David Tran/iStock Editorial via Getty Images

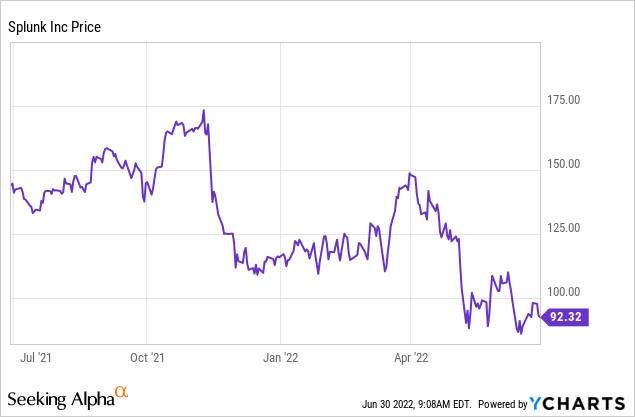

While I understand the shift toward a more cautious investing attitude this year due to heightening macro risks, the declines in several individual stocks have far exceeded what fundamentals should allow. Splunk (NASDAQ:SPLK), for example, has fallen to multi-year lows not seen since 2018 despite the fact that the business has never looked healthier.

Splunk, for investors who are unfamiliar with the name, is a large-cap big data software stock. It specializes in “machine data”, helping companies gather and analyze the data generated by their internal technology assets. Originally used primarily for security purposes, Splunk’s use cases have since evolved across the full spectrum of business analytics.

Year to date, shares of Splunk have fallen ~20%. This is milder than most tech stocks, but do note that Splunk did see a major squeeze downward in November (again, due more to sentiment than to fundamentals) – over the past year, the stock is down 36%. It’s an excellent time, in my view, for investors to take a hard second look at this name.

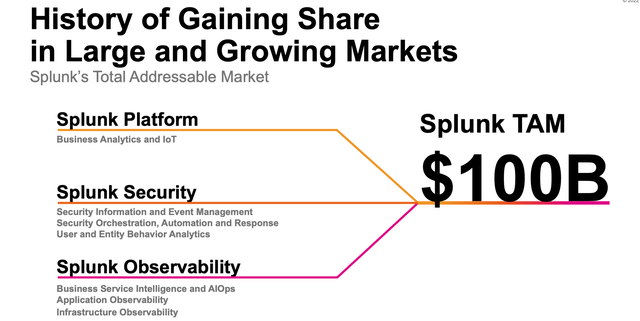

Splunk’s $100 billion TAM and the long-term bull case

I remain firmly bullish on Splunk. On a short-term basis, the company is hitting on all the right notes. Growth is exceeding 30% y/y, and the company is finally reaping the benefits of its multi-year cloud transition. Customers are expanding their contracts, and cloud is now at sufficient scale to allow for significant margin expansion. And in acknowledgement of its strong execution year to date, Splunk boosted its guidance outlook for FY23.

On a longer-term view, investors should remember that big data is one of the broadest and most lucrative markets in enterprise software. Splunk, in particular, estimates its TAM at a whopping $100 billion:

Splunk TAM (Splunk Q1 earnings deck)

Here is a full rundown of the reasons to be bullish on Splunk:

-

The use cases for Splunk are infinite. In its early days, Splunk’s machine data-mining capabilities were often used for security purposes to flag and respond to anomalies within corporate systems. But as Splunk has evolved, the company’s machine data capabilities are applicable across virtually any industry and across many functions.

-

Usage-based pricing. Some of the most successful software stocks are usage-based, meaning that revenue climbs proportionally to a customer’s usage of the product. Splunk’s platform is charged on a data volumes/computing power basis. As data volumes continue to explode and companies push the boundaries of how they integrate data into operations and decision-making, Splunk has a tremendous opportunity to derive growth from within its install base.

-

Splunk isn’t without competitors, but the company’s focus on machine data is unique. It’s also the largest company in the space. The company’s closest large/public peers are the monitoring companies like Datadog (NASDAQ:DDOG) and New Relic (NYSE:NEWR), which primarily focus on monitoring the performance and uptime of applications and infrastructure. Splunk focuses on visualizing and analyzing machine data (information passively generated by computers, phones, and other endpoints within networks). We note as well that Splunk’s ~$3.3 billion annual revenue scale makes it twice as large as its next-closest competitor, Datadog.

-

Industrywide recognition. More to the point above, it’s fine to have competition when Splunk also is widely considered the best-in-breed vendor for machine data analytics. Gartner, the software industry’s leading analyst and reviewer, has bestowed the “Leader” designation to Gartner in the security information and event management space, and also named it as the vendor with the highest ability to execute. These commendations don’t come lightly to IT buyers when making a purchase decision.

-

Significant international expansion opportunity. Splunk has become a global brand name, and it’s time for Splunk to chase more opportunities overseas. Currently, only about ~35% of its revenue base comes from international markets (and an even smaller ~20% slice of the cloud business is overseas). I see significant opportunity for Splunk to expand its presence outside of the U.S.

Valuation check and guidance boost

In spite of all of these merits, Splunk’s persistent stock price decline has led to its most attractive valuation ever. At current share prices near $92, Splunk trades at a market cap of $14.85 billion. After we net off the $1.83 billion of cash and $3.87 billion of debt on Splunk’s most recent balance sheet, the company’s resulting enterprise value is $16.89 billion.

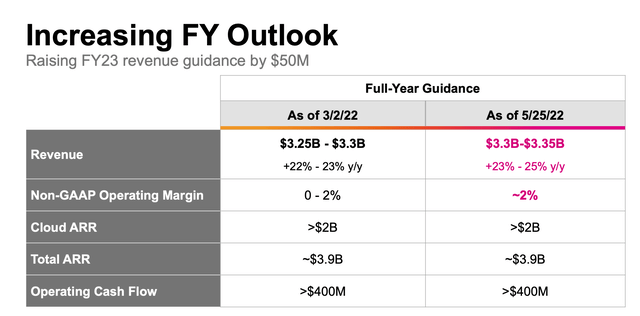

Meanwhile, the company has recently boosted its full-year guidance outlook to $3.30-$3.35 billion in revenue, representing 23-25% y/y growth. We note that with 34% y/y revenue growth and 29% y/y bookings growth in Q1, there could still well be opportunity on top of this outlook.

Splunk guidance (Splunk Q1 earnings deck)

Regardless, at the midpoint of Splunk’s current guidance, we arrive at a valuation of just 5.1x EV/FY23 revenue – a downright bargain for a cloud stock currently growing north of >30% y/y.

Q1 download

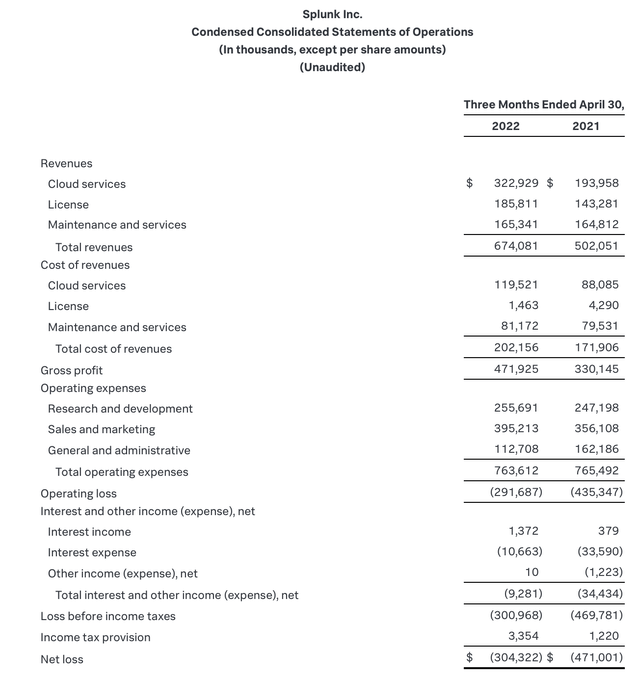

Splunk’s latest Q1 results were, no surprise, excellent. Take a look at the Q1 earnings summary below:

Splunk Q1 results (Splunk Q1 earnings deck)

As previously mentioned, revenue grew 34% y/y to $674.1 million, beating Wall Street’s expectations of $629.7 million (+25% y/y) by a huge nine-point margin. Revenue growth also accelerated considerably from 21% y/y in Q4.

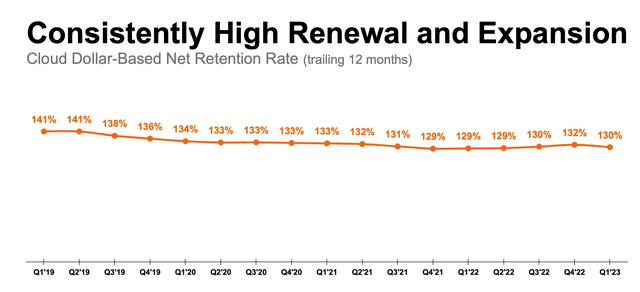

Splunk also achieved a net retention rate for its cloud products at 130% – indicating that the average upsell that its customers commit to is 30%.

Splunk net expansion rates (Splunk Q1 earnings deck)

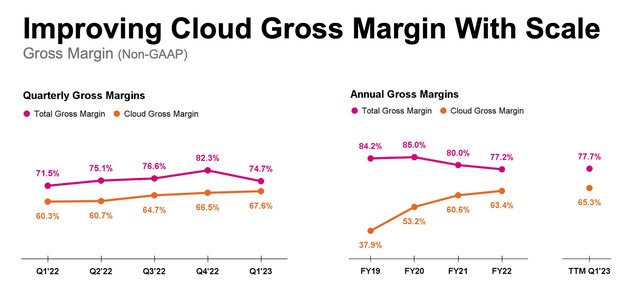

Perhaps even more impressive than top-line strength this quarter, however, was margins. We needed to be patient with Splunk over the past few years as it got its cloud business off the ground and migrated customers over to cloud. But now at scale, Splunk’s cloud gross margin stands at 67.6%, 740bps higher than 60.3% in the year-ago quarter. In turn, this has boosted overall company gross margins to 74.7% (now in line with many other cloud peers), up 320bps from 71.5% in the year-ago quarter.

Splunk gross margins (Splunk Q1 earnings deck)

The company is making similar moves on the opex side. One impressive thing that the company is doing is flattening its org structure at the leadership level, which is not something that companies usually do (especially not with a new CEO). Per CEO Gary Steele’s prepared remarks on the Q1 earnings call:

I’ve been overwhelmed by Splunkers’ passion and high energy, and we have an exceptional base of talent serving our customers. I continue to meet with our teams around the world to understand our go-to-market and product opportunities. From these conversations, I see an opportunity for more streamlined processes across the company.

In line with this, my first priority has been to increase internal speed and agility across our people and organizations. Flattening our org structure will help us do that. You noticed that following the departure of Teresa Carlson, we did not backfill her role as President of go-to-market. Today, we’re also announcing the departure Shawn Bice, President of Products and Technology, and we will not backfill his position either. I will be hands-on with the go-to-market and product leadership teams with an emphasis on scaling efficiently where we can. We appreciate your contributions here, Shawn, and wish you the best of luck in your next endeavor.”

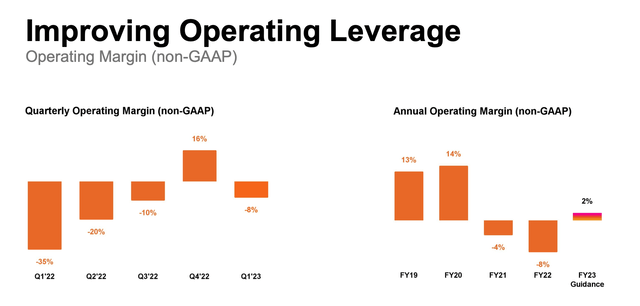

Due to operating leverage driven in no small part by these moves, as well as the lift in gross margins, Splunk’s pro forma operating margin in Q1 was -4%, much better than -35% in the year-ago Q1.

Splunk operating margins (Splunk Q1 earnings deck)

The company also lifted its full-year operating margin outlook to 2%, up from 0-2% previously and the first time that Splunk will return to positive operating margins since it kicked off its cloud transition.

Key takeaways

At ~5x forward revenue, Splunk is an absolute steal. You’re getting a company with accelerating revenue growth, strong bookings, incredible progress on profitability, a huge end-market and an energized new leadership team. Stay long here and wait on the rebound.

Be the first to comment