Liens

An Update on Uranium

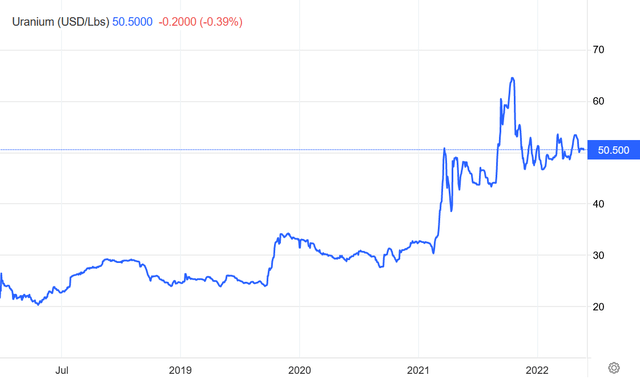

Throughout 2022, the Uranium sector continued the multi-year bull run despite macroeconomic turmoil and a tightening liquidity cycle. The Uranium price kept on rising from ~$45 to ~$51 as of now. After the Russian Invasion of Ukraine, the price spiked to a peak of ~$65. But the initial risk-off price spike was quickly over when it became clear that the Kazakhs would have no problem delivering their enriched Uranium to western utilities.

Uranium (USD/Lbs) (tradingeconomics.com)

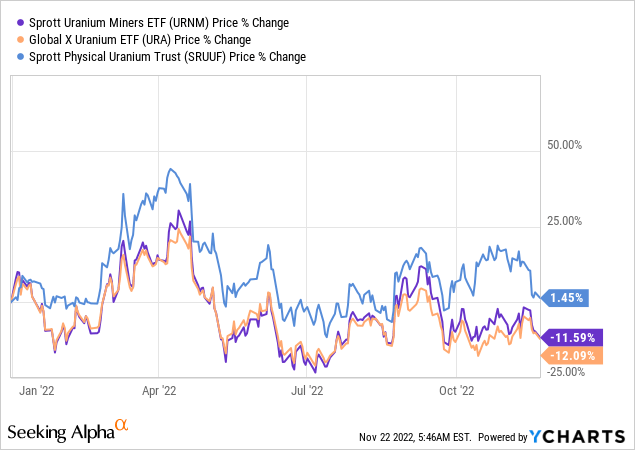

However, Uranium equities performed worse since they are more affected by the restrictive monetary policy of the Federal Reserve and investment flows, not being tied to the price of U3O8. The biggest sector ETFs are still negative YTD. The Sprott Uranium Miners ETF (URNM) is down 11.5 % YTD, and the Global X Uranium ETF (URA) is roughly down 12 % YTD:

In my opinion, the best risk/reward in the Uranium space remains speculating on the positive price movement of the material. Two investment vehicles allow direct investment in the price of U3O8: The Sprott Physical Uranium Trust (OTCPK:SRUUF) and Yellow Cake (OTCQX:YLLXF). In this article, I’ll be focusing on the Sprott Physical Uranium Trust (“SPUT”) because of its superiority in terms of inflows during the last 12 months and its superiority in Net-Asset-Value.

The Sprott Physical Uranium Trust…

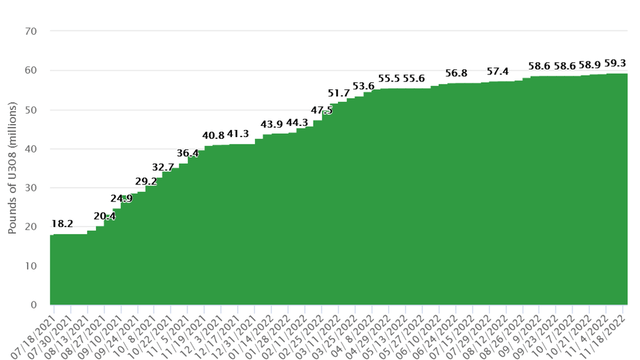

The Sprott Physical Uranium Trust invests and holds substantially all of its assets in Uranium in the form of U3O8 in storage locations in the US, Canada, and France. Investors can buy and sell trust units with an at-the-market (ATM) program. If shares of the SPUT trade at a 1% premium to NAV, the trust can issue additional units to the market. The trust then buys pounds of Uranium with the proceeds, which increases the fund’s NAV and takes off physical pounds from the uranium market. Therefore, SPUT can also trade at a discount to NAV. The trust managed to increase the total pounds of U3O8 held from 18.3 million in July 2021 to 59.3 million in November 2022, adding pressure to the already tight market conditions. Therefore, the price of the SPUT vehicle was many times above its NAV, and additional shares were issued to close the premium.

…Could corner the Uranium Market

Note that this doesn’t work the other way around, though. Even if SPUT trades at a significant discount to NAV, the share count of the trust remains the same. Therefore, liquidity plays a huge role for the ability of SPUT to accumulate U3O8. Note that the fastest pace of accumulation was right after Sprott Inc. (SII) launched its SPUT vehicle. That was during 2021, when liquidity was much easier and financial conditions weren’t tightened by the Federal Reserve via raising rates and Quantitative Tightening. SPUT works best in an environment with loose liquidity conditions.

Total pounds of U3O8 held by SPUT (Sprott Physical Uranium Trust Investor Relations)

The management has to know that SPUT could be able to corner the Uranium market and lead to significantly higher prices if the liquidity inflows are sufficient, given the supply and demand outlook and the potential of supply disruption from the Kazakhs because of geopolitical issues.

The key points for the Uranium investment case are:

- Weak supply side due to decade-long bear market

- Rising demand due to overfeeding in the mid-term and rising demand in the long-term due to new reactors

- Change of public opinion due to energy prices and the climate debate

- Utilities are accelerating Uranium purchases because of global polarization

For a better overview of the Uranium investment case, read my first article about SPUT and Yellowcake: “Buy Discounted Uranium With The Sprott Physical Uranium Trust & Yellow Cake”. This article will primarily focus on SPUT.

Investors should know that the structure of the closed-end fund SPUT could also work against them. As long as the supply and demand picture is fundamentally bullish, liquidity inflows should always close the discount to NAV in the medium-term. However, a permanently more bearish supply and demand outlook could impact the investment case of the SPUT vehicle dramatically.

A Thought Experiment

Let’s imagine that in the future the bull market tops after the price gets squeezed to the upside. A glut of additional supply hits the Uranium market, primarily from new US miners. Investors are happy and start cashing out. They start selling SPUT trust units to the market, which puts the SPUT price lower than the NAV. Because of the way the trust is structured, the now-created imbalance can only be restored by other investors buying. But the incentives to invest in SPUT are gone because the price has already spiked to obviously unsustainable levels. So the trust should trade at a permanent discount to NAV in such a scenario.

Retail is likely going to buy into the narrative of “discount” Uranium after the prices rise and will provide some exit liquidity. But because of the poor availability of SPUT for retail investors and the focus on institutional players, I believe this could potentially spiral out of control after the bull market has ended.

Now, I believe the bull market still has years ahead of itself, as no major supply is hitting the market yet. But it is certainly an important point to consider one’s exit strategy when speculating on the price of U3O8 via the SPUT vehicle. In the end, Sprott Inc. profits the most from this vehicle via the Management Expense Ratio of 0.68 % p.a., of course.

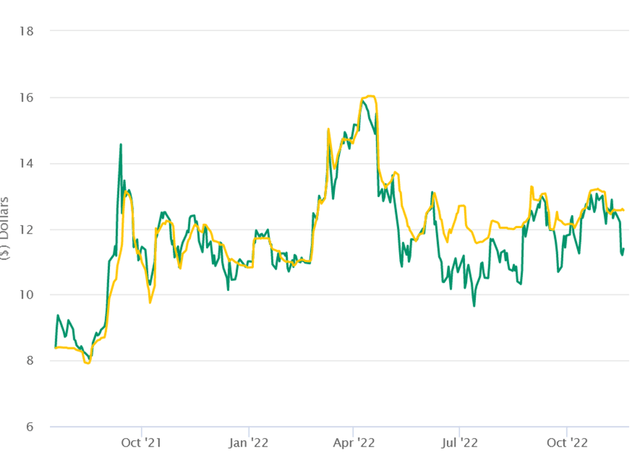

After I published my first article about Yellow Cake and the Sprott Physical Uranium Trust in late July, the SPUT fully closed the discount to NAV and rose ~28 % to ~$13. As of now the SPUT is again trading at a 9 -10 % discount to NAV at ~$11.

NAV (yellow) and SPUT (green) (Sprott Physical Uranium Trust Investor Relations)

I believe this is a good buying opportunity with a time horizon of two years. The downside seems limited, while the upside could be huge, especially if the liquidity cycle turns and financial conditions loosen because of accommodative monetary policy. I don’t believe this will happen in the next six months, but I think a pivot of the global Central Banks has to happen during the next two years. In such a scenario, I could see SPUT raising more cash, buying more U3O8, and potentially cornering the Uranium market resulting in a huge price spike for investors to enjoy. The SPUT price will likely decouple from the U3O8 price and stay at a discount to NAV. Investors should not view this as a buying opportunity after the price spikes. For now, investing in SPUT during times of a discount to NAV is healthy in my opinion.

Uranium Price Correlations

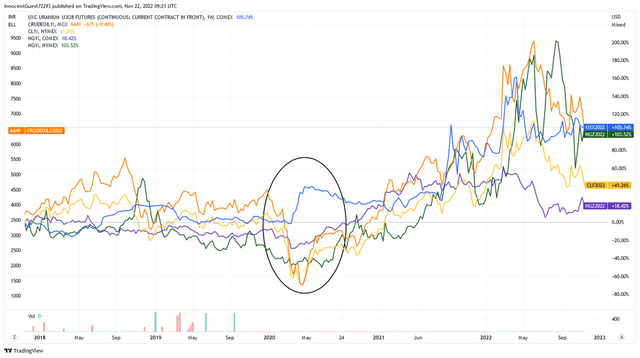

U3O8 prices seem uncorrelated to most commodity prices. Additionally, Uranium prices tend to rise in a risk-off environment while other commodities suffer. When taking a look at the 5-year price charts of the futures of U3O8 (blue), natural gas (green), coal (yellow), copper (purple), and crude oil (orange), one scenario stands out:

Comparison of commodity prices (Tradingview.com)

U3O8 prices were one of the few commodity prices to react positively to the Covid news from mid-March to April 2020. Due to changes in expectations of energy and commodity usage because of the imposed lockdowns, natural gas, coal, and copper sold off. Oil went negative during that time because of storage issues. U3O8 prices soared from $24 to $34 during the same period. U3O8 prices profit from disruption because the demand side is largely unaffected by global demand for energy. Utilities need to buy Uranium from the market because nuclear reactors can’t just be shut off in an instant. The supply side is much more important in the short term.

Therefore it is unlikely that a drastically slowing economy in 2023 will be a large headwind for U3O8 prices. We’ve seen a slowing economy in 2020 already, during a similar supply and demand situation, and it has only benefitted the price of U3O8.

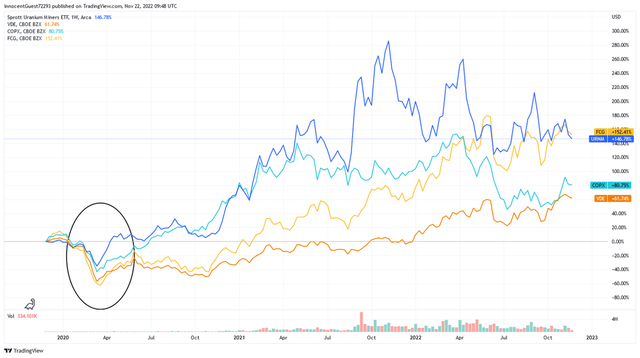

However, the correlations of Uranium miners are different:

Comparison of Miner ETFs (Tradingview.com)

During the risk-off event in 2020, Uranium miners sold off, together with stocks of companies in the energy & commodity sector. In a risk-off period, Uranium miners will have a harder time searching for capital, even if the price of U3O8 rises. Almost all Miners (except the largest two companies) are just restarting their Uranium mines because the price appreciation of U3O8 was too little to break even during the last few years. These companies require constant funding because of their negative cash flows. Providing sufficient funding gets progressively harder as financial conditions tighten.

In times of monetary tightness it is harder for SPUT to build up U3O8 storage because investors are cautious about their capital and the fund rarely trades at a premium to NAV. Since the Federal Reserve tightened monetary policy, the SPUT couldn’t accumulate Uranium at the 2021 pace. But because the U3O8 prices are uncorrelated to other energy and commodity prices, the drawdown of the SPUT seems limited, given the supply and demand outlook for the industry.

If an acute liquidity crisis reveals itself, however, in the very short-term, SPUT could sell off too. This would be a great buying opportunity. Miners suffer directly from the slowing economy and monetary tightness. In times of distress, which I expect in 2023, I try to speculate as directly as possible on the price of U3O8. During risk-on regimes however, Miners seem preferable because of greater leverage to financial conditions.

Closing Thoughts

I believe the ~9 % discount to NAV is yet another attractive opportunity to buy U3O8 with a time horizon of 2 years. In my opinion, the Sprott Physical Uranium Trust has the best risk/reward setup, especially considering a slowing economy in 2023 and further monetary tightening. After the liquidity cycle turns, miners are likely to outperform, and the Sprott Uranium Miners ETF seems preferable. As long as the market hasn’t discounted significantly lower earnings in 2023 (SPX: A Rallying Stock Market Is Bearish), I prefer directly speculating on the price of Uranium.

Be the first to comment