Moussa81

In a previous article, I discussed my bullish scenario for silver. In this article, I look at gold, at its current valuation and especially at my favorite way to own it, namely the Sprott Physical Gold Trust (NYSEARCA:PHYS).

Unlike silver, gold is almost exclusively a monetary metal. It is regarded as an inflation hedge and as a safe haven asset. However, despite bullish circumstances, including high inflation and geopolitical tensions, the gold price has declined almost 20% from its all-time highs.

There is a lot of frustration among gold investors about the recent price action. Nonetheless, I believe gold is roughly fairly valued at the moment (I will discuss a simple valuation framework in the following).

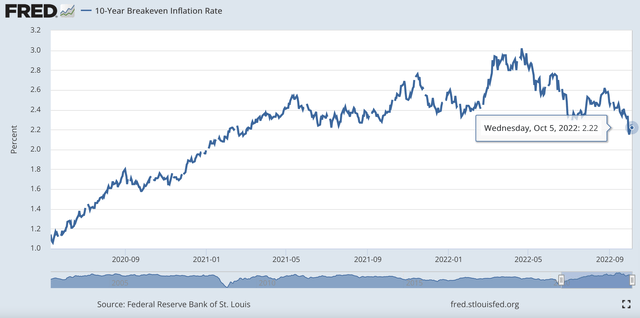

Gold is facing tremendous headwinds, with yields rising at the fastest rate in decades but inflation expectations still anchored slightly above 2%. In other words, the markets are buying the Fed’s narrative that it is going to hike rates as much as needed to bring inflation back to target.

10Y breakeven inflation rate (Federal Reserve Bank of Saint Louis website)

I don’t fully share this confidence. I do believe the Fed will continue to raise rates in the near future (especially in light of the last CPI reading and a still tight job market). However, I also believe that either the Fed will break something and stop, or it will manage to temporarily reduce inflation (which will however remain well above target), declare victory, and stop. More importantly, I believe that higher nominal rates, higher inflation, and negative real rates are going to be the new norm, and that they will be used as a tool to inflate away the debt over the next decades.

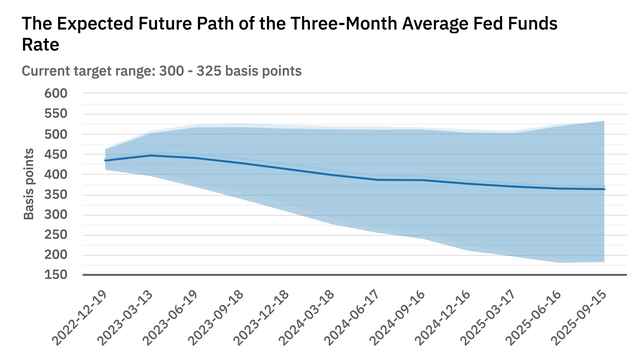

It is very difficult to estimate exactly how close we are to peak tightening. Estimating it, however, is crucial since it will likely be the catalyst for a new bull market in gold. According to market-implied projections, peak tightening will be reached sometime in Q2 2023, after which the Fed will pause.

Expected future path of the three-month average Federal Fund Rate (FFR) (Federal Reserve Bank of Atlanta website)

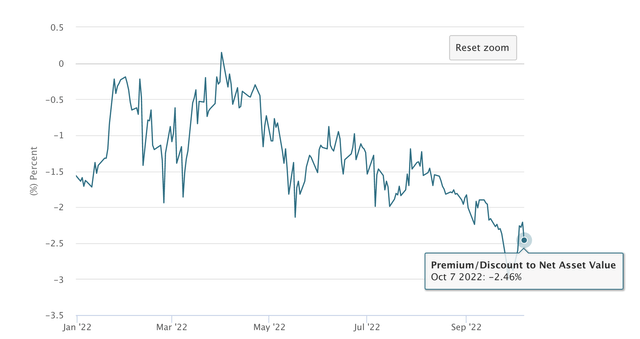

My favorite way to own gold (together with physical gold and selected gold miners) is the Sprott Physical Gold Trust. Advantages of this instrument, compared to similar products, include: gold bars are held outside the financial system by the Royal Canadian Mint, are segregated within the vault and fully unencumbered; a low expense ratio (0.41% per annum); high liquidity (average volume of 1.8 million units per day); a relatively high discount to NAV (-2.46% as of October 7); a redemption feature for physical metal; potential tax advantages for US investors.

In the rest of the article, I will first discuss the current macroeconomic scenario, then present a valuation framework for gold, and finally unpack in more detail the reasons that make PHYS a superior way to invest in gold.

Macro considerations

Since my recent take on silver, the August CPI reading has come out, followed by a re-iteration of the Fed’s hawkish commitment to curb inflation at all costs, and the associated renewal of the dollar’s rally, on the background of a general risk-off environment, with major indices making new year-to-date lows. Recent developments have confirmed my conviction that the Fed is at high risk of losing control of inflation, that is only a question of time before the markets wake up to this risk, and that the precious metals bull market is just waiting for a catalyst to get started again.

Before the August CPI reading, there was an entrenched belief that inflation was at, or close to, its peak, on the back of declining oil and commodity prices. In fact, the headline inflation rate did decrease slightly in August, as was more or less expected. However, the concerning part is that inflation has now spread to the core components, and it is actually growing there. This dramatically increases the risk that it will stay elevated for longer.

It is clear that the transitory inflation camp, originally championed by the Fed, has been proven wrong. This inflation phenomenon is not a one-off effect related to the shutdowns, but rather the consequence of the reckless monetary and fiscal policies in response to the COVID crisis. A 42% increase in the money supply has caused up to now a 15% increase in the CPI, so it stands to reason that, as monetary velocity picks up, inflation still has a lot of space to run. Because of baseline effects, inflation might not make new highs this year, but it could in 2023.

Take the case of energy. The oil price has recently decreased by roughly 30% from its peak, because of macroeconomic fears of a global slowdown. However, last week, OPEC announced its first significant production cut since 2020, for a total of 2 million barrels per day (bpd). There are two different interpretations of this event. One is that OPEC is worried about demand, and front-running a global depression by preemptively reducing production. The other is that OPEC is defending the fundamentals of a market that, in their words (and also in those of most O&G companies executives), remains tight. I believe that the second hypothesis is far more likely and that the main risk in the oil market is to the upside, with bullish catalysts including: gas to oil switching from utilities, the end of China’s zero-COVID policy, the EU ban on Russian oil, and the depletion of the Strategic Petroleum Reserve (SPR).

The Fed is therefore between a rock and a hard place. It has to continue hiking rates, as inflation is not slowing down. But there is only so much they can do by adjusting the price of money. There can be no solution to the energy crisis coming only from monetary policy, for instance. Meanwhile, fiscal policy is pushing in the opposite direction, stimulating demand, and accelerating monetary velocity. Ultimately, rates cannot be hiked too much, because the system is overleveraged.

In fact, the current fundamental question for Western policymakers is how to get rid of all the debt. In principle, there are four possible solutions on the table. The first is for the economy to grow at a robust rate in real terms. However, the developed world has been unable to achieve high growth for a long time. This solution might require, for instance, a new technological breakthrough. It is obviously a desirable solution, but not something that can be planned for. The other solutions that are under our control are: austerity, hyperinflation, and financial repression. Given that austerity is extremely unpalatable from a political standpoint and that hyperinflation is extremely risky, I believe that Western policymakers are going to opt for financial repression.

Financial repression requires having nominal rates always below the inflation rate, which implies that real rates are artificially kept in negative territory for a long period. Suppose, for instance, that inflation averages 5% over the next two decades, but nominal rates are at 2%. In real terms, the debt burden decreases by 3% every year. After 20 years, the debt would have been halved. Real rates are also one of the main drivers of the gold price, which is why I consider all precious metals to be major winners under the coming new market regime.

In conclusion, in recent years, developed nations have seized the opportunity of the COVID crisis to engage in both monetary and fiscal policies that were aimed at reviving inflation. At the moment, inflation needs to be reined in a little, but the plan is not to go back to 2% anytime soon. Therefore, the Fed will continue hiking rates to bring down inflation, but it will stop too soon. This moment, as I mentioned before, is the moment to get long gold.

Is gold cheap?

I rate PHYS a HOLD, rather than a BUY, because of the belief that peak tightening has not yet been reached, and therefore gold will remain weak until then. More generally, I see gold as cheap, but not extraordinarily so. This brings us to the question of how to value gold.

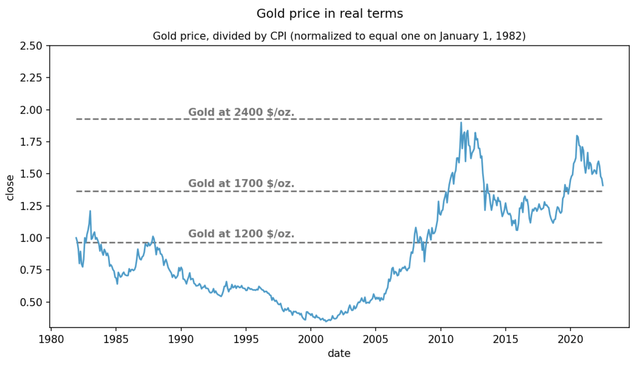

The gold price has many complex drivers, such as dollar strength and changes in real rates, just to mention a few. However, as an inflation hedge, gold should roughly keep pace with the CPI level. That is, the price of an ounce of gold divided by the CPI level should be roughly constant in time. I will call this the real price of gold and normalize it to equal 1 on January 1, 1982. This is a plot of the gold real price.

Gold real price (own computation)

Gold got very cheap in the early 2000s. It also got way ahead of itself in the early 2010s. As investors, we would like to buy low (and sell high) to achieve good returns. Of course, we are interested in real returns, rather than nominal returns, that is returns that factor in the effect of inflation. We therefore expect a low (real) gold price to be correlated with a higher future (real) return.

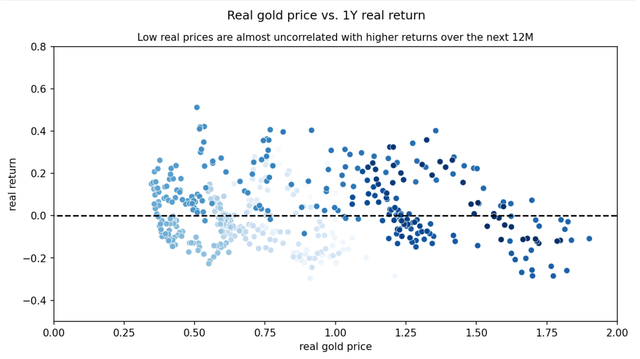

However, if we plot the (real) returns of gold over an investment horizon of only one year, versus its starting (real) prices, the picture is quite noisy.

Real returns vs real prices for gold with an investment horizon of one year (own computation)

It seems that lower prices are indeed correlated with higher returns, but it is not a very strong relationship. The average one-year return is just slightly positive, meaning gold historically earns some small return after inflation, but the standard deviation is huge. In other words, gold is an unreliable inflation hedge over a short period of time.

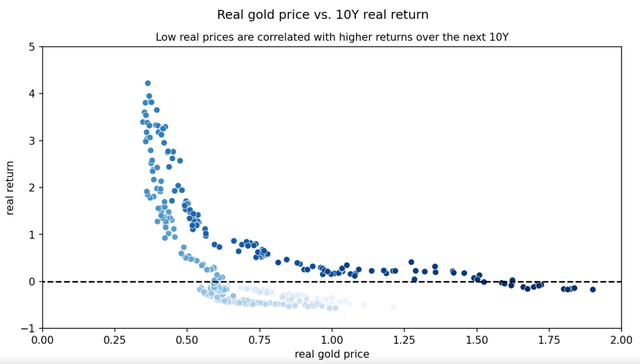

The picture changes if we consider longer time horizons. Here is the same plot with a horizon of ten years.

Real returns vs real prices for gold with an investment horizon of ten years (own computation)

Now the relationship is much stronger. Notice that the color indicates time: stronger hues of blue represent more recent periods. The present corresponds to a nominal price of around $1700 per ounce, or a real price of around 1.3. Clearly, the dots tend to align along two distinct downward sloping curves. The most recent curve is shifted to the right. This suggests that inflation is understated by the current CPI definition.

The main conclusion from this analysis is that gold has historically been a reliable inflation hedge over longer periods of time. When the real price is around 1.5, then the gold price can be expected to roughly keep up with inflation (gold is fairly valued). Prices over 1.5 would mean that gold is overvalued and is expected to earn a negative return after inflation. Vice versa, for prices below 1.5, gold is going to outperform inflation. Currently, with gold at 1700, the real price would be around 1.3. That is, gold is likely going to earn a positive return after inflation, but it is also not extraordinarily cheap. In the near future, gold might get cheaper in real terms, even if the nominal price were not to change, if the CPI keeps climbing.

Why PHYS

The Sprott Physical Gold Trust offers a liquid and secure form of owning gold, without the inconveniences of storing the physical metal. Like many other similar instruments, e.g. the more popular SPDR Gold Trust ETF (GLD), it has a low management expense ratio (0.41% per annum). However, unlike GLD and similar gold-based ETFs, PHYS is required to be fully backed by physical gold at all times. You can actually go to the Sprott website and see the serial numbers of all the gold bars held in storage.

The metal is kept outside the financial system, in the vaults of the Royal Canadian Mint (RCM). Periodically, the RCM confirms its holdings for which the Mint is acting as a custodian on behalf of the Trust. This transparency is quite in contrast with GLD’s lack of clarity regarding exactly how much of the gold can be unallocated at any one time. Moreover, the GLD’s prospectus, also discloses further counterparty risks, such as the following:

Gold held in the Trust’s unallocated gold account and any Authorized Participant’s unallocated gold account will not be segregated from the Custodian’s assets. If the Custodian becomes insolvent, its assets may not be adequate to satisfy a claim by the Trust or any Authorized Participant.

With PHYS, it is also possible to hold Trust units directly in the investor’s name, rather than through any financial intermediaries, via DRS (Direct Registration System). Direct ownership is then evidenced in the records of the Trust, as opposed to holding units through a broker, who in turn appears as the owner on the Trust’s books.

The Trust’s units can even be redeemed for physical metal, though the minimum redemption size is quite large: one full-sized London Good Delivery bar (which is approximately 400 ounces).

A further advantage of PHYS concerns its tax advantages. For holding periods of more than one year, US investors are eligible for a reduced tax rate, equal to the long-term capital gain rate of 15% or 20%. Further details can be found directly on the Sprott website.

Finally, the Trust is currently trading at a discount to NAV of around 2.5%. The following plot shows that this is actually quite a significant discount compared to history. It is certainly a symptom of the bearish sentiment that surrounds gold at the moment.

PHYS discount to NAV (Sprott website)

Conclusions

Gold at $1700 per ounce is roughly fairly valued. This means that it should keep up with inflation over the coming years. Gold investors need to be aware that gold acts as a reliable inflation hedge only on long time horizons.

At the moment, gold has a real price of around 1.3, which is well above its median price of around 0.7 over the last 40 years. This estimate is likely biased by an understatement of inflation through the CPI. Historical data suggests that by buying at today’s price, investors can expect to earn an annual real return of around 2% after inflation.

The Sprott Physical Gold Trust (PHYS) is the superior way to own gold compared to other gold ETFs, because of its low costs, high liquidity, its redemption feature mechanism, and the fact that the metal is held in fully allocated form outside the financial system.

Be the first to comment