da-kuk

SPDR Portfolio S&P 1500 Composite Stock Market ETF (NYSEARCA:NYSEARCA:SPTM) is an exchange-traded fund that provides investors with exposure to 1,527 holdings (as of November 18, 2022) which have been accumulated so as to track the S&P Composite 1500 index. The index combines the three leading U.S. equity indices: the S&P 500; the S&P MidCap 400; and the S&P SmallCap 600. SPTM had assets under management of $5.75 billion as of November 18, 2022, with a very affordable gross expense ratio of just 0.03%.

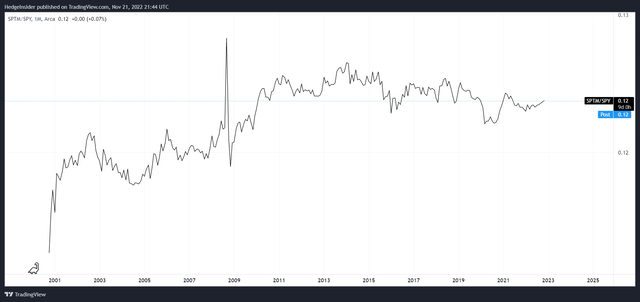

Few investors beat the S&P 500 U.S. equity index over the long run. Further, there is an idea that small- and mid-cap stocks, which are typically associated with smaller businesses and therefore “riskier” businesses, carry larger-than-average return potentials over the long run. That is owing to the idea that, if smaller companies are riskier, they should be priced with higher embedded equity risk premiums. An investor’s return is a function of the sum of the prevailing risk-free rate and equity risk premiums. A popular ETF that tracks the S&P 500 is SPDR S&P 500 ETF Trust (SPY). The chart below illustrates the relationship between SPTM and SPY since SPTM’s inception in October 2000.

This is a basic introductory observation worth making: SPTM did out-perform SPY going into the 2007/08 crisis. Thereafter, out-performance stopped from early 2010 onward; sometimes the fund out-performs, sometimes it under-performs, but the long-term track record is neutral (since early 2010 to present). The fund’s five-year historical beta is basically 1x (in line with the S&P 500). Therefore, SPTM is almost indistinguishable performance wise from U.S. equity funds that track the most popular U.S. equity index (the S&P 500). Nevertheless, given that SPTM has a very low expense ratio, and more holdings, one might consider the value in buying into SPTM merely for the added diversification. Yet the point from the above information is that one should not expect the performance to deviate much from the broader markets.

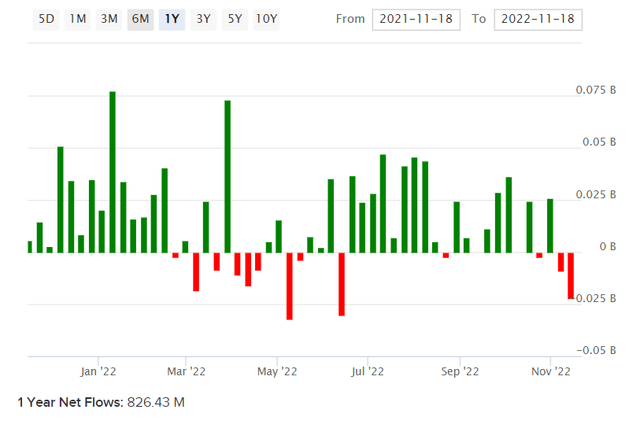

Recent net fund flows into SPTM have been positive. Over the past year, net fund flows were circa $826 million (see below).

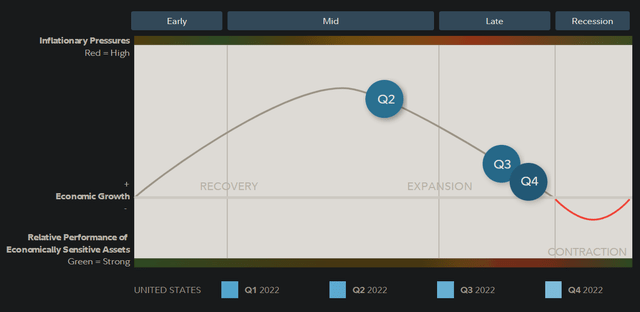

U.S. equities, and thus SPTM, have however performed poorly over the past year. Elevated inflationary pressures, coupled with rising risk-free rates (i.e., the Federal Reserve has been hiking rates, which has had the bond market re-rate bond yields upward across the curve) has led to falling valuations. Further, earnings growth expectations have softened. Stocks have fallen as a result, not to mention geopolitical risks (Russia-Ukraine, China-Taiwan, North Korea, and more). Nevertheless, we can still value SPTM as we can any other fund.

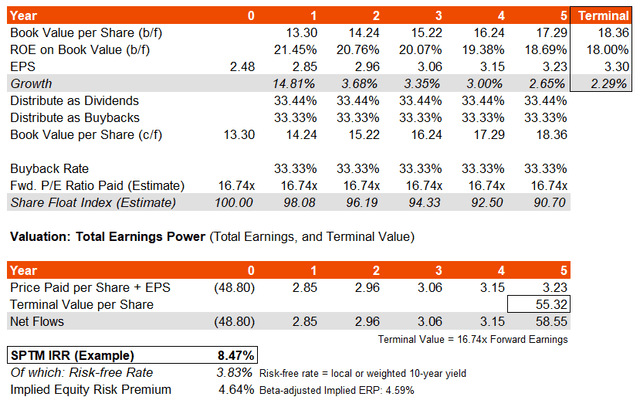

The most recent factsheet for the fund’s benchmark, cited in the first paragraph, provides us with trailing and forward price/earnings ratios of 19.22x and 16.74x, respectively (both as of October 31, 2022), with a price/book ratio of 3.59x and a dividend yield of 1.74%. These numbers can be used to approximate SPTM’s portfolio. The implied forward return on equity is 21.45%. Additionally, a consensus three- to five-year average earnings growth rate estimate from Morningstar suggests SPTM’s portfolio’s earnings could grow at 11.99% per year.

Another relevant data-point: Yardeni Research suggests up to 60% of operating earnings are paid out via share buybacks per the S&P 500. While SPTM has capital invested in the S&P 500, we would expect the forward buyback rate for SPTM’s portfolio to be, on average, less than the more cash-generative S&P 500 companies. Still, the total is still likely to be large, given the large-scale earnings of the largest companies within SPTM’s portfolio. One large company engaged historically in buybacks is Apple Inc. (AAPL) which represented 6.26% of the SPTM portfolio as of November 18, 2022. However, the company’s share buyback program is expected to peter out over the next few years, so it is difficult to predict what happens next in aggregate.

Given that a third of SPTM’s portfolio’s earnings were paid out in dividends, using historical data from the fund’s benchmark’s factsheet (the ratio between the indicative dividend yield and trailing price/earnings, etc.), I will assume share buybacks hold at least a further third (on average over the next five years). I will also assume that the fund’s return on equity will drop to 18% to be a little conservative, which seems doable since the forward one-year earnings projection is based already on a time in which the United States is likely heading into a recessionary phase (if Fidelity research is anything to go by).

These assumptions take my forward three- to five-year average earnings growth rate to 5.40-7.15%, which is safely below the consensus figure cited of 11.99% earlier. Nevertheless, on a current U.S. 10-year yield of 3.83% at the time of writing, SPTM’s underlying IRR potential (based on total earnings power) is circa 8.47%, with a healthy underlying equity risk premium of 4.64%.

The nice take-away point here is that there is likely a safe underlying return in SPTM’s current pricing in spite of consensus analyst earnings being on the high side. That means that negative revisions to earnings, if earnings surprise to the downside, will still allow SPTM to generate a decent long-term return over the next few years. It seems as though the market is already discounting optimism built into earnings expectations; this, in my mind, is a prevailing risk as the U.S. potentially heads into a recession. Therefore, it is more than possible that the market has already bottomed, which would not be surprising either as markets tend to lead the real economy by 6-12 months or so.

A return potential of 8-9% per year with dividends reinvested is quite “average” if one is buying into favorable prices following a bear market. Nevertheless, I would still take a bullish view in spite of the lack of a large potential forward return, as U.S. markets have managed to beat all other equity markets over the long run. Being able to buy U.S. stocks, and especially a diversified U.S. equity fund such as SPTM, is a privilege if it can be done at very fair prices. SPTM is not “undervalued”; I would argue it is fairly valued, but priced constructively. I think SPTM’s pricing also bodes well for broader markets, as international equities tend to correlate positively with U.S. markets.

Be the first to comment