roundhill/E+ via Getty Images

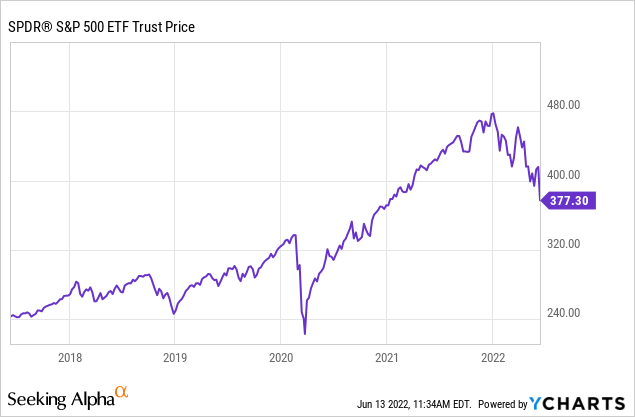

As of my writing this, the S&P 500 index (NYSEARCA:SPY) is down roughly 21% for the year. The proximate cause for the most recent drop was Friday’s release of the May Consumer Price Index. What was so shocking about the report is that there was truly no silver lining. Inflation was bad in every category, led by energy, food, and housing. Not long before this, a Freight Waves report showed slowing real demand from US consumers (likely driven by skyrocketing prices). Earnings warnings from the likes of Target (TGT), Microsoft (MSFT), and DocuSign (DOCU) cast additional doubt on whether earnings can grow at all this year. All signs now point to the worst-case reasonable scenario of corporate profits coming in below expectations and multiples shrinking on top of it. This is known as stagflation.

In a development with echoes of 2008, popular crypto exchange Celsius halted investor withdrawals today. This is an ongoing situation with a rescue plan potentially in the works, but barring some sort of external bailout, my degree of confidence that they’ll be able to return depositors’ money in full is low. Celsius gathered tens of billions of investor deposits by promising double-digit interest payments on investor deposits, but it seems that their product was a little riskier than they let on. Well, people are asking for their money back and Celsius doesn’t seem to have it! The cryptocurrency market went into meltdown when the rumors of this began to spread last night, with most major cryptos down 10%-25% over the last 24 hours and Bitcoin (BTC-USD) down about 16% for the day as of my writing this. And like 2008, Celsius is likely not the last shoe to drop.

The Updated Short-Term Outlook For The S&P 500

Put another way, the massive government stimulus of 2021 got investors to collectively believe that the pandemic had somehow unlocked increased prosperity and growth and that previous valuations for stocks were previously too low. Now, this thesis is under some serious examination.

When it comes to public finance, you generally can’t get something for nothing. People in business routinely make millions of dollars off of niches, a relationship, or luck. When you’re running a country though, everything is a tradeoff and there are almost never quick fixes. The current surge of inflation shows that printing money in all likelihood did not lead to increased prosperity for the world – and that corporate profits and stocks probably need to correct back to where they were pre-pandemic, which implies a fair value for the S&P 500 somewhere in the 3200-3300 range. This isn’t to discount the long-term potential of American business – we can do great things by improving productivity with technology and new thinking. But these changes take years to take full effect. Before that happens, there are a lot of junky companies that got funding in the stimulus-driven, computer-simulation economy that need to go out of business.

The current stock market situation isn’t too different than the fire suppression policies that have been the bane of California’s existence. When you put out every fire, what happens is that over time the dead wood builds up, and when the fire does happen, it’s extremely hard to control. For the economy, cutting interest rates and/or doing QE every time the economy has slowed down has driven markets up more than they would have gone otherwise, but led to an increase in the number of weak, unprofitable companies in business and an increase in the severity of bear markets since the turn of the century. There have been two 50% drops since 2000, and I wouldn’t be terribly surprised if we get a third here, taking stocks down to S&P 2400 or so. This said, if it did, stocks would be very undervalued. I don’t think it will get that bad, but anyone who’s living fully off of their money should at least game plan a 2008-style scenario happening in 2022-2023.

This has been something we’ve been talking about for the last nine months and I’ve helped people reduce risk and hedge, but if you’ve held all the way down there’s not much you can do at this point besides selling speculative positions (you can buy them back in 31 days if you’re a true believer), harvesting tax losses, and paying down debt when possible. Options prices have skyrocketed, while stock prices have tanked, closing the window for people to hedge with puts.

I believe the S&P 500 is still a bit less than 20% over fair value, but the value of selling, booking gains, etc., is diminished now that the market has turned so decisively. Q2 earnings and guidance throughout July and August will let us know the extent of the damage and determine whether we can reach a bottom.

The Biggest Present Threat To The Economy: Housing

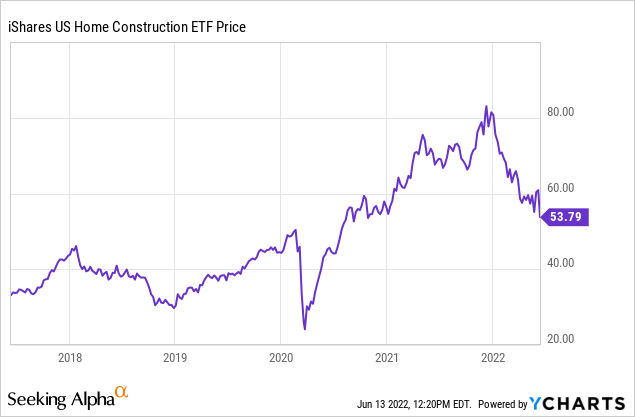

Mortgage rates have gone from roughly 3% to 6% in one of the fastest moves ever. These are on top of price increases of 30% or more. I’ve personally seen payments for deals people are doing locally go from about $1,500 per month to $4,500 per month due to skyrocketing prices, skyrocketing rates, huge property tax increases, and big increases in HOA dues and homeowners insurance.

That’s not all – have you gotten your utility renewals? Mine was quoted at about a 15% increase. Imagine buying a 5,000-square-foot house here in Texas and paying $1,000 per month in electricity bills during the summer. The minute unemployment ticks up, there’s going to be a deluge of selling. People simply cannot afford to get hit with all of these simultaneously with wages only up mid-single digits. If you bought 10 years ago, this likely doesn’t concern you. But people paying 6% on a house that’s 30%-40% more expensive than two years ago with few constraints to long-term supply are likely in a lot of trouble.

Buyers are waiving inspections, bidding mid-to-high five figures over asking prices, moving in, and then the county comes back and doubles their property tax. And adjustable-rate mortgages are back in full force as buyers can’t qualify any other way. The only way they’ll make money on these is by selling to someone else for an even higher price, or holding for decades to amortize the dramatic increase in cost over time.

To put this in view, the purchasing power of someone with $100,000 annual income back when rates were 3% was about $720,000 (assuming a 20% down payment). Now, with rates at 6%, it’s about $530,000. In a vacuum, this implies a drop in buyer purchasing power of nearly 26%. This is on top of the additional mortgage fees/taxes imposed by the government on high-value homes and investors to slow down the housing market. This is one top of the surprising fact that we’re overbuilding based on slowing population growth. Something’s got to give, and mortgage rates are now at 6.1% as of this morning.

Look out for the iShares Home Construction ETF (ITB), one of the biggest losers over the last week.

Inflation and Commodities

The Fed’s narrative was that core inflation was peaking and that they could go slow with interest rate hikes so as to not shock the economy. Then inflation reaccelerated, led by food and skyrocketing gas prices, with the U.S. national average now over $5 and possibly headed to $6.

The Fed meets this week in what will be another huge test of the market’s resolve. The press release will come out at 1 p.m. Wednesday, followed by a press conference.

The FOMC is expected to raise interest rates by 50 bps to a range of 1.25-1.5%, but the market doesn’t believe this is enough. Whether the Fed goes 75 bps or more, and if their comments on the economy imply sharper rate increases to come are very important for the short-term direction of the market.

The biggest problem here is oil. Oil has relentlessly ground higher while the economy slows down, backed by the tailwinds of Ukraine, underinvestment domestically, and global political chaos. There are no easy fixes for this, only a long process of demand destruction, improving energy efficiency, and hoping for luck.

Some of this stuff going on with oil simply cannot be made up. The White House is potentially going to Saudi Arabia to ask them to pump more oil. In return, the Saudis are sure to ask for an arm and a leg. They’ve been asking for advanced weaponry like F-35 jets for a long time now, and they’d likely be willing to trade oil for it. But there’s no guarantee that the regime won’t change 5-10 years down the road, leading to the risk of these weapons being used against American or Allied troops. Across the Persian Gulf, Iran will sell us oil, for their own price and with potentially worse consequences.

Russia too would be happy to sell the US oil, but they’re harshly sanctioned due to the war in Ukraine. Russia also has taken the step of funding conflict in oil-rich Libya, which makes Russian oil more valuable – and gives them an astronomical return on investment while hurting the entire global economy. The White House wants to bring Venezuela back to producing more, but they have their own issues. Permian shale doesn’t look so bad in this context, but it’s considered political suicide for the Democrats to help them. Why won’t they help increase oil production in Texas? How about the Keystone Pipeline? None of these are mutually exclusive with continuing to develop sustainable sources of energy. This doesn’t hold a candle to Germany’s energy policy, which handed Putin a mountain of leverage after they shut down the nuclear power plants that were providing much of their power.

This means that the only real way we can stop oil from surging higher is to reduce global demand, make politically unpalatable deals, or deal with 5-10 years of stagflation until solar and EV technology bails us out. I just hope it doesn’t get to 1970s-style gas shortages, power blackouts, and us having to read by candlelight.

I’ll cover oil more in-depth for readers soon. The best I can do on the inflation front is to go back to the well on I-Bonds from the US Treasury, which are paying close to 10% annually now, risk-free.

Key Takeaways

- The worst-case reasonable scenario looks to be playing out for the economy and stocks. This potentially means we could enter a period of stagflation, with falling standards of living, falling corporate profits, and rising prices for food and energy.

- Unfortunately, there are no easy political or economic fixes for this, leading stocks likely lower from here.

- Stocks likely have another 15%-20% downside to fair value (although forecasting this isn’t an exact science).

- The traditional bear market gameplan will still work, and as long as the market is in a downtrend you’re probably better paying off debt with new money than buying the dip in stocks.

- If stocks continue to fall, there are likely to be special situations that investors can take advantage of. In the past, these were well-covered on Seeking Alpha.

- You should prepare psychologically for much steeper declines and have a plan for if stocks fall 50% from peak to trough.

Be the first to comment