The Covid-19 outbreak and the shutdown of the global economy has investors fleeing Square (NYSE:SQ). The mobile payment company is highly dependent on small business customers, and the economic slowdown is going to hit their customer base the hardest. Just weeks ago, my view on the stock was negative with the price back above $80, and now, the stock is far more appealing after a 50% collapse in a matter of weeks.

Image Source: Square website

Small Business Focus

Square built their business of supplying a mobile payments solution to small businesses when other POS systems weren’t flexible enough for a business outside of a traditional retail store. For this reason, a substantial amount of their revenue is derived by customers requiring physical engagement likely hit hard by the coronavirus outbreak.

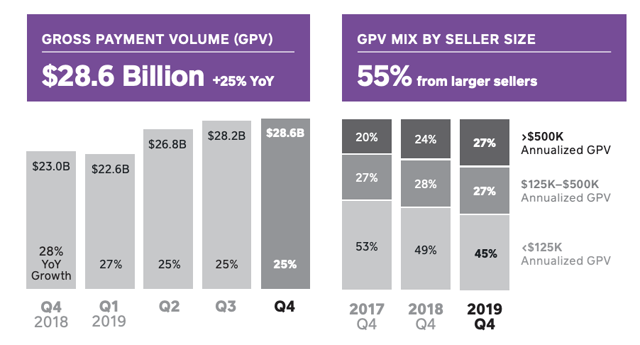

The company is constantly shifting business mix towards larger sellers, but Square still has 45% of their payments business from sellers generating under $125,000 in annualized gross payment volumes or GPV. These are businesses that by default can only employ a few people and are unlikely to be well capitalized.

Source: Square Q4’19 shareholder letter

The stock is down for this reason due to a large portion of their business with retailers destroyed over the next month or so. Even businesses in the $500,000 annualized GPV range with 5-10 employees are likely to struggle.

Square could easily see 30% of this business disappear in the next month with up to 10% never to return. The GPV last Q1 was $22.6 billion, and the payments company was on a path to 25% growth.

Normalized GPV in the quarter would’ve been around $28.3 billion without the coronavirus disruption. One can’t really predict the quarterly impact, but one has to guess the size of the customer base for Square once this virus shutdown ends.

The company could easily lose up to 10% of volumes through next year. Even with market share gains, Square could see growth rates dip from a 30% range to 20% or below. On an adjusted revenue basis, revenues were only scheduled to grow 24% to $2.8 billion, so the revenue growth rate would dip to below 15% with a loss of 10% of volumes.

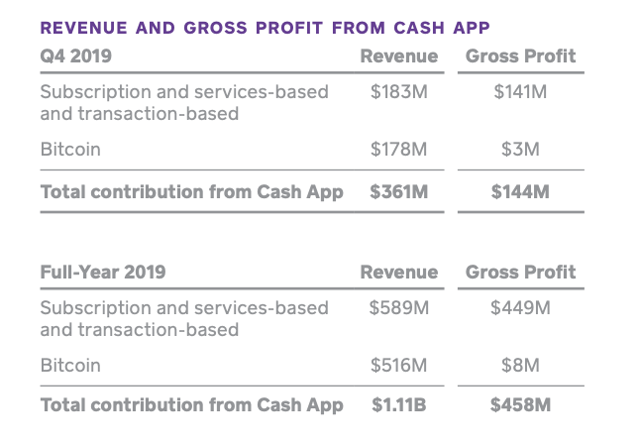

The big question is whether Cash App revenues are disrupted. The App alone delivered $183 million in Q4 revenues, while Bitcoin revenues were $178 million. Square should see a substantial dip in Bitcoin trading revenues with the price down substantially, though these revenues don’t count in the traditional adjusted revenue used to value the stock. Those revenues will shrink either during Q1 and definitely by Q2, but the only amount that matters is whether the $183 million from the Cash App revenues hold up here with the younger crowd lacking jobs and cash.

Source: Square Q4’19 shareholder letter

Stock Hit

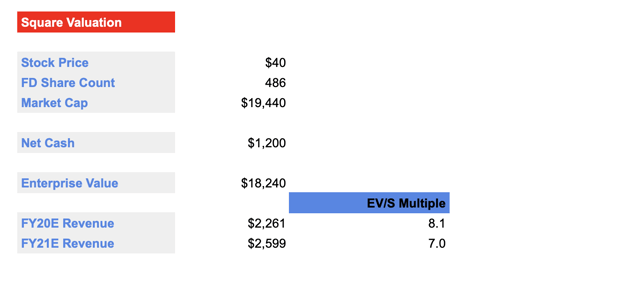

The stock has traded down from above $80 to below $40 in weeks. With a diluted share count of 486 million, Square is still worth $19.4 billion with the stock at $40.

If the company still forecasted adjusted revenues of $2.8 billion, the stock would be an extreme buy with revenues forecasted to grow at a 24% range. The question is what the market pays for the stock with a 10 percentage point hit to the revenue growth rate in the future.

At only 15% adjusted revenue growth for 2021 after the best outcome of probably flat adjusted revenues in 2020, Square would generate revenues of $2.6 billion next year. Now, these are more normalized numbers as the company could see a 30% to 50% hit to revenues in the next few months.

Square has a cash balance of $2.1 billion, so the company has no real liquidity concerns. The stock currently has an enterprise value of $18.2 billion.

Based on updated expectations of Square not generating any adjusted revenue growth in 2020 and returning to only 15% growth in 2021, the stock trades at about 7.0x 2021 revenue estimates.

Source: Stone Fox Capital calculations

Source: Stone Fox Capital calculations

Takeaway

The key investor takeaway is that even with the impact to revenues, Square hasn’t traded this cheap in years. Over the long run, the payments company is innovative enough to come out of this difficult time stronger and could return to faster growth than forecasted. Users could actually utilize the Cash App more aggressively in a virtual world, making Square a buy at $40. Anybody buying the stock has to brace for some volatile numbers in the next few quarters.

Looking for a portfolio of ideas like this one? Members of DIY Value Investing get exclusive access to our model portfolios plus so much more. Signup today to see the stocks bought by my Out Fox model during this market crash.

Looking for a portfolio of ideas like this one? Members of DIY Value Investing get exclusive access to our model portfolios plus so much more. Signup today to see the stocks bought by my Out Fox model during this market crash.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Be the first to comment