koto_feja/E+ via Getty Images

**This article was originally published for ROTY subscribers on May 2nd, but has been updated where necessary.

Shares of Merus (NASDAQ:MRUS) have risen by 40% since my June 2020 ROTY update and sport a 35% gain over the past 5 years. On the other hand, they’ve shed a third of their value since the start of 2022 (taking a significant hit along with the overall biotech sector).

In ROTY’s model account, I purchased a 3% portfolio weighting in late April and added to our position multiple times after oral presentation for Zeno (HER2 x HER3 bispecific antibody) in NRG1 fusion cancers at ASCO on June 5th proved encouraging.

Let’s move on to my update on this intriguing platform technology play and why it potentially has the kind of clinical momentum and asymmetric risk/reward profile that would allow me to keep holding patiently.

Chart

Figure 1: MRUS weekly chart

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares rise above $30 in early 2021 after the license agreement was inked with Loxo Oncology/Eli Lilly (LLY). From there, shares again rebounded in October after promising responses were reported for Peto/MCLA-158 in HNSCC (head and neck squamous cell carcinoma) at the AACR-NCI-EORTC conference. Currently, shares are trying to regain the 20-day moving average on the weekly chart and have rebounded nicely post ASCO presentation of Zeno data. My initial take is that investors interested in the name would do well to purchase a pilot position presently and add more exposure on dips ahead of Peto readout later this year.

Overview

In my 2020 update, I touched on the following keys to our bullish thesis:

- I stated that the company’s mission is to pursue unique bispecific and trispecific cancer candidates based on well characterized immunoglobulin format (very easy to manufacture, low immunogenicity risk, improved half-life). I also pointed out that Merus’ lead candidates are novel (not “me too” treatments).

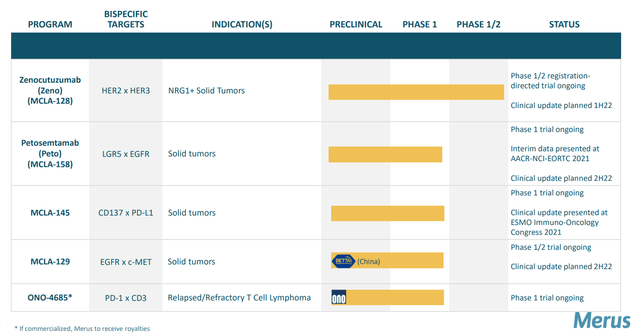

Figure 2: Pipeline

- MCLA-128 (ZENO) was thought to be the first HER3 targeting agent that’s proven effective. Zeno uniquely blocks NRG1 heregulin interaction (these cancers typically don’t have any other cancer driver mutations so they are truly driven by NRG1 gene fusion product and thus this particular MOA directly blocks this function). Early data in patients whose cancers harbored NRG1 fusions was promising, including partial responses in multiple pancreatic cancer patients as well as a NSCLC (non small cell lung cancer) patient. These subjects were heavily pretreated, including the latter with 6 prior lines of therapy. Importantly, the drug was well tolerated with a strong safety profile.

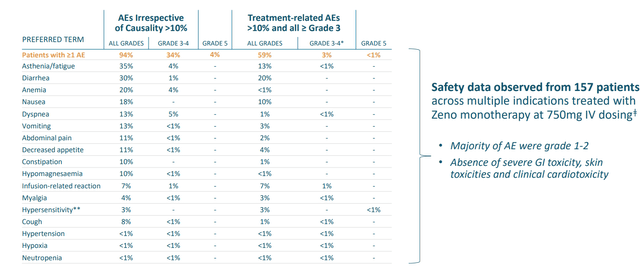

Figure 3: Zeno safety profile, mainly Grade 1 to 2 adverse events

- As for market opportunity, I pointed to company estimates of these fusions occurring in 0.3% to 3% of NSCLC, 0.5 to 1.5% of pancreatic cancer and less than 1% in other solid tumor types. AACR post on prevalence indicated market opportunity could be smaller (identified NRG1 fusions in approximately 0.2% of over 20,000 patients with diverse tumor types including 0.3% in patients with lung cancer). Following in the steps of precision oncology pioneers such as Loxo, management believed an efficient path to market exists via single arm enrichment study.

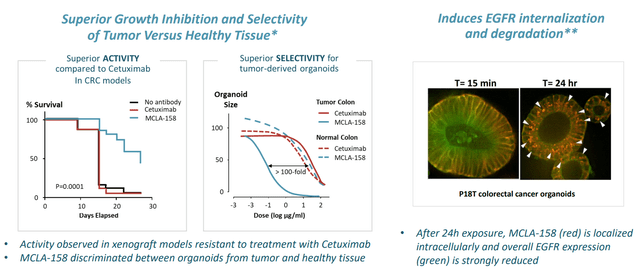

- As for MCLA-158, I noted that this first-in-class bispecific antibody is targeting LGLR5 (leucine-rich repeat-containing G protein-coupled receptor 5) and EGFR. For a frame of reference, I cited cetuximab (Erbitux) which at its peak achieved global sales of close to $2 billion despite a safety profile that left much to be desired (the rash comes to mind as one AE leading to dose reduction or treatment discontinuation).

Figure 4: Peto’s innovative mechanism of action would appear to offer the best of both worlds, selectivity & efficacy, in preclinical models

- As for leadership, I noted that prior CEO and President Dr. Ton Logtenberg was stepping down with Dr. Sven Lundberg to succeed him. New CEO Lundberg appeared to have some relevant experience, including serving prior as Chief Scientific Officer at CRISPR Therapeutics and as Head of Translational Medicine at Alexion Pharmaceuticals. Thus, he seemed to be a good fit to take the company into its next stage of value creation. Two appointments to Board of Directors caught my interest, Dr. Anand Mehra (General Partner at Soffinova Investments) and Paolo Pucci (former CEO of ArQule, where he led an impressive turnaround that culminated with the $2.7 billion buyout by Merck). I also highlighted Dr Victor Sandor on the board, who served prior as Chief Medical Officer at Array BioPharma, which was acquired by Pfizer for $11.4 billion.

Let’s move onto my notes from Needham Virtual Conference webcast.

Needham Notes

CEO Bill Lundberg starts by highlighting the common light chain technology utilized in Merus’ Biclonics and Triclonics, which allows them to produce monoclonals out of a single cell.

For Zeno, they met with the FDA at the end of last year, aligning on NRG1 fusion cancers being a population that could receive a drug approval and that the company’s ongoing clinical program could support such a filing (if efficacy and number of patients is sufficient). Lundberg expects they have aligned with the FDA and will have sufficient enrollment and patient follow up to support BLA filing. This is a competitive space, but there have been 5 prior approvals for tumor agnostic setting for solid tumors (among them, response rates ranged from 29% to 75% with durability of 5 months all the way to 1 year). If data is consistent with that range, they have potential for BLA filing. They did discuss specific, granular numbers with the FDA but have chosen not to share them for competitive reasons.

As for Zeno’s commercial opportunity (challenge of finding and identifying these patients), they have been successful enrolling 100+ patients in study which for uncommon tumor type is promising. The general trend toward personalized medicine should provide a tailwind as well (molecular panels already include NRG1). If patients have RAS wild type mutation, that is a smaller subtype in which NRG1 fusions almost exclusively occur. More recently, they have been able to enroll virtually every patient on the eNRGy trial instead of Early Access Program (as Covid has let up some). One key caveat is that Lundberg is “hopeful” the data package would be supportive of regulatory filing, but this sounds far from certain.

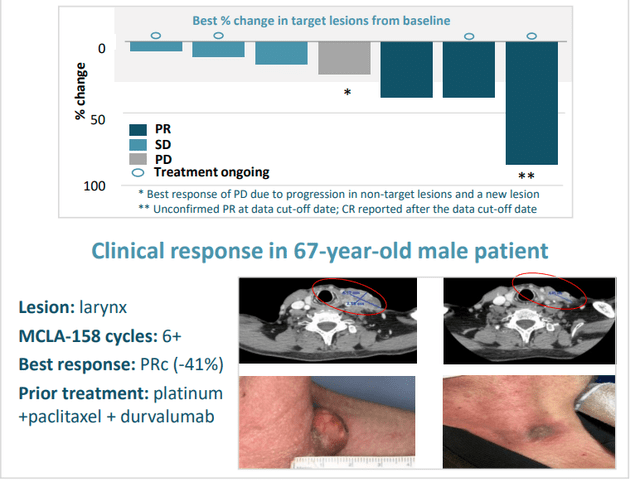

As for MCLA-158 (Peto), Lundberg notes that LGR5 is not typically expressed after birth (small subsets of cancer stem cells express the target as do certain cancer subtypes including colorectal, head & neck, gastric esophageal). These 3 cohorts are what they’re interested in testing the drug in. In fall of last year, they presented early data on an initial cohort of previously treated HNSCC patients. 7 of 10 patients reached their first tumor evaluation, and all 7 had tumor shrinkage with 3 partial responses (1 PR deepened to complete response after data cutoff date). Keep in mind these patients with 2 prior lines of therapy are treated typically with a platinum and a biologic, with few good options after that (historical response rate for cetuximab is just 13%).

Figure 5: Peto’s early clinical activity in HNSCC

As for other tumor types, Lundberg says they have another cohort of gastric esophageal that they will present at the same conference as updated HNSCC results. Protocol allows for enrolling up to 40 patients for HNSCC. The caveat is again it’s early in the study and we need to see strong signal in higher number of patients.

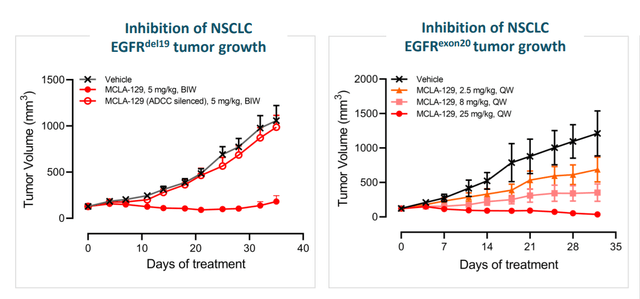

Moving onto MCLA-129 (EGFR c-MET bispecific antibody), they started developing it several years ago when it became clear that one major mechanism of resistance to EGFR targeting drugs was activation of MET pathway. The drug entered clinic in Q2 last year in phase 1/2 dose escalation study. AACR poster demonstrated preclinical data, showing the antibody blocks mechanism of action for EGFR and c-MET. The drug also induces ADCC and ADCP which rely on host immune system to kill cancer cells. MCLA-129 also blocks the growth of cancer in mouse model with EGFR exon20 mutation.

Figure 6: MCLA-129 supportive preclinical data

As for competition and differentiation, Johnson & Johnson’s (JNJ) Rybrevant is already on the market and also binds to EGFR/c-MET. MCLA-129 appears to have similar affinity to both targets, whereas Rybrevant binds tighter to c-MET (more similar affinities gives wider therapeutic window generally speaking). 129 is also fully ADCC-enhanced, Rybrevant may only be half-ADCC enhanced. 129 is produced from a single cell (advantages of monoclonal antibody production), whereas Rybrevant must be produced through making two monospecific antibodies then mixing them together in a costly and time-consuming process. It’s too early to state whether MCLA-129 has an advantage in safety or efficacy (or merely similar in base case scenario). The goal is to find the recommended phase 2 dose, evaluate early evidence of efficacy in multiple cohorts to decide where they should invest in (early evidence suggests pursuit of additional indications outside of NSCLC as well).

Moving onto MCLA-145 (PD-L1 x CD137), expectations are low here considering that in January partner Incyte decided to opt out continued development. Early data was presented in December where they demonstrated 25mg range is the right range. They also believe they are not fully blocking PD-L1/PD1 access, so the drug could work better with full blockade (combine with PD-1 drug).

Their trispecific TriClonics platform provides same technical advantages (being able to produce out of a single cell). Third binding domain adds complexity and could have technical advantages for a number of indications (active research here, but keeping new molecules under wraps it would seem).

As for the balance sheet, they reported $430 million in cash at end of 2021 which will take them beyond 2024. Lundberg hints that partnerships could be appropriate for certain assets (which makes me think he’s talking about c-MET) in being realistic about what late-stage studies and commercialization they can approve on their own.

Other Information

For Q1, the cash balance was $384M (down from $430.8M at December 31st). Net loss rose to $18.9M, while R&D rose by $6.2M to $27M. G&A rose by $2.4M to $11.75M. Management is guiding for operational runway beyond 2024.

Key milestones remain unchanged, including data updates for Peto (Lgr5 x EGFR) and MCLA-129 (EGFR x c-MET) in the second half of the year.

Here are a couple nuggets from May 24th Wainwright webcast:

- Peto (EGFR x LGR5) they saw 3 clinical responses out of 7 evaluable HNSCC patients in early data, with all 7 showing signs of tumor shrinkage. They will be providing update on HNSCC cohort 2H 22 (interesting that they don’t mention gastric this time).

- Platform allows them to develop large inventory of diverse panel of common light chain antibodies against numerous targets. They can evaluate thousands of multi-specific antibodies in parallel using robotics and automation, then evaluate them in screening to identify best candidates for clinical application (does not guarantee success but gives them higher probability of success).

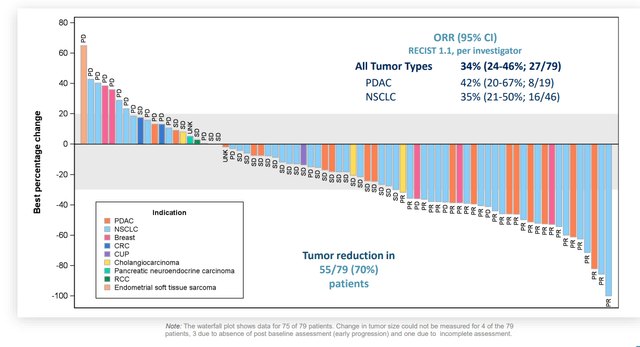

On May 26th, the company announced publication of Zeno data in phase 1/2 eNRGY trial via abstract on ASCO website. Of 73 evaluable patients, a very respectable 34% overall response rate was observed with median duration of response (DOR) of 9.1 months. 35% response rate in NSCLC and 39% ORR in pancreatic cancer appears approvable to my eyes (well within FDA guidance). Breast cancer 2/4 responders and cholangiocarcinoma 1/3 responders also looks good, a caveat is the low number of patients.

Figure 7: Zeno shows broad activity across multiple NRG1+ tumor types

Merus is well ahead of competitor Elevation Oncology, who enrolled just 15 patients in its CRESTONE study so far though the 33% response rate for seribantumab lines up well with Zeno (mainly NSCLC patients, only 1 pancreatic).

ASCO oral update (see slides) contained little in the way of surprises, with 34% overall response rate in 79 evaluable patients. Pancreatic cancer (PDAC) response rate increased from 39% in prior abstract to 42%, which is good to see. Importantly, as noted prior, the company remains 2+ years ahead of competition in NRG1+ tumors.

We are also reminded that the company appointed Shannon Campbell as EVP and Chief Commercial Officer to lead commercial strategy for Zeno (prior to that she led Novartis’ (NVS) US Oncology Solid Tumor Franchise and prior to that helped build Bayer’s US Oncology business).

As for partnerships, I remind readers that the MCLA-145 option termination by Incyte was not the end of their collaboration. The two companies continue to work together on development of up to 10 bispecific or monospecific antibody programs (Merus can exercise co-development option to become responsible for 35% of global development costs in exchange for 50% share of US profits/losses). As for the Loxo Oncology/Lilly partnership inked in January of 2021, Merus is helping the larger company develop up to three CD3-engaging T-cell re-directing bispecific antibody therapies. Merus stands to receive up to $540 million in milestones per product ($1.6B in total across all 3) as well as tiered royalties ranging from the mid-single to low-double digits on product sales.

As for competition for Zeno, I cited in my previous article Elevation Oncology’s (ELEV) seribantumab in phase 2 study. This program prior belonged to Merrimack before it was divested in April for just $2.5 million. Patients on the study have progressed on at least one prior line of standard therapy and harbor an NRG1 fusion. Elevation contends that seribantumab has potential to be a best-in-class therapy, but they need to enroll many more patients before such claims should be made.

Also, Boehringer Ingelheim’s Gilotrif/afatinib (inhibits EGFR and HER2) is in 60 patient phase 2 study (July 2024 primary completion date). Consider that efficacy for this drug in patients with NRG1 fusion has already been observed in NSCLC patients. Interestingly enough, investigators estimated NRG1 fusion prevalence of 0.2% in various solid tumors but as high as 31% in lung invasive mucinous adeno- carcinoma. Of case studies discussed, I thought it quite promising to read of a 70-year-old patient with pan-wild type, nonmucinous lung adenocarcinoma who received 14 lines of therapy had rapid response and stayed on drug for nearly 2 years. Ongoing response in another patient with 4 prior lines of therapy (PR with 19 months and ongoing on the drug) was also encouraging.

For MCLA-129, I cite as a comparator JNJ’s amivantamab/Rybrevant which was approved last year in NSCLC with EGFR exon20 mutation. Monotherapy data in patients who progressed after platinum chemo showed 40% overall response rate (4% complete response) and median duration of response 11.1 months. However, the drug was not without its challenges as 11% of participants stopped treatment due to adverse events (label includes warnings about severe infusion reactions, insterstitial lung disease, severe skin problems to the point patients should avoid sun exposure and eye problems). Initial data for amivantamab in combination with 3rd generation EGFR TKI inhibitor lazertinib in NSCLC patients with EGFR/MET-based resistance yielded 47% ORR with median PFS of 6.7 months. The combination previously showed a 100% response rate in 20 previously treated EGFR positive metastatic patients and is going head to in a phase 3 study versus Tagrisso. On clinical trials gov website, I found 9 studies evaluating the drug that are recruiting patients (gastric esophageal, NSCLC, advanced solid tumors, multiple lazertinib combo trials). ASCO data update (lazertinib combo for patients with disease progression after receiving osimertinib and platinum-based chemotherapy) was encouraging and also has positive readthrough to Merus’ MCLA-129

As for institutional investors of note, Biotechnology Value Fund owns a 9.6% stake in the company. Boxer Capital owns a 4.4% stake as well.

As for prior financings, I remind readers that the previous November 2021 offering took place at $28.50 per share ($118.7 million in proceeds) and January 2021 offering took place at $24.75 per share ($129.4 million).

Moving onto IP, the company continues to aggressively build its portfolio. For Zeno, application filed under Patent Cooperation Treaty application and two issued European patents (others pending) have expected expiry of no earlier than 2035 (composition of matter, methods, etc). The patent portfolio for CD3 technology includes issued and pending patents with expiry no earlier than 2036 (second PCT application with expected expiry of no earlier than 2040). For Peto, a similar picture exists with composition of matter and methods (expiry no earlier than 2036) and 2038 for MCLA-129.

Final Thoughts

To conclude, I find Merus to be an attractive platform play in the oncology space, with potential advantages inherent in its Biclonics/Triclonics technology being recognized by Eli Lilly and Incyte. Zeno is the clear leader in NRG1+ cancers with a potential multi-year lead time to market, with tumor agnostic approval looking increasingly likely (some risk here given lower patient numbers for certain types of cancer). Peto and MCLA-129 provide investors substantial optionality with data updates coming this year, not to mention longer term appeal exists via Triclonics candidates that leadership is keeping under wraps for the present. Valuation remains at the middle of the range of where shares have traded over the past year.

For readers who are interested in the story and have done their due diligence, MRUS is a Buy. I suggest initiating a pilot purchase in the near term and accumulating dips ahead of data updates for both EGFR drug candidates in the second half of the year.

As for risk rating (1=low, 5= high), I’d rate this one a 3 given multiple irons in the fire and promising data for Zeno (and Peto) to date. I also note that the company’s Biclonics platform appears to have higher probability of success given the uncomplicated manufacturing leading to better behaved molecules in patients (durable and consistent half-life and solid structure versus more complex approaches like JNJ’s Rybrevant where two monoclonal antibodies are mixed and there’s higher risk of impurities). One key risk is Peto data disappointing (overall rate of response drops as drug is tested in higher number of patients). For MCLA-129, I’d also hope that if we see promising data here, that Merus’ would opportunistically license out the drug (or retain 50/50 US) to a worthy pharma partner instead of taking on large phase 2 to 3 trials on their own in a highly competitive space. Disappointing deal terms for any partnership, including possible commercial collaboration for Zeno so they don’t have to solo launch, are also a possibility.

Be the first to comment