David Tran/iStock Editorial via Getty Images

There are some investors who are in the bearish camp who think that the markets will see another sharp drop by year-end. As for me, I don’t think that’s the case: all the “bad news” has already spilled out earlier this year, including rising rates, the threat of stagflation, and increased geopolitical tensions. The markets have churned downward on fears of the same news, and though volatility has continued, we have also seen brief rally re-starts that show that investors are tiring of being bearish.

As such, I think it’s important for investors to start overweighting growth again, specifically in stocks that still show good value and have gotten a beat-down since last year. Splunk (NASDAQ:SPLK), in my view, is an excellent large-cap portfolio choice for investors who want to be exposed to one of the software sector’s most promising and broadly applicable names.

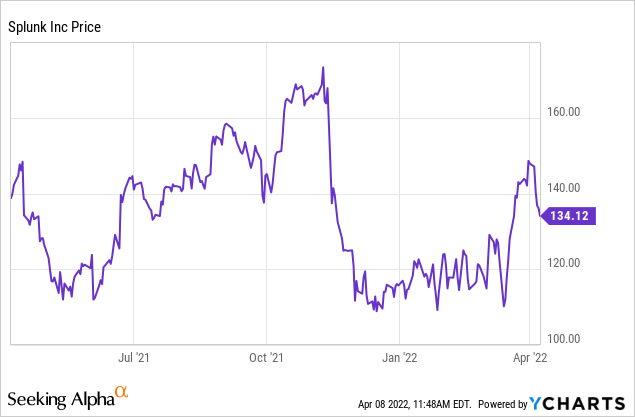

Splunk has, admittedly, retained its value better than most other high-growth SaaS peers. Year to date, the stock is even up ~15%; but that being said, Splunk is still down ~20% from all-time highs notched last November, and I think current share prices still offer plenty of opportunity for upside.

Splunk, for investors who are newer to this name, is a “big data” stock. Specifically, its software helps companies mine the “machine data” that its technology assets already generate. Splunk’s original and primary use case was network security, but data unlocks many more possibilities – so its products are now also used for analytics and observability.

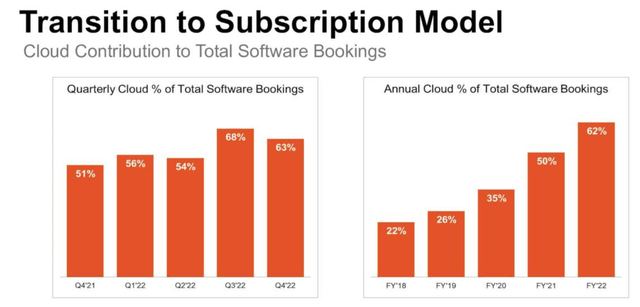

Splunk used to be a “legacy” license-based software vendor, but over the past several years it has followed the trend of its peers into the SaaS arena, and now roughly two-thirds of its software bookings are cloud-based. That transition into the cloud temporarily halted revenue growth (as one-time upfront license deals were now suddenly spread into thinner streams of revenue over time), but now that Splunk’s cloud transition has reached a mature phase, its growth and profitability metrics are getting back on track.

The company also just signed on a new CEO, Gary Steele – the former founder and CEO of Proofpoint. Initially, the news of Splunk CEO Doug Merritt’s departure after leading Splunk for 7+ years came as an unwelcome surprise to investors, but given the stock market’s reaction since Steele’s press release, investors seem to be confident in the choice of this seasoned technology industry executive.

Here’s a recap of what I believe to be the key bullish drivers for Splunk:

- The use cases for Splunk are infinite. In its early days, Splunk’s machine data-mining capabilities were often used for security purposes to flag and respond to anomalies within corporate systems. But as Splunk has evolved, the company’s machine data capabilities are applicable across virtually any industry and across many functions.

- Usage-based pricing. Some of the most successful software stocks are usage-based, meaning that revenue climbs proportionally to a customer’s usage of the product. Splunk’s platform is charged on a data volumes/computing power basis. As data volumes continue to explode and companies continue to push the boundaries of how they integrate data into operations and decision-making, Splunk has a tremendous opportunity to derive growth from within its install base.

- Splunk isn’t without competitors, but the company’s focus on machine data is unique. It’s also the largest company in the space. The company’s closest large/public peers are the monitoring companies like Datadog (NASDAQ:DDOG) and New Relic (NYSE:NEWR), which primarily focus on monitoring the performance and uptime of applications and infrastructure. Splunk focuses on visualizing and analyzing machine data (information passively generated by computers, phones, and other endpoints within networks). We note as well that Splunk’s ~$2.5 billion annual revenue scale makes it nearly three times larger than its next-closest competitor, Datadog.

- Industrywide recognition. More to the point above, it’s fine to have competition when Splunk also is widely considered the best-in-breed vendor for machine data analytics. Gartner, the software industry’s leading analyst and reviewer, has bestowed the “Leader” designation to Gartner in the security information and event management space, and also named it as the vendor with the highest ability to execute. These commendations don’t come lightly to IT buyers when making a purchase decision.

- Significant international expansion opportunity. Splunk has become a global brand name, and it’s time for Splunk to chase more opportunities overseas. Currently, only about ~35% of its revenue base comes from international markets (and an even smaller ~20% slice of the cloud business is overseas). I see significant opportunity for Splunk to expand its presence outside of the U.S.

From a valuation perspective, Splunk isn’t exactly a huge bargain, but it’s trading at a reasonable value for the quality of its fundamentals. At current share prices near $134, Splunk trades at a market cap of $21.51 billion. After netting off the $1.76 billion of cash and $3.14 billion of debt on Splunk’s most recent balance sheet, the company’s resulting enterprise value is $22.88 billion.

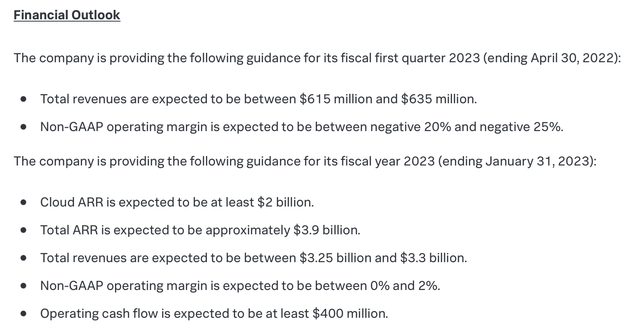

Meanwhile, for the upcoming fiscal year, Splunk is guiding to $3.25-$3.3 billion in revenue (22-23% y/y growth) as well as flat to low single-digit pro forma operating margins:

Splunk FY23 outlook (Splunk Q4 earnings release)

Against the midpoint of Splunk’s revenue guidance, the stock trades at 7.0x EV/FY23 revenue – again, not exactly a bargain, but for a cash-flowing company with ~20% y/y growth, during tech’s heyday last year, a financial profile like this would have been valued north of ~10x revenues.

The bottom line here: now that a lot of noise stemming from Splunk’s cloud transition plus its CEO switch are in the rearview mirror, investors can now focus on the company’s solid fundamentals. Stay long here.

Q4 download

Let’s now dig into Splunk’s latest Q4 results in greater detail. You may recall that Splunk stock dropped heavily at the tail end of Q3 because of a low guidance outlook for Q4. In true “underpromise, overdeliver” fashion that has become so common for the software industry, Splunk came nowhere near its original guidance.

Take a look at the earnings summary below:

Splunk Q4 results (Splunk Q4 earnings release)

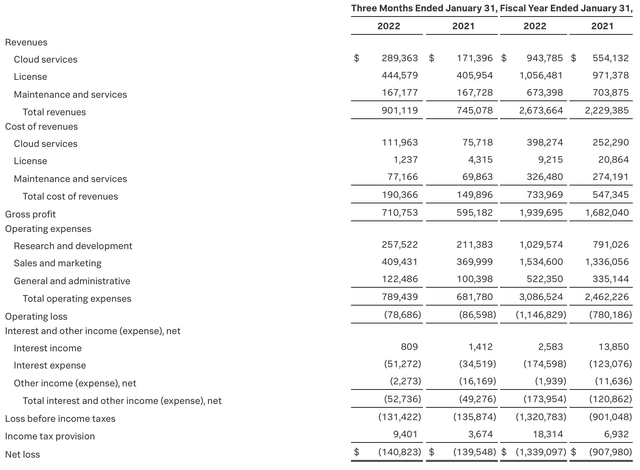

Splunk’s revenue in Q4 grew 21% y/y to $901.1 million in the quarter, beating Wall Street’s expectations of $776.4 million (+4% y/y) by a massive seventeen-point margin. Note that the company had originally guided to a -1% to +6% y/y growth rate for the quarter.

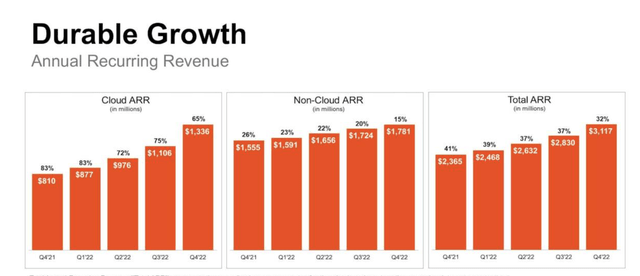

Now, the unpredictability of Splunk’s revenue is largely driven by its cloud/subscription transition, where timing of license deals / number of customers moving over from license renewals to cloud renewals is highly unpredictable. In Q4, 63% of Splunk’s new software bookings accrued to cloud, up twelve points from the year-ago quarter. You can also see on the right-hand side of the chart below how the cloud bookings mix has grown over time:

Splunk cloud bookings (Splunk Q4 earnings deck)

Similarly, Splunk has managed to grow total ARR at a 32% y/y pace to $3.1 billion in the quarter. We note that with Splunk guiding to “only” $3.25-$3.30 billion of revenue in FY23, and with ~96% of that revenue already locked into the ARR base, there’s quite a bit of opportunity for Splunk to overachieve its FY23 forecast just as it did in Q4. Note as well that the cloud portion of the ARR base, representing just shy of half the total, grew 65% y/y.

Splunk ARR trends (Splunk Q4 earnings deck)

Management believes the revenue headwinds from the cloud transition are largely in the rearview mirror, and going forward revenue growth should more closely mirror ARR growth. Here’s some additional helpful commentary from CFO Jason Child’s prepared remarks on the Q4 earnings call:

Q4 was an excellent finish to a strong year. Most importantly, the significant financial headwinds related to our transformation are now largely behind us. For the full year FY 2022, revenue growth accelerated from minus 5% to positive 20%. RPO bookings growth accelerated from minus 17% to positive 35% […]

We continue to drive cloud adoption and develop migration strategies with our customers. As Graham said, cloud mix is likely to increase more gradually from this point. Our full year cloud bookings mix was 62% for FY 2022, and we estimate that it will approach 70% this fiscal year. This increase of roughly 8 percentage points compared to the 12 percentage point gain we saw from fiscal 2021 to fiscal 2022.

Now that, revenue is normalizing and average term contract duration is more comparable on a year-over-year basis, RPO bookings is becoming a better indicator of overall bookings momentum and will be an important growth metric going forward. Our confidence in bookings growth is based on the scheduled renewal of approximately $1.5 billion of annual contract value this year and a consistently high cloud DB NRR, which reached 132% last quarter.”

Splunk has also made strong inroads on profitability, which is relatively unsurprising when its pro forma gross margins sit in the mid-80s (which can be considered best-in-class among software stocks).

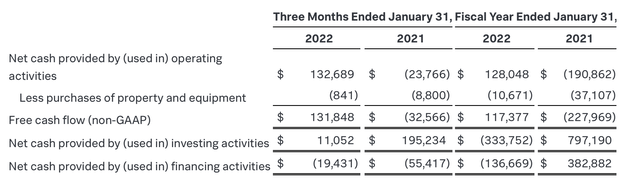

In particular, note that Splunk is now free cash flow positive again: in FY22, the company generated $117.4 million in FCF, despite burning through nearly double that amount in FY21.

Splunk FCF (Splunk Q4 earnings release)

Key takeaways

With a leadership transition complete and a cloud shift now in the rearview mirror, it’s time for investors to refocus on Splunk’s incredible growth story and the broad applicability of its machine data platform. Splunk’s valuation leaves ample room for upside in the case of a broader market rally. Stay long here.

Be the first to comment