GoodLifeStudio/iStock Unreleased via Getty Images

Investment Thesis

Airbnb, Inc. (NASDAQ:ABNB) stock has gone nowhere since its IPO in December 2020. Instead, the stock primarily traded within a considerable consolidation range, straddling its resistance and support levels.

Nevertheless, Airbnb has proved that it could survive what was probably its worst possible crisis imaginable due to the pandemic. Management was always on its feet and pivoted the company adroitly towards sub-urban and long-term stay use cases. As a result, the company has recovered its pre-COVID performance. It even leveraged its higher ADR tailwinds and gained operating leverage remarkably.

However, we think ABNB stock’s growth premium remains a challenge. While Airbnb would undoubtedly benefit from the reopening, its margins could be impacted. Furthermore, the bifurcation between its valuation and its less expensive peers could affect its stock’s momentum. It could also explain why ABNB stock has not performed well, despite the robust recovery of its business.

As a result, we have decided to rotate away from ABNB stock. Consequently, we revise our rating on ABNB stock from Buy to Hold.

ADR Tailwind Is Likely To Wear Off

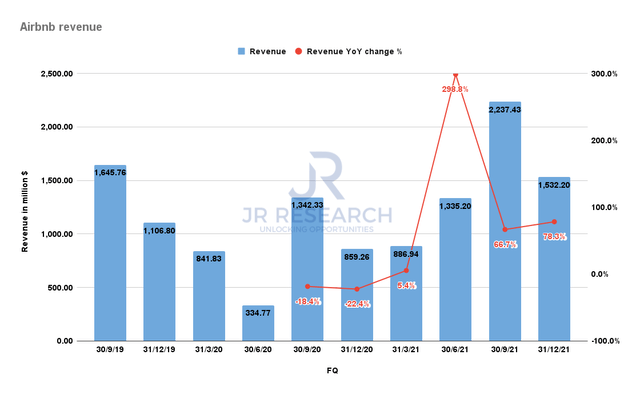

Airbnb revenue (S&P Capital IQ) Airbnb ADR (Company filings)

Airbnb reported another robust quarter in FQ4, as revenue surged 78.3% YoY. It has maintained its remarkable recovery seen in its previous two quarters, demonstrating the resilience of its business model. Airbnb differentiated itself against its OTA or hotel peers as it managed to leverage the remote working trend impressively.

The company also believes that the hybrid/remote working trend is likely to continue. In addition, Airbnb also expects the reopening to lift its summer vacation spend, given pent-up demand. Notably, Airbnb did not expect a material impact on travel demand despite the Russia-Ukraine conflict.

However, we expect the upward trend of its ADRs to moderate moving forward. The higher ADRs from longer-term stays should be normalized as the reopening gains cadence. Shorter duration stays could also impact its ADRs moving forward. Notably, the company didn’t provide clear guidance on its moderation, as CFO Dave Stephenson articulated (edited):

ADRs may moderate this year and as the mix of our business changes, that will be an offset to some of the further improvements in our fixed cost leverage and variable costs.

We expect that as urban comes back, and we are continuing to see urban accelerate every quarter and some of our lower ADRs markets would start coming back.

So if ADRs moderate a little bit less, there’s room for some upside in EBITDA. But, ADR is a little bit of a challenge to forecast. If ADRs remain higher and stronger, that’s a tailwind to EBITDA. But, if more urban returns, more lower ADR regions return, that will be a continued headwind for our margins.

– Source: Airbnb’s FQ4’21 earnings call

Also, GAAP Profitability Is Weak

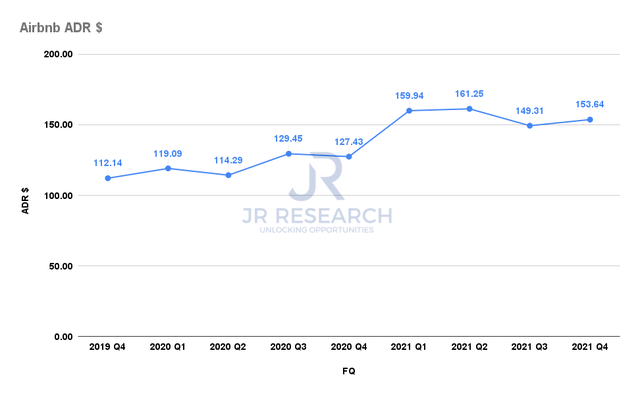

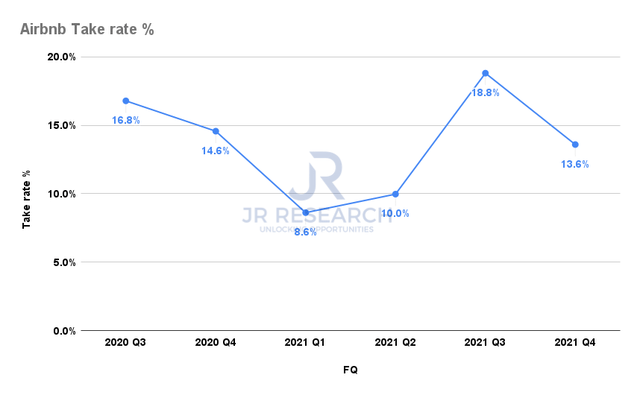

Airbnb EBITDA margins % (S&P Capital IQ, company filings) Airbnb take rate % (Company filings)

We can already observe the impact on its take rate in FQ4. As a result, it has also affected its EBITDA margins. The company’s preferred guide is its adjusted or non-GAAP EBITDA margins. Airbnb reported an adjusted EBITDA margin of 21.8% in FQ4, down markedly from FQ3’s 49.2%. That was quite an anomaly which the company didn’t expect to repeat even in a fantastic quarter. However, its GAAP EBITDA margins were relatively weak. FQ4’s GAAP EBITDA margins came in at just 7%. Therefore, investors must be careful when utilizing the company’s adjusted metrics.

Nonetheless, Airbnb emphasized that it’s still in growth mode. Therefore, the company would carefully manage its balance between growth and profitability. We think it makes sense. The company trades with an embedded growth premium. Consequently, it needs to demonstrate superior topline growth to justify its premium. Consensus estimates suggest Airbnb’s FY22 revenue could increase by 31.2% YoY to $7.86B. Notably, it was revised upwards from its pre-earnings estimate of $7.3B (up 21.8% YoY). Therefore, it was a significant revision to the upside, which lifted its stock post-earnings.

The Street also remains optimistic about its FY22 adjusted EBITDA margins. It expects an adjusted EBITDA margin of 27%. But, we think there could be discernible downward pressure on its take rate that needs to be carefully monitored. Moreover, given ABNB’s growth premium, its stock could face compression if the impact on its profitability was more significant than estimated.

Is ABNB Stock A Buy, Sell, Or Hold?

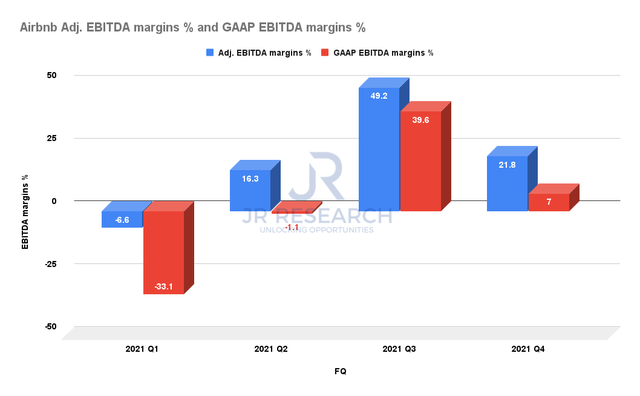

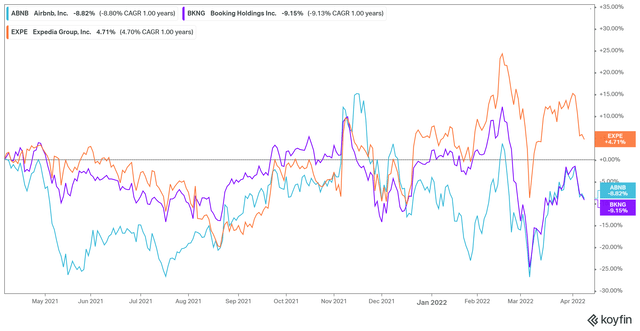

ABNB stock NTM FCF yield % (TIKR) ABNB stock vs. peers (Koyfin)

Airbnb is FCF profitable. It also has more than $8B in cash & equivalents. Therefore, the company is well-positioned to invest in its growth and product development.

However, its stock’s growth premium is implied in its NTM FCF yield. ABNB stock traded at an FCF yield of 2.1%, below Booking (BKNG) stock’s 4.8%. It was also significantly below Expedia (EXPE) stock’s 13.4%. Given EXPE stock’s outperformance against ABNB over the past year, it’s hard to argue that valuation didn’t matter.

Also, ABNB stock’s marked growth premium necessitated the company to execute well on its growth strategies. But, we are concerned about its bottom line hit, which could also impact its FCF margins moving forward. Therefore, we think the Street could be too optimistic.

Given the multitude of growth stock opportunities afforded by the recent tech bear market, we have closed all our ABNB stock positions. Consequently, we revise our rating on ABNB stock from Buy to Hold.

Be the first to comment