico vs. Turkey, Argentina, Nevada, and Saskatchewan. Finally, Agnico’s costs should be below $980/oz next year vs. $1,125/oz+ in the case of SSR Mining.

Technical Picture

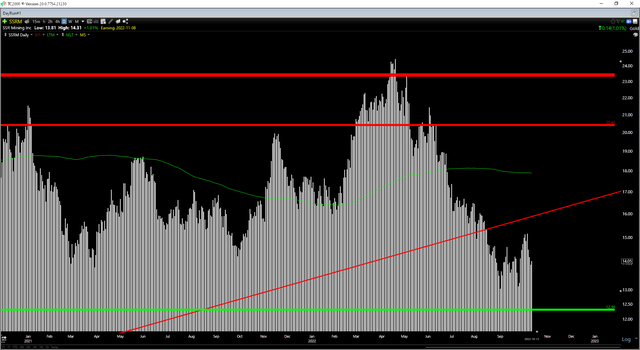

Moving over to the technical picture, SSR Mining is approaching a low-risk buy zone, sitting just 12% above major support at $12.30 and with no major resistance until $20.40. This translates to a 3.80 to 1.0 reward/risk ratio, with $1.70 in potential downside to support and $6.40 in potential upside to resistance. Generally, when it comes to mid-cap stocks, I prefer a minimum 5.0 to 1.0 reward/risk ratio, so while SSR Mining is getting close to entering a low-risk buy zone, the more attractive area to start a position in the stock if I were looking to buy would be $13.55.

That said, with SSR Mining having lots of room on its buyback program (authorization to buy over 5.0+ million additional shares), the stock may not head this low again without further weakness in the gold price.

SSR Mining – Daily Chart (TC2000.com)

Summary

SSR Mining had a phenomenal year in FY2021, which explains its outperformance in Q1/Q2 2022 with a 50%+ rally, but the stock has come under pressure lately due to revising cost guidance and an incident at Çöpler. Fortunately, the issue is resolved, and the cost guidance revision is hardly a company-specific issue, with a significant portion of the sector underestimating the impact of inflationary pressures this year. In summary, there’s undoubtedly value here at a current share price of $14.00, and a pullback below $13.55 would offer a low-risk buying opportunity. That said, two ideas I see as being far more mispriced currently are i-80 Gold (IAUX) and Agnico Eagle.

Be the first to comment