DNY59/E+ via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. A version of this article was published to members of the CEF/ETF Income Laboratory on March 26th, 2022.

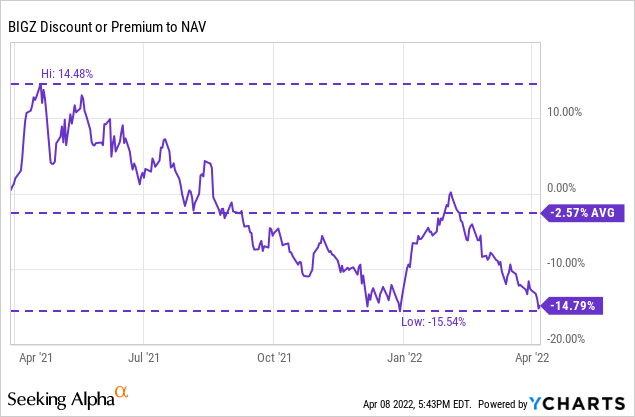

BlackRock Innovation & Growth Trust (NYSE:BIGZ) might be a buy here if an investor can stomach the more significant risks. Both the discount and the sheer magnitude of the drop mean that it is a better value than when it first launched. At one time, shortly after the fund launched, it raced to a premium and traded there for a while. I bought shortly after the IPO myself, but before it reached some wild premium levels.

As of March 26th, 2022, it was the biggest red percentage number in my closed-end fund portfolio. On a share price only, I’m at a loss of 31.82% as of writing. On a side note, it might be interesting to note that I’ve had energy funds down significantly more at points (March 2020). Perhaps a small consolation. Now, Kayne Anderson NextGen Energy & Infrastructure (KMF) and Tortoise Energy Infrastructure (TYG) are the greenest positions in my portfolio based on price performance. Funny how that can change so drastically.

I’ve averaged down on a couple of occasions in BIGZ. With a lot of exposure to BlackRock’s other tech/innovation funds, I’m comfortable with my positioning here more broadly. However, I’ve been continuing to debate adding more anyway, just about every day.

I believe, in the past, I’ve tried to make it apparent that BIGZ is a riskier position. Its underlying holdings are in high growth positions, with interest rates rising; that’s exactly what investors don’t want at this time. They also have exposure to private investments, making things even more uncertain.

A line I’ve included in my previous articles continues to remain my feelings today.

BIGZ might have been a bit of a disappointment so far, but this is a long-term investment, in my opinion. It will take a good 5 to 10 years’ worth to see if this investment pans out or not. In the meantime, investors can receive the monthly distributions.

The Basics

- 1-Year Z-score: N/A

- Discount: 14.79%

- Distribution Yield: 11.08%

- Expense Ratio: 1.29%

- Leverage: N/A

- Managed Assets: $3.116 billion

- Structure: Term (anticipated liquidation date of March 26th, 2033)

The objective of BIGZ is to “provide total return and income through a combination of current income, current gains and long-term capital appreciation.”

The fund attempts to achieve this objective by focusing on “mid- and small-capitalization growth companies that are “innovative.” These are companies that have introduced or are seeking to introduce, a new product or service that potentially changes the marketplace. The Trust utilizes an options writing (selling) strategy in an effort to generate current gains from options premiums and to enhance the Trust’s risk-adjusted returns.”

At this time, it only has an overwritten portion of its portfolio at 10.34%. That is quite low and can be by design. If BIGZ is hoping for its portfolio to make a recovery, having fewer calls written will help so it doesn’t have positions called away as it rebounds. They confirms this sentiment in their Q4 commentary.

The options program is a dynamic call-writing process, focused on single stocks to allow for the greatest combination of current yield and capital appreciation. Given the team’s positive outlook on portfolio companies and recent weakness in the small and mid-cap market, the percentage of the portfolio overwritten remained low at the end of the year, which we believe positions the strategy for greater upside in coming quarters. As of December 31st, 10.5% of the portfolio was overwritten with covered calls.

The fund’s expense ratio comes to 1.29%. This is on the higher side for a BlackRock equity option-writing fund. However, it also reflects the higher management fee for investing in private holdings. It often takes more research and digging to do that. Unfortunately, those added expenses haven’t produced positive results at this time.

BIGZ doesn’t employ any leverage, which is probably a good thing as its underlying holdings are volatile enough. That being the case, that is one less negative to consider going forward from higher interest rates.

The fund is a limited-term fund and expects to liquidate on its 12th anniversary. Though they include the typical language to extend the fund with an eligible tender offer for 100% of outstanding shares at 100% of NAV. If they have $200 million in net assets remaining, the Board can decide to eliminate the term structure.

Performance – Attractive Discount

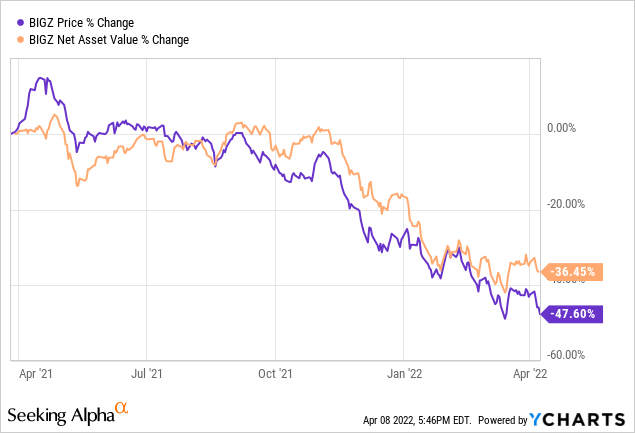

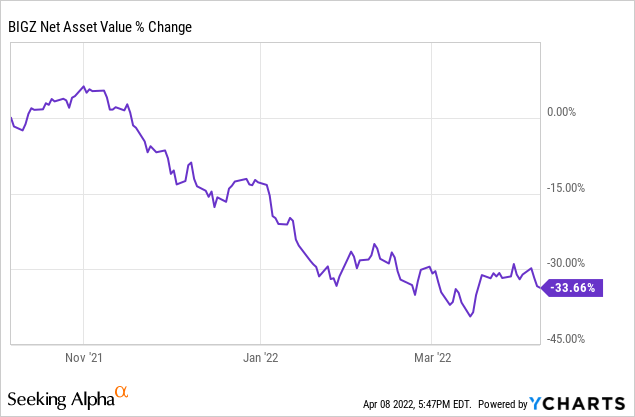

Today is the 1 year anniversary of the fund. It launched on March 26th, 2021. Since that time, if we take a look at just the share price and NAV declines, they are quite substantial.

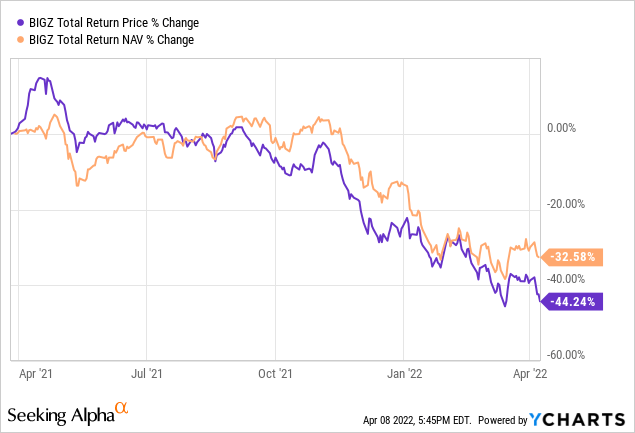

Taking a look at the fund’s total returns, it is still showing substantial declines. However, the distributions help take a bit of the sting away. The NAV is down by just about a third since launching.

We can see in the charts above that the fund was holding up throughout a lot of 2021. It was when innovation names started to slump in November that we saw BIGZ also declining materially.

Since then, shares have been on a rather rapid descent lower in a volatile manner. Certainly not something for the faint of heart to hold a position in, so I try to reiterate how risky this fund is.

The latest discount of the fund is at an unusually wide 14.79%. If its rather short history is any guide, the discount shouldn’t widen out too much further. Previously, the discount low was 15.54%.

One other thing that should be noted in terms of the performance is from the management team themselves. They continue to mention a “J-curve” with their private investments.

Some of our recent investments in this space, like Discord, Varo Money, Under Canvas, and Relativity Space showcase our cross-market approach to uncovering innovative companies that are enforcing change within their industries. These names, and other private holdings, are compelling for us because they are both consumers and producers of technology in ways that can drive scale, market share and ultimately long -term investment performance for our strategy. These companies are not marked to market daily, and so we expect the portfolio to experience a J-curve-like effect over time as their valuation becomes more fully accounted for in the NAV of the portfolio.

This is essentially saying that since it isn’t valued regularly, it could be a higher valuation over time as it gets priced in. However, that could be taken the other way as well. Since they aren’t being valued regularly, it could indicate that the values are lower than it is now. So to some degree, I understand the discount we are seeing. The market hates uncertainty, and investing in private companies does just that.

Distribution – Risk For A Cut

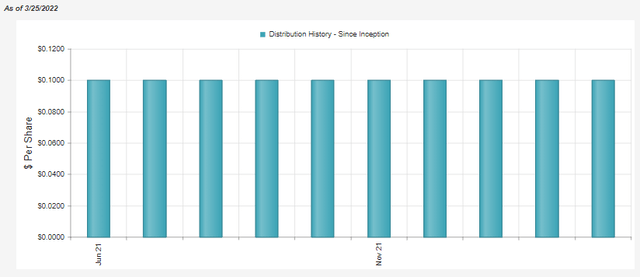

Since the fund launched, it has maintained a $0.10 per share monthly payout. That pushes the fund’s distribution yield to a lofty 11.08% at current levels. On an NAV basis, it is an elevated 9.44%. Since the fund relies on capital gains entirely to fund its distribution, one could expect a distribution cut.

BIGZ Distribution History (CEFConnect)

At the current level, I would suspect that we could see a cut in the next 6 to 12 months if things don’t turn around and head higher. It is incredibly difficult to predict equity funds because they can essentially pay whatever they want, for however long they want. At least until the NAV is wholly paid out. BlackRock doesn’t tend to cut as quickly as some other fund sponsors either.

Combining that with just how volatile BIGZ is can make it even more challenging to estimate what an appropriate payout is. The NAV can jump 20 or 30 cents a day. If we get a strong momentum in the innovation space, BIGZ could be back to IPO NAV in 6 months. I don’t necessarily see that happening given the current interest rate environment, but it is certainly possible. It basically only took 6 months for the NAV to decline over 35%.

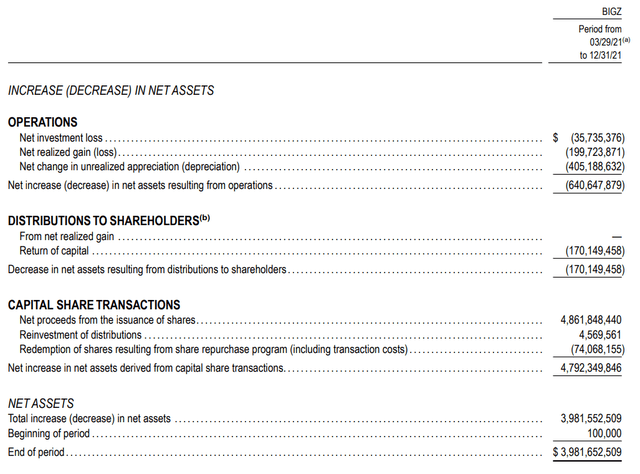

Here are the earnings from its latest Annual Report. However, it hadn’t been a whole year for the fund.

BIGZ Annual Report (BlackRock)

What we see is that the fund produced no income, no gains – realized or unrealized. Therefore, it could be thought that the entire distribution would have technically been destructive to the fund. With all that being said, it is up to management and the Board on exactly what they want to pay or if they keep up the current amount. In BlackRock we trust.

BIGZ’s Portfolio

The management team continues to be confident in the longer-term story, as one would expect a management team to be optimistic. However, it also makes sense to me that it continues to be a long-term play that could require 5 or 10 years+. Here is from the latest Q4 commentary that they have available touching on their private investments;

Perhaps the most exciting feature of BIGZ is the private equity side of the strategy, which we expect to be a critical driver of return for our portfolio over time. We have remained vigilant in both sourcing and investing in attractive deals across the market and have grown closer to our target allocation of 25%. At the end of the quarter, we had invested $744 mm across twenty-five high potential companies, which together accounted for 19.9% of the portfolio. Importantly- and like the public side of the portfolio- our private investments span a diversified slate of sectors including consumer discretionary, consumer staples, financials, industrials, and technology; areas we feel are ripe with innovation.

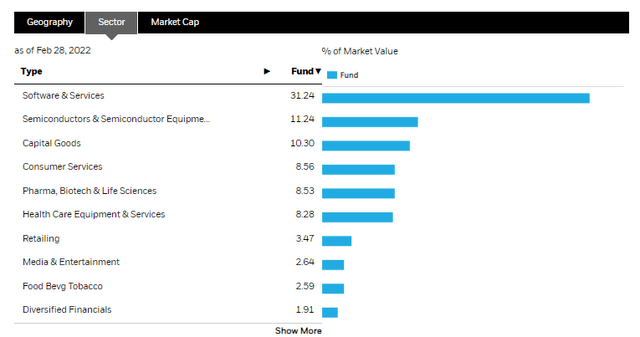

One of the reasons why I like BIGZ is that it isn’t necessarily all tech-related, as is often the case with growth/innovation funds. Tech certainly is some of the largest exposure, but representation elsewhere can help make it a bit more diversified.

BIGZ Sector Weightings (BlackRock)

Software & services, as well as semiconductors & semiconductor equipment, would most certainly be subcategories of tech. That represents around 42.5% of the portfolio, the remainder being outside of the sector, which is appealing. Especially when I already own BlackRock Science and Technology (BST) and BlackRock Science and Technology II (BSTZ). Those two funds are entirely tech-focused.

That’s another focus of the fund they pointed out in the commentary. It had 54 publicly traded holdings and 25 private holdings. Those holdings represented 9 of 11 “economic sectors.” They also touched on having different country exposure, but the vast majority of the portfolio is the U.S. based at over 86%.

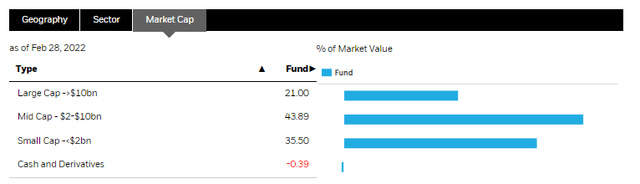

Since our previous coverage, BIGZ has interestingly reduced its large-cap exposure. I think we are also seeing a decline in valuations play out. Declines have happened to such a degree that it has increased the small-cap allocation of the fund.

BIGZ Market Cap Weighting (BlackRock)

Previously, large-cap represented nearly 44% of the portfolio. So this was quite a drastic change. The average market cap of its holdings at the end of February was $8,366.1 million, a decline from the $10.8 million level.

While I would firmly classify myself as an income investor, one of the frustrating things for growth investors has to be that earnings are still growing strong. This was no different for BIGZ’s underlying portfolio. They highlighted strong growth, yet they aren’t being rewarded for it. One of the reasons is just how well these stocks had done throughout 2020 that elevated their valuations to sky-high levels. Now the earnings have to catch up to the valuations.

As indicated earlier, despite the market pressure on the innovation segment, our companies continued their momentum during last quarter’s earnings season. During the third quarter reporting cycle, 77% of our public holdings beat on consensus revenue expectations, and another 73% beat on consensus EBITDA figure. Not only are the BIGZ businesses outgrowing expectations, but revenue is flowing through to the bottom line as our businesses carefully execute on growth avenues and allocate capital effectively to do so. Again, these results reaffirm our conviction in the strategy and the current (and future) earnings potential of the BIGZ portfolio. We also believe these results highlight the profound impact that small and medium-sized business will continue to have on the US economy in the years ahead.

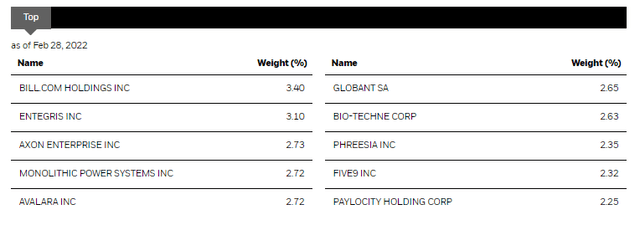

Looking at the top ten, we see several names that remain in the portfolio. Overall, they don’t have a significant number of positions. At the end of Q4, they mentioned 79 holdings. At the end of February 2022, we see 87 positions. The top ten make up nearly 27% of the portfolio.

Since our previous update, Bill.com Holdings (BILL) has moved itself into the number one position. Phreesia (PHR) is still positioned in a top spot but was previously the largest position at the end of October.

The only new position that wasn’t in the top ten previously is Globant (GLOB). This is a tech company with operations around the globe, headquartered in Luxembourg. For some idea of what they provide, they “offer e-commerce, new distribution capabilities, augmented revenue management, hyper connect operation, and a conventional user experiences service through reinvention studies; digital lending, commercial effectiveness, finance, sustainability, regulation analytic, transformation and post-merger integration, and payment and open banking services; and game and graphic engineering, UI and UX design, game as a service, DevOps, and online services, as well as high tech tools”

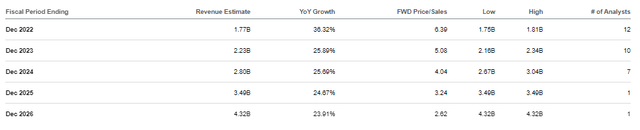

To better summarize, they are an IT and software development company. Similar to these other holdings, they have been experiencing strong growth. They are expected to continue to see strong growth going forward as well.

GLOB Revenue Estimates (Seeking Alpha)

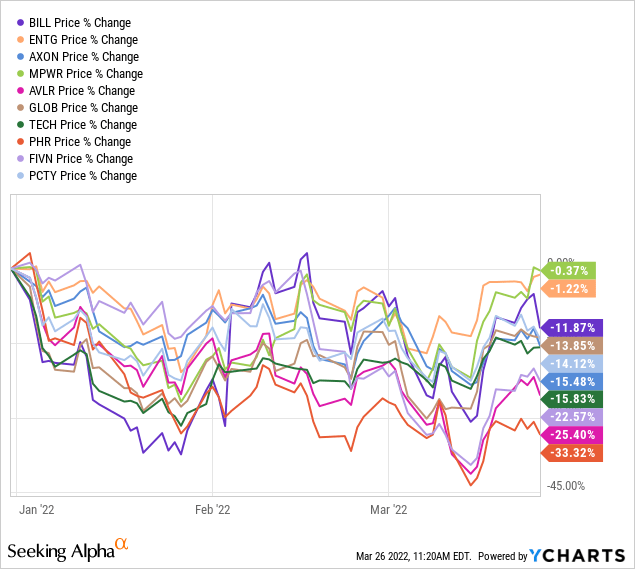

Taking a look at the YTD performance of these ten stocks reflects why BIGZ has been in such a decline lately. It is important to remember that a CEF is just a shell with underlying holdings. It moves with how its portfolio moves; it isn’t an asset itself.

YCharts

The “best” performing positions have been Monolithic Power Systems (MPWR) and Entegris (ENTG). Even then, those have declined on a YTD basis in terms of price performance.

Conclusion

BIGZ isn’t for everyone. It is quite risky, and we continue to see this play out. For those that don’t mind riskier holdings and the potential for strong growth in the future, I suspect this would be an appropriate holding. This is especially true at the current discount of the fund, in my opinion. At the same time, one can collect a regular monthly distribution. I don’t believe the current level is sustainable for long if we don’t get a rebound; however, it will still ultimately pay something to investors.

Some final notes; I plan to continue to hold and am very seriously debating adding more to average down further. It represents 1.26% of my CEF portfolio, so it is also essential to consider position sizing for one’s own comfort level. If by some chance, this CEF went to $0 somehow, I’m not out anything too substantial and damaging to my overall portfolio.

Be the first to comment