mihailomilovanovic/E+ via Getty Images

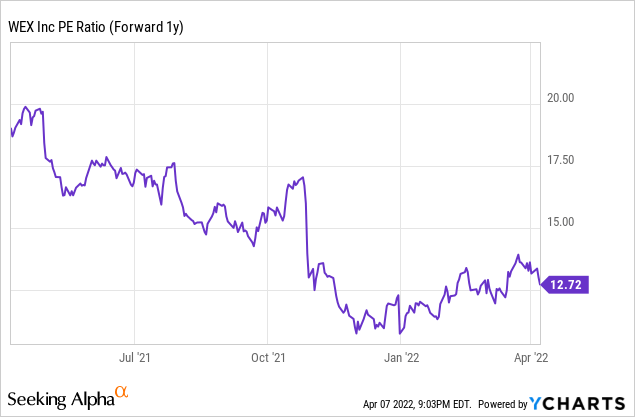

Leveraging its positioning at the intersection of the secular cash to card migration, WEX Inc (NYSE:WEX) brings to life the idea that complex payment systems can be made simple. The WEX business model allows it to generate predictable revenue growth due to its high retention rates and long-term contract terms. WEX’s pricing power also allows it to take annual 1% to 2% price increases with limited resistance from clients – a particularly crucial element given the current inflationary backdrop. Plus, WEX operates a payment network that scales, so continued growth should result in high incremental, transaction-based margins going forward. There is a scarcity of companies that can comfortably sustain 10-15% revenue growth (including M&A) and high-teens earnings growth targets, but with WEX, investors are presented with an excellent opportunity to own one at a reasonable ~13x P/E valuation.

Fuel Price Tailwind Supports the Outlook, Compounding Potential Intact

WEX’s 2022 investor day started off with some good news – expect a revision to the full-year guide at the Q1 2022 earnings as on a quarter-to-date basis, fuel prices were a $0.04/share tailwind (or ~2%) to the current EPS guidance. Based on the YTD oil price and the futures curve, WEX’s base case has now also moved to a $4.00 average fuel price scenario for the full year (vs. the previous $3.55 fuel price guidance). For context, an incremental $0.10 move in the fuel price translates to $15m of additional revenue, so the implied ~$70m tailwind for the year is great news. Now, if we were to assume 100% flow through to earnings from the incremental fuel revenue, we could be looking at a significant ~7% EPS tailwind for the year. Near term, fundamental drivers such as a more unified approach with its global commerce platform should boost the outlook as well – given its ~$25bn TAM across its three segments and 5-10% market growth rates, any cross-segment synergies could yield meaningful upside.

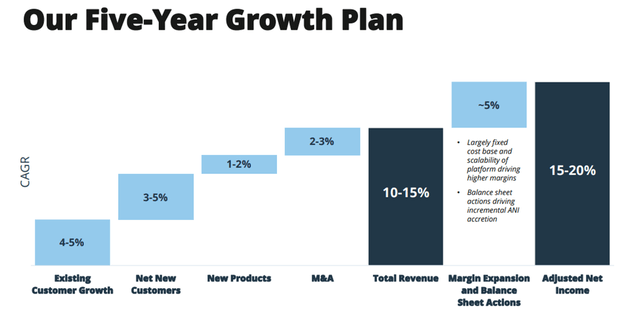

There were no surprises on the mid-term outlook, though, as WEX’s prior targets of 8-12% organic growth (10-15% including M&A) were re-iterated. By segment, Fleet offers the slowest growth at 4-8%, although the 10-15% and 15-20% guidance for Corporate & Travel and Health and Employee Benefits represent a robust acceleration from recent growth trends. Assuming these growth targets hold, the scalability of the platform could play a key role, as the high fixed-cost base is spread over a larger base, translating into further margin expansion. Plus, WEX is in the early innings of extracting the cross-sell opportunities across its platform – as <10% of existing customers use more than one WEX solution, WEX’s recent investment in a direct sales force should pay dividends. Additionally, the digital channel remains an untapped growth opportunity – while ~60% of new fleet customers were acquired through digital, a ramp-up in digital marketing efforts this year should drive an increased digital share of customer acquisition going forward.

EV Headwinds are Material but Gradual; Opportunities Exist

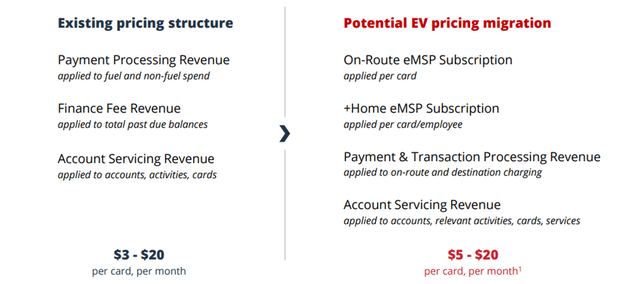

EV concerns have clouded the WEX investment case for a while, and rightly so, in my view – by 2025, WEX has guided EV penetration to reach 8% in the US and 15% in Europe. The migration to EVs will not be straightforward and WEX risks getting left behind, but if successful, I’d contend that WEX could unlock significant accretion given the superior EV unit economics. A single EV card of $5-$20/card/month compares very favorably to an ICE vehicle card at $3-20/card/month, given the richer value-added service offerings such as home charging reimbursement. EVs also add complexity to consolidated reporting, benchmarking, and cost of ownership analysis, all of which could drive additional recurring fees from mixed fleets over the long run. Another factor that could play into WEX’s favor is that large numbers of ICE vehicles are still being added to the road, and thus, any transition will likely be gradual. Key initiatives to look out for include WEX’s EV charging solution in Europe (slated for an H1 2022 launch) and a prototype release for US customers later this year. That said, WEX’s current five-year guide doesn’t embed any material headwinds from EV, which does leave the stock exposed to potential disappointments down the line, particularly with oil prices at multi-year highs right now.

Ample Capital Allocation Optionality

Given its high ROIC profile, it makes sense that WEX has prioritized investing internally – hence, the updated guidance is for its capex run-rate to accelerate to ~6% of revenue this year. M&A is the second priority, with WEX outlining strategic objectives around scale, product extensions, and geographic expansion opportunities. With leverage still below its long-term 2.5x-3.5x target range, however, I suspect WEX will funnel more cash flow into M&A over time to drive more relative growth outperformance. This is a good thing, in my view – WEX has a solid infrastructure in place to vet its deal flow, and thus, it has been able to maintain price discipline and realize significant accretion (>$80m in revenue synergies) in the seven deals closed since 2016. The third option is for capital return. The preference here has been for buybacks thus far, but a modest ~1% dividend yield could also quite easily be implemented. While investors aren’t likely to get rich off a ~1% yield, a dividend would broaden the investor base and could be accretive to the valuation multiple in the long run.

Fintech Compounder at a Reasonable Price

There is a lot to like about WEX’s business model, from its durable competitive advantages and high barriers to entry to its proven ability to widen the moat through targeted M&A. In its current form, WEX has pricing power, which has allowed it to realize 10-15%/year revenue growth even through the COVID-driven turbulence. This should continue into the coming years, given the secular tailwinds in its high-growth Travel/Corporate payments business and with the Health/Benefits business still in the early innings of its growth trajectory. While cyclical concerns on its Fleet Solutions business are valid, some perspective is important – the segment is still guided to grow at a 4-8% pace, with additional fleet wins likely to add incremental upside to the growth target over the coming years. Plus, its non-fleet businesses, which are increasingly growing into a meaningful revenue contributor, are less cyclical and relatively insulated from volatile fuel prices. The most common pushback I’ve encountered with the WEX investment case is its price, but with its YTD weakness, the stock trades at ~13x fwd P/E, which isn’t pricey at all relative to the mid-term guidance. Naturally, I would prefer to own WEX at a lower price point, but quality companies rarely come at depressed valuations, so current levels still present an attractive entry point, in my view.

Be the first to comment