Andreus/iStock via Getty Images

Not much happened at FARO Technologies, Inc (NASDAQ:FARO) since our last coverage. We tagged the stock with a hold recommendation 18 months ago. This followed two previous articles in which we were bullish. We are staying with a hold rating, but three developments spark our renewed interest. They can make it a profitable opportunity for retail value investors.

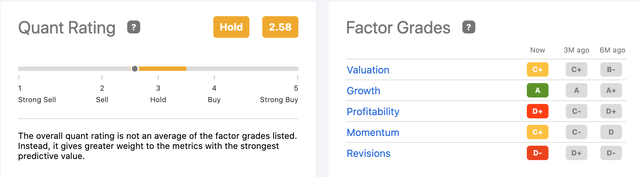

Seeking Alpha upgraded to hold its Quant Rating about this 3D measurement, imaging, and software solutions company digitizing the physical world. SA overwhelmingly took a strong sell (or sell) position on FARO. SA still is not firmly in buy territory. The company still struggles to improve its profitability SA Factor Grades have not improved in the last six months.

Quant & Factors FARO (seekingalpha.com/symbol/FARO/ratings/quant-ratings)

Company Image

FARO Technologies is a Florida company that designs, builds, and markets patented multi-dimensional measurement and imaging devices and proprietary software. Products sell globally for a host of markets. Markets include aerospace and defense, architecture, construction, engineering and reverse engineering, factory automation, building information modeling, public safety crime and fire investigations, and more.

The company bought a UK mobile scanning business mid-year. It paid nearly a half-million dollars in Faro shares and over $23M in cash.

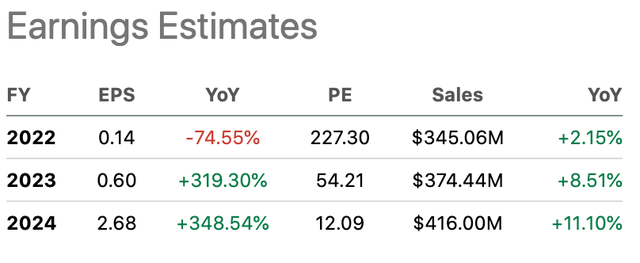

At the beginning of this month, FARO Technologies reported Q3 Non-GAAP EPS of $0.03; that was good news since it beat estimates by six cents. Revenue in the quarter was up nearly 8% Y/Y to $85.33M. Last year’s Q4 EPS hit $0.48. We do not anticipate it will top $0.36 next quarter. The company has a mixed record of beating EPS estimates; it did so in the last two quarters but fell short of estimates for the three prior consecutive quarters.

We expect the worldwide imaging and measurement market to grow. Revenue will be +20% CAGR. It will reach +$100B in 2030. FARO Technologies recorded 2021 revenue of $338M (EPS: $0.56) and forecasts 2022 revenue of $345M and an EPS of just $0.14. Revenue has been in this range for five years, except in 2020. Then it scraped by at about $304M. There is plenty of room to grow Demand for new imaging and measurement technology is in the 4D and 5D stages, especially in the medical and low-cost mapping software fields.

Earnings Estimates (seekingalpha.com/symbol/FARO)

These Are FARO Technologies’ Most Popular Products

· FARO Technologies’ Quantum FaroArm is a combination portable articulated measurement arm with a computer and CAM2 software programs.

· The new Vantage Laser Tracker is a portable large-volume laser measurement tool and computer with CAM2 software programs for great measurement accuracy.

· The Laser Projector provides virtual template operators and assemblers use to quickly and accurately position components.

· Its Laser Scanning Portfolio measures and collects a cloud of data points.

· ScanPlan is a handheld mapper that captures two-dimensional floor plans.

· The entry-level Focus Core Laser Scanner expands the scanning range for construction, building operations, and public safety.

· HoloBuilder has a new video in walk mode with a 360-degree camera that simplifies and speeds up the capture project in construction progress management workflow, saving users money and time.

· Faro’s SaaS three-dimensional software integrates with its hardware merging data and providing collaborative workflows and applications. This year the company added a four-dimensional digital reality platform. The CEO told shareholders recently the…

Sphere provides a central location for users to store, view, share and analyze reality captured data, allowing construction and operation professionals to benefit from faster site updates, virtual collaboration, and real-time feedback.

· On November 8 ’22, Faro announced the release of its updated software, FARO Zone 3D, for the public safety market. It offers advanced graphics for crime, crash, fire, and security situations that include customizable vehicle modeling and measuring capabilities from photos that enhance documentation, training, analysis, and presentation.

Future Outlook

The share price was down 57.4% over the last 12 months and nearly that much in 2022. The 52-week share price high was $75.88, slipped to $45 by May ’22, and it has been wandering in the mid-$30s for over six months. Short interest is a low 2.6%, the PE is a whopping 227.3, and the Beta volatility rating is high at almost 1. Trading volume is a meager 93K shares traded on average.

While there does not seem an outstanding incentive to add FARO shares to a portfolio, the company is profitable and low-risk, in our opinion. It is an innovator in a massively growing field sporting a healthy R&D commitment. In the immediate, there are downsides to consider if owning the stock.

It does not pay a dividend. In Q3, the gross margin stumbled from 53.5% to 50.7% Y/Y. Operating expenses rose to over $50M from $47.5, but less than the rate of inflation. The net loss of $6.3M jumped from about $4M Y/Y. Cash flow from operations (TTM) is -$16.06M.

There are some things we like about the status of the company at the present time. Its market cap is $609M. FARO Technologies is a small player but in business for over four decades. It does not experience internal turmoil and big impact on business because of unfolding events.

Total assets last quarter reached $445.2M while liabilities were $145.7M. In the last quarter, the company held $48.5M in cash but has little to no debt. Institutions hold 99% of the stock. The number of hedge funds holding shares steadily increased since Q3 ’21 when just 9 held shares; at the close of Q3 ’22, 14 funds held shares. Catherine Wood increased her holdings by 26.5% worth $6.43M. There are no reports we can locate showing corporate insiders sold shares over the last year, but they bought shares in every quarter of 2022.

Interesting Developments

As we note at the beginning of this article, three developments spark our interest in FARO. The first is that revenue is up again for the year. This follows a tough 2020 when growth stymied the industry. Customers use FARO Technologies products on-site, and in the field; they were limited during the pandemic because of lockdowns and corporate closings.

Our second sign of better times comes following the appointment, three years ago, of a new CEO; he is apparently emphasizing the commercialization of new hardware products realizing a 70% increase because of products that came on the market in the last two years. We believe the focus on new products will improve the company’s growth, which is in the bottom quarter of all companies in the digital imaging and measurement business. It is about average in liquidity for its industry, with a ratio of 2:2 compared to its industry median of 1.97.

Third, government revenues and corporate earnings appear to be holding up. They again have cash in their pocket to upgrade and replace the products FARO Technologies sells. Faro products save time and money and improve the accuracy of finished goods and labor. Bullish news articles about Faro are appearing again.

Media Coverage (tipranks.com/stocks/faro/stock-news)

Takeaway

FARO Technologies is maximizing the digitization of the physical world for streamlining business with money and time-saving hardware and software. A shortcoming of the CEO’s shareholder presentation is any discussion about marketing that will increase revenue. Yet, he predicts Q4 revenue between $99M to $107M; non-GAAP earnings will be $0.25 and $0.45, so management must have a plan.

The company is not sparkling or glitzy but a yeoman. It does not capture a lot of attention but helps undergird a myriad of basic industries. The few analysts covering FARO are leaning toward bullish positions in the last four months up from a neutral one. We see a potential opportunity for the average price target to hit or top $40 in the next six months with little risk for a substantial downturn that we can identify at the present time. FARO Technologies might appear lackluster but interrupters often lead to a watershed one day.

Be the first to comment