David Tran

Investment Thesis

Splunk (NASDAQ:SPLK) has seen its share price go nowhere fast in 5 years. And now, with a new CEO at its helm for a few months, Splunk is rapidly gaining traction on its profitability profile.

By my estimates, Splunk is priced at 26x free cash flow. But the problem, I believe, is that Splunk’s cloud story is struggling for traction.

What’s Happening Right Now?

Gary Steele has been Splunk’s CEO for several months now. By this time, we would expect to see some progress in Splunk. What investors want to see from Splunk is a tangible narrative about customers’ readily adopting its cloud business.

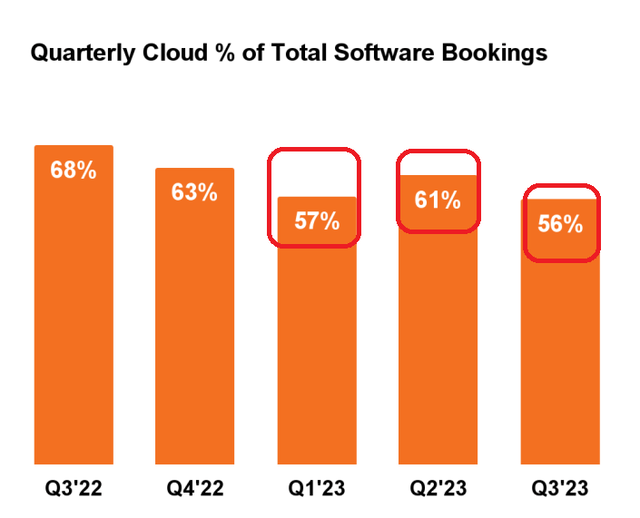

What you see above, is cloud bookings were the lowest now in all quarters in fiscal 2023. That’s not commensurate with a narrative that investors want to see.

Revenue Growth Rates Revised Upwards a Nudge

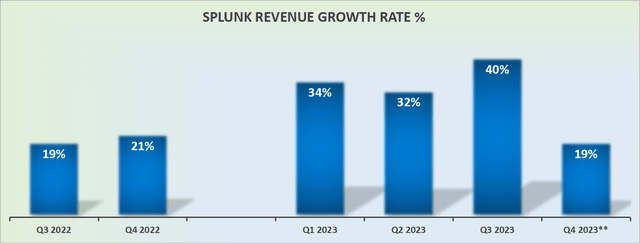

As you can see here, Splunk’s guidance for Q4 should leave investors a little skeptical. Is this or isn’t this a high-growth company? Because despite a small upwards revision in Q4 revenues, growing at 19% y/y isn’t so attractive.

To contextualize my comments, consider what CEO Steele said,

So as we indicated last quarter, we did see because of macro conditions, we saw some cloud migrations and expansions move out. and it was very consistent through Q4 where we saw the same behavior on buying. We did not see, however, we didn’t see any less loyalty to renewal. Our renewal rate stayed incredibly high. And so I think what’s happening is customers definitely see the value of cloud.

They know they’re going there, but they will pace their migration. And they will pace their migration when they are ready to make that move.

Investors truly want to see resilient cloud migration being the central part of Splunk’s story.

Profitability Profile Continues to be Revised Upwards

Back in Q4 2022, Splunk guided to finish fiscal 2023 with about 2% non-GAAP operating margins. Then, in Q1, Splunk upwards revised its full-year fiscal 2023 non-GAAP operating margins to reach roughly 2%, thereby indicating marginally better was possible.

Then, halfway through the fiscal year, Splunk further upwards revised its non-GAAP operating margin to 8%. The first serious sign of the new CEO Steele putting down his mark on the company.

And now, Splunk has upwards revised its non-GAAP operating margin to as high as 13%.

With that in mind, let’s discuss its valuation.

SPLK Stock Valuation — 26x Free Cash Flow

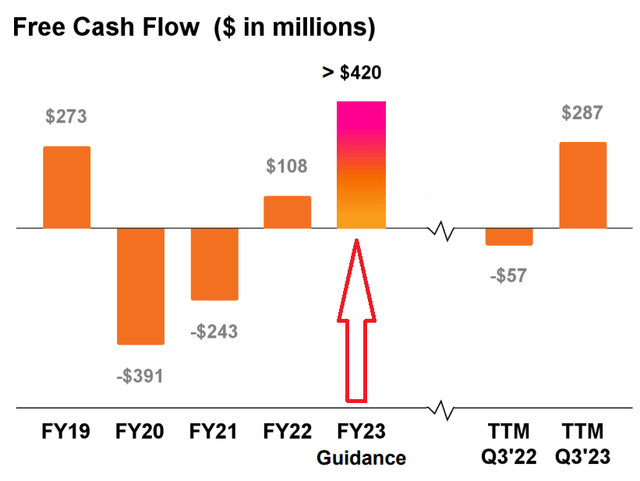

In the graphic that follows is Splunk’s free cash flow guidance, having been upwards revised from $400 million to +$420 million in fiscal 2023.

If we think that before Splunk transitioned its business model away from its lucrative but ultimately shrinking on-premise-focused sales model for its security and observability products to a cloud-based approach, Splunk was printing just under $275 million of free cash flow.

Accordingly, this newly updated target of $420 million in free cash flow is truly very attractive and provides peace of mind to really long-term investors in the name.

But will this be enough to entice new shareholders into this company? At 33x this year’s free cash flow, the stock doesn’t seem expensive.

What’s more, if we believe that looking out to next fiscal year, this free cash flow could increase to approximately $500 million, this puts Splunk priced at 26x free cash flow.

The Bottom Line

Splunk has been a problem child for a while. In fact, the stock went nowhere fast for years as investors didn’t buy into the previous CEO’s vision.

Now, I’m inclined to believe that investors will reconsider Splunk. Particularly as the company continues to provide investors with steady and consistent doses of positive news.

What’s more, of the many cloud companies I follow, I can’t name too many that are not only reporting strong free cash flows but companies whose free cash flows are substantially increasing too, as quickly as Splunk’s.

Be the first to comment