VallarieE/E+ via Getty Images

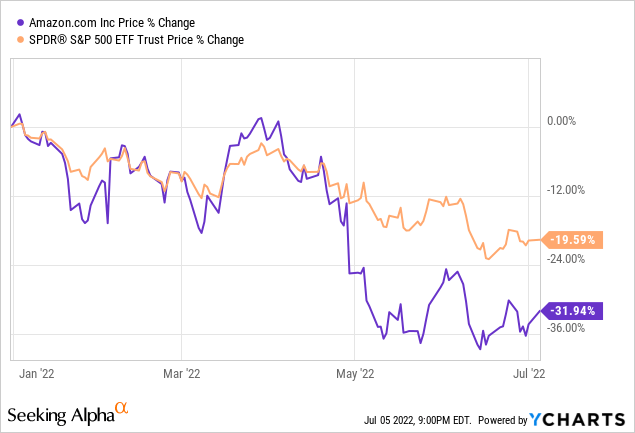

The poor performance of the first half of 2022 is offering no shortage of doomsday predictions today. Investors who are unlucky to start positions on the S&P 500 (NYSEARCA:SPY) between November 2021 and January 2022 already lost 20.4% of their investment. Still, investors who are averaging down by dollar-cost averaging will have bigger absolute losses if equity markets crash closer to 50%.

Roubini Predicted Another 50% Drop

Known as Dr. Doom, Nouriel Roubini predicted another 50% drop. He asked, “Will equity markets rebound from the current bear market (a decline of at least 20% from the last peak), or will they plunge even lower?”

He answered that markets will most likely plunge lower.

Roubini is famous for predicting the 2007-2008 subprime mortgage crisis in the U.S. and the global financial crisis that followed. Skeptical, bullish investors who are used to buying the stock market dip will ignore this economist. Bullish investors will reason that lower stock prices from the short-term volatility lower the average price paid for a stock index.

This is partly true.

The average cost basis will fall: SPY at $479.98 plus an equal weighting at $381.96 (the closing price on July 5) is $430.97. The loss falls by half, from 20.42% to 11.37%. However, the stock exposure doubles. If markets fall by 50% more based on Roubini’s prediction, then investing losses will mount.

Young investors may reason that with a timeframe of 20-30 years, today’s losses are tomorrow’s gains because markets always go up.

Fed Initiates Quantitative Tightening

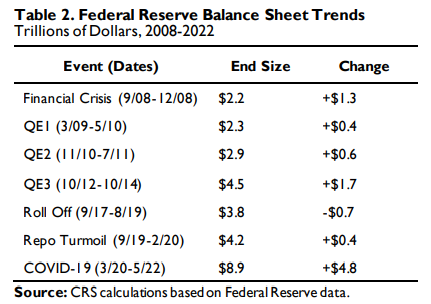

Since 2008, the Federal Reserve added $28.8 trillion to its balance sheet. Since the financial crisis, the U.S. central bank-led world banks in QE.

Fed’s QE (CRS Reports)

The Fed’s addiction to printing money is the primary catalyst for the rising stock markets. In November 2021, the Fed abruptly ended QE. It announced that it would taper asset purchases.

The bank gave markets plenty of advanced warnings for Quantitative Tightening. It will shrink its Treasury securities by up to $30 billion monthly. In addition, it will allow $17.5 billion in mortgage-backed securities to roll off its balance sheet. This is the monthly target.

Investors buying stocks steadily are betting on two things. First, they are guessing that June 2022’s consumer price index will ease. CPI must fall steadily throughout the summer before the Fed slows its pace of rate hikes.

Second, investors are finding comfort in the belief that the Federal Reserve will not let stock markets crash.

At the congressional testimony, Jerome Powell said, “We are strongly committed to bringing inflation back down, and we are moving expeditiously to do so.” The Fed Chair did not mention the importance of the stock market.

The Fed’s two tasks are to achieve full employment and stable inflation. May 2022’s CPI increase of 8.6% is not stable inflation.

Transitory Inflation Partly True

Investors may criticize the Fed for characterizing inflation as transitory. Unfortunately, workers are demanding higher wages to compensate for higher costs. This will lead to permanent inflation. Still, The Fed’s view of transitory inflation has some truth to it.

Covid-19 lockdowns worldwide caused a deeply disrupted supply chain. When Russia invaded Ukraine, it disrupted the supply chain further. In addition, China adopted an impossible dynamic zero Covid-19 policy. Initially planning a seven-day lockdown, the country ended up locking Shanghai for over two months.

Those events sent raw material prices soaring. More recently, wheat prices fell and WTI crude prices fell below $100.

Is Dr. Doom Right?

Investors should not rely on macroeconomic forecasts from anyone. They cannot rely on Roubini’s prediction, relying on past stock market declines.

Every bear market is different.

The economy has too many moving parts to make such predictions. People will often behave differently than what models assume.

In the stock market, investor expectations are even more unpredictable. Just a few weeks ago, investors cheered that Shell (SHEL) and ExxonMobil (XOM) would report record quarterly profits. This bullishness abruptly reversed on June 9, 2022. Markets are now spinning the story that a recession will curb demand.

Investors should digest the available data and assess where that will take markets. Inflation will remain at stubbornly high levels. The Federal Reserve will keep raising rates at every policy meeting until inflation falls.

People will cut back on spending. Higher mortgage, food, and energy costs will hurt their disposable income. They will spend less on “nice to have” luxuries. This includes streaming video, cable television, luxury clothing, and fancy cars.

Russia’s war with Ukraine will not end anytime soon. This could lead to a severe food shortage in neighboring countries. It could cause another immigration crisis for the European Union.

Europe will face an energy crisis as the winter approaches. This will decrease the energy supply and increase prices.

Is S&P 500 a Buy?

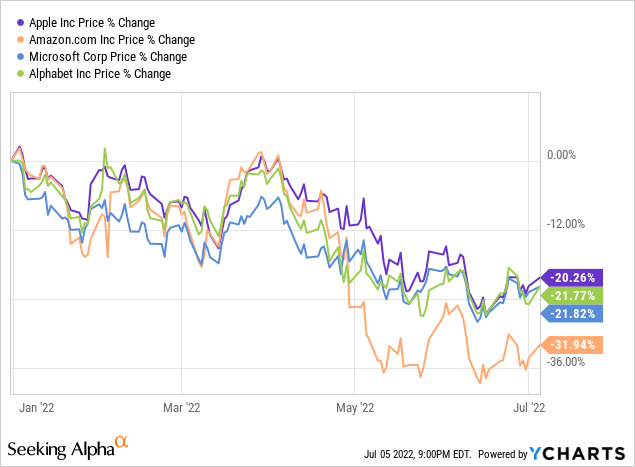

In my earlier example of DCA, I said that a falling index would increase investment losses. Investors need to formulate a fair value for the S&P 500, Nasdaq (QQQ), and other sub-sectors. Both ETFs will have a heavy weighting in Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Google (GOOGL), and Tesla (TSLA).

Per YCharts, the top S&P 500 holdings are:

|

Symbol |

Name |

% Weight |

Price |

|

AAPL |

Apple Inc |

6.60% |

141.6 |

|

MSFT |

Microsoft |

6.00% |

262.94 |

|

AMZN |

Amazon.com |

2.96% |

113.46 |

|

GOOGL |

Alphabet Inc |

2.02% |

2266.24 |

|

GOOG |

Alphabet Inc |

1.86% |

2278.42 |

|

TSLA |

Tesla Inc |

1.77% |

698.86 |

|

BRK.B |

Berkshire Hathaway Inc |

1.55% |

275.67 |

|

UNH |

UnitedHealth Group |

1.50% |

505.12 |

|

JNJ |

Johnson & Johnson |

1.46% |

177.53 |

Consumers are unlikely to delay their iPhone upgrades. Apple will increase its affordability by offering a payment plan. If Apple device sales weaken, the company will rely on service revenue instead. In the March quarter, Apple posted a record in Services revenue. Its platform added 165 million subscribers in the last 12 months alone. It now has 825 million paid subscriptions.

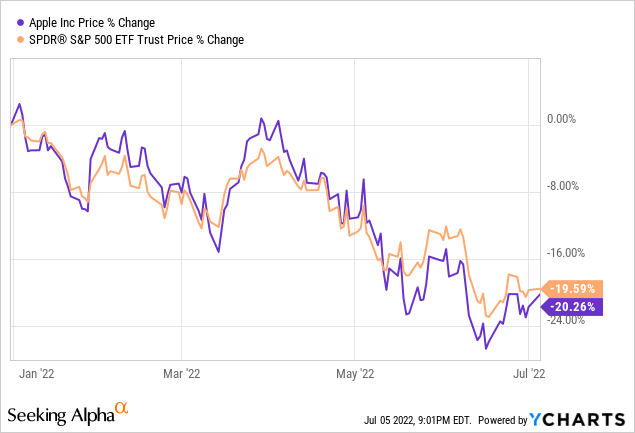

Above: AAPL stock could lift SPY ETF.

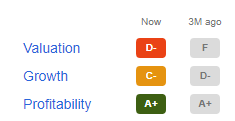

After the stock fell from a $182.94 high, its valuation score improved:

AAPL Quant score (SA Premium)

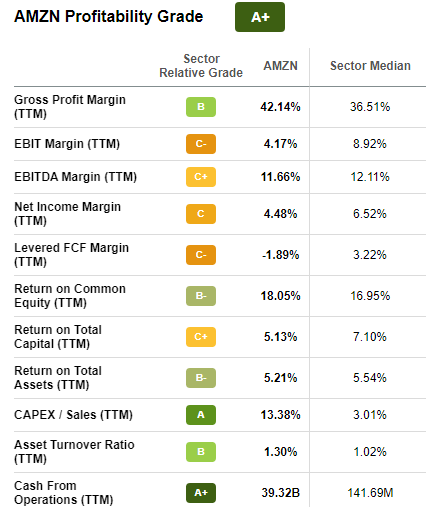

Amazon is slowing its expansion plans for its e-commerce business. It spent 40% of its $61 billion capital investments on a trailing 12-month period for infrastructure, primarily supporting AWS.

Amazon is a dominant online retailer whose stock could trade in a $102 – $120 range. When markets improve, the stock could trend higher. AMZN stock scores an A+ on profitability.

AMZN stock profitability scores (SA Premium)

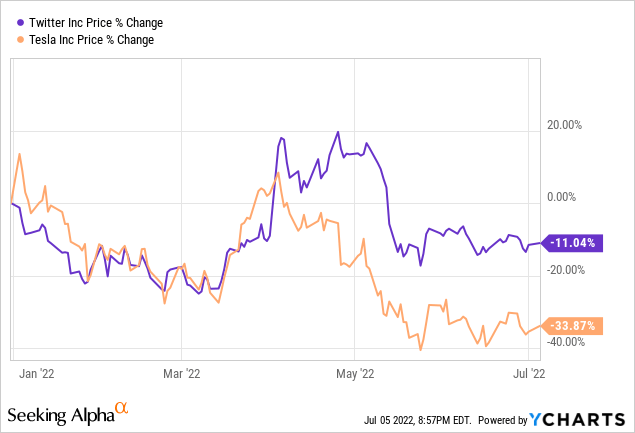

Bears will point to Tesla’s valuation as a reason to avoid the stock. And while CEO Elon Musk is distracted buying Twitter (TWTR), the electric vehicle has a sizable lead.

Above: mergers and acquisition investors may bet on Elon Musk seriously buying Twitter (TWTR).

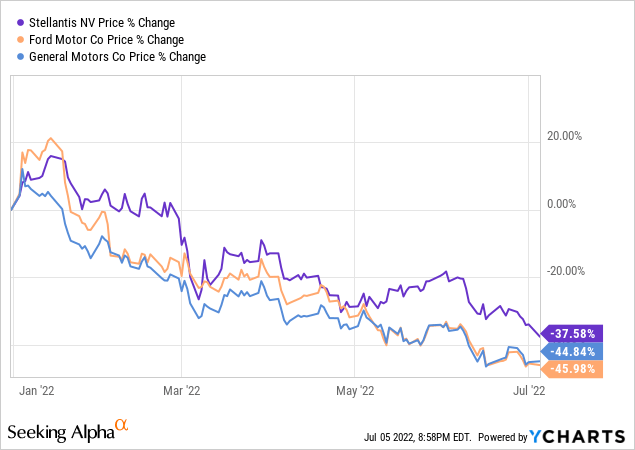

Other internal combustion engine firms have a divided objective. They must maintain their traditional, low-margin business while spending billions to catch up to Tesla. Those companies include General Motors (GM), Ford (F), and Stellantis (STLA)

Above: Stellantis is the worst of the three ICEs. It blamed a chip shortage for its problems. Ford posted a 31.5% Y/Y sales increase. It did not mention a decline in Mach-E sales. GM posted a 15% decline in sales.

Your Takeaway

The 50% plunge in market’s headline is fearmongering. Investors should use the warning as a reminder to re-adjust the portfolio. Accumulate companies that have a strong underlying business. Companies like Apple, Tesla, and Amazon are relatively resilient regardless of market conditions.

Weaker firms will falter, while the biggest, best ones will thrive.

Be the first to comment