assistantua/iStock via Getty Images

Investment Thesis

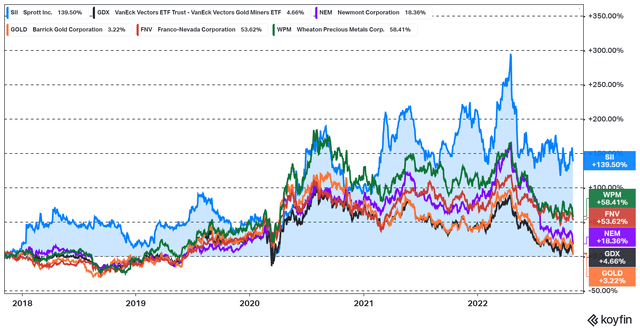

Sprott Inc. (NYSE:SII) is a Canadian investment company in the natural resource industry, with a focus on precious metals and uranium. It is a stock I have covered frequently over the last few years. It is listed in both the U.S. and Canada.

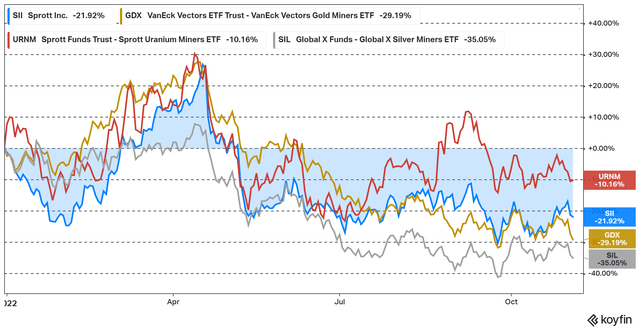

The stock has had a relatively weak stock price performance this year, slightly weaker than I would have expected given that assets under management (“AUM”) are still up a few percentages this year. The growth over the last couple of years primarily has come from the new mandates in the uranium industry. Sprott has a relatively attractively valuation and has excellent potential once the precious metals and uranium markets start generating more momentum again.

Sprott reported its Q3 earnings today and this article includes my main takeaways from the Q3-22 financial report. The company will also have a conference call later today.

Exchange-Listed Products

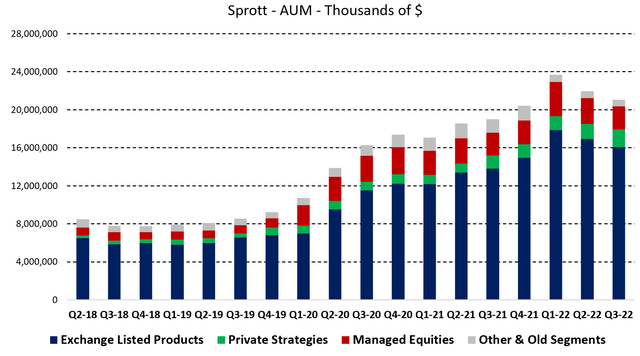

Figure 2 – Source: Quarterly Reports

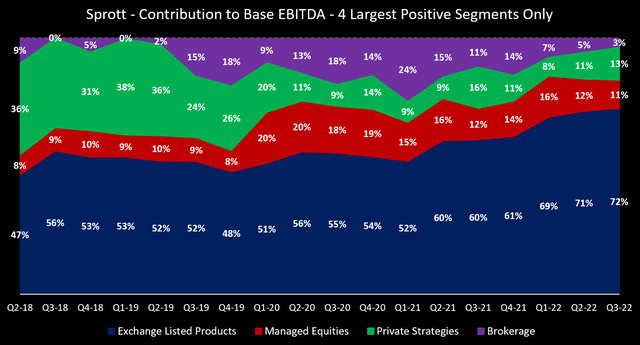

The Exchange-Listed Products segment is by far the most important segment at Sprott. It accounts for the majority of assets under management, earnings, and most of the growth over the last few years.

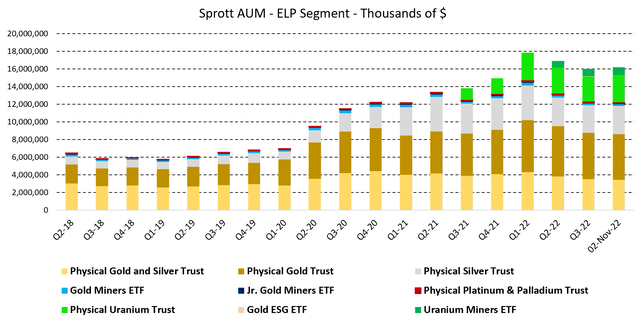

Figure 3 – Source: Quarterly Reports & Sprott.com

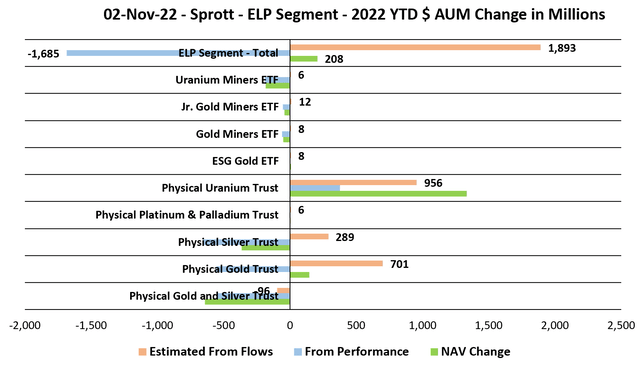

The core of the segment are the physical trusts, which have for a third year in a row seen very healthy inflows. This year, we are so far looking at close to $1.9B in inflows, which have offset the negative precious metals performance. The inflows are primarily in the uranium, gold, and silver trusts. The acquisition of the uranium miners exchange-traded fund (“ETF”) (URNM) has also boosted the AUM in the segment by about $1B.

Figure 4 – Source: Quarterly Reports & Sprott.com

Other Segments & YoY Change

Figure 5 – Source: Quarterly Reports

The managed equity and brokerage segments have continued to be relatively quiet over the last few quarters, but that should not come as surprise to anyone given the extremely bearish sentiment in precious metals equities lately.

Figure 6 – Source: Quarterly Reports

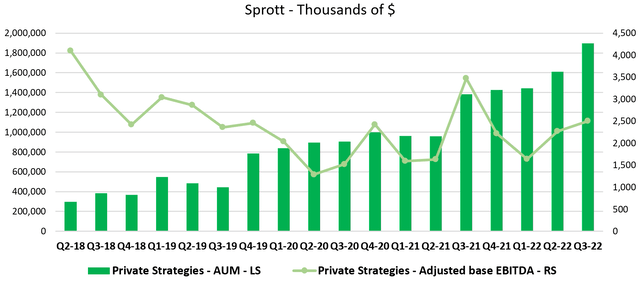

The private strategies segment has however started to see some positive momentum, with both AUM and earnings climbing. That is due to a few more mandates being launched and the ongoing deployment of the second lending fund. The segment can be somewhat countercyclical to the other segments at Sprott.

Figure 7 – Source: Quarterly Reports

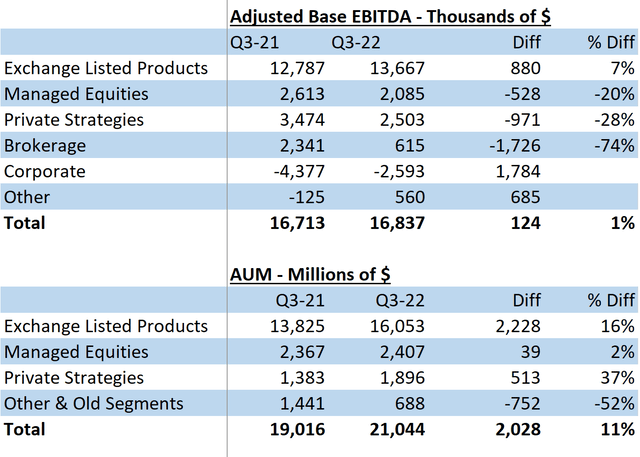

Year-over-year, we can see that AUM is up 11%, where the growth has come from exchange-listed products and private strategies. Adjusted Base EBITDA is, however, flat compared to last year, which is primarily due to weakness in the brokerage and to some extent the managed equity segment as well. Q3 last year was also a particularly strong quarter for private strategies’ earnings.

Conclusion

I have touched on this in the past, but I feel confident that the 2023 estimates for Sprott are overly conservative given the impressive history of generating growth even during challenging market environments.

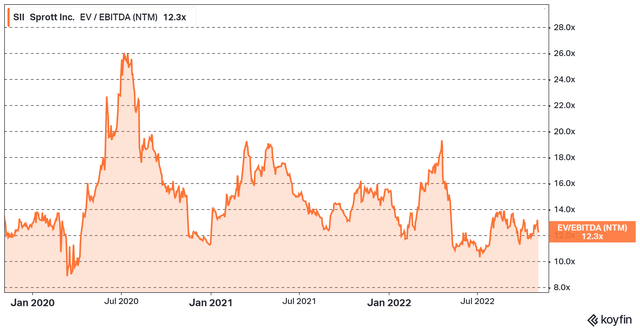

Having said that, the forward-looking EV to EBITDA is still relatively attractive compared to the recent history. I think we are likely to see both earnings climb and the multiple increase once we get more momentum in precious metals equities and uranium equities.

Exactly when that will materialize is more difficult to say, but I like owning Sprott at this level given the minimal jurisdictional, permitting, and operational risks. The company also pays a healthy 2.9% dividend yield with quarterly dividend distributions.

Sprott has managed to grow AUM by almost 200% in the last three years, from about $8B in Q3-19 to almost $24B in Q1-22 even if we have retraced some of the growth over the last couple of quarters. Looking forward another 3-5 years, I think the likelihood is quite high that we will see assets under management grow by another 100-200%, which could take AUM above $50B. That would likely lead Sprott to continue to perform well over the long term.

Be the first to comment