Suchat longthara/iStock via Getty Images

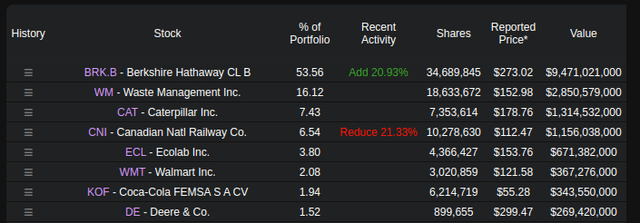

If you look at the Bill & Melinda Gates Foundation Trust, the fifth biggest position is in Ecolab (NYSE:ECL), which develops and offers services, technology and systems for water treatment, purification, cleaning and hygiene in a wide variety of applications. It also has important operations in food safety, and other cleaning and sanitizing solutions to manufacturing, food and beverage processing, among others.

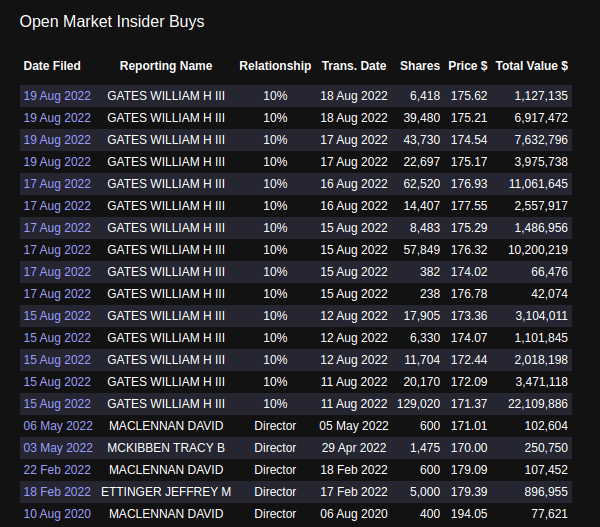

The reasons why we thought this would be a good time to analyze the company are that we noticed that Bill Gates has been buying shares recently. As can be seen below, he has made several purchases during the month of August, which signals that he still likes the company and finds value at current prices.

dataroma.com

We believe the market is currently focusing too much on near-term cost inflation and the potential for a recession.

As Ecolab’s hospitality customers recover from the Covid crisis, the institutional business should see full profit recovery over the next couple of years. In the industrial business, rising freshwater costs should incentivize water-intensive manufacturing plants to install Ecolab’s water management products and services.

2Q 2022 Results

The Q2 2022 results showed the company continues to battle inflation, but results are improving compared to the previous quarter, thanks in part to price increases starting to take hold. Revenue was up 13% y/y, while operating income was down 5% as inflation reduced profits. The 5% decline showed a sequential improvement compared to the 14% decline seen in Q1. It is likely that the company will continue to see sequential improvement throughout the year, and return to growth in 2023, as price increases take hold and the company’s customers continue to recover from the Covid crisis.

Financials

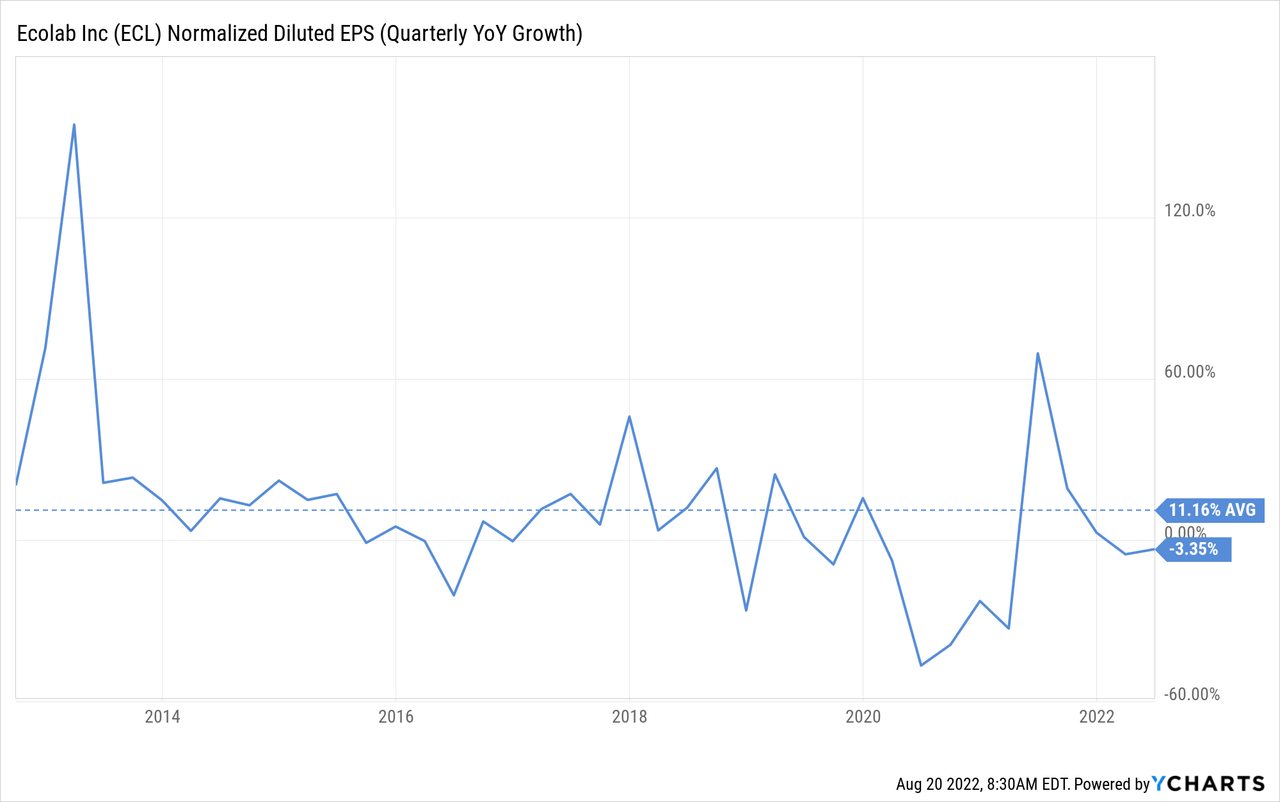

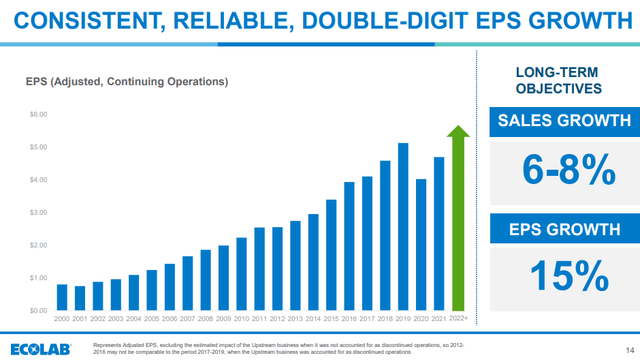

If you want earnings growth consistency, few companies outperform Ecolab on that front. As can be seen in the graph below, since the year 2000, Ecolab had been reliably increasing earnings per share almost every year. It took the Covid crisis and out-of-control inflation for Ecolab’s profits to go down significantly from one year to the next. Even then, they are already on the path to recovery, with 2021 being higher than 2020, and 2022 expected to be much better. The company’s long-term objectives are for sales growth in the range of 6% to 8%, and EPS growth of ~15%.

Historically, the company has delivered closer to a ~11% EPS growth, so we are a bit skeptical of the 15% EPS growth target, but we believe shareholders can still do very well if the company manages to grow earnings at more than 10% for a long time. Sales have historically grown about 7% per year, so we believe the sales growth target is more achievable.

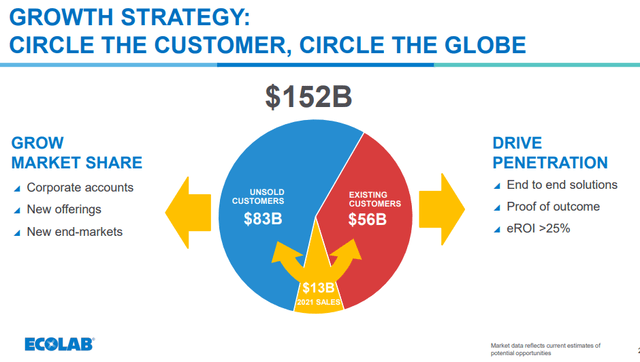

Growth

While Ecolab expects most of its growth to come from new customers, new products, and new end-markets, it believes it still can grow share of wallet significantly with its existing customers. Traditionally, it is easier to win more business from an existing customer compared to starting a new business relationship from scratch. Therefore, it is reassuring to see that there is still so much room for expansion within its existing customer base.

Balance Sheet

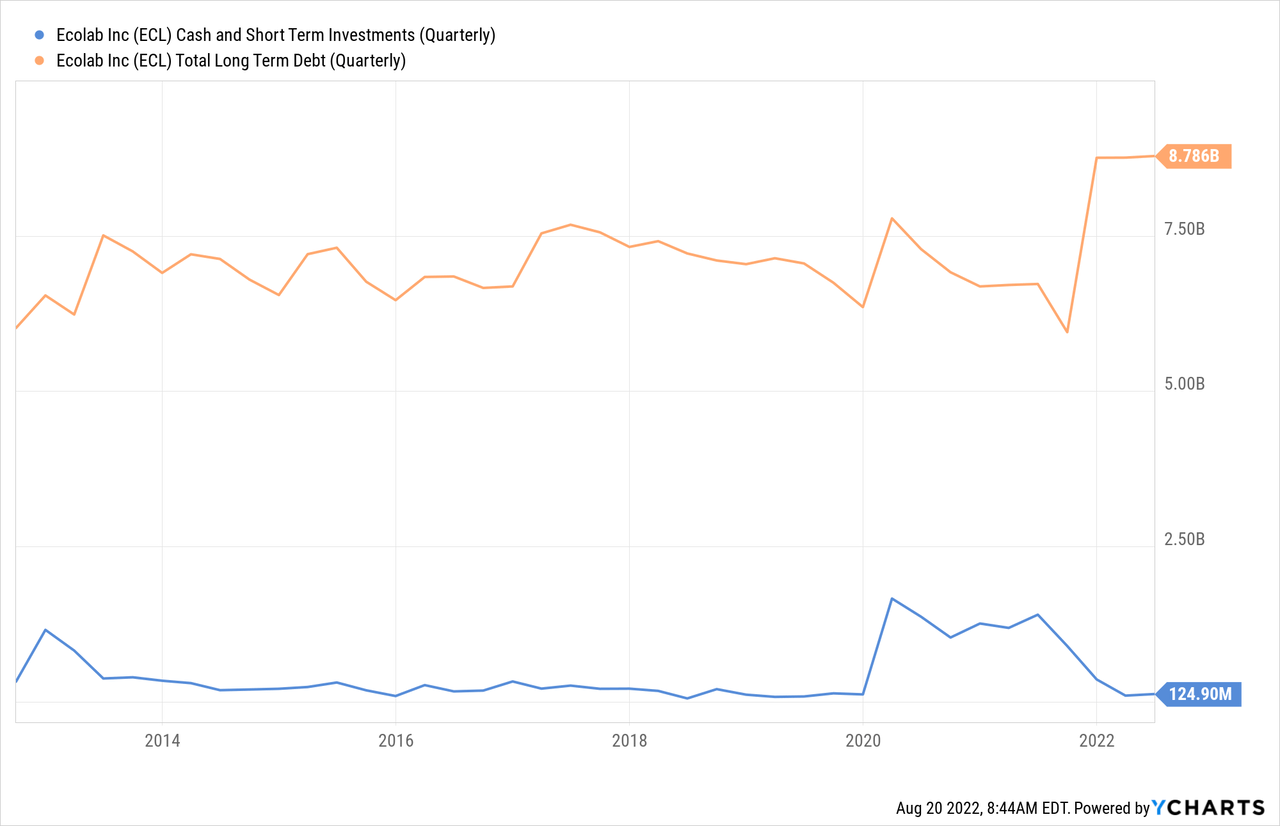

Ecolab does carry a significant amount of debt of ~$8.7 billion, especially when compared to its cash and short-term investments which amount to only ~$124 million.

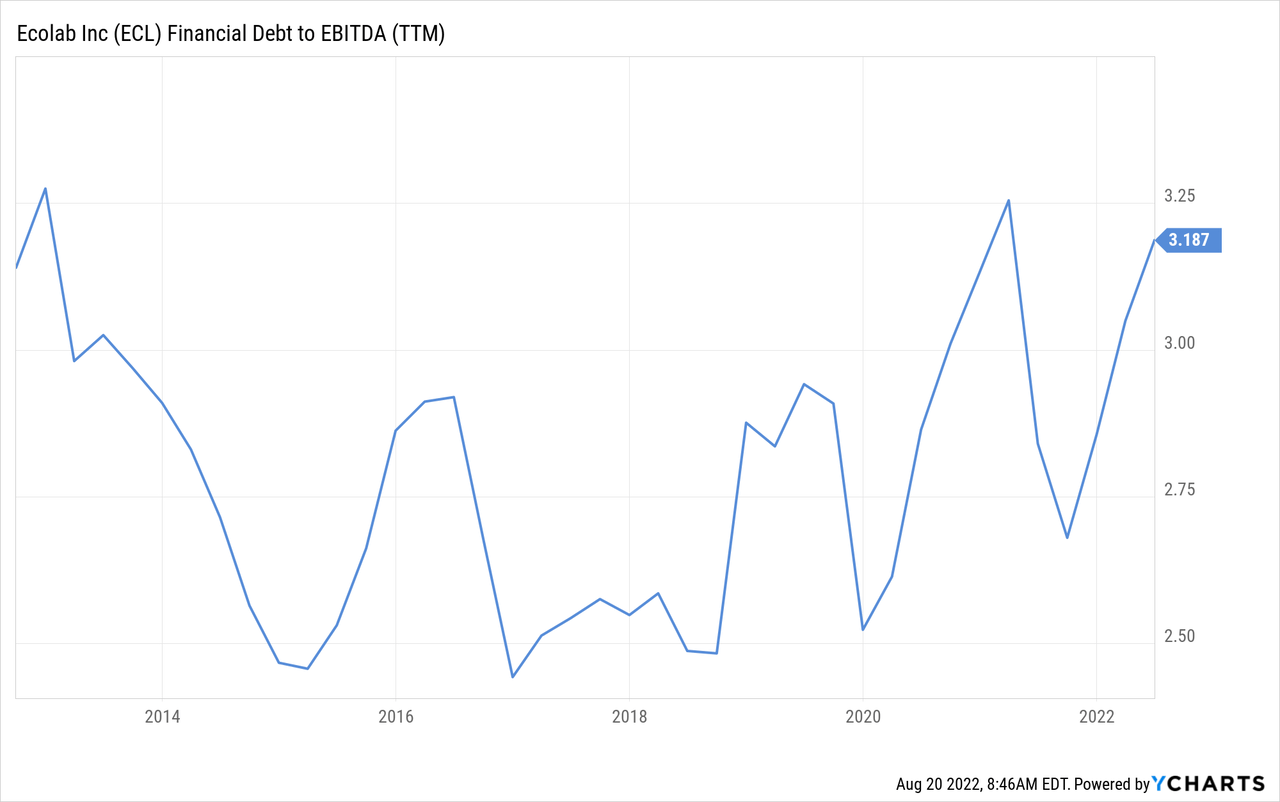

The company has a financial target of having ~2x net debt / adjusted EBITDA, but right now, it is closer to 3x.

ESG

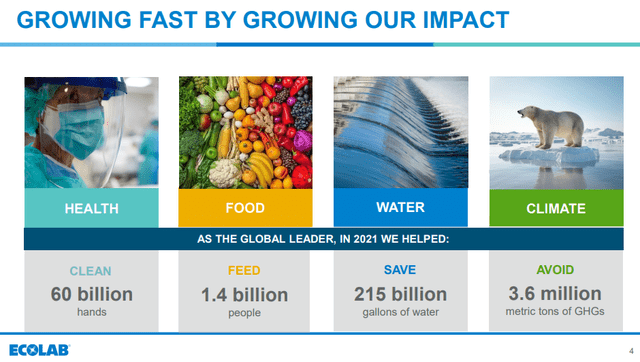

A discussion about Ecolab would not be complete without discussing its ESG impact. We believe that besides the attractive financials, this is also why Bill Gates liked the company, as it aligns with many of his goals, such as improving global health and fighting climate change by reducing Greenhouse Gas Emissions.

Ecolab is working to incorporate a lot of the best ESG practices in its own operations, but importantly, it also helps other companies achieve their own sustainability targets. These are some of the reasons it has been named one of the most sustainable corporations in the world.

Valuation

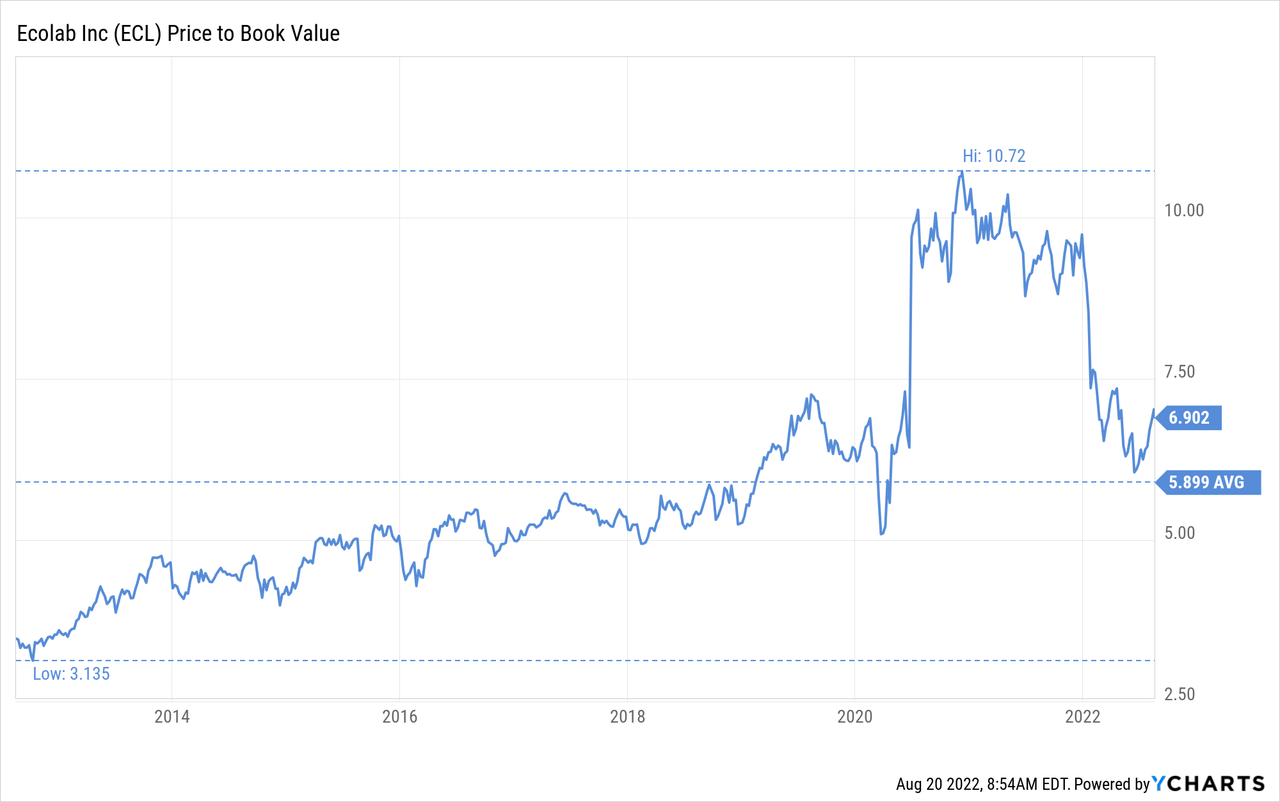

So, is Bill Gates overpaying for Ecolab shares by buying at current prices, or is he getting a good deal? Shares are definitely a lot cheaper than they had been for a while. For example, starting with price/book value, shares are close to the ten-year average of ~5.8x, currently trading at ~6.9x.

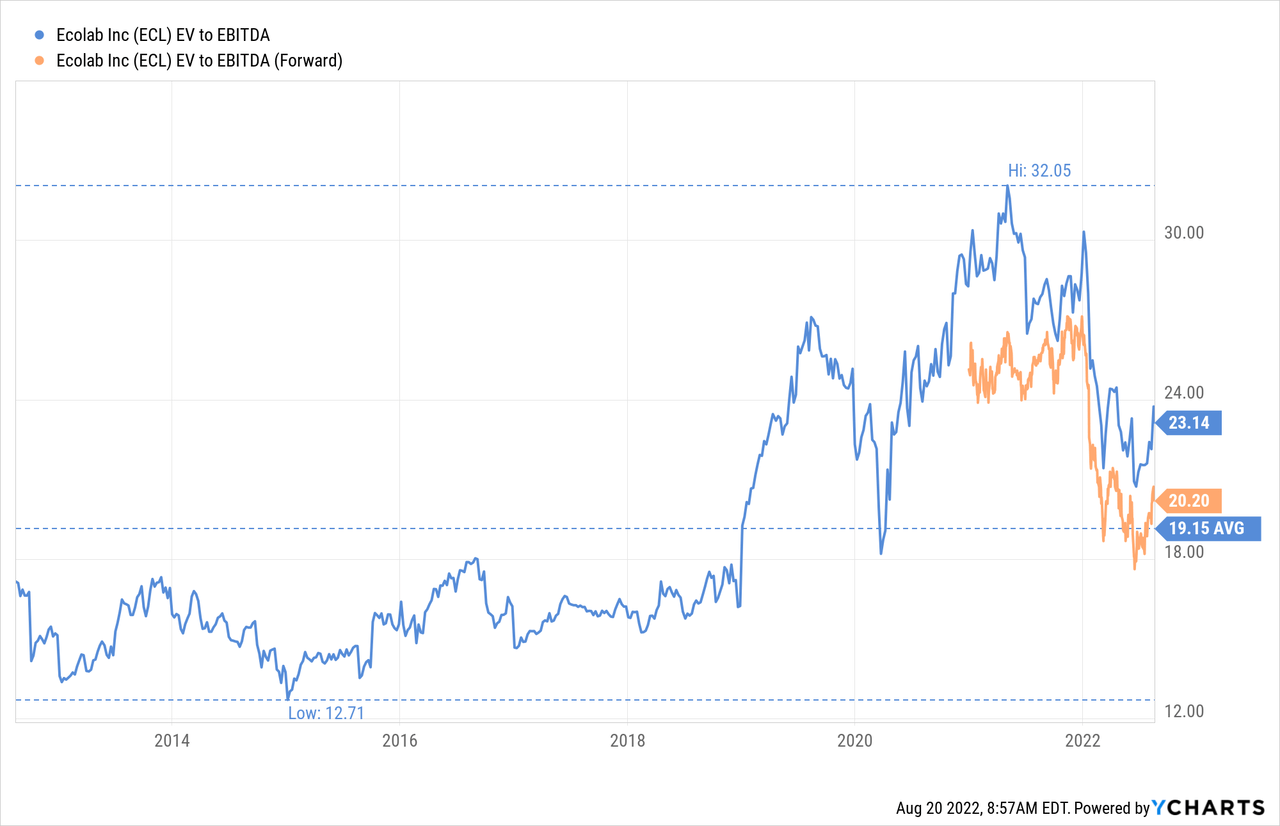

Forward EV/EBITDA is close to the ten-year average of ~19x. The trailing twelve months EV/EBITDA multiple is somewhat higher, but we have to remember that profitability is currently still being impacted by Covid and inflation.

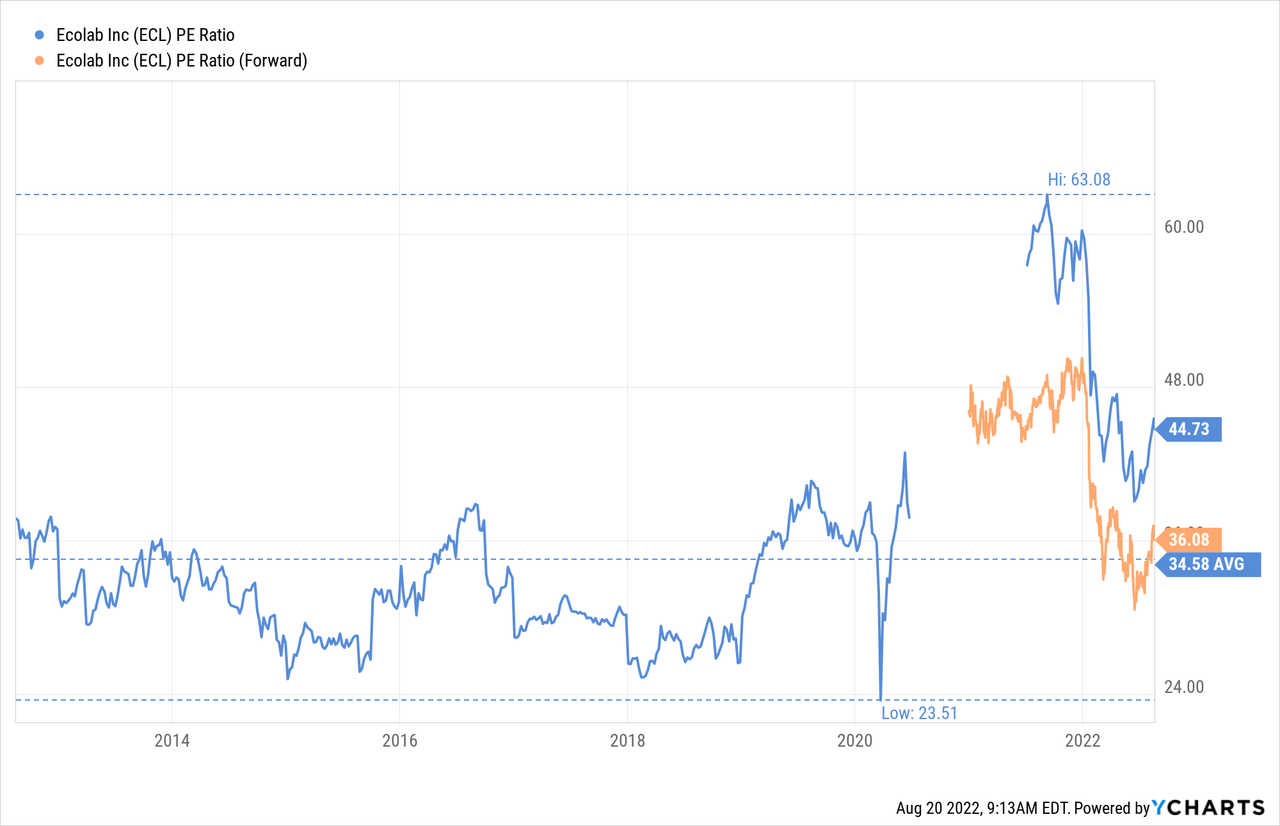

The price/earnings ratio tells a similar story, with the forward version being very close to the ten-year average, but the trailing twelve months version being a bit higher due to the current profitability issues.

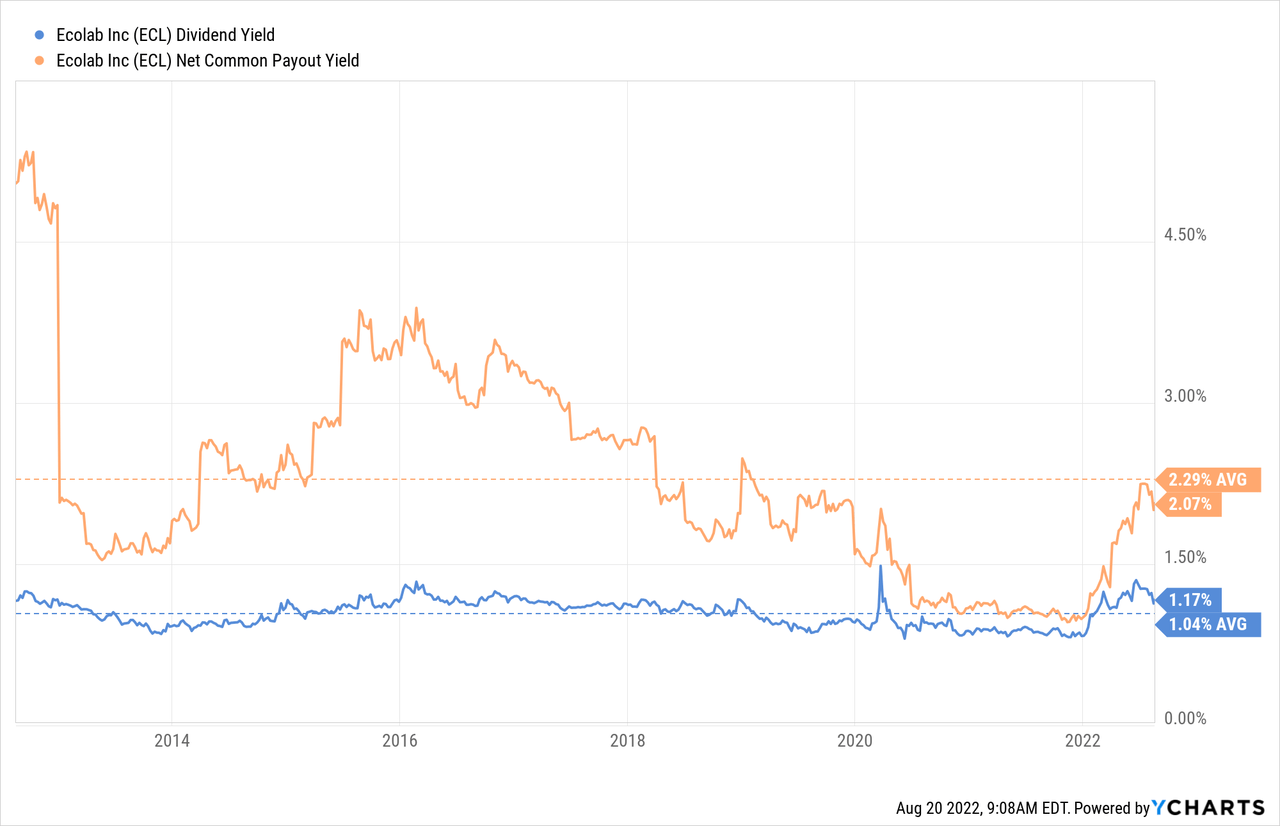

Finally, looking at the dividend yield and net common payout yield (which takes buybacks into consideration as well), we can see that both are close to their respective ten-year averages as well. We, therefore, conclude that shares appear fairly valued compared to the company’s historical valuation. We do not think that shares are currently a bargain, but we do not think they are overly expensive either.

Risks

For the time being, it seems that inflation and Covid will continue to depress earnings, and the company carries a significant amount of debt. While we would not call its leverage excessive, it is higher than management’s own target and could become a problem if the company’s profitability deteriorated significantly.

Another risk worth considering is that historically the company has traded at a premium valuation given its growth and stability, which means that shares could drop significantly should growth or profitability disappoint going forward.

Conclusion

We can see why Bill Gates likes Ecolab, it is a company that has grown very consistently for a long time until it was impacted by Covid and inflation. Bill Gates recently made open market purchases, which means that he probably sees value in the shares at current prices. We find the valuation reasonable, but not a bargain, with shares trading close to their historical multiples on a number of valuation indicators.

Be the first to comment