D3signAllTheThings

Investment Thesis

Sociedad Química y Minera de Chile S.A. (NYSE:SQM), as the name entails, is a foreign chemical company. Typically, readers would have no interest in SQM for two reasons: its a foreign business and the bulk of its revenues come from a chemical.

But today, the investment landscape has changed. Why? As Lukasz Bednarski describes in his book, lithium is the new oil. And what Bednarski describes is that there’s a clamor for lithium, and not all lithium grades are the same.

This is an industry prone to vertical integration, where only the biggest will survive.

What you need to do is back companies that are established, with enough experience and prowess to deliver into one of the fastest moving corners of the market.

So let’s get to what’s at play here.

This Is A Lithium Story

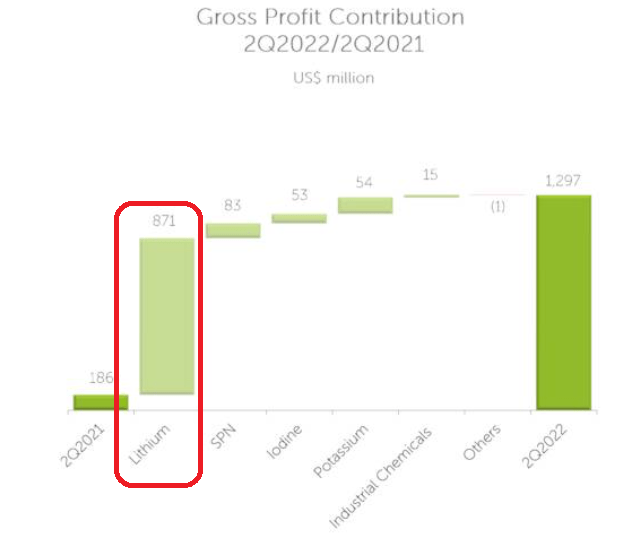

As of H1 2022, approximately 70% of SQM’s gross profits come from SQM’s lithium and derivatives segment.

SQM Q2 2022

Lithium is SQM’s fastest-growing segment. Consequently, I don’t consider other elements of this company to be accretive to the investment case here, one way or the other, either bearish or bullish.

Moving on, for the vast majority of investors, lithium is known as a commodity that’s required in EVs. And while that’s certainly the case, there’s more nuance to it than that. Why?

Two factors are important. In the first instance, the gradient of lithium is an important consideration. Given that not all lithium gradients are equal, and only the highest gradients matter for EVs.

Within this consideration, keep in mind that the one thing that is keeping EVs from broad consumer adoption are the charging capabilities. Simply put, lithium is less commoditized than many investors believe. The highest quality lithium leads to higher battery capacities.

Thus, the highest qualities of lithium are less commoditized and more of a specialized chemical.

The second consideration that is important is getting this lithium into EVs. Lithium needs to be transported out of the ground, and one of the biggest EV markets is likely to be the US.

With this in mind, lithium in Australia will not be a significant competitor to SQM. After all, transporting lithium from Australia would substantially break the economics of a lithium miner.

Thus, I believe that there are some natural barriers to entering the lithium market, provided some level of a moat around this sector.

The US Needs Lithium

As alluded to already, the US has ambitions to become a large EV market. And so far, it’s far behind China. In order to play catch up, the US government launched its Inflation Reduction Act bill.

This bill provides subsidies to EV companies that manufacture a substantial portion of the car components either in the US or from a free trade partner, such as Chile.

Consequently, we can surmise that both the Chilean government and the US government are looking very favorably toward SQM.

Bearish Considerations For SQM

Presently, there are some concerns that the EV market may be showing some signs of slowing down. We’ve recently seen Tesla (TSLA) make some comments that lead one to believe that all may not be so sunny in the EV market.

To be fair, it’s not entirely shocking, given that the US economy has gone from being incredibly strong, to highly uncertain in a course of a few months.

Consequently, given that SQM has been so aggressive in negotiating a substantial portion of its lithium contracts away from long-term contracts and closer to the spot market, there could be some unnecessary exposure that the company may be opening itself to.

For now, this is not a worry, with the lithium spot market moving from strength to strength. But if the EV sector starts to show some weakness, and OEMs start to cut production, all of a sudden, the lithium market could sell off.

The Bottom Line

SQM is priced roughly at around 12x EBITDA. That’s clearly cheap for a business that’s growing at a breakneck pace. But there again, it’s cheap for a reason. Because we are talking about investing in a non-US company.

That being said, my whole investment thesis is not about multiple expansion. That’s not where the bull case finds itself.

The bull case is that there’s a huge demand for lithium and there’s not enough supply coming online any time soon. There are no heroics necessary here for investors to be rewarded. Investors that have a little patience and are looking for a medium-term investment would do well to consider SQM.

Be the first to comment