Hirurg

Summary

I believe Sportradar (NASDAQ:SRAD) is undervalued. The proliferation of mobile betting and the increasing demand for interactivity and personalization have fueled the growth of the sports-betting market. SRAD’s global presence and comprehensive services have helped them maintain a strong position in the industry and expand their customer base.

Company overview

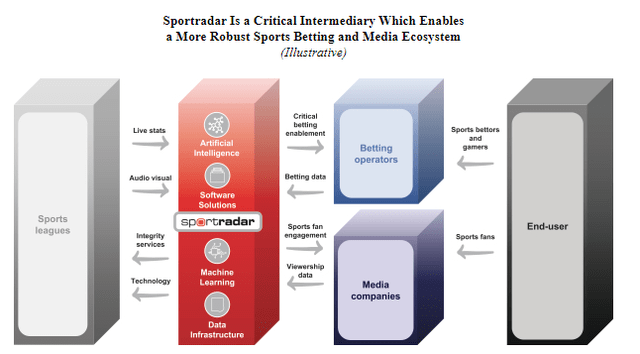

SRAD is the industry-standard technological platform and primary supplier of B2B solutions for the international sports-betting market. Their subscription services supply sports leagues, betting operators, and media companies with essential software, data, and content.

Sports betting is bigger today than ever before

For me, as a sports fan, there is an unbreakable bond to the teams I root for, and I imagine the same is true for sports fans everywhere. Nowadays, sports fans have higher expectations than ever before for interactivity, personalization, and the ability to access content across multiple platforms. SRAD’s prospectus claims that nearly nine in ten executives in the sports industry anticipate that live sports broadcasts will become more visually compelling, interactive, and immersive in the near future. I also think there will be new uses in virtual and augmented reality, live betting, and distribution.

Given that sports bettors engage with sports data and content more deeply than normal viewers, I believe sports betting is a core driver of this trend. Those who wager on sports tend to look for information that can help them make educated decisions by analyzing trends and patterns in past results, current conditions, and future projections. Due to this, new use cases in sports media, like player tracking, visualizations, and AR/VR, are rapidly gaining traction in response to the increased demand from sports bettors. In fact, it wouldn’t surprise me if similar additions were made in the near future.

Lastly, the proliferation of mobile betting, which has expanded access to sports betting and increased interactivity, is the most important development of the past decade. Betting on individual plays and other events that happen during a game in real time is one example. Therefore, I think the market for mobile betting will explode. This line of thinking is predicated on the assumption that sports bettors place a high value on the flexibility of being able to make wagers from any location with an internet connection.

Regulators are working their way to legalize sports betting

If you cannot beat them, join them. As a rapidly expanding sector of the gaming industry, sports betting is a force that regulators, in my opinion, cannot afford to ignore. By 2026, for instance, the United States, with its rapidly expanding legal market, is projected to generate $24.3 billion in gross revenue from the gaming industry.

The thing is, many of the world’s most important markets-the UK, Australia, Italy, and other parts of Europe and Asia Pacific-have legalized sports betting for years. Despite being a latecomer to the market, I expect the United States’ legalization of sports betting to spur rapid expansion in the industry and open up new markets for providers of sports data and technology. However, countries in other regions, including Brazil, India, and others in the African and Asia-Pacific regions, are actively considering or advancing regulatory efforts to move their betting markets from the unregulated to the regulated category. I believe the COVID-19 pandemic has worsened government budget shortfalls, which may make governments more receptive to legalizing sports betting as a new source of revenue.

SRAD has a strong market position in the industry

In my experience, SRAD is the only company that provides software for every step of the value chain, including but not limited to lead generation and ad tech, data collection, processing, and extrapolation, data visualization, and other operational solutions. Customers in over 120 countries can access all of these services from SRAD. I believe that SRAD’s global presence and variety of services make them the best suited to meet the needs of sportsbooks of all sizes. The convenience of SRAD as a one-stop shop for these operators is a major selling point, as they no longer have to worry about coordinating different pieces of software that may or may not work together.

I think that SRAD’s ability to offer a wide range of solutions to the betting industry bodes well for the company in emerging markets like the US, where operators will put a high value on customer acquisition, retention, and engagement while also being more likely to automate most of their betting service and platform operations.

Mission-critical solution

A significant barrier to entry exists in the SRAD market as a result of the high degree of operational and technological integration that typically exists between SRAD providers and their customers. The solutions provided by SRAD are indispensable to the functioning of sports betting organizations, as they increase the companies’ potential to generate gross gaming revenue and enhance the effectiveness of their internal processes. Furthermore, the solutions allow betting customers to automate a number of essential functions, which in turn reduces costs and allows them to better leverage SRAD’s scale and compete in the market.

Aside from making it difficult for new competitors to enter the market, this also gives SRAD a leg up on future price increases. Given how integral SRAD is to their business, I think customers would rather pay the premium than completely replace their digital infrastructure.

Strong portfolio of content

When compared to its rivals, SRAD’s portfolio of data rights is more extensive, and its coverage of events is greater. To put things in perspective, SRAD tracks more than 83 different sports from all over the world, such as the NBA and DFL (as per F-1). The NBL and AFC are just two examples of lower-level sports and regional sports leagues whose data SRAD collects.

I think SRAD has a competitive advantage in the sports betting industry due to their extensive database and in-house team of data journalists and analysts. This allows them to provide accurate live coverage and data for hundreds of thousands of events annually, giving them an edge in odds generation and original content creation for virtual sports. Replicating this level of expertise and technology would require a significant investment in time and resources, making SRAD a strong competitor in the market.

SRAD also offers alternative content and licenses the AV rights to broadcast 19 sports to bettors. This became particularly useful during the pandemic, when live sports were cancelled. By providing high-quality data and content for a wide range of events, SRAD helps its sports betting and media customers increase engagement and revenue.

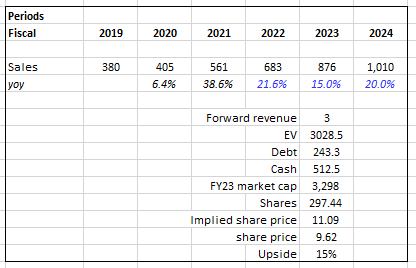

Valuation

My model suggests that SRAD is undervalued. At this valuation, investors are probably looking at a 15% return over a 1-year period.

My model assumption is based on management’s FY22 revenue guidance and my belief that the company would be able to continue growing at a high rate moving forward, post FY23, which I expect to be a down year where growth slows due to a weak macro-environment. One key assumption to make is at what valuation STAD should trade in FY23. SRAD currently trades at 3x forward revenue, which is 1.5x below its average. I have my beliefs that SRAD can trade back at to 4.5x again, but even if it doesn’t, it is still worth $11.09 in FY23.

Own calculations

Risk

Sports betting may never become fully legalized

While the trend and recent evidence suggest that sports betting will be legalized at some point, there is no guarantee. Even if it did, the timeline could be much longer than what current stakeholders anticipate. It would be detrimental to SRAD in either case.

Another pandemic

We’ve seen how damaging COVID has been to other industry players. Because there are no sports to bet on, the suspension of live games effectively eliminates the need for SRAD. In the event that a similar pandemic occurs again, stock prices could plummet.

Conclusion

SRAD has a 1-year upside of 15%. SRAD is a leading technology platform and supplier of B2B solutions for the international sports betting market. The growth of mobile betting, increased consumer demand for interactivity and personalization, and the legalization of sports betting in various markets have all contributed to the expansion of the industry. SRAD offers a comprehensive range of services and a global presence, making them well-suited to meet the needs of sportsbooks of all sizes.

Be the first to comment